No categories assigned

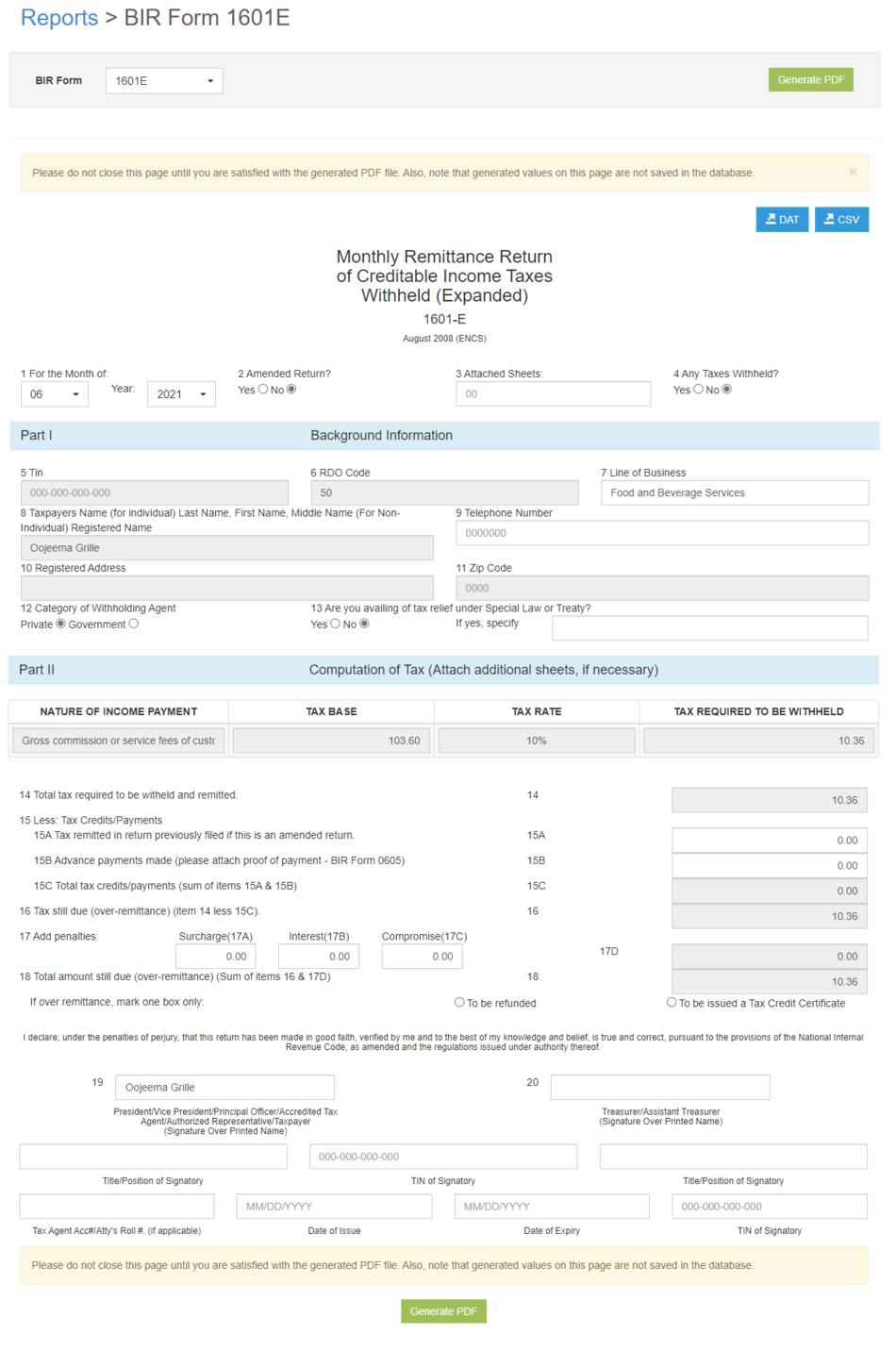

BIR Form 1601E

-

- Last edited 4 years ago by Gelo

-

BIR Form 1601E

BIR Form 1601-E, or also known as Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) is a tax return filed by a designated Withholding agent who is required of withholding taxes on income payments subject to Expanded / Creditable Withholding Taxes.

BIR Form 0619-E terms on Oojeema Pro

| Field | Description |

|---|---|

| 1. Month/Year | Current Month of the tear when the form will be submitted |

| 2. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 3. Attached Sheet | Number of Sheets attached on the form |

| 4. Any Taxes Withheld | Taxes Withheld if any |

| Part I - Background Information | |

| 5. TIN | Tax Identification Number of the Company/Branch |

| 6. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 7. Line of Business | Nature of Business of the Company |

| 8. Tax Payer's Name | Registered Name for Non-Individual(Company) and Whole name for Individual |

| 9. Telephone Number | Contact Number of the Tax Payer |

| 10. Registered Address | The registered Address of the Tax Payer. |

| 11. Zip Code | Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer |

| 12. Category of Withholding Agent | Withholding Agent Category

|

| 13. Tax Relief | (Optional)

Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty. |

| Part II - Computation of Tax | |

| 14. Total tax required to be withheld and remitted. | Total Tax Required to be withheld base from Nature of Income Payment, Tax Base and its Tax Rate |

| 15. Less: Tax Credits/Payments | Components

|

| 16. Tax still due (over-remittance) (item 14 less 15C). | Tax still due base from Total Tax Required to be withheld and remitted less the total tax credits/payments |

| 17. Penalties | Penalties to be applied to if there is any.

|

| 18. Total amount still due (over-remittance) (Sum of items 16 & 17D) | Total amount still due base from Penalties and Tax still due |

| 19. President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name) | President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details

|

| 20. Treasurer/Assistant Treasurer (Signature Over Printed Name) | Treasurer/Assistant Treasurer details

|

Notes:

- For further instructions on how to generate BIR Form 1601E, the user may visit the BIR Form 1601E Job Aids which can be found here

| Reports | |

|---|---|

| Tax Report | Sales Journal | Purchase Journal | Receipt Journal | Discount Senior and PWD | Disbursement Journal | BIR Form 0605 | BIR Form 0619E | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551M | BIR Form 2551Q | BIR Form 1601E | BIR Form 1601EQ | BIR Form 1604E | Sales Relief | Purchase Relief |

| Reports Job Aid Aids | |

| Tax Report | Sales Journal Job Aids | Purchase Journal Job Aids | Receipt Journal Job Aids | Discount Senior and PWD Job Aids | Disbursement Journal Job Aids | BIR Form 0605 Job Aids | BIR Form 0619E Job Aids | BIR Form 1601E Job Aids | BIR Form 1601EQ Job Aids | BIR Form 1604E Job Aids | Sales Relief Job Aids | Purchase Relief Job Aids |

| Modules | |

| Sales | Sales | Sales and Service Invoice | Receive Payments |

| Maintenance | Bank | Chart of Account | Tax |

| Job Aid Modules | |

| Sales Aids | Sales Job Aids |

| Maintenance Aids | Bank | Chart of Accounts Job Aids | Tax Job Aids |