No categories assigned

BIR Form 1604E

-

- Last edited 4 years ago by Gelo

-

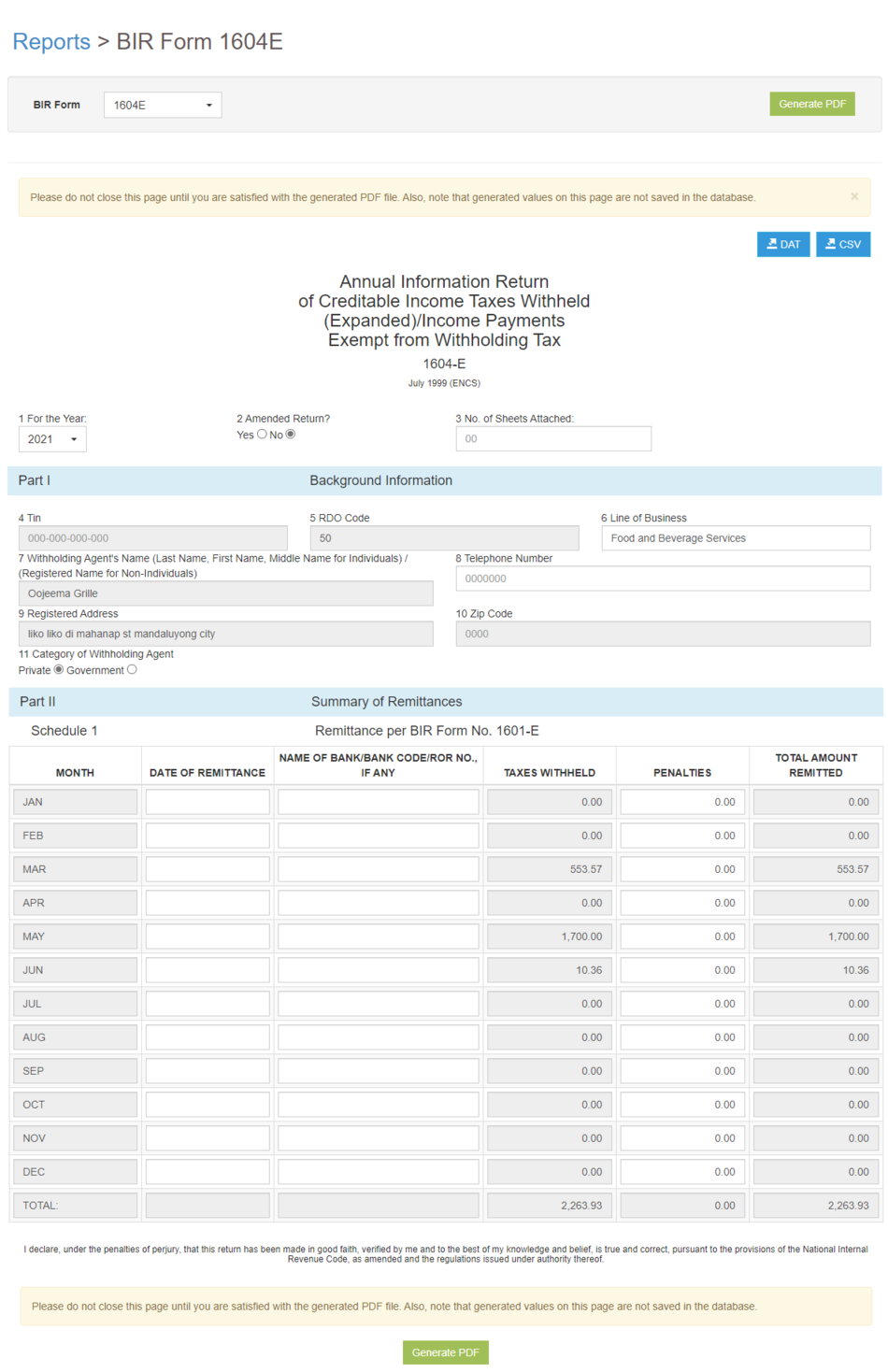

BIR Form 1604E

BIR 1604E is annual tax return that summarizes the BIR Form 1601E – Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) paid/filed by the taxpayer within the taxable year (January to December).

| Field | Description |

|---|---|

| 1. Year | The current year when the BIR Form 1604E was issued. |

| 2. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 3. No. of Sheets | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 1604E |

| Part I - Background Information | |

| 4. TIN | Tax Identification Number of an Individual or Business |

| 5. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 6. Line of Business/Occupation | Nature of Business of the Company or the Occupation of an Individual |

| 7. Withholding Agent’s Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 8. Telephone No. | Contact Number of the Tax Payer(Individual/Business). |

| 9.Registered Address | The registered Address of the Tax Payer

|

| 10. ZIP Code | Contact Number of the Tax Payer(Individual/Business). |

| 11. Category of Withholding Agent | Private - if the type of business is a Private Company

Government - if the Agent is working on any Government Sector. |

| Part II - Summary of Remittances | |

| Month | List of Months in the form

|

| Date of Remittance | Date of Remittance declared on each month.

|

| Name of Bank/Bank Code/ ROR No | (Optional)

Bank - the bank where the payment was made.

ROR(Revenue Official Receipts) - put the Reference Number of Filing or Payment. If no reference number

|

| Taxes Withheld | The amount of withholding tax paid for the applicable return |

| Penalties | Total penalties implied based from

|

| Total Amount Remitted | Total Amount Remitted based from Taxes withheld and Penalties applied. |

| Reports | |

|---|---|

| Tax Report | Sales Journal | Purchase Journal | Receipt Journal | Discount Senior and PWD | Disbursement Journal | BIR Form 0605 | BIR Form 0619E | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551M | BIR Form 2551Q | BIR Form 1601E | BIR Form 1601EQ | BIR Form 1604E | Sales Relief | Purchase Relief |

| Reports Job Aid Aids | |

| Tax Report | Sales Journal Job Aids | Purchase Journal Job Aids | Receipt Journal Job Aids | Discount Senior and PWD Job Aids | Disbursement Journal Job Aids | BIR Form 0605 Job Aids | BIR Form 0619E Job Aids | BIR Form 1601E Job Aids | BIR Form 1601EQ Job Aids | BIR Form 1604E Job Aids | Sales Relief Job Aids | Purchase Relief Job Aids |

| Modules | |

| Maintenance | Bank | Chart of Account | Tax |

| Job Aid Modules | |

| Maintenance Aids | Bank | Chart of Accounts Job Aids | Tax Job Aids |