Tax

-

- Last edited 3 years ago by Gelo

-

Contents

Tax

This maintenance screen allows the user to configure and add tax types to be used on their transactions.

Requirements before using Tax

- The user should setup the following Maintenance Module in order to proceed on using the Tax

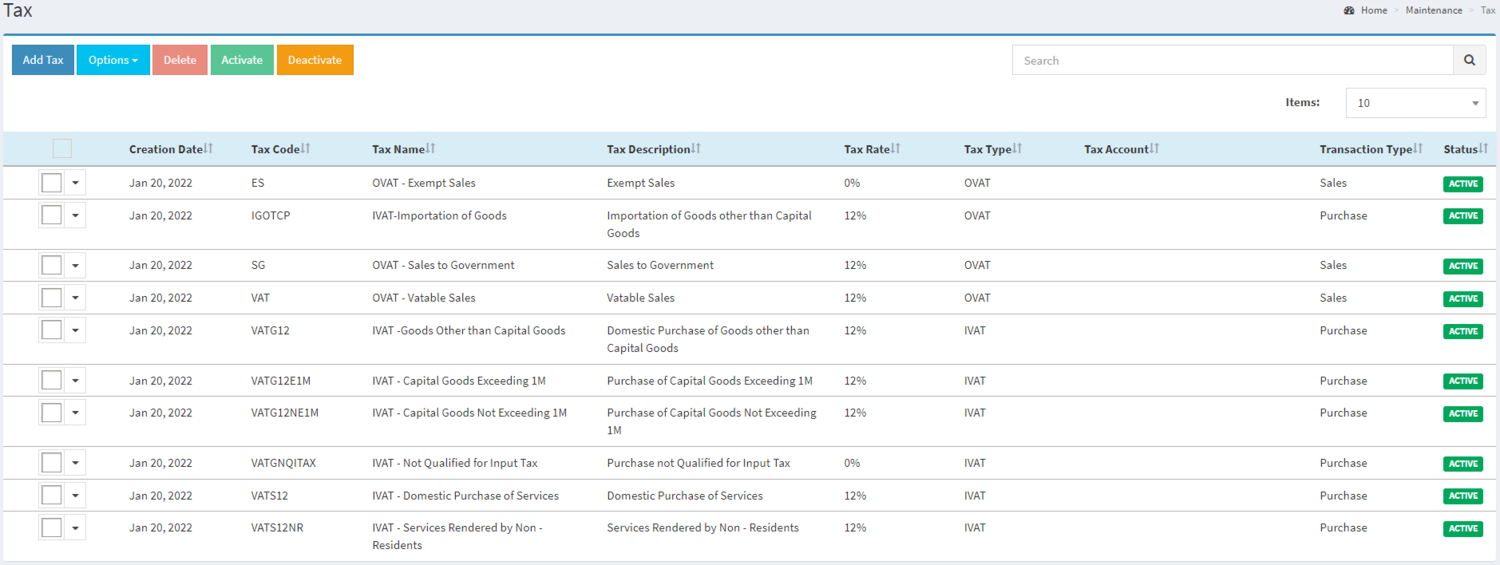

Tax Record List

Notes:

- Tax, as long as its status is ACTIVE can be used in the following modules:

- Sales Quotation

- Sales Order

- Sales Invoice

- Purchase Order

- Accounts Payable

- Accounts Receivable

- Accounts Receivable generated from Sales Invoice cannot be edited

- Past Transactions with INACTIVE tax can still be used prior to its deactivation but for new transactions, INACTIVE tax cannot be used.

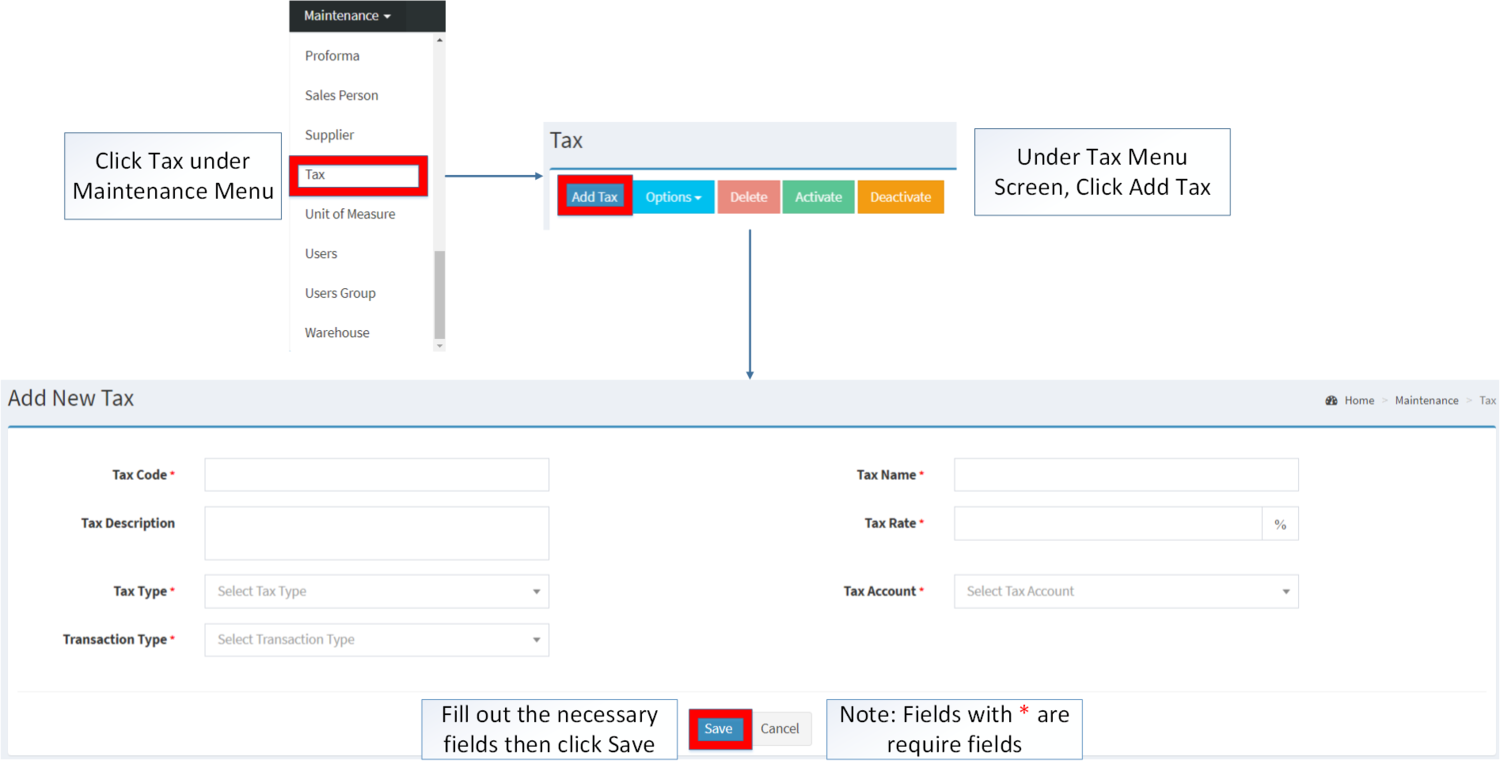

Adding Tax Record

- Click Tax under Maintenance Menu

- Under Tax Menu Screen, Click Add Tax

- Fill out the necessary fields then Click Save. Note: Fields with * are require fields

| Field | Description | Allowed Inputs | Input Restrictions | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.Tax Code | •Reference Code for Tax | *Alphanumeric

*Special Characters |

None | 10 | Yes |

| 2.Tax Name | •Name of Tax | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 3.Tax Description | •Description of Tax | *Alphanumeric

*Special Characters |

None | 100 | No |

| 4.Tax Rate | •Rate to be Apply when applying tax | *Numeric | *Alphabet

*Special Characters |

5 | Yes |

| 5.Tax Type | •Nature of Tax | *Input Tax

*Output Tax *Percentage Tax *Withholding Tax |

Any inputs not mentioned in the required inputs | N/A | Yes |

| 6.Tax Account | •Account to be applied when applying tax | *Account Code under Account List provided in Chart of Account Maintenance Module | Any inputs not mentioned in the required inputs | N/A | Yes |

| 7.Transaction Type | •Type of Transaction when applying Tax | *Sales

*Purchase *Both |

Any inputs not mentioned in the required inputs | N/A | Yes |

Notes:

- Tax Code is a unique required field in the Module. This field cannot be edited once the Tax Record is created.

- Tax Count is a required field. Accounts can be used from Chart of Account as long as the status of that account is ACTIVE

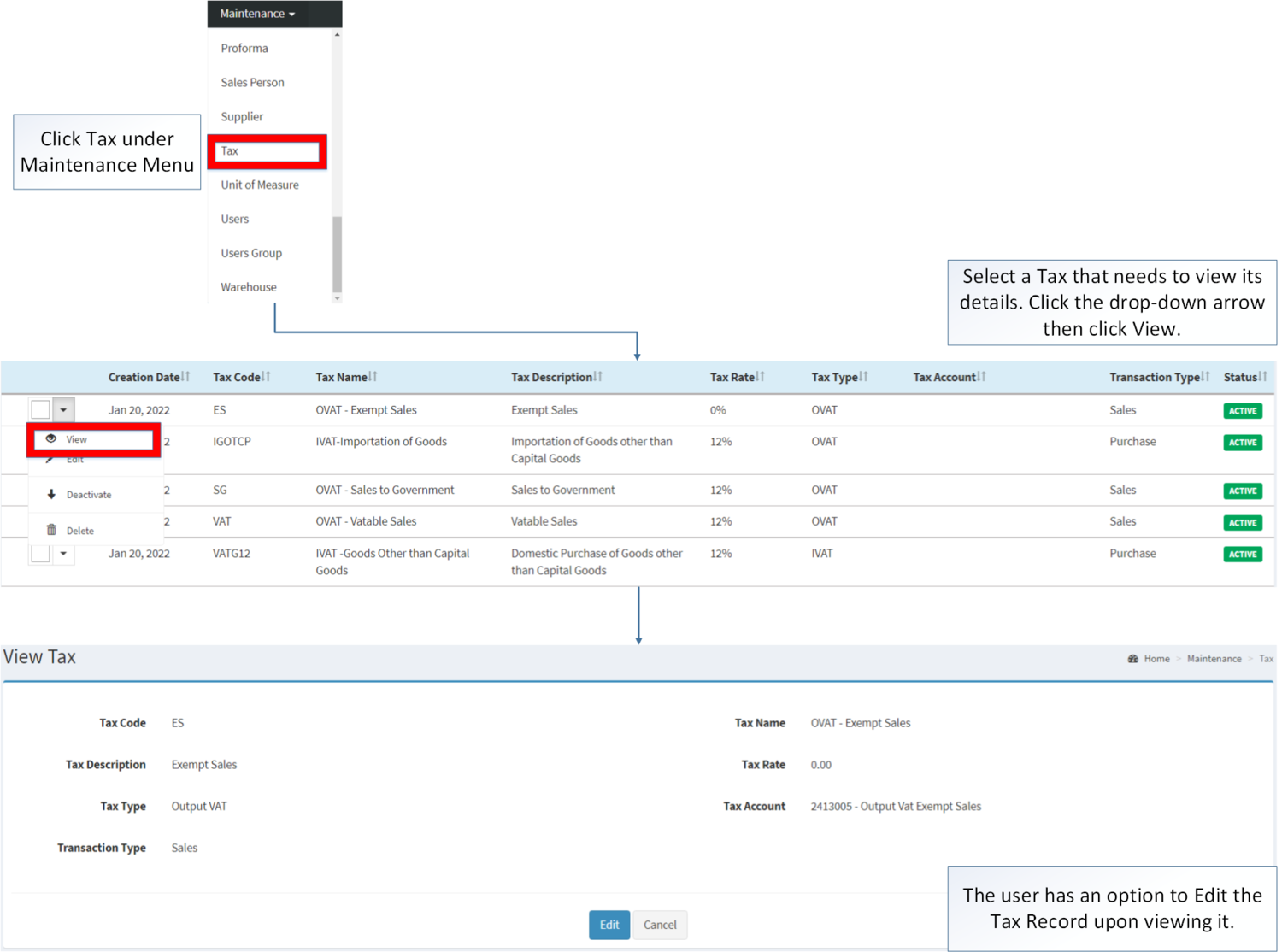

View Tax Record

- Go to Maintenance then click Tax

- Select a Tax that needs to view its details. Click the drop-down arrow then click View.

- The user has an option to Edit the Tax Record upon viewing it.

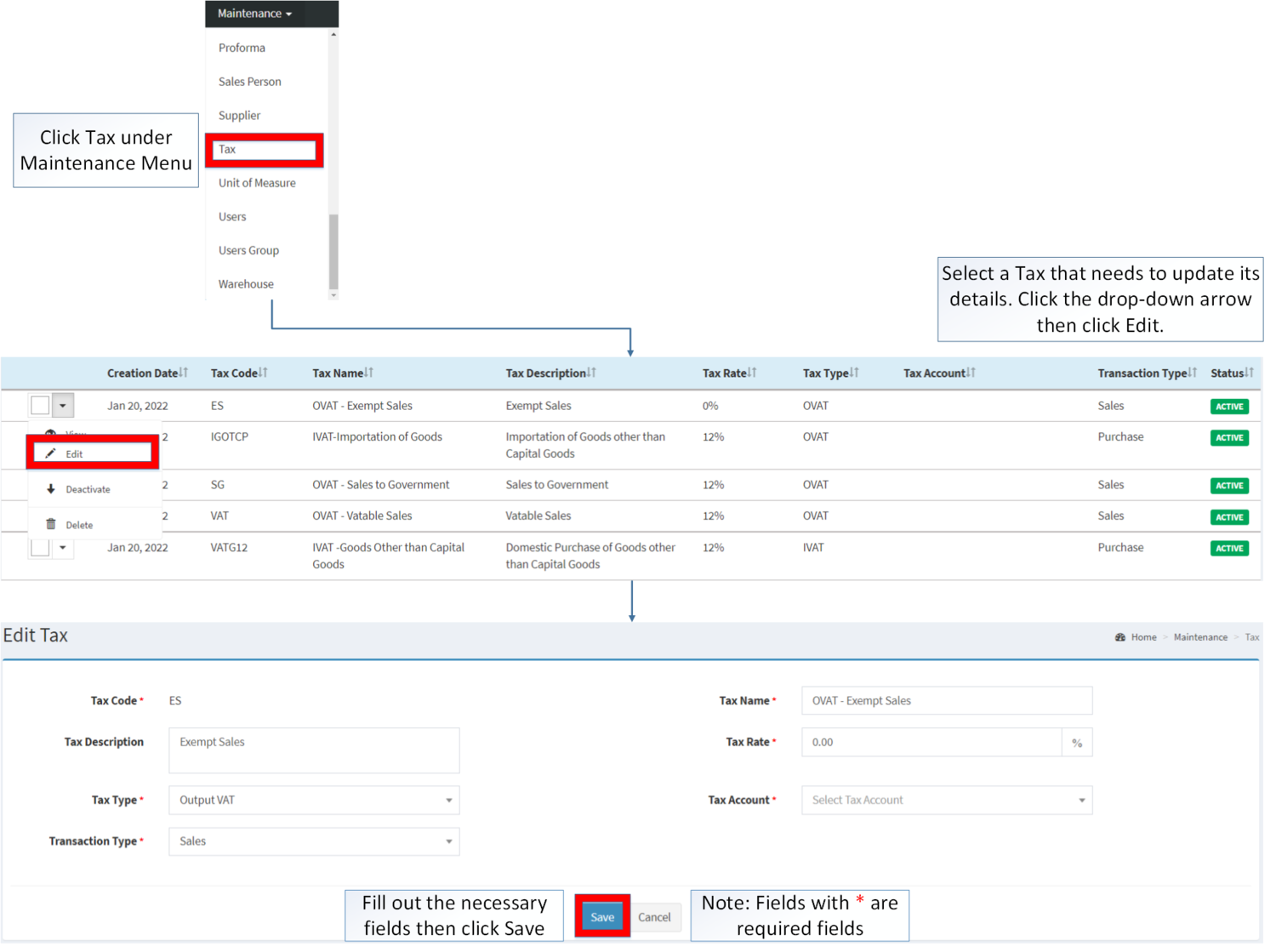

Editing Tax Record

- Go to Maintenance then click Tax

- Select the Tax that needs an update. Click the drop-down arrow then click Edit

- Update the necessary Fields and Click Save

| Field | Description | Allowed Inputs | Input Restrictions | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.Tax Code | •Reference Code for Tax | None | None | 10 | Yes |

| 2.Tax Name | •Name of Tax | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 3.Tax Description | •Description of Tax | *Alphanumeric

*Special Characters |

None | 100 | No |

| 4.Tax Rate | •Rate to be Apply when applying tax | *Numeric | *Alphabet

*Special Characters |

5 | Yes |

| 5.Tax Type | •Nature of Tax | *Input Tax

*Output Tax *Percentage Tax *Withholding Tax |

Any inputs not mentioned in the required inputs | N/A | Yes |

| 6.Tax Account | •Account to be applied when applying tax | *Account Code under Account List provided in Chart of Account Maintenance Module | Any inputs not mentioned in the required inputs | N/A | Yes |

| 7.Transaction Type | •Type of Transaction when applying Tax | *Sales

*Purchase *Both |

Any inputs not mentioned in the required inputs | N/A | Yes |

Notes:

- Tax Count is a required field. Accounts can be used from Chart of Accounts as long as the status of that account is ACTIVE

- The status of Accounts can be seen in Chart of Account Maintenance Module

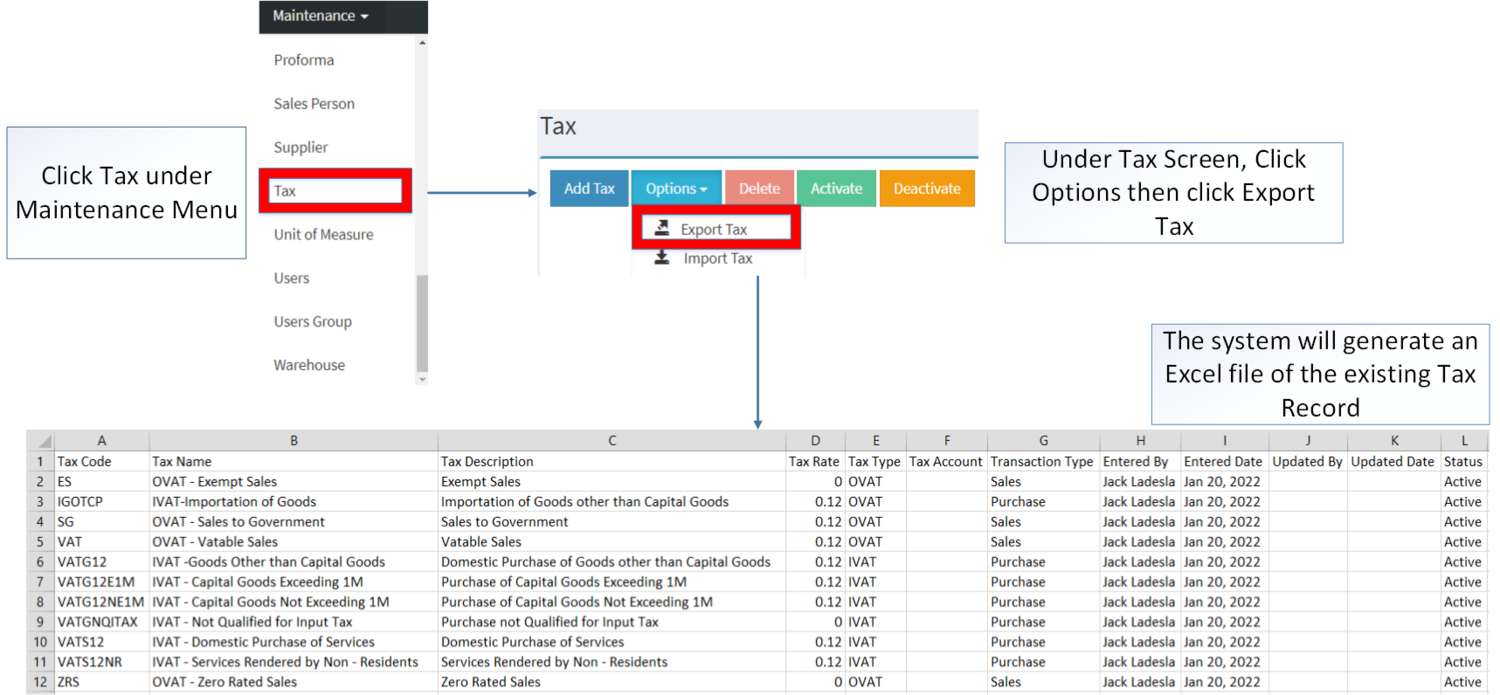

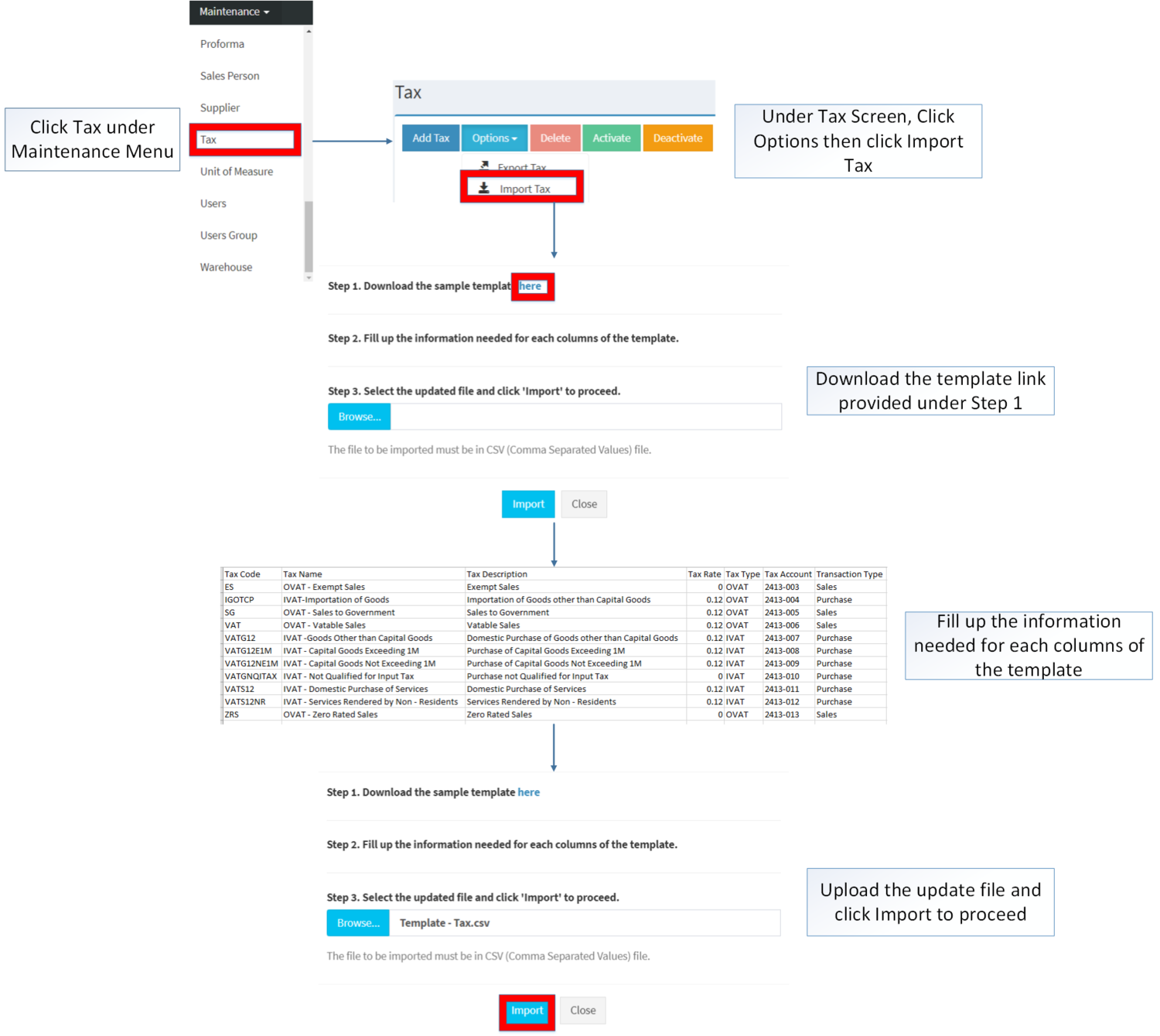

Importing and Exporting Option

1. Under Tax Maintenance Screen, Click Options

2. Under Options, The user may Export or Import The Record

- When Exporting the records, the user may also use the filter options through tabs for precise searching and exporting of records.

- When Importing the records, the user should follow the following steps provided in the Importing Tax Screen such as

| Field | Description | Allowed Inputs | Input Restrictions | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.Tax Code | •Reference Code for Tax | N/A | N/A | N/A | N/A |

| 2.Tax Name | •Name of Tax | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 3.Tax Description | •Description of Tax | *Alphanumeric

*Special Characters |

None | 100 | No |

| 4.Tax Rate | •Rate to be Apply when applying tax | *Numeric | *Alphabet

*Special Characters |

5 | Yes |

| 5.Tax Type | •Nature of Tax | *Input Tax

*Output Tax *Percentage Tax *Withholding Tax |

Any inputs not mentioned in the required inputs | N/A | Yes |

| 6.Tax Account | •Account to be applied when applying tax | *Account Code under Account List provided in Chart of Account Maintenance Module | Any inputs not mentioned in the required inputs | N/A | Yes |

| 7.Transaction Type | •Type of Transaction when applying Tax | *Sales

*Purchase *Both |

Any inputs not mentioned in the required inputs | N/A | Yes |

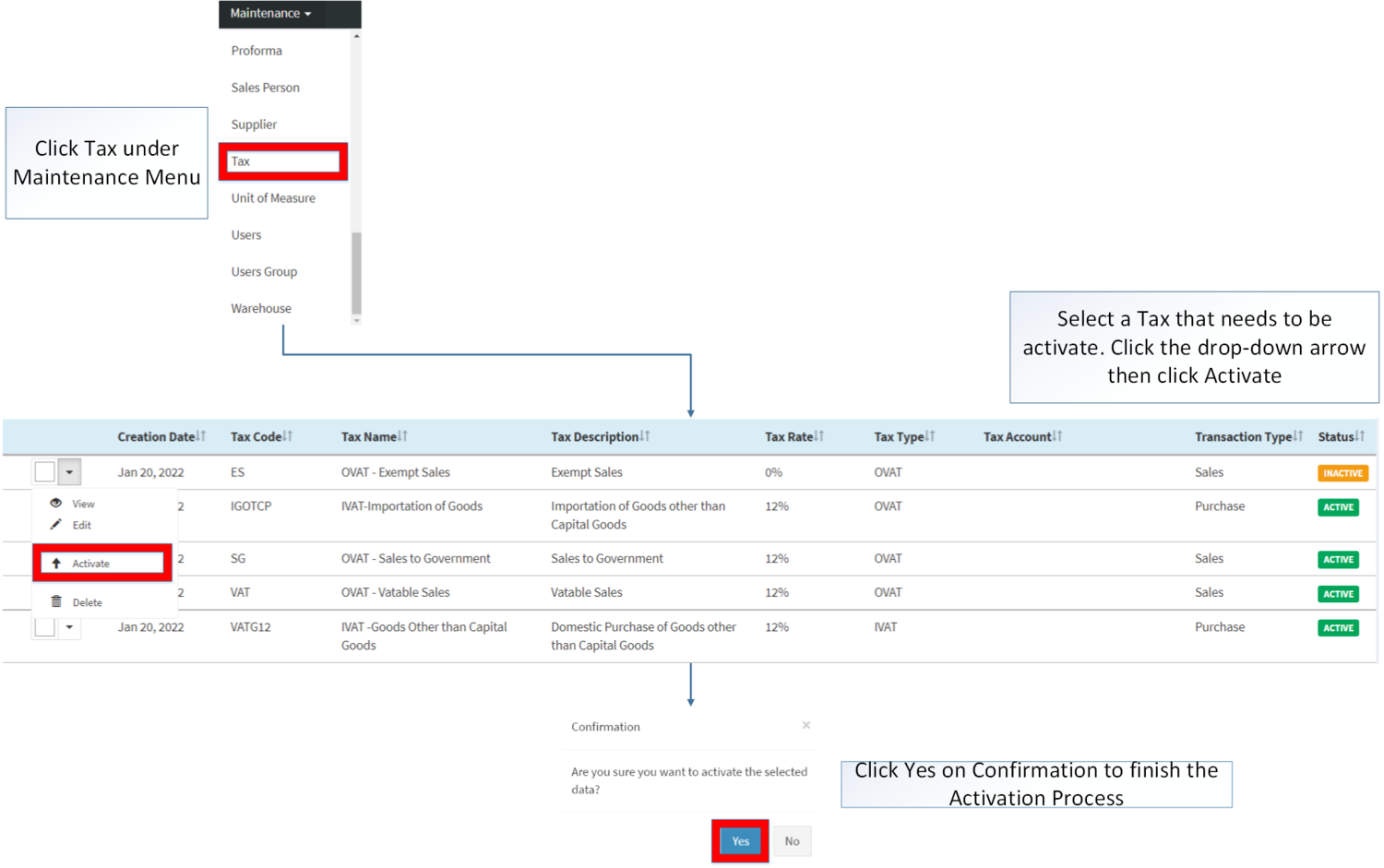

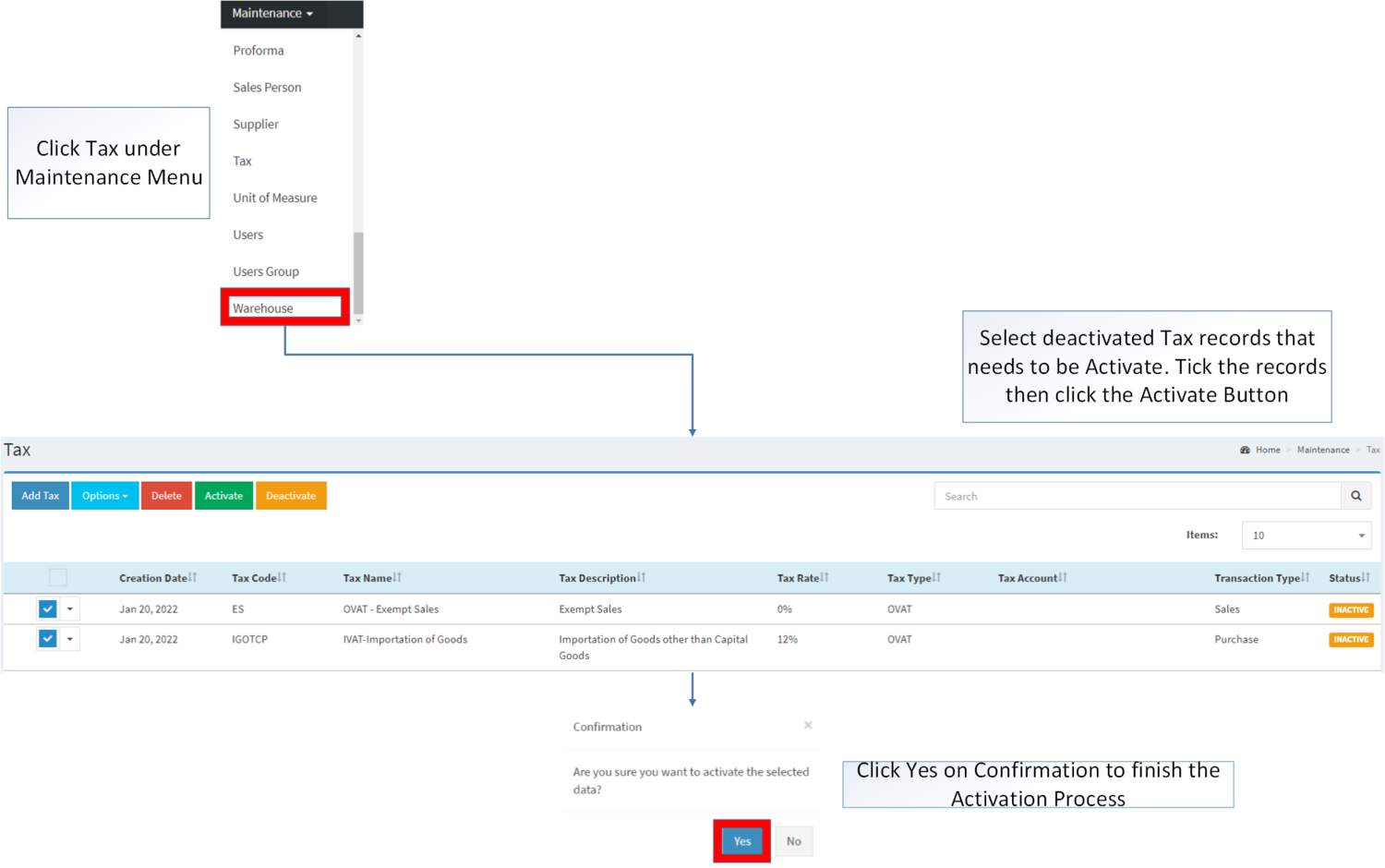

Activating Tax Record

Tax can be Activated in two ways:

- Using drop-down arrow of a record can be used in single record Activation

- Using Activate Button for activating multiple record

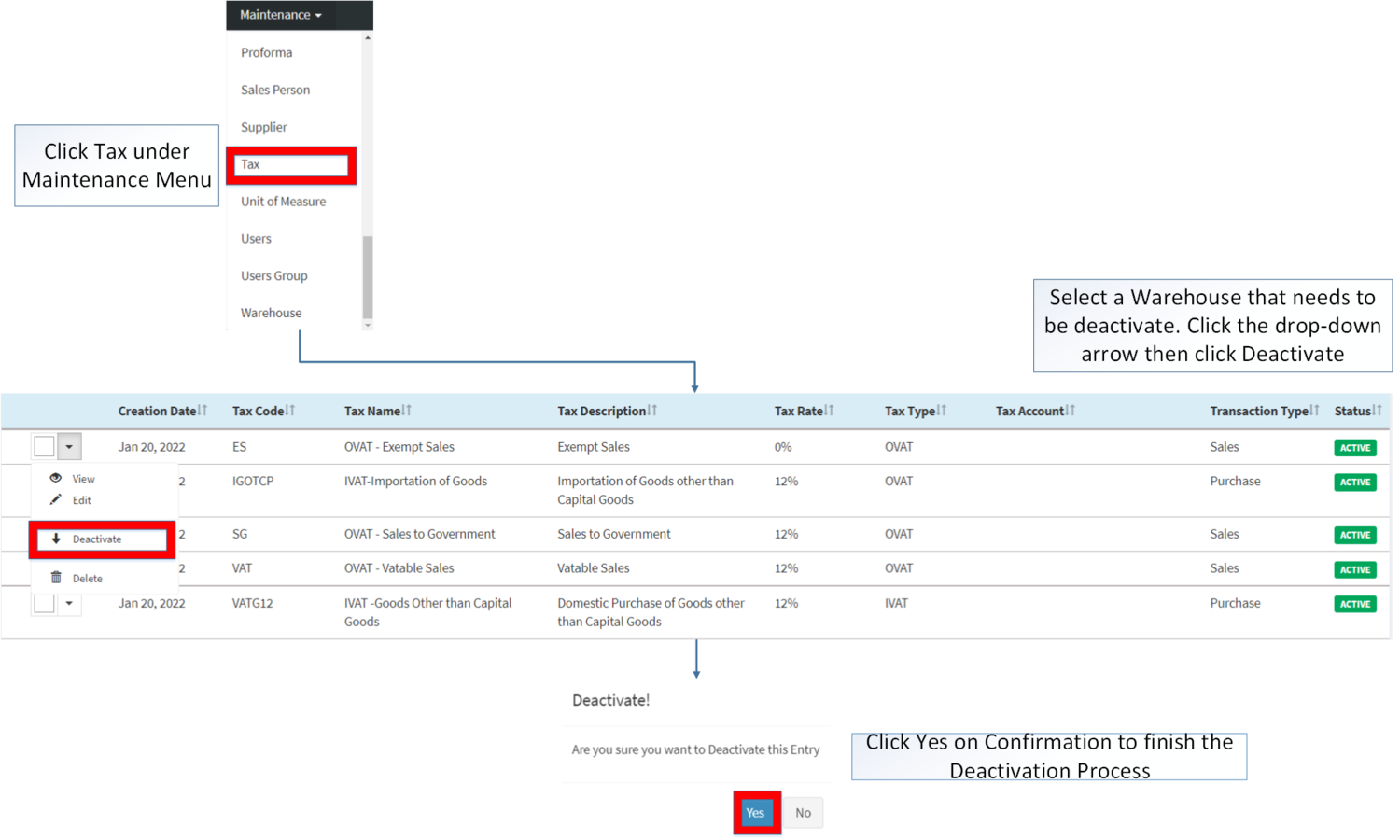

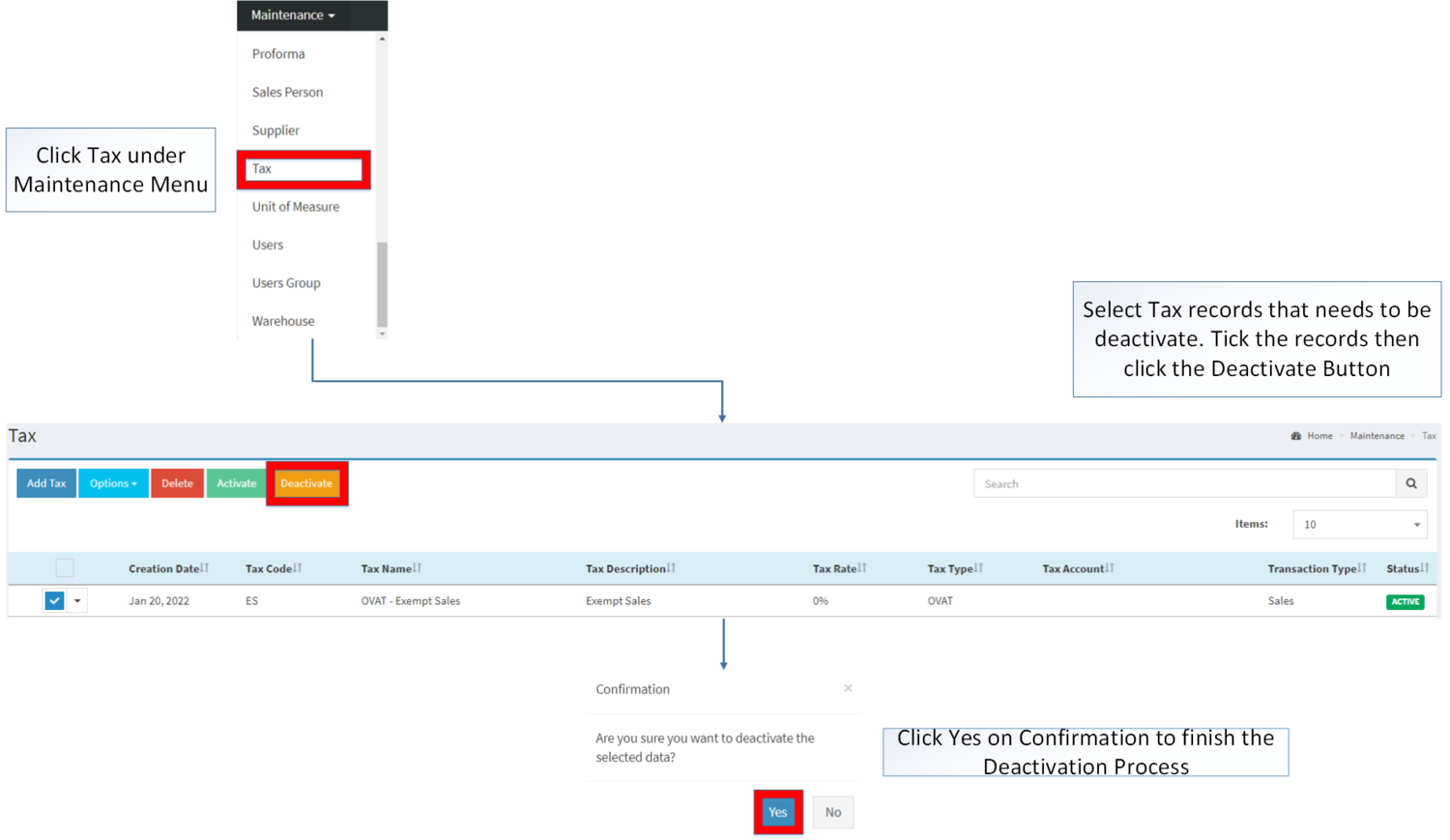

Deactivating Tax Record

Tax can be deactivated in two ways:

- Using drop-down arrow of a record can be used in single record deactivation

- Using Deactivate Button for deactivating multiple record

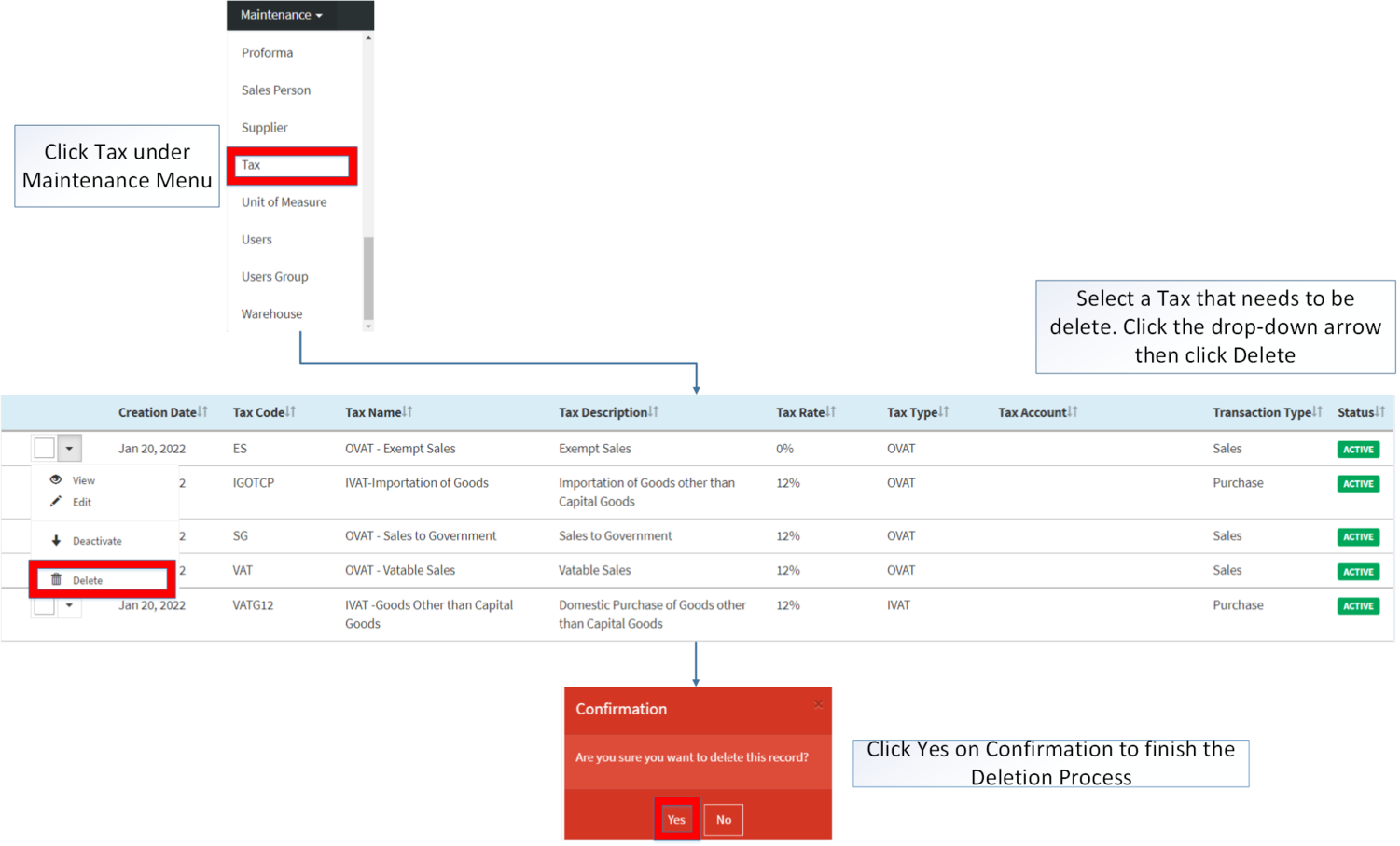

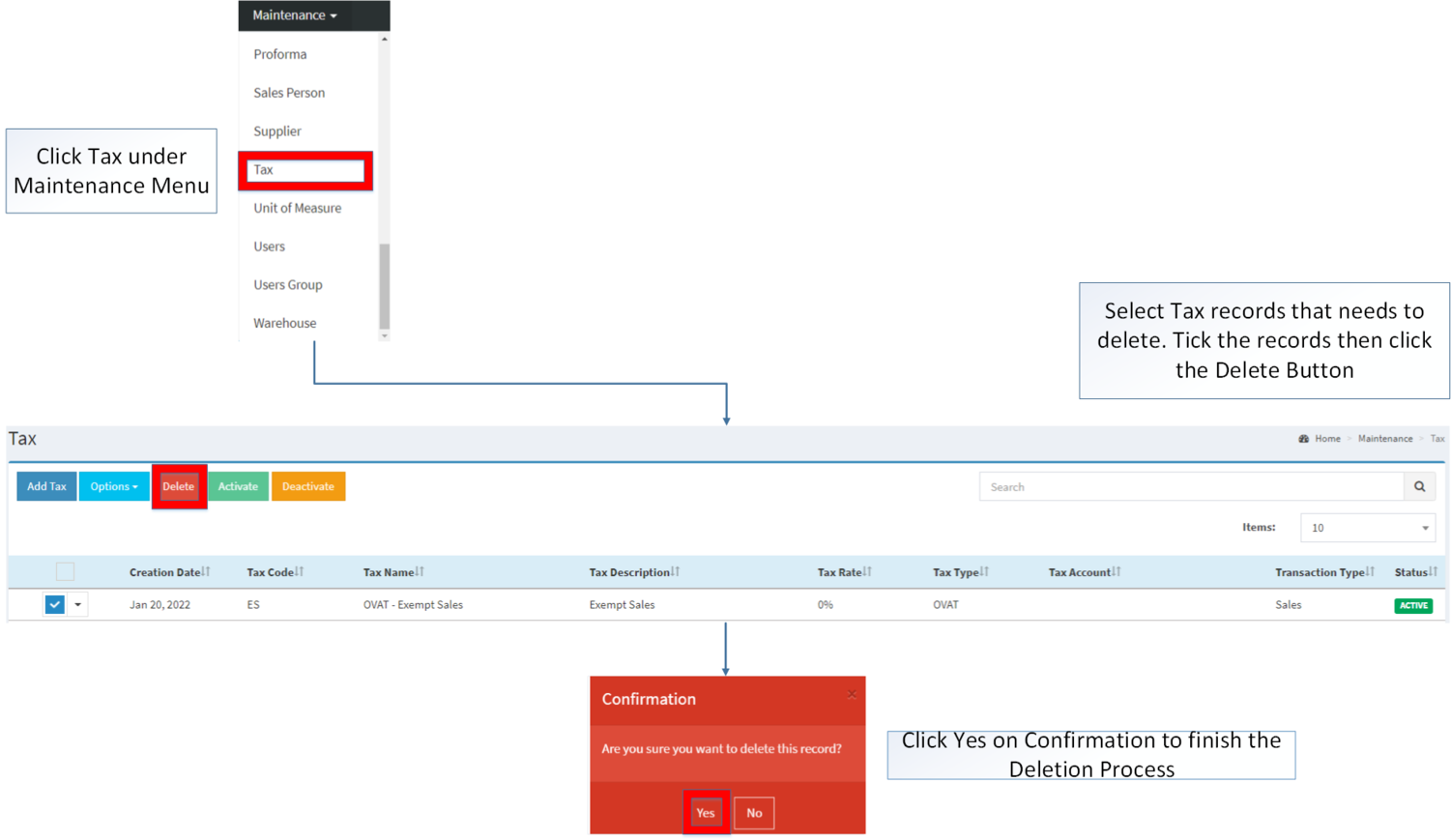

Deleting Tax Record

Tax can be deleted in two ways:

- Using drop-down arrow of a record can be used in single record deletion

- Using Delete Button for deleting multiple record

Tax Record Option

| Status | View | Edit | Deactivate | Activate | Delete |

|---|---|---|---|---|---|

| ACTIVE | ☑ | ☑ | ☑ | ☑ | |

| INACTIVE | ☑ | ☑ | ☑ | ☑ |

Notes:

- The user can edit the details while viewing the record.

- Tax that has been in transactions or other maintenance modules cannot be deleted.

- INACTIVE Tax cannot be used in the transaction but the INACTIVE Tax on the past transactions can still use it.

- Activating/Deactivating and Deleting of Records can be done in two ways.

- For single records, the user may use the drop down arrow then the action that need to perform.

- For multiple records, the user may tick the records then click the action button that need to perform

- Click the Yes in the confirmation to proceed on the action taken.

| Modules | |

|---|---|

| Maintenance | Maintenance | Tax | ATC Code | Chart of Account |

| Sales | Sales Quotation | Sales Order | Sales Invoice |

| Purchase | Purchase Order |

| Financials | Accounts Payable | Accounts Receivable |

| Inventory | Inventory Adjustment |