ATC Code

-

- Last edited 3 years ago by Gelo

-

Contents

ATC Codes

Alphanumber Tax Codes or ATC Codes or ATCs are codes used to identify the type of tax that has to be paid.

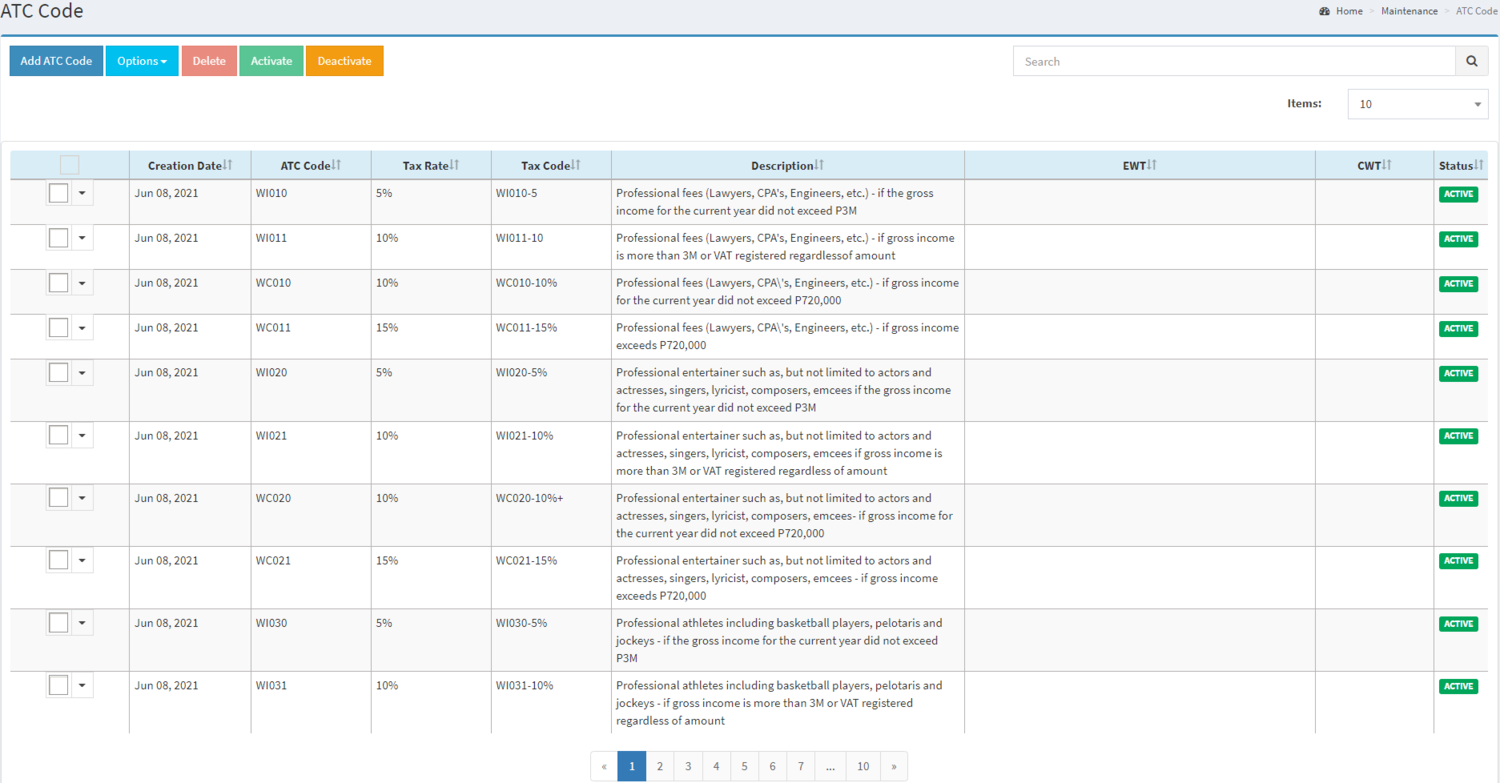

ATC Code Record List

Notes:

- Deactivating ATC Codes restricts the user to use the ATC code in Receipt Voucher.

- Deactivating ATC Codes restricts the user to apply Withholding tax in Payment Voucher

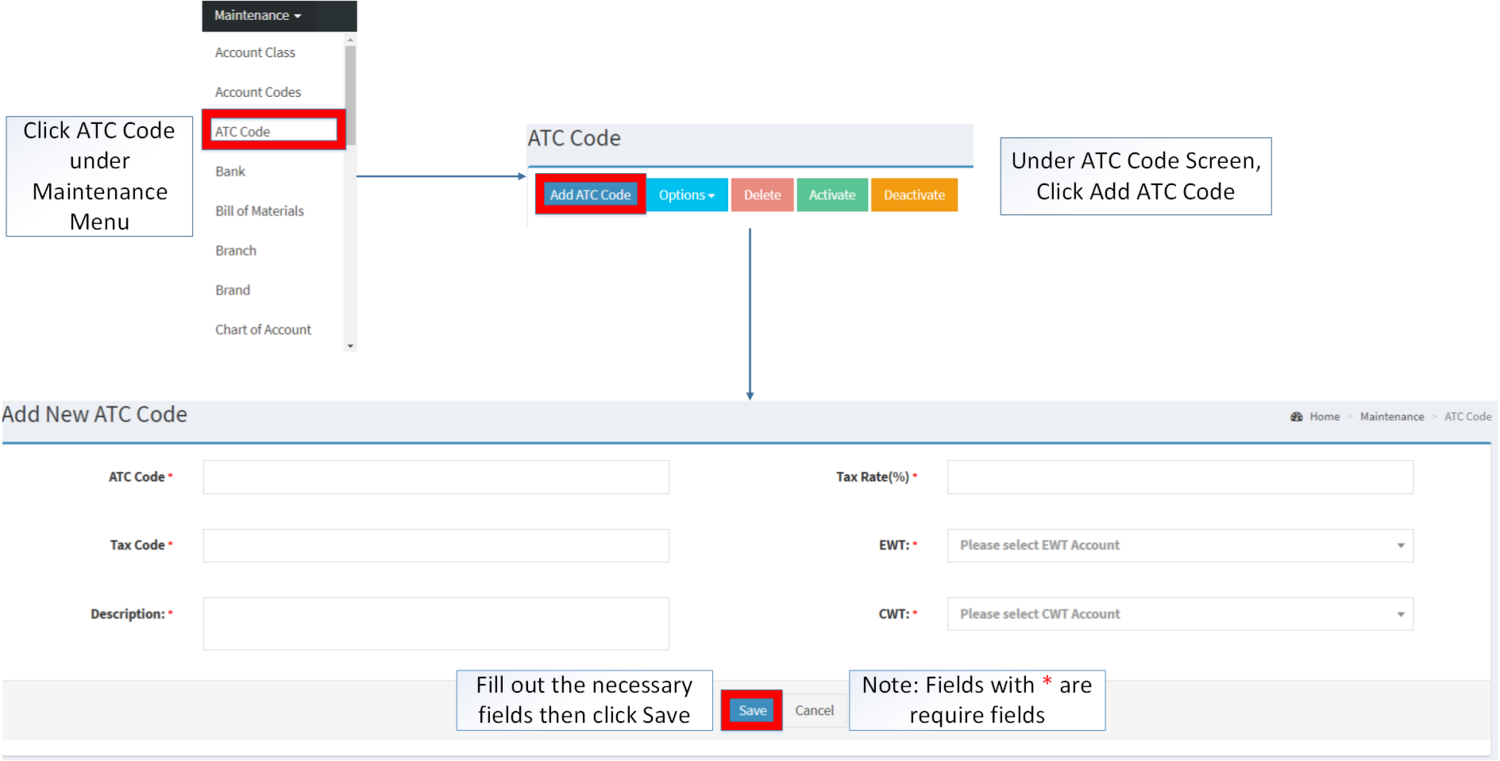

Adding ATC codes

- Click ATC Codes under Maintenance Module

- Under ATC Codes Menu Screen, Click Add ATC Codes

- Fill out the necessary fields then click Save.

| Field | Description | Allowed Inputs | Restricted Inputs | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.ATC Code | •Reference Code for ATC | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 2.Tax Code | •Tax Code Reference for the ATC Code | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 3.Description | •Description of the ATC Code | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | *Numeric | Any inputs except numbers | 5 | Yes |

| 5.EWT | •Expanded Withholding Tax | *EWT List provided in the field | Any inputs not included in the list | N/A | Yes |

| 6.CWT | •Credit Withholding Tax | *CWT List provided in the field | Any inputs not included in the list | N/A | Yes |

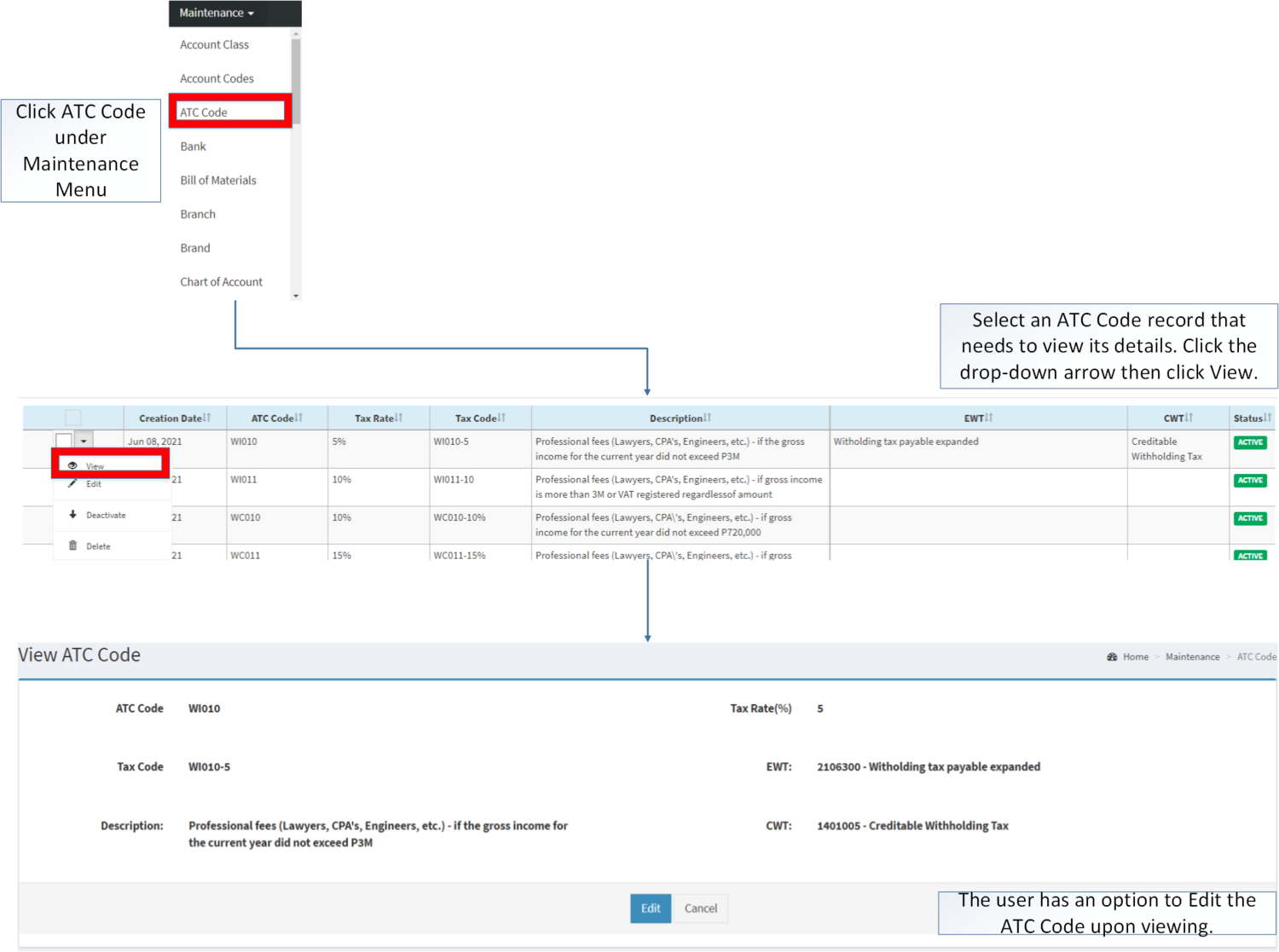

Viewing ATC codes

- Click ATC Codes under Maintenance Module

- Select a ATC Codes that needs to view its details. Click the drop-down arrow then click View.

- The user has an option to Edit the ATC Code upon viewing.

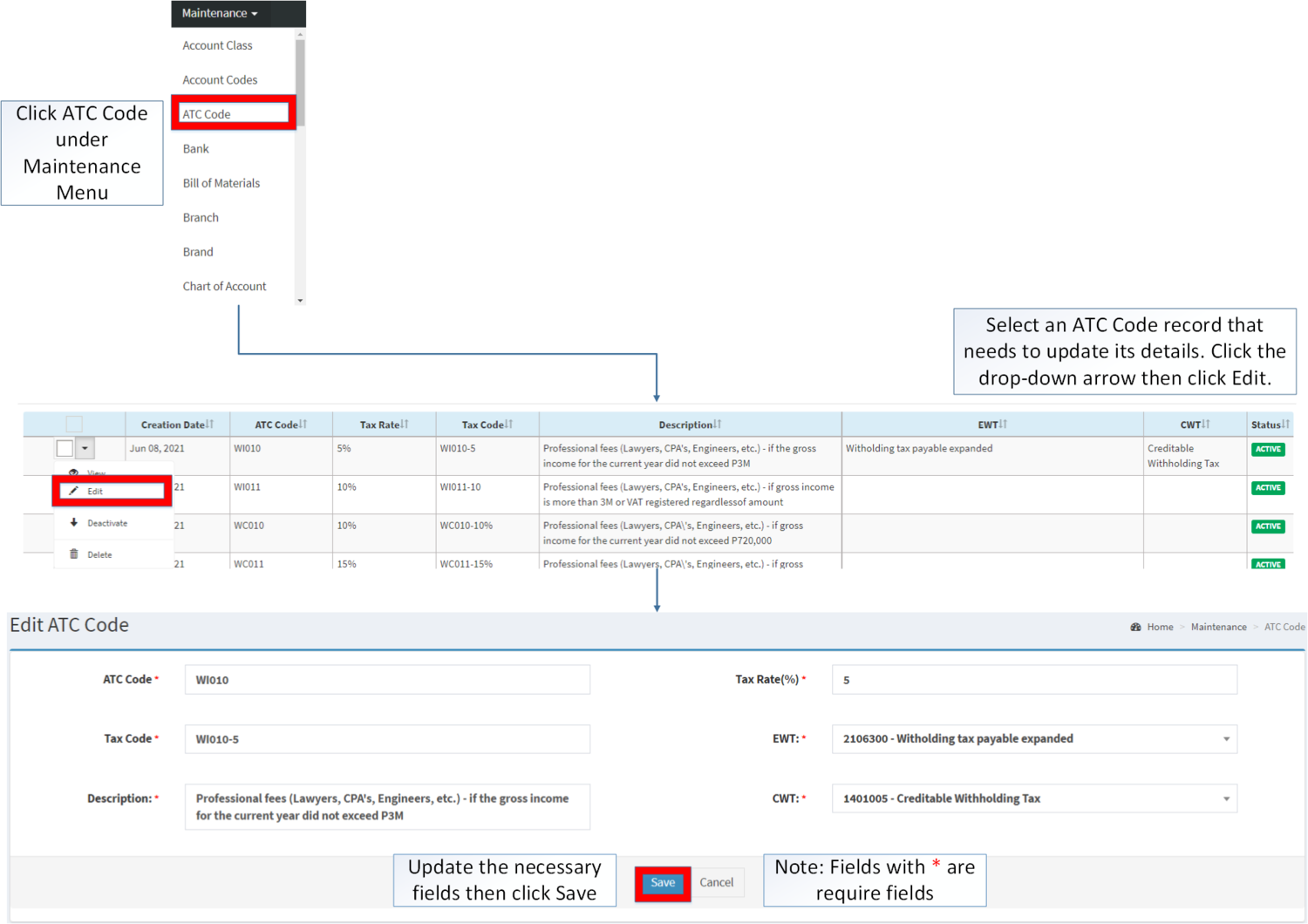

Editing ATC codes

1. Click ATC Codes under Maintenance Module

2. Select a ATC Codes that needs to update its details. Click the drop-down arrow then click Edit.

3. Update the necessary fields then click Save.

| Field | Description | Allowed Inputs | Restricted Inputs | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.ATC Code | •Reference Code for ATC | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 2.Tax Code | •Tax Code Reference for the ATC Code | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 3.Description | •Description of the ATC Code | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | *Numeric | Any inputs except numbers | 5 | Yes |

| 5.EWT | •Expanded Withholding Tax | *EWT List provided in the field | Any inputs not included in the list | N/A | Yes |

| 6.CWT | •Credit Withholding Tax | *CWT List provided in the field | Any inputs not included in the list | N/A | Yes |

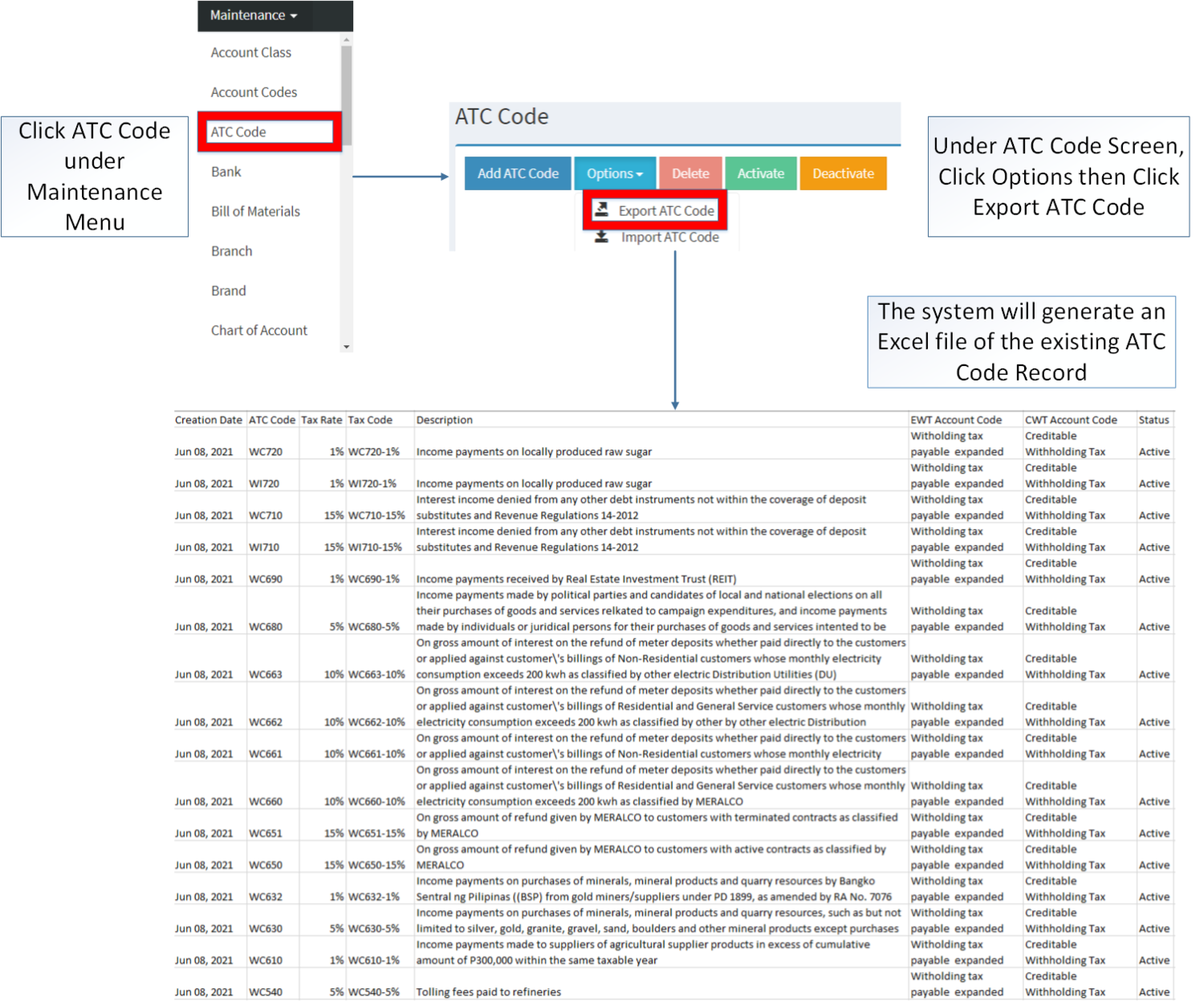

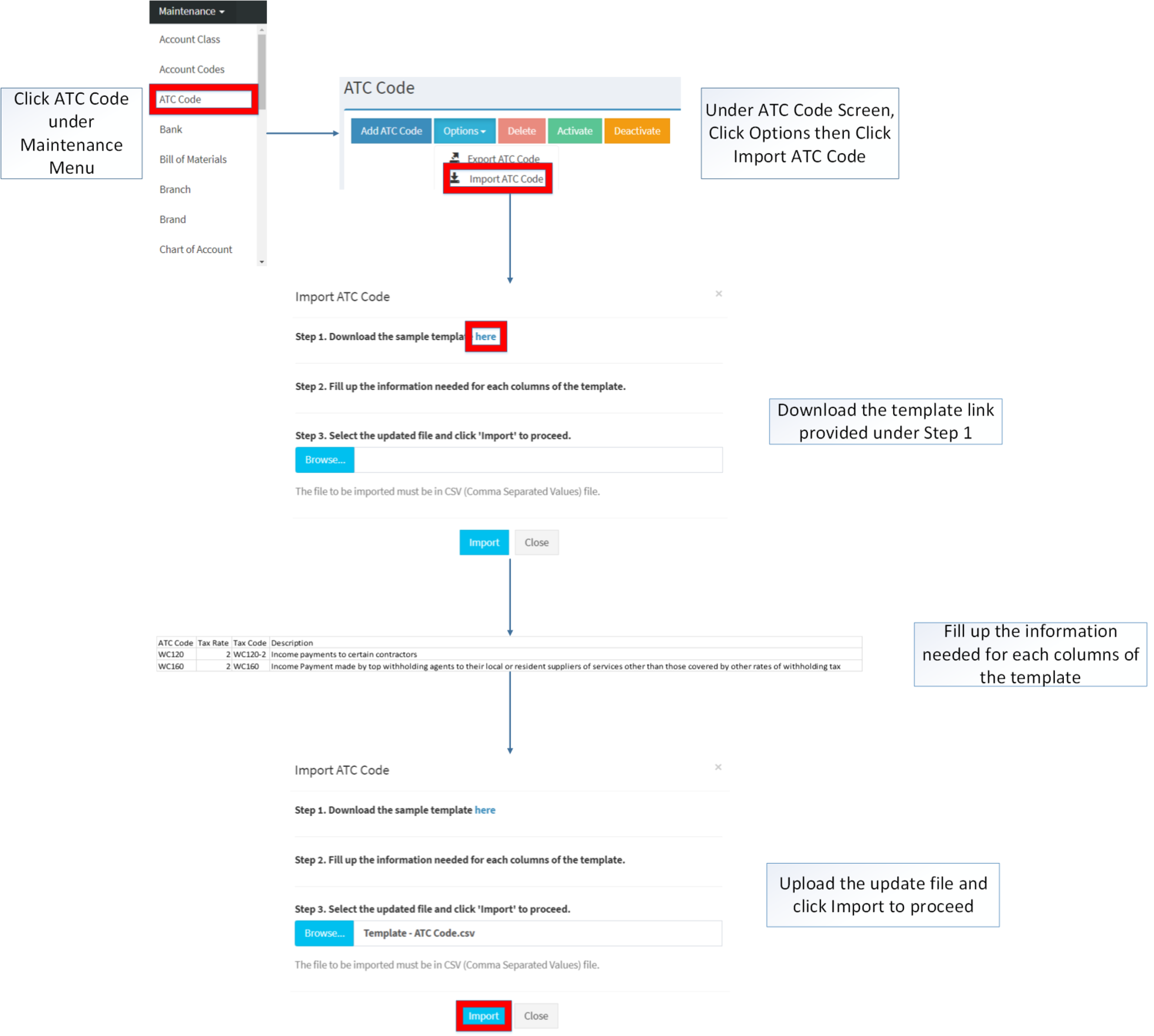

Importing and Exporting ATC codes

1. Under ATC Codes Screen, Click Options

2. Under Options, The user may Export or Import The Record

- When Exporting the records, the user may also use the filter options through tabs for precise searching and exporting of records.

- When Importing the records, the user should follow the following steps provided in the Importing ATC Codes Screen such as

- Downloading the template link provided under Step 1.

- Filling up the information needed for each columns of the template

- Uploading the updated Template

| Field | Description | Allowed Inputs | Restricted Inputs | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.ATC Code | •Reference Code for ATC | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 2.Tax Code | •Tax Code Reference for the ATC Code | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 3.Description | •Description of the ATC Code | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | *Numeric | Any inputs except numbers | 5 | Yes |

| 5.EWT | •Expanded Withholding Tax | *EWT List provided in the field | Any inputs not included in the list | N/A | Yes |

| 6.CWT | •Credit Withholding Tax | *CWT List provided in the field | Any inputs not included in the list | N/A | Yes |

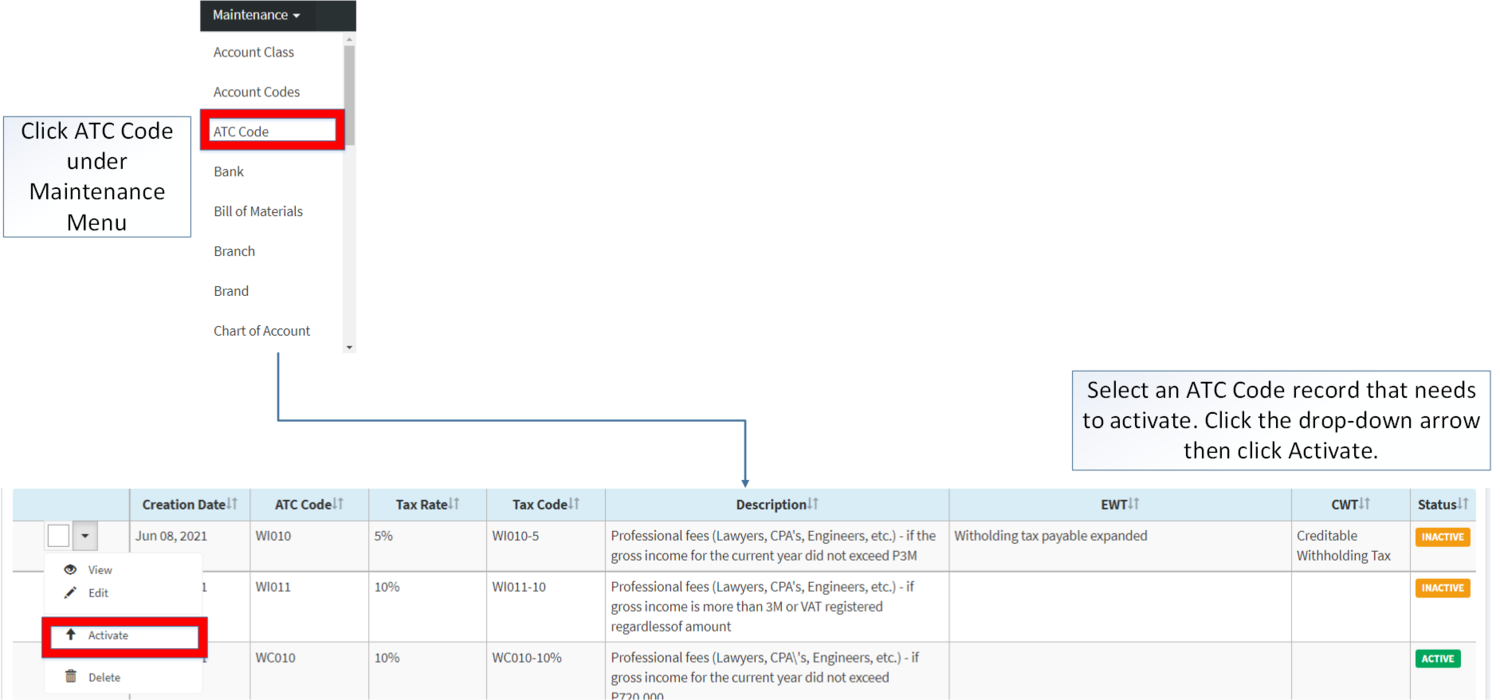

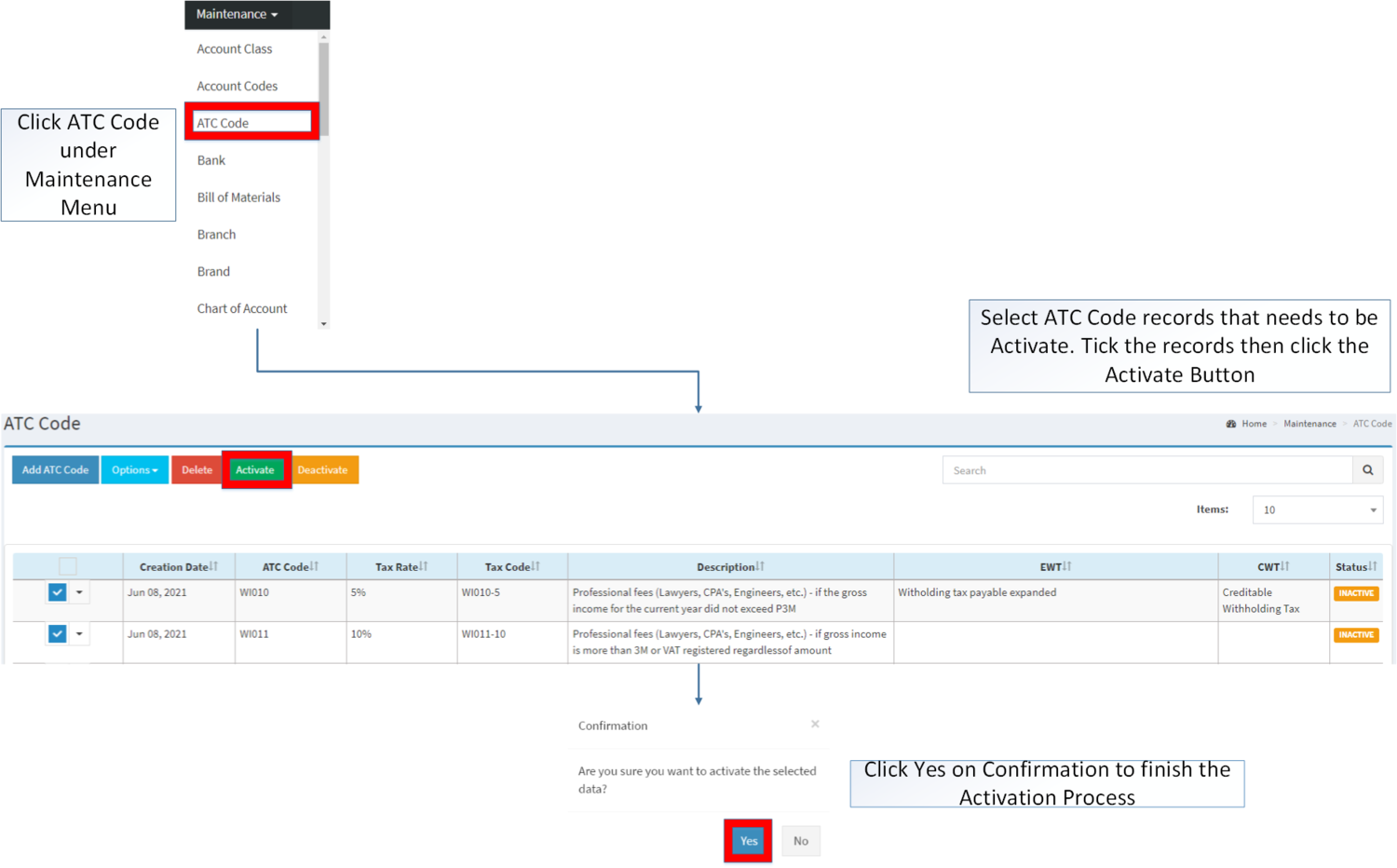

Activating ATC Code Record

ATC Code can be Activated in two ways:

- Using drop-down arrow of a record can be used in single record Activation

- Using Activate Button for activating multiple record

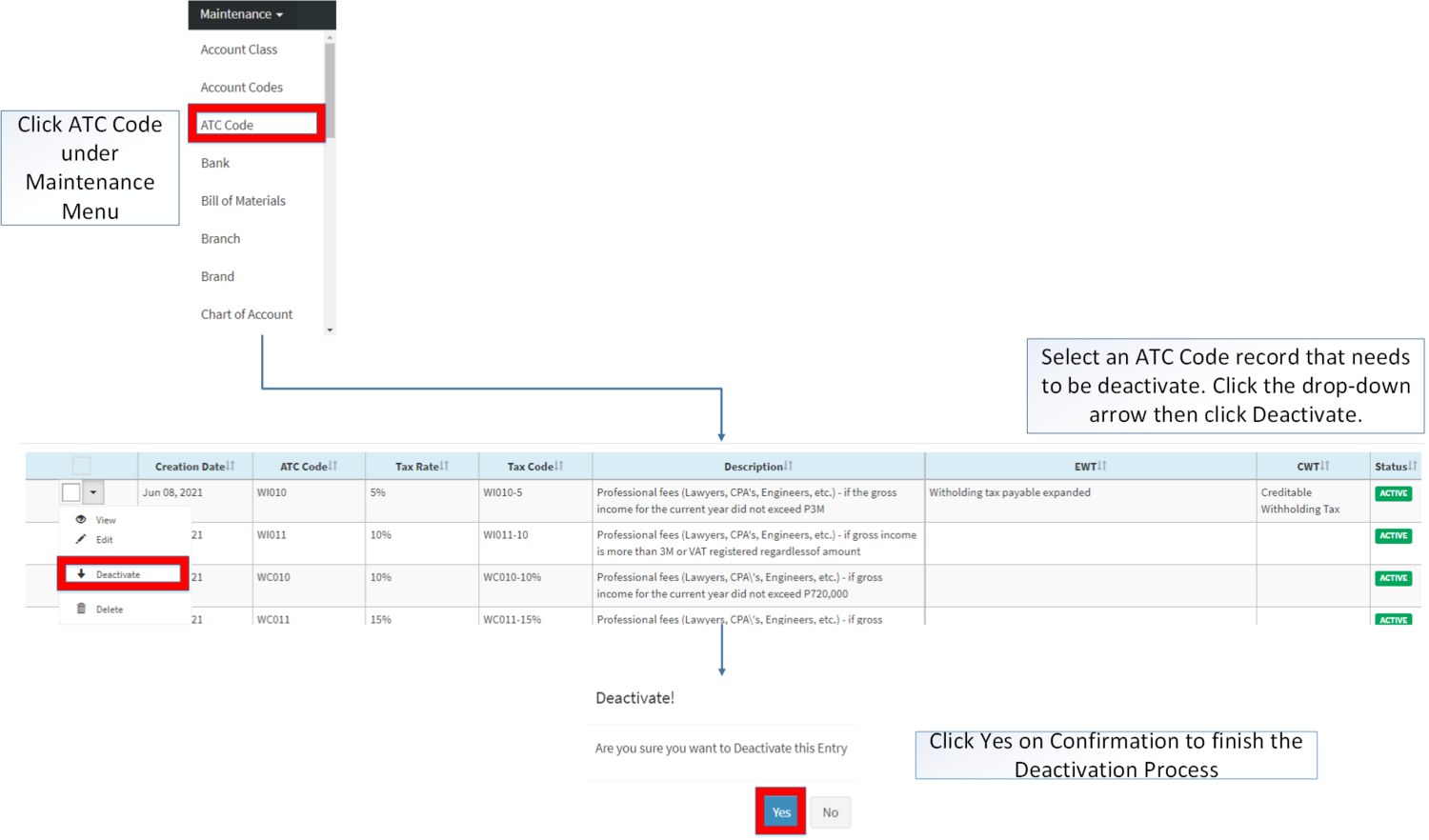

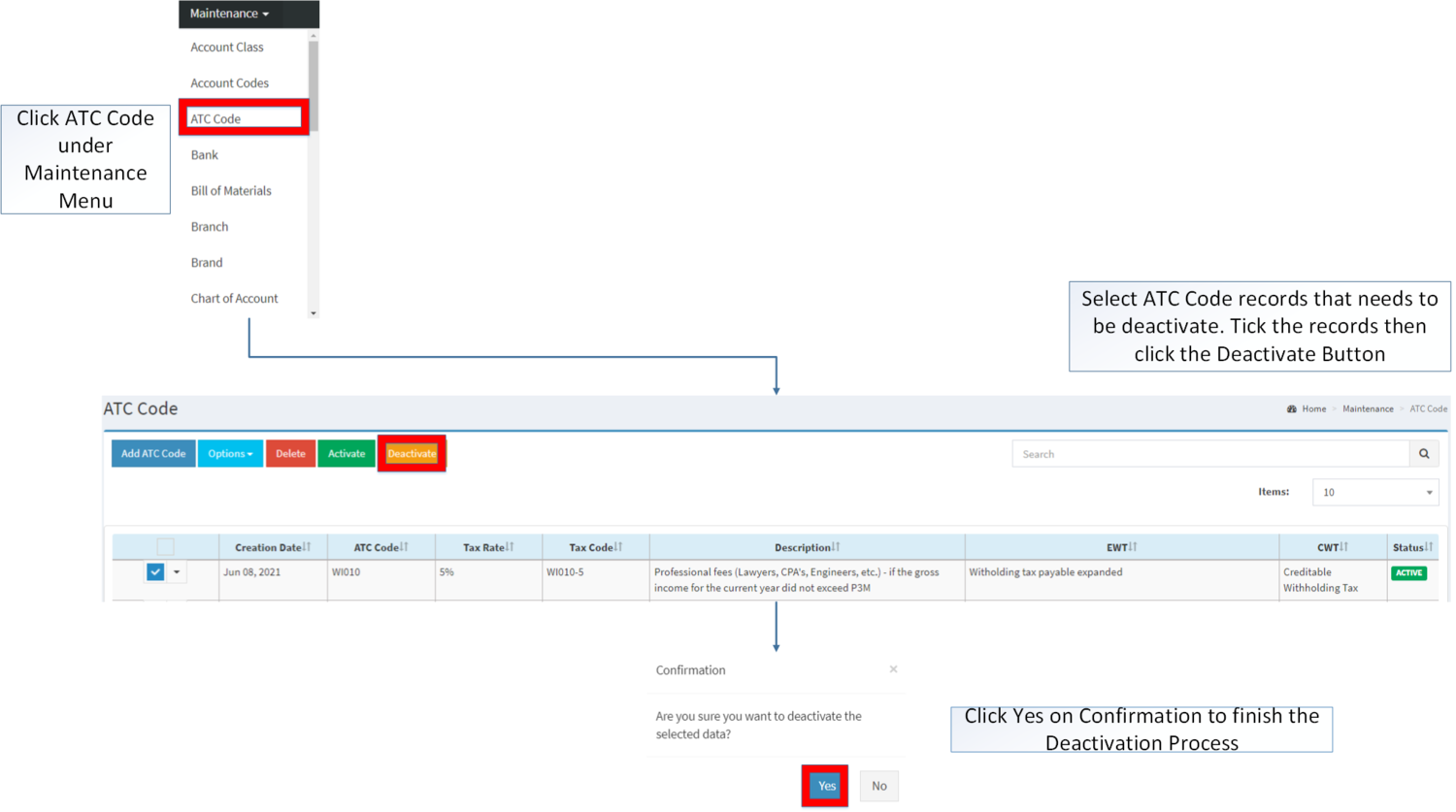

Deactivating ATC Code Record

ATC Code can be deactivated in two ways:

- Using drop-down arrow of a record can be used in single record deactivation

- Using Deactivate Button for deactivating multiple record

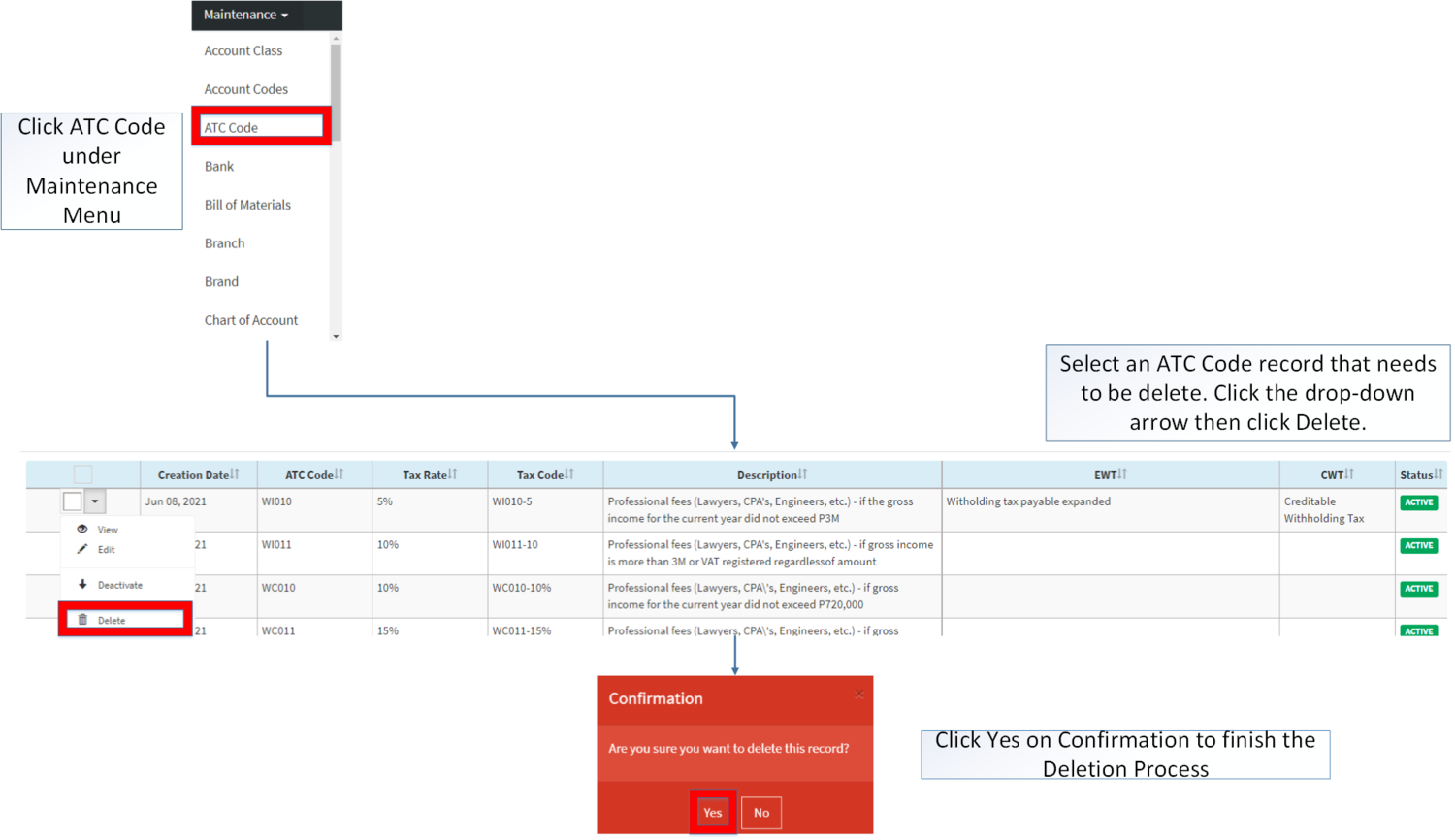

Deleting ATC Code Record

ATC Code can be deleted in two ways:

- Using drop-down arrow of a record can be used in single record deletion

- Using Delete Button for deleting multiple record

ATC record options

| Status | View | Edit | Deactivate | Activate | Delete |

|---|---|---|---|---|---|

| ACTIVE | ☑ | ☑ | ☑ | ☑ | |

| INACTIVE | ☑ | ☑ | ☑ | ☑ |

- The user may Edit the ATC Code while under view mode.

- Inactive Chart of Accounts Record cannot be used in ATC Code

- Used ATC Code cannot be deleted.

- Activating/Deactivating and Deleting of Records can be done in two ways.

- For single records, the user may use the drop down arrow then the action that need to perform.

- For multiple records, the user may tick the records then click the action button that need to perform

- Click the Yes in the confirmation to proceed on the action taken.

| Modules | |

|---|---|

| Maintenance | Maintenance | Chart of Account | ATC Code | Tax |

| Financials | Payment Voucher | Receipt Voucher |