You are viewing an old version of this page. Return to the latest version.

Version of 12:34, 9 June 2021 by Gelo

Difference between revisions of "Pro Accounts Receivable Aging"

(Created page with "== Accounts Receivable Aging == Accounts Receivable Aging are list of Accounts Receivable that has not been paid by User. This report categorizes the set of invoice that has b...") (Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 1: | Line 1: | ||

| − | == Accounts Receivable Aging == | + | {{DISPLAYTITLE:Accounts Receivable Aging}} |

| + | |||

| + | ==Accounts Receivable Aging== | ||

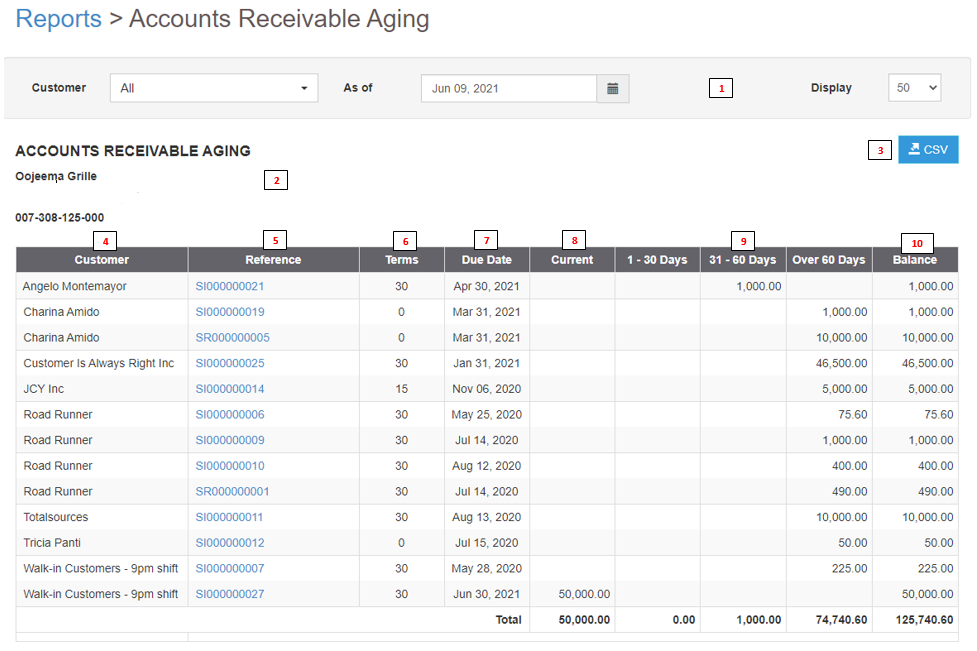

Accounts Receivable Aging are list of Accounts Receivable that has not been paid by User. This report categorizes the set of invoice that has been outstanding over a specific period(can be within a month range, 2 months range or over 2 months) | Accounts Receivable Aging are list of Accounts Receivable that has not been paid by User. This report categorizes the set of invoice that has been outstanding over a specific period(can be within a month range, 2 months range or over 2 months) | ||

[[File:Pro Accounts Receivable Aging Menu.png|center|thumb|977x977px|Accounts Receivable Aging Menu]] | [[File:Pro Accounts Receivable Aging Menu.png|center|thumb|977x977px|Accounts Receivable Aging Menu]] | ||

| Line 10: | Line 12: | ||

| style="" |Set of filter record for precise search of records. | | style="" |Set of filter record for precise search of records. | ||

| − | * Records will be defaulted to set on Filter All for customers, current date on as of Date and 50 for Display List | + | *Records will be defaulted to set on Filter All for customers, current date on as of Date and 50 for Display List |

|- | |- | ||

|2. '''Company Details''' | |2. '''Company Details''' | ||

| Line 24: | Line 26: | ||

| style="" |The reference record for the Accounts Receivable of the Customer. | | style="" |The reference record for the Accounts Receivable of the Customer. | ||

| − | * Clicking the Receivables link will let the user view the status of the Receivable. | + | *Clicking the Receivables link will let the user view the status of the Receivable. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |6. '''Terms''' | | style="" |6. '''Terms''' | ||

| Line 32: | Line 34: | ||

| style="" |The date on which the receivable should be paid. | | style="" |The date on which the receivable should be paid. | ||

| − | * Due dates will based on the Transaction date plus the Terms applied on the customer. | + | *Due dates will based on the Transaction date plus the Terms applied on the customer. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |8. '''Current''' | | style="" |8. '''Current''' | ||

| Line 40: | Line 42: | ||

| style="" |A range of days where the receivable exceeds to its due date. | | style="" |A range of days where the receivable exceeds to its due date. | ||

| − | * Range will be categorized within 30 days , within 60 days and more than 60 days. | + | *Range will be categorized within 30 days , within 60 days and more than 60 days. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |10. '''Balance''' | | style="" |10. '''Balance''' | ||

| style="" |The total amount to be paid on a specific Transaction. | | style="" |The total amount to be paid on a specific Transaction. | ||

|} | |} | ||

Revision as of 12:40, 9 June 2021

Accounts Receivable Aging

Accounts Receivable Aging are list of Accounts Receivable that has not been paid by User. This report categorizes the set of invoice that has been outstanding over a specific period(can be within a month range, 2 months range or over 2 months)

| Field | Description |

|---|---|

| 1. Record Filter | Set of filter record for precise search of records.

|

| 2. Company Details | Basic Details of the company |

| 3. Export | Allows the user to Export the report into Spreadsheet |

| 4. Customer | The customer assigned for the specific Receivables. |

| 5. Reference | The reference record for the Accounts Receivable of the Customer.

|

| 6. Terms | the set default days on the customer for them to pay their outstanding balance on their receivables. |

| 7. Due Date | The date on which the receivable should be paid.

|

| 8. Current | The balance to be paid on the receivables during the span of Transaction date up to Expiration Date. |

| 9. Aging Range | A range of days where the receivable exceeds to its due date.

|

| 10. Balance | The total amount to be paid on a specific Transaction. |