Accounts Receivable

-

- Last edited 3 years ago by Gelo

-

Contents

- 1 Accounts Receivable

- 1.1 Requirements before using Accounts Receivable

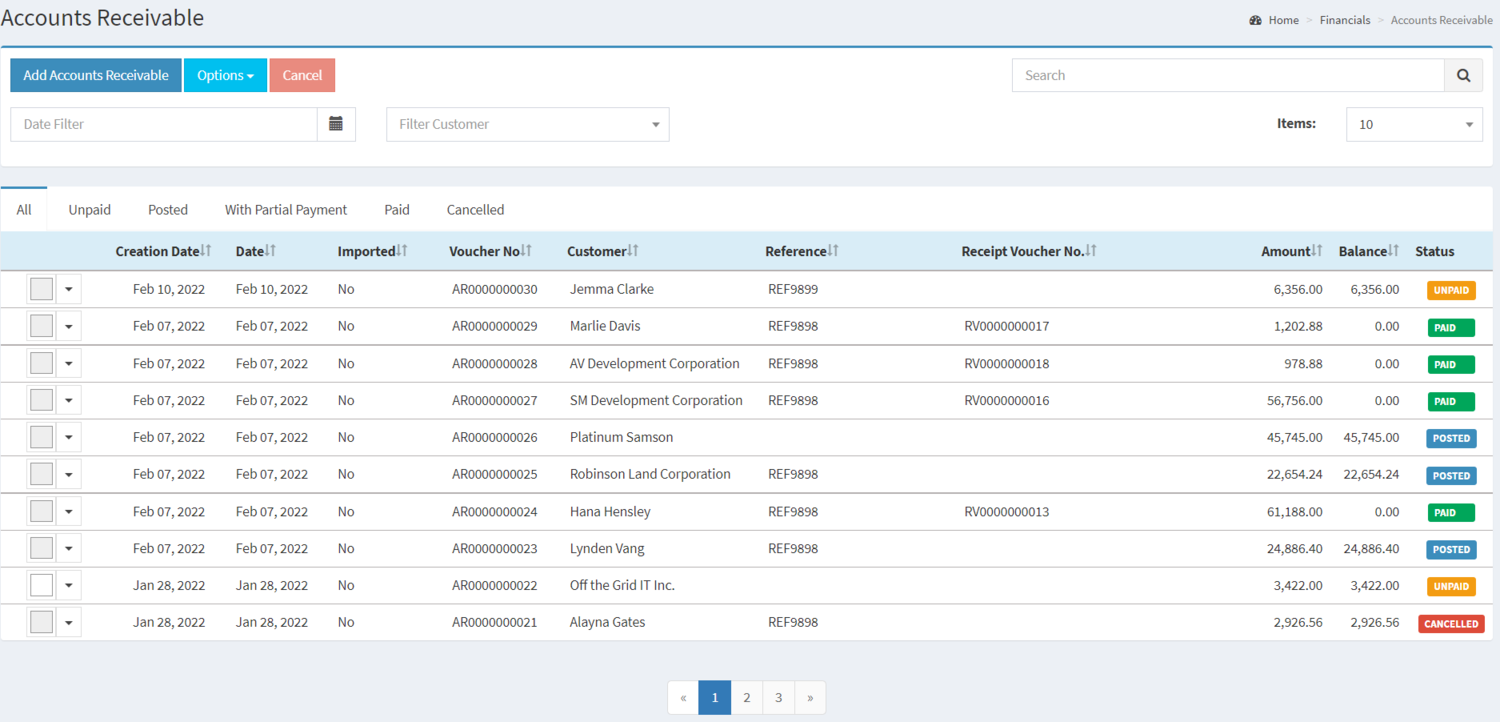

- 1.2 Accounts Receivable Record List

- 1.3 Adding Accounts Receivable

- 1.4 Viewing Accounts Receivable

- 1.5 Editing Accounts Receivable

- 1.6 Printing Accounts Receivable

- 1.7 Posting Accounts Receivable

- 1.8 Unposting Accounts Receivable

- 1.9 Receiving Payment in Accounts Receivable

- 1.10 Cancelling Accounts Receivable Record

- 1.11 Importing and Exporting Accounts Receivable

- 1.12 Accounts Receivable Record Option

Accounts Receivable

Allows the user to create a transaction for the balance due to a firm for goods and services delivered or used but not yet paid for by customers.

Requirements before using Accounts Receivable

- The user should setup the following Maintenance Module in order to proceed on using the Accounts Receivable

| Status | Description |

|---|---|

| UNPAID | If the Accounts Receivable has been created |

| POSTED | If the Accounts Receivable is Posted and ready to receive its payment |

| WITH PARTIAL PAYMENT | If the Accounts Receivable is Paid Partially |

| PAID | If the Accounts Receivable is completely Paid |

| CANCELLED | If the Accounts Receivable is cancelled |

Accounts Receivable Record List

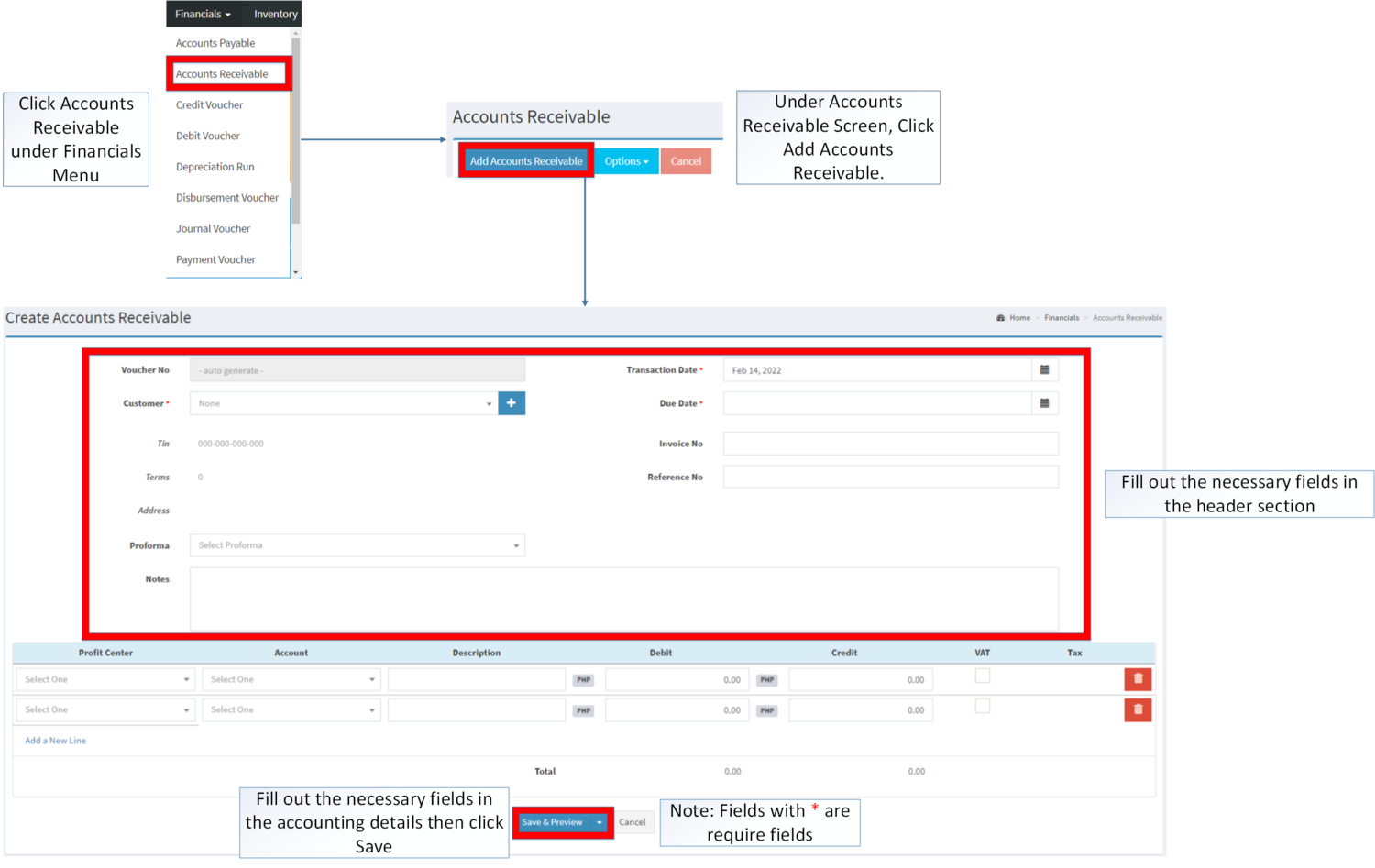

Adding Accounts Receivable

- Click Accounts Receivable under Financials menu

- Under Accounts Receivable Screen, Click Add Accounts Receivable

- Fill up the necessary fields in the Header Section

- Fill up the necessary fields in the Accounting Details then Click Save. Note: Fields with * are require fields

| Field | Description | Allowed Inputs | Restricted Inputs | Character Limit | Required Fields? |

|---|---|---|---|---|---|

| 1. Voucher No. | •Voucher Reference number generated upon creation | •Alphanumeric(Auto-Generated) | N/A | N/A | N/A |

| 2.Customer | •Name of Customer | •Customer List provided in the Customer Maintenance Module | N/A | N/A | Yes |

| 3.Tax Identification Number(TIN) | •TIN of the Customer | •Number(Auto-Generated base from Customer's Profile) | N/A | N/A | N/A |

| 4.Terms | •Days on completing the sale | •Number(Auto-Generated base from the

Customer's Profile) |

N/A | N/A | N/A |

| 5.Address | •Address of the Customer | •Alphanumeric(Auto-Generated base from the Customer's Profile) | N/A | N/A | N/A |

| 6.Proforma | •Financial statements is to facilitate comparisons of historic data and projections of future performance. | •Proforma list provided in the Proforma Maintenance Module | N/A | N/A | No |

| 7.Transaction Date | •Date when the Payable Transaction was created | •Date picker provided by the system | N/A | N/A | Yes |

| 8.Due Date | •Due date of Payable Transaction | •Date picker provided by the system | N/A | N/A | Yes |

| 9.Invoice No | •Invoice number reference for the transaction | •Alphanumeric

•Special Characters |

None | 20 | No |

| 10.Reference No | •Reference No for the transaction | •Alphanumeric | Special Characters | 20 | No |

| 11.Notes | •Other Remarks on the Transaction | •Alphanumeric

•Special Characters |

None | 300 | No |

| 12.Account | •Account to be charged for credit and debit amount on the transaction | •Account list in the Chart of Accounts Maintenance Module | N/A | N/A | Yes |

| 13.Description | •Any remarks or Notes in the Account Line of the transaction | •Alphanumeric

•Special Characters |

None | 250 | No |

| 14.Debit | •Debit Amount for the Transaction | •Numeric | Any Inputs except numbers | 20 | Yes |

| 15.Credit | •Credit Amount for the Transaction | •Numeric | Any Inputs except numbers | 20 | Yes |

| 16.Value Added Tax(VAT) | •VAT to be applied in the amount on the accounting details in the transaction | •Tick/Untick | N/A | N/A | No |

| 17.Tax | •Type of Tax to be applied when the VAT is ticked | •Tax List provided in the Tax Maintenance Module | N/A | N/A | N/A |

Notes:

- Accounts Receivable Transactions are auto-generated when it is created from Billing and Delivery Receipt with Sales Invoice in it.

- Account should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Chart of Account Maintenance Module.

- Proforma should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Proforma Maintenance Module

- Customer should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Customer Maintenance Module

- Tax should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Tax Maintenance Module

- This will be only available in the transaction when the VAT column is checked.

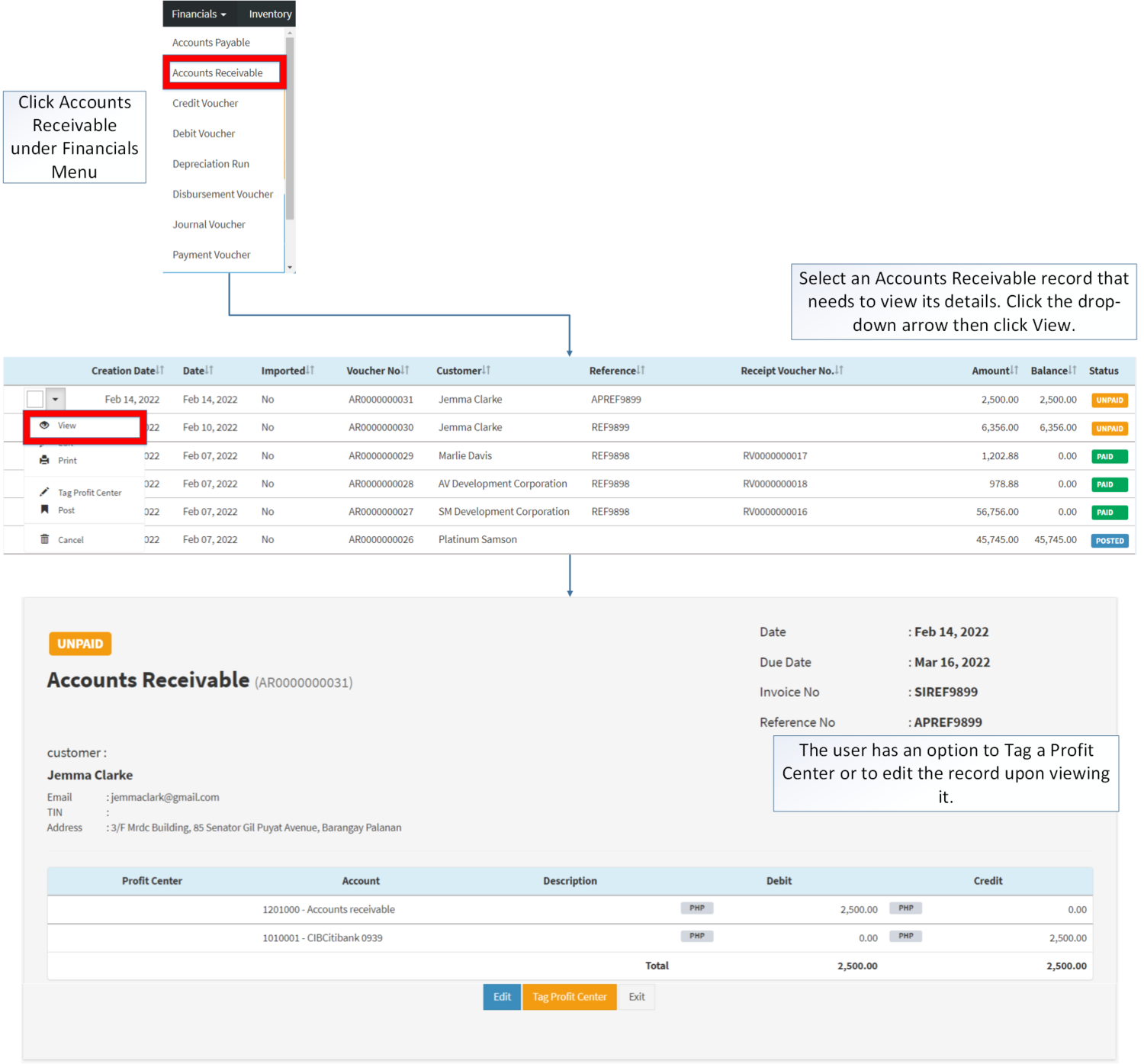

Viewing Accounts Receivable

- Click Accounts Receivable under Financials Menu

- Select an Accounts Receivable record that needs to view its details. Click the drop-down arrow then click View.

- The user has an option to Tag a Profit Center or to edit the record upon viewing it.

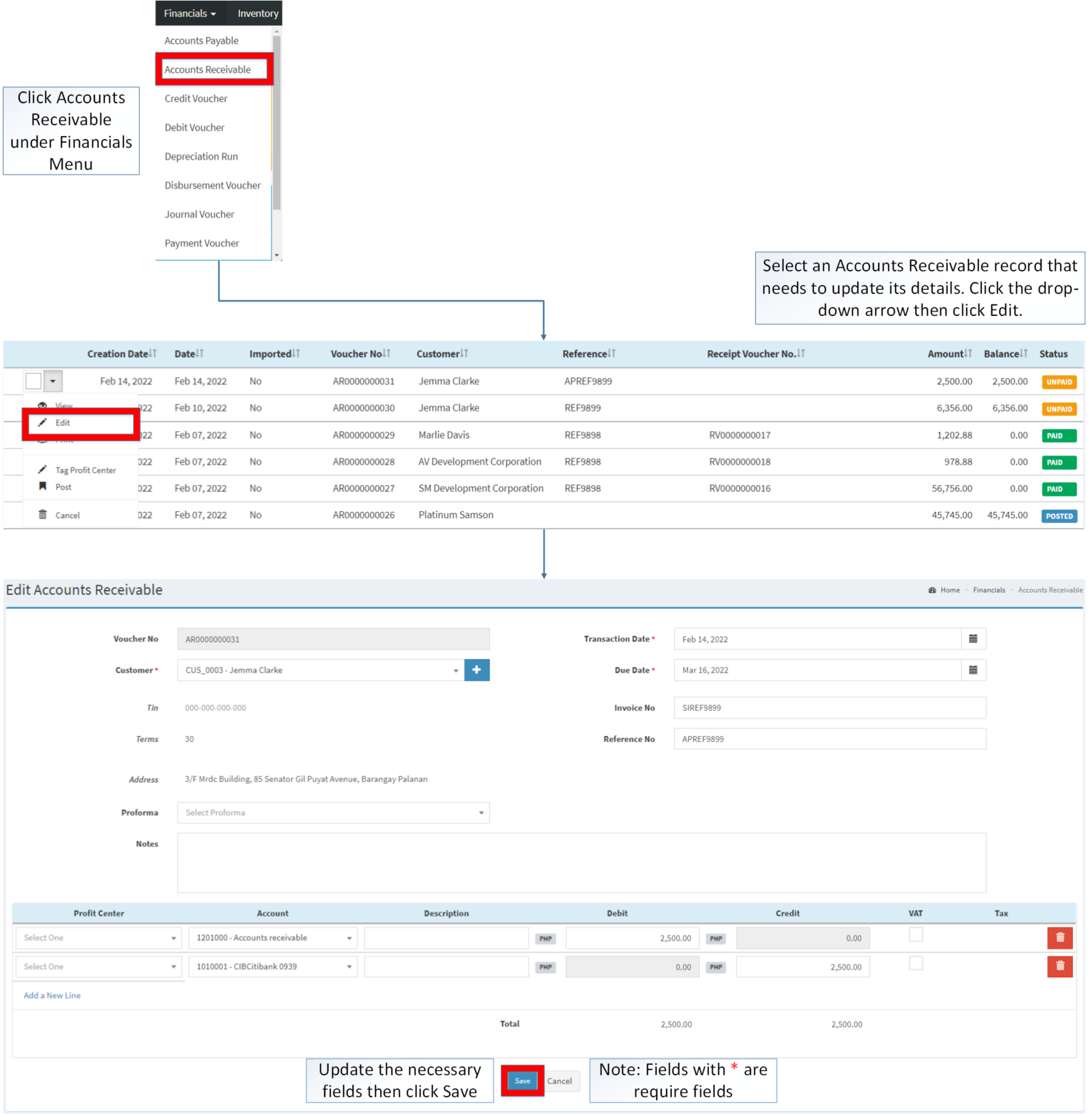

Editing Accounts Receivable

- Click Accounts Receivable under Financials Menu

- Select the Accounts Receivable that needs to update its details. Click the drop-down arrow then click Edit.

- Update the necessary information then click Save.

| Field | Description | Allowed Inputs | Restricted Inputs | Character Limit | Required Fields? |

|---|---|---|---|---|---|

| 1. Voucher No. | •Voucher Reference number generated upon creation | •Alphanumeric(Auto-Generated) | N/A | N/A | N/A |

| 2.Customer | •Name of Customer | •Customer List provided in the Customer Maintenance Module | N/A | N/A | Yes |

| 3.Tax Identification Number(TIN) | •TIN of the Customer | •Number(Auto-Generated base from Customer's Profile) | N/A | N/A | N/A |

| 4.Terms | •Days on completing the sale | •Number(Auto-Generated base from theCustomer's Profile) | N/A | N/A | N/A |

| 5.Address | •Address of the Customer | •Alphanumeric(Auto-Generated base from the Customer's Profile) | N/A | N/A | N/A |

| 6.Proforma | •Financial statements is to facilitate comparisons of historic data and projections of future performance. | •Proforma list provided in the Proforma Maintenance Module | N/A | N/A | No |

| 7.Transaction Date | •Date when the Payable Transaction was created | •Date picker provided by the system | N/A | N/A | Yes |

| 8.Due Date | •Due date of Payable Transaction | •Date picker provided by the system | N/A | N/A | Yes |

| 9.Invoice No | •Invoice number reference for the transaction | •Alphanumeric

•Special Characters |

None | 20 | No |

| 10.Reference No | •Reference No for the transaction | •Alphanumeric | Special Characters | 20 | No |

| 11.Notes | •Other Remarks on the Transaction | •Alphanumeric

•Special Characters |

None | 300 | No |

| 12.Account | •Account to be charged for credit and debit amount on the transaction | •Account list in the Chart of Accounts Maintenance Module | N/A | N/A | Yes |

| 13.Description | •Any remarks or Notes in the Account Line of the transaction | •Alphanumeric

•Special Characters |

None | 250 | No |

| 14.Debit | •Debit Amount for the Transaction | •Numeric | Any Inputs except numbers | 20 | Yes |

| 15.Credit | •Credit Amount for the Transaction | •Numeric | Any Inputs except numbers | 20 | Yes |

| 16.Value Added Tax(VAT) | •VAT to be applied in the amount on the accounting details in the transaction | •Tick/Untick | N/A | N/A | No |

| 17.Tax | •Type of Tax to be applied when the VAT is ticked | •Tax List provided in the Tax Maintenance Module | N/A | N/A | N/A |

Notes:

- Auto-Generated Accounts Receivable can only be edited through its Sales Invoice

- To edit the total amount of the receivable, the delivery receipt should also be edited by cancelling the Sales Invoice and reverting its Delivery Receipt to prepared.

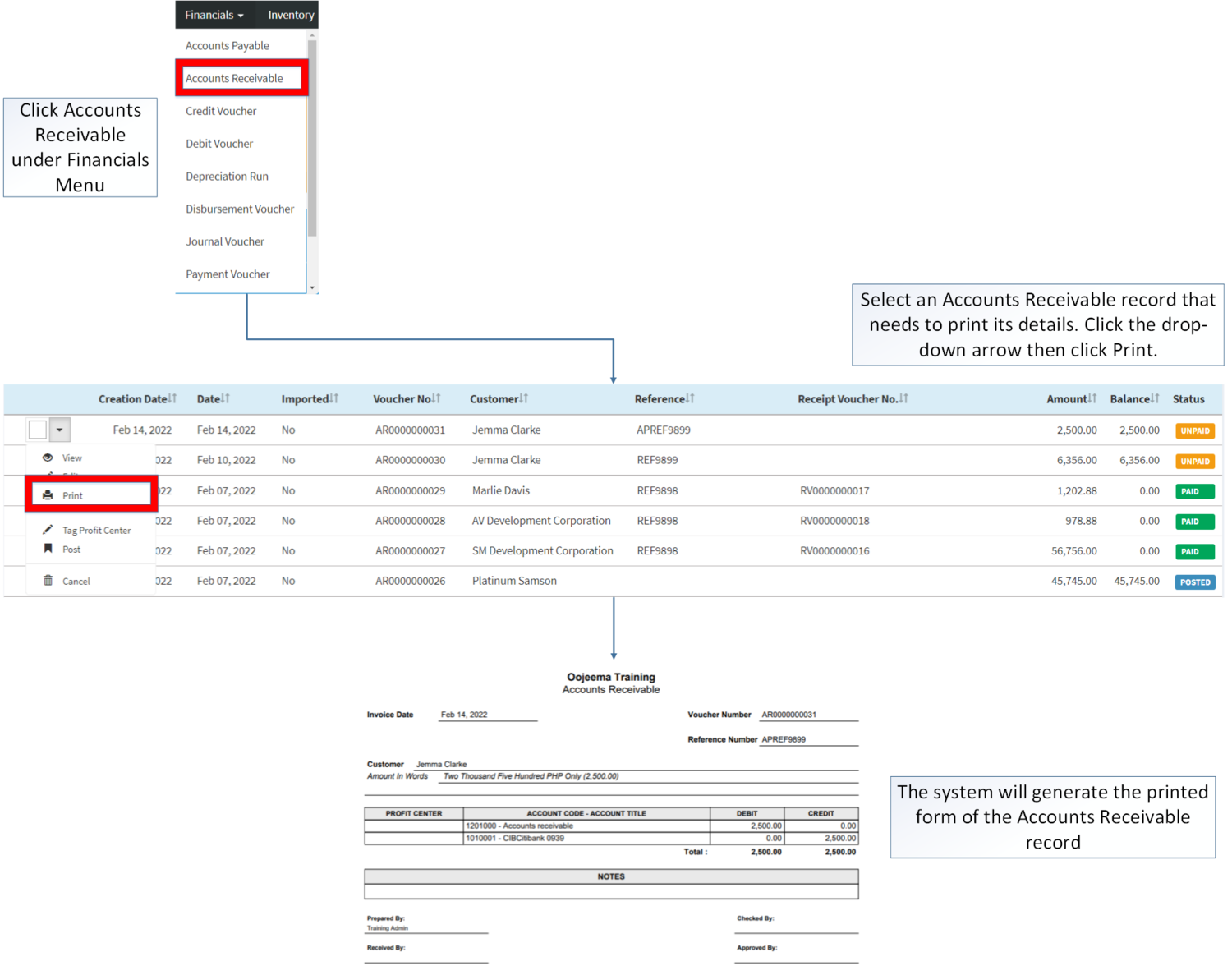

Printing Accounts Receivable

- Click Financials then click Accounts Receivable

- Select the Accounts Receivable that needs to print its details. Click the Drop-down Arrow then press Print.

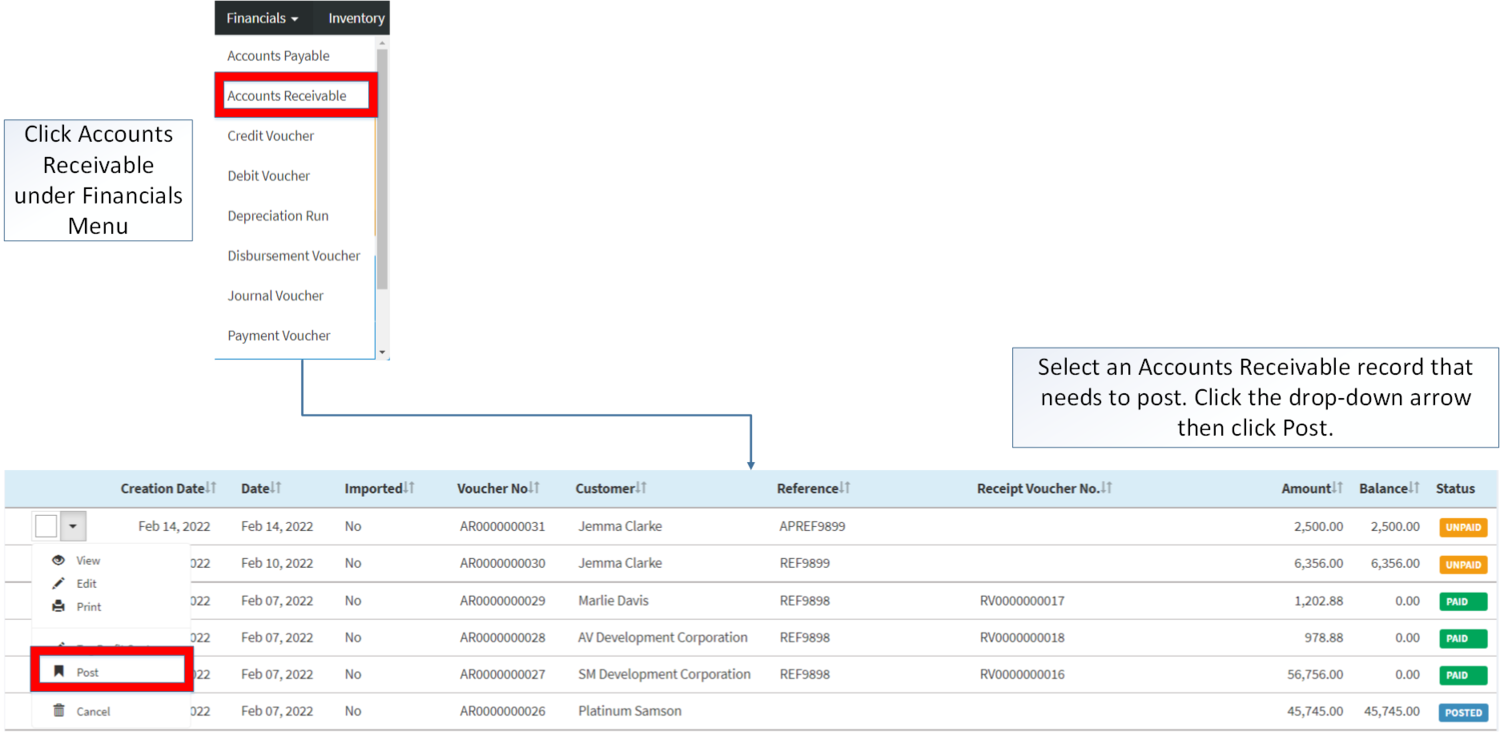

Posting Accounts Receivable

- Click Financials then click Accounts Receivable

- Select the Accounts Receivable that needs to post its details. Click the drop-down arrow then click Post

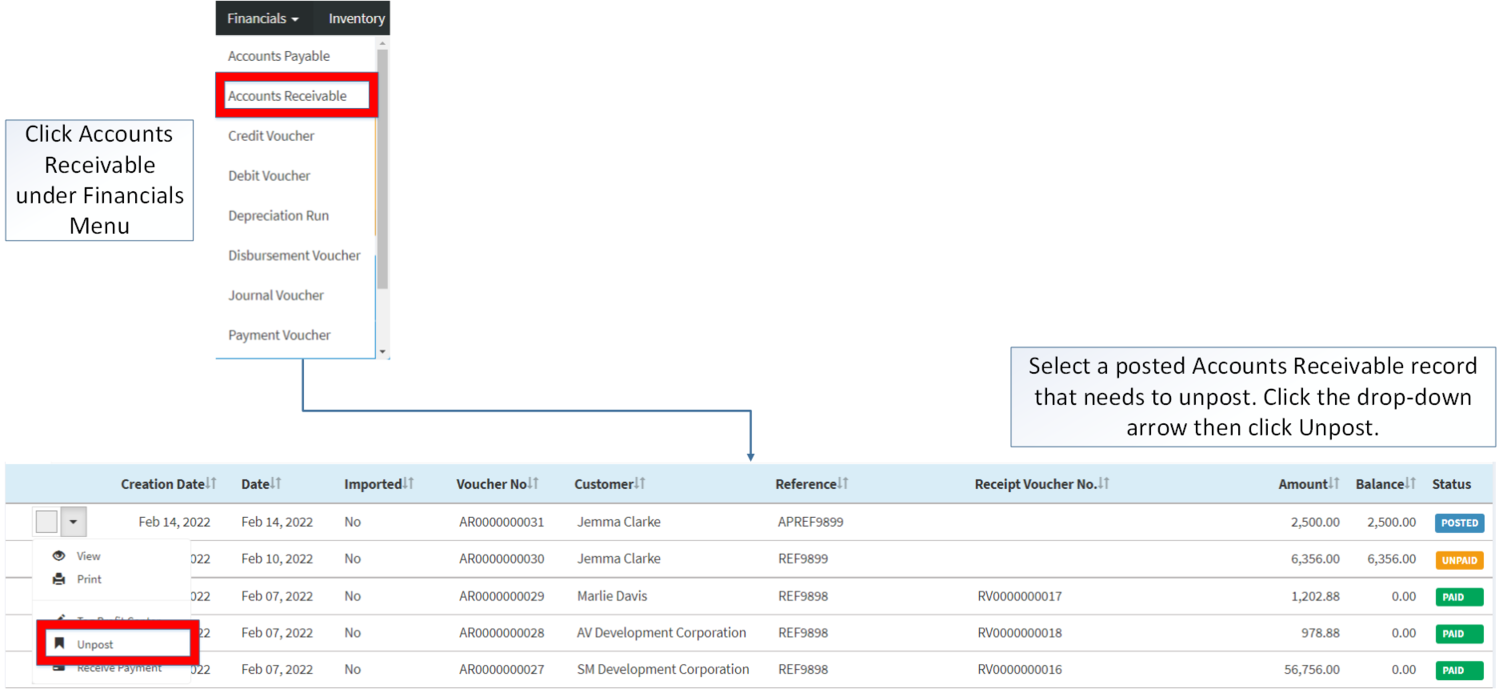

Unposting Accounts Receivable

- Click Financials then click Accounts Receivable

- Select a Posted Accounts Receivable that needs to post its details. Click the drop-down arrow then click Unpost

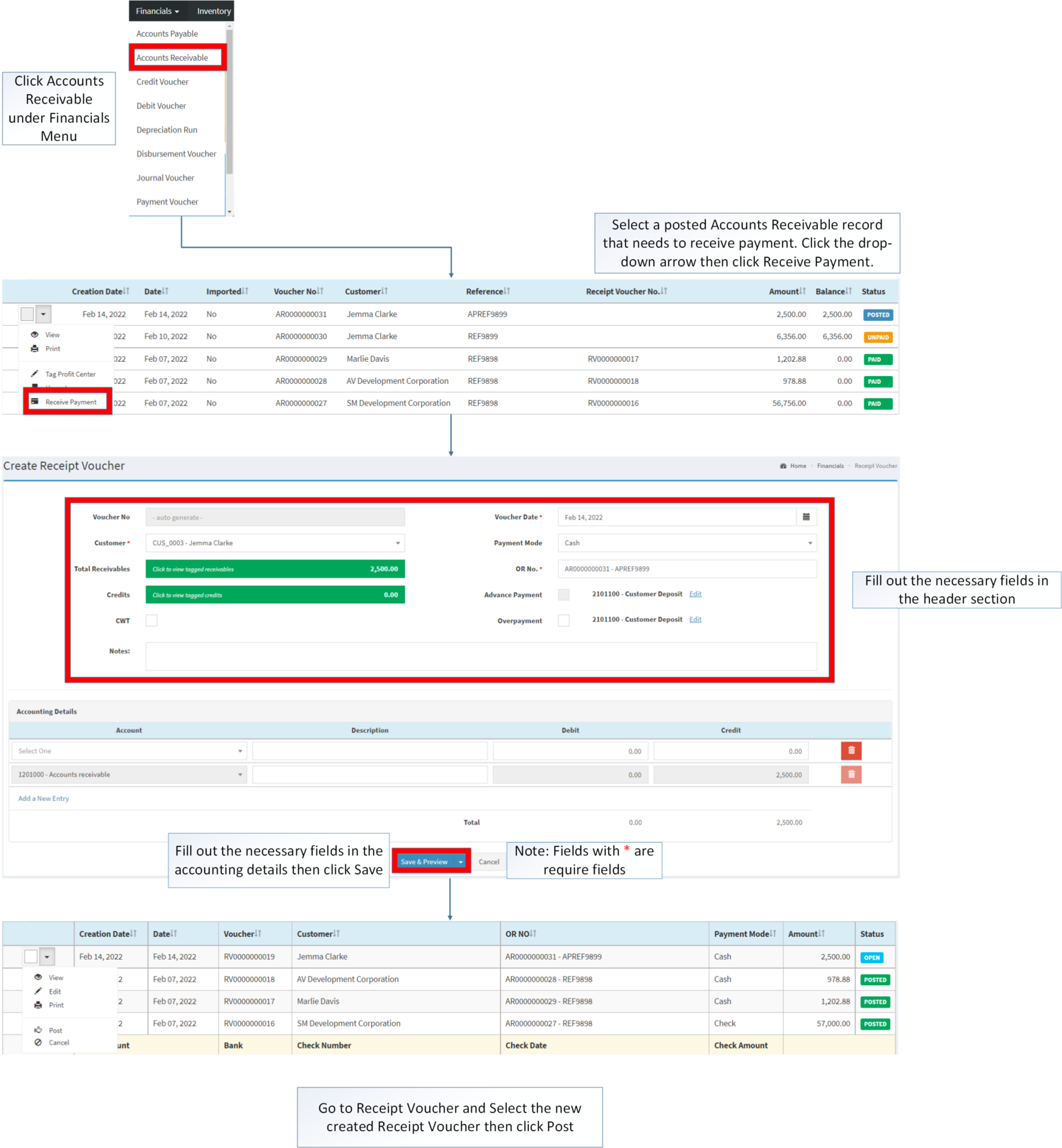

Receiving Payment in Accounts Receivable

- Click Accounts Receivable under Financials Menu

- Select a posted Accounts Receivable record that needs to receive payment. Click the drop-down arrow then click Receive Payment

- Fill out the necessary fields in the header part.

- Fill out the necessary fields in the accounting details then click Save. Note: Fields with * are require fields.

- Go to Receipt Voucher and select the newly created Receipt Voucher then click Post.

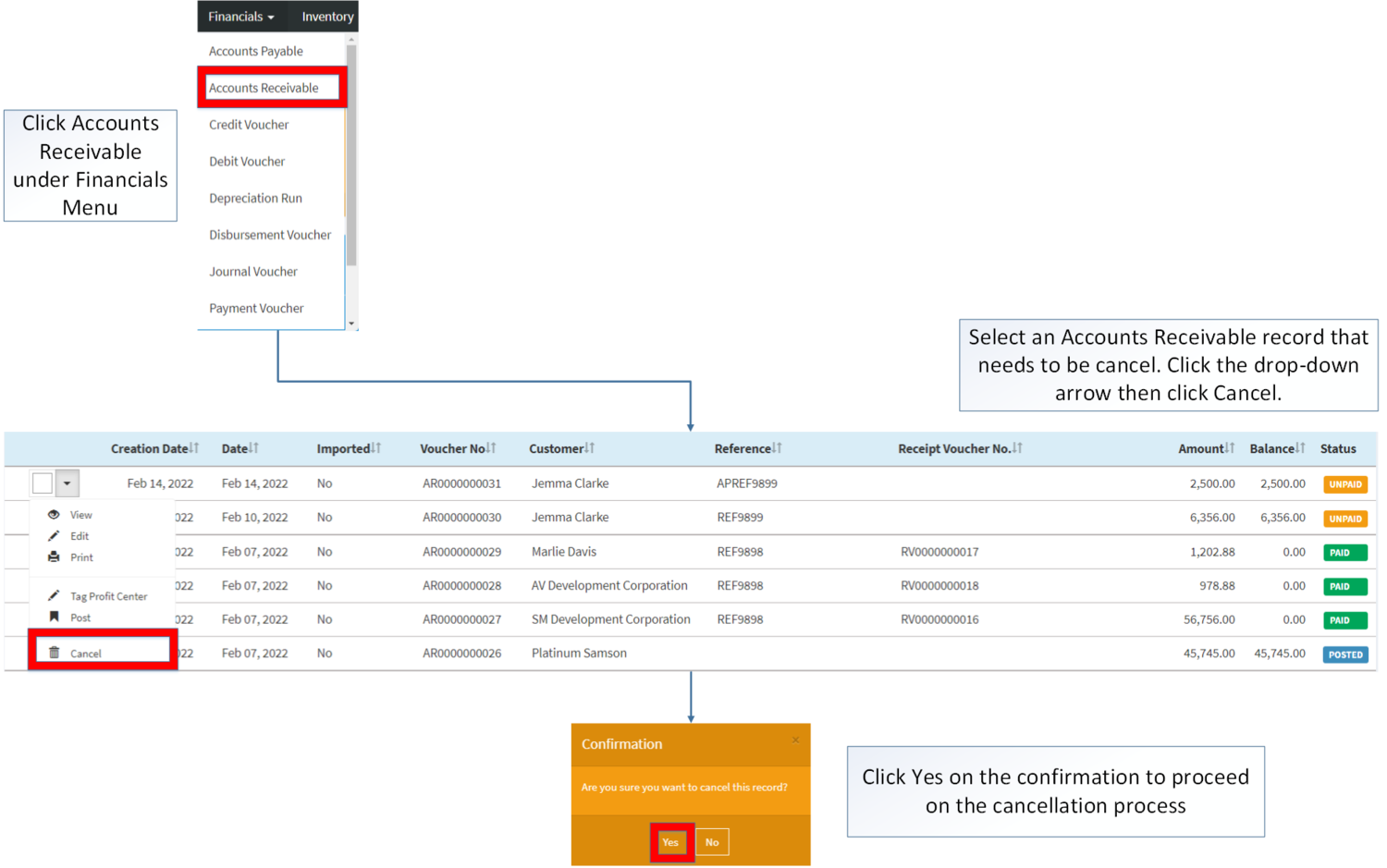

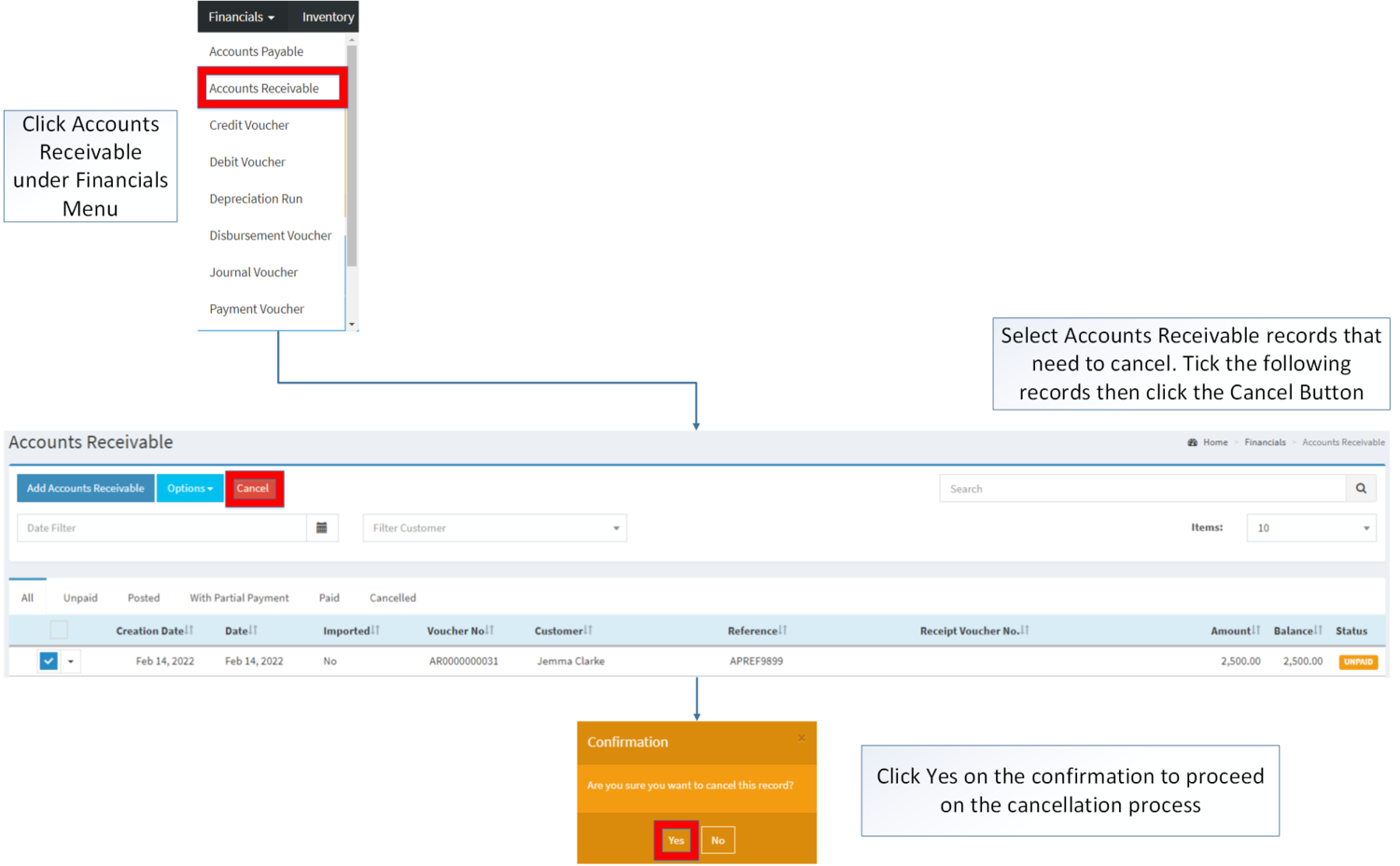

Cancelling Accounts Receivable Record

Import Accounts Receivable can be canceled in two ways:

- Using drop-down arrow of a record can be used in single record cancellation

- Using Cancel Button for cancelling multiple records

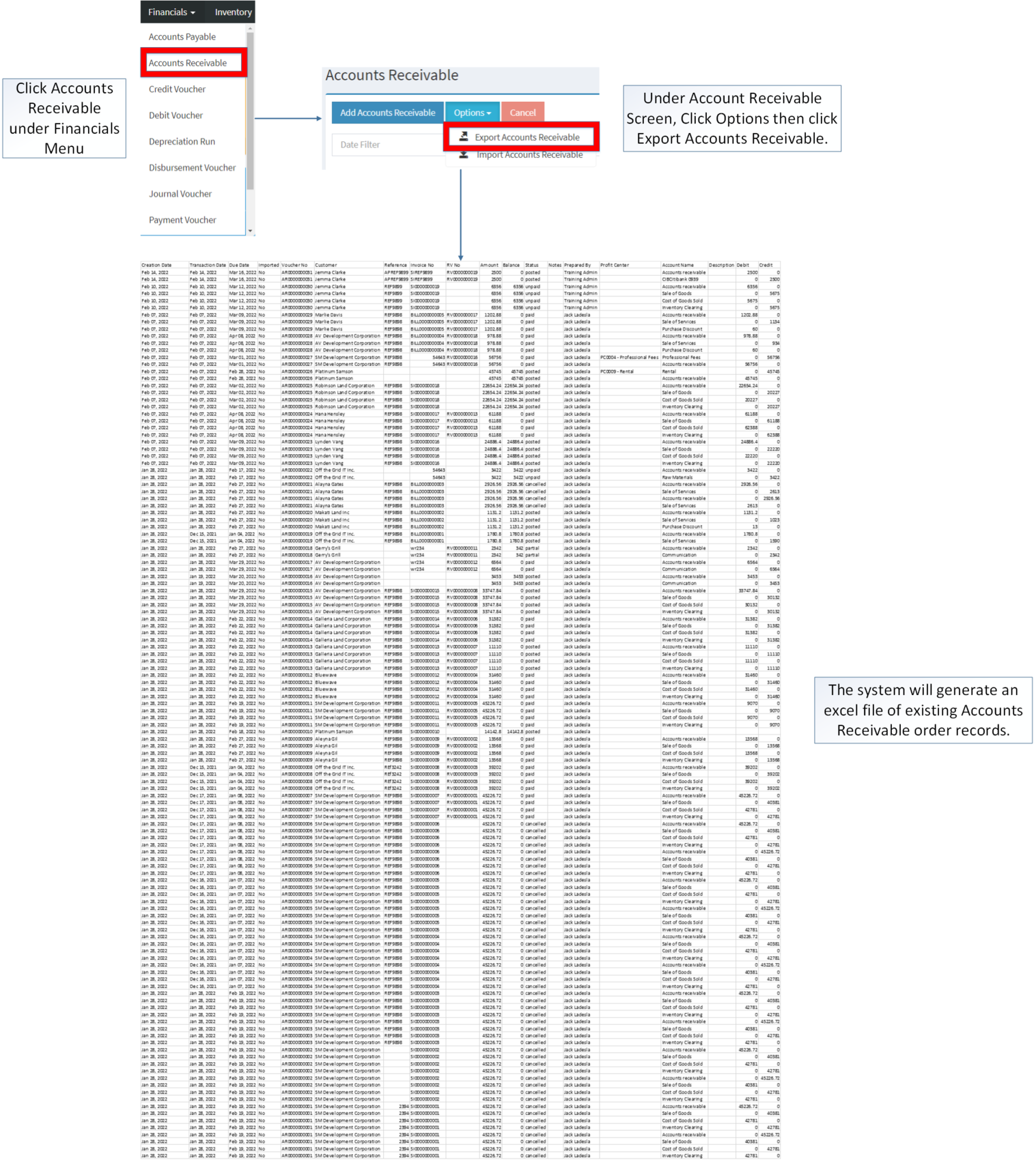

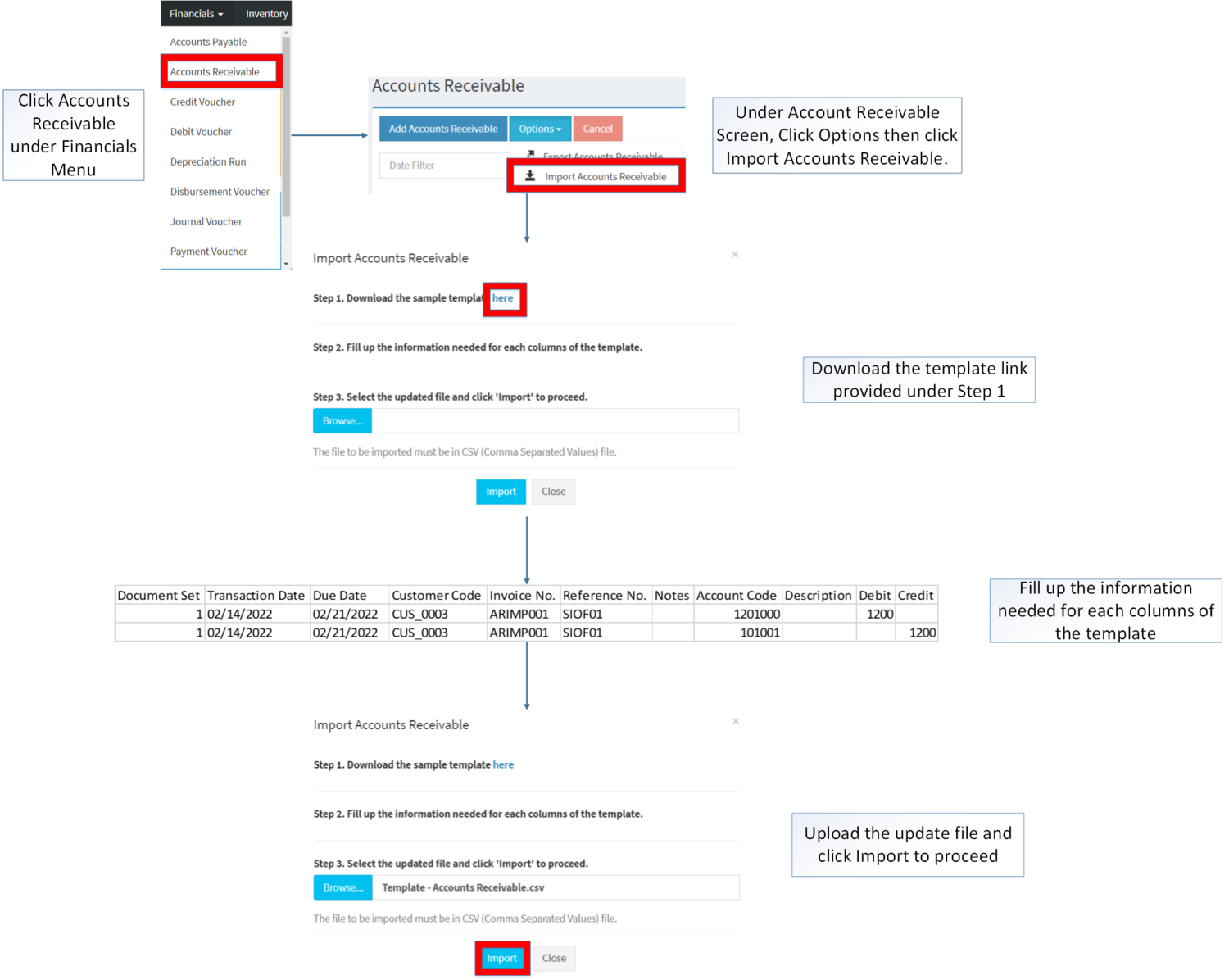

Importing and Exporting Accounts Receivable

- Under Accounts Receivable Screen, Click Options

- Under Options, the user may Export or Import Accounts Receivable

- When Exporting the records, the user may also use the filter options such as Date Filter, Search Bar and Customer filter for precise searching and exporting of records.

- For batch creation, under Accounts Receivable menu, click options then choose Import Accounts Receivable button

| Field | Description of Data Output | Allowed Inputs | Input Restrictions | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1. Document Set | Manual entry of Document Set of Accounts Receivable (e.g., 1, 2, 3, A, B, C) | *Alphanumeric

*Underscore (_) |

Other special characters not mentioned | 5 | Yes |

| 2. Transaction Date | Manual entry of Transaction Date of Accounts Receivable | *Numeric

*Dash (-), Backslash (/) |

Other special characters not mentioned | N/A | Yes |

| 3. Due Date | Manual entry of Due Date of Accounts Receivable – must be based on Customer’s payment terms | *Numeric

*Dash (-), Backslash (/) |

Other special characters not mentioned | N/A | Yes |

| 4. Customer Code | Manual entry of Customer code – must be based from Customer Data maintenance | *Numeric

* Customer Code based from Customer maintenance |

Any input not mentioned in the required inputs | N/A | Yes |

| 5. Invoice No. | Manual entry of Accounts Receivable Invoice No. | *Alphanumeric

*Underscore (_), Dash (-) |

Other special characters not mentioned | 20 | No |

| 6. Reference No. | Manual entry of Accounts Receivable Reference No. | *Alphanumeric

*Underscore (_), Dash (-) |

Other special characters not mentioned | 20 | No |

| 7. Notes | Manual entry of Accounts Receivable Notes | *Alphanumeric

*Underscore (_), Dash (-) |

Other special characters not mentioned | 300 | No |

| 8. Account Code | Manual entry of Account Code – must be based from Chart of Accounts maintenance | *Numeric

*Account Code based from Chart of Accounts maintenance |

Any input not mentioned in the required inputs | N/A | Yes |

| 9. Description | Manual entry of Account Description | *Alphanumeric

*Special Characters |

None | 250 | No |

| 10. Debit | Manual entry of Debit amount | *Numeric | Any input excepts numbers | 20 | Yes |

| 11. Credit | Manual entry of Credit amount | *Numeric | Any input excepts numbers | 20 | Yes |

Accounts Receivable Record Option

| Status | View | Edit | Post | Receive Payment | Cancel |

|---|---|---|---|---|---|

| UNPAID | ☑ | ☑ | ☑ | ☑ | ☑ |

| POSTED | ☑ | ☑ | |||

| WITH PARTIAL PAYMENT | ☑ | ☑ | |||

| PAID | ☑ | ||||

| CANCELLED | ☑ |

Notes:

- The user can only Receive Payment the Accounts Receivable if the Receivable transaction has tag reference on it.

- Posted Receivable can also received payments but cannot be edited.

| Modules | |

|---|---|

| Financials | Financials | Accounts Receivable | Receipt Voucher |

| Sales | Delivery Receipt | Sales Invoice |

| Maintenance | Customer | Proforma | Chart of Account | Tax |

| Reports | |

| Financial Reports | Accounts Receivable Aging | AR Detailed Report | AR Transaction Report |