Bank Reconciliation

-

- Last edited 3 years ago by Gelo

-

Bank Reconciliation

Bank Reconciliation refers to the process of reconciling the balances in an entity's accounting records for a cash account to the corresponding information on a bank statement is known as bank reconciliation. The purpose of this procedure is to determine the discrepancies between the two and, if necessary, make modifications to the accounting records.

Requirements before using Bank Reconciliation

- The user should setup the following Maintenance Module in order to proceed on using the Sales Invoice

- The user must have any of the following record in order to proceed on using the Sales Invoice

- Receipt Voucher

- Payment Voucher

- Petty Cash

- Bank Statements

Performing Bank Reconciliation

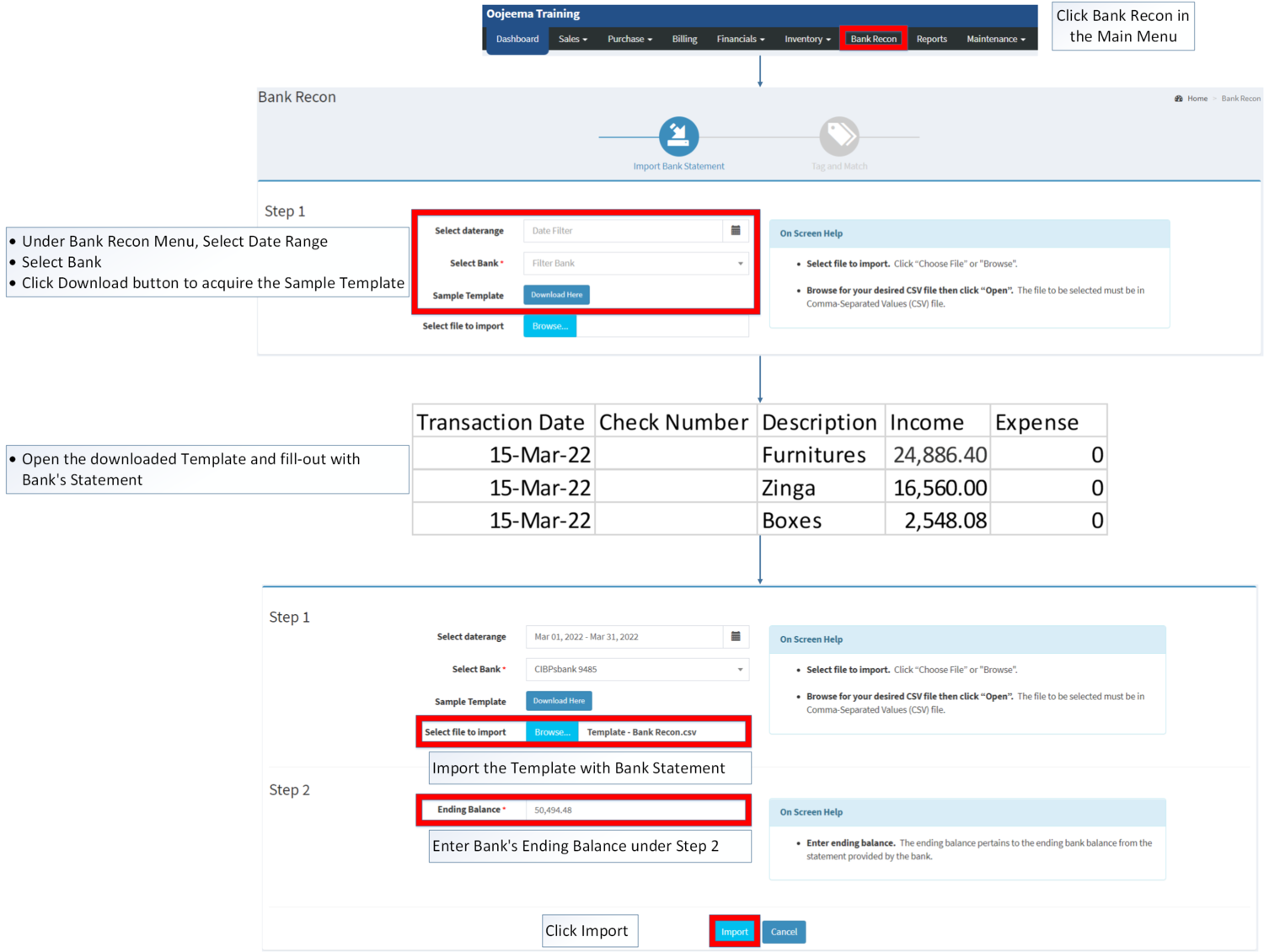

- Click Bank Recon in the Main Menu

- Under Bank Recon Menu, Select Date Range

- Select Bank

- Click Download button to acquire the Sample Template

- Open the downloaded Template and fill-out with Bank's Statement

- Import the Template with Bank Statement

- Enter Bank's Ending Balance under Step 2

- Click Import

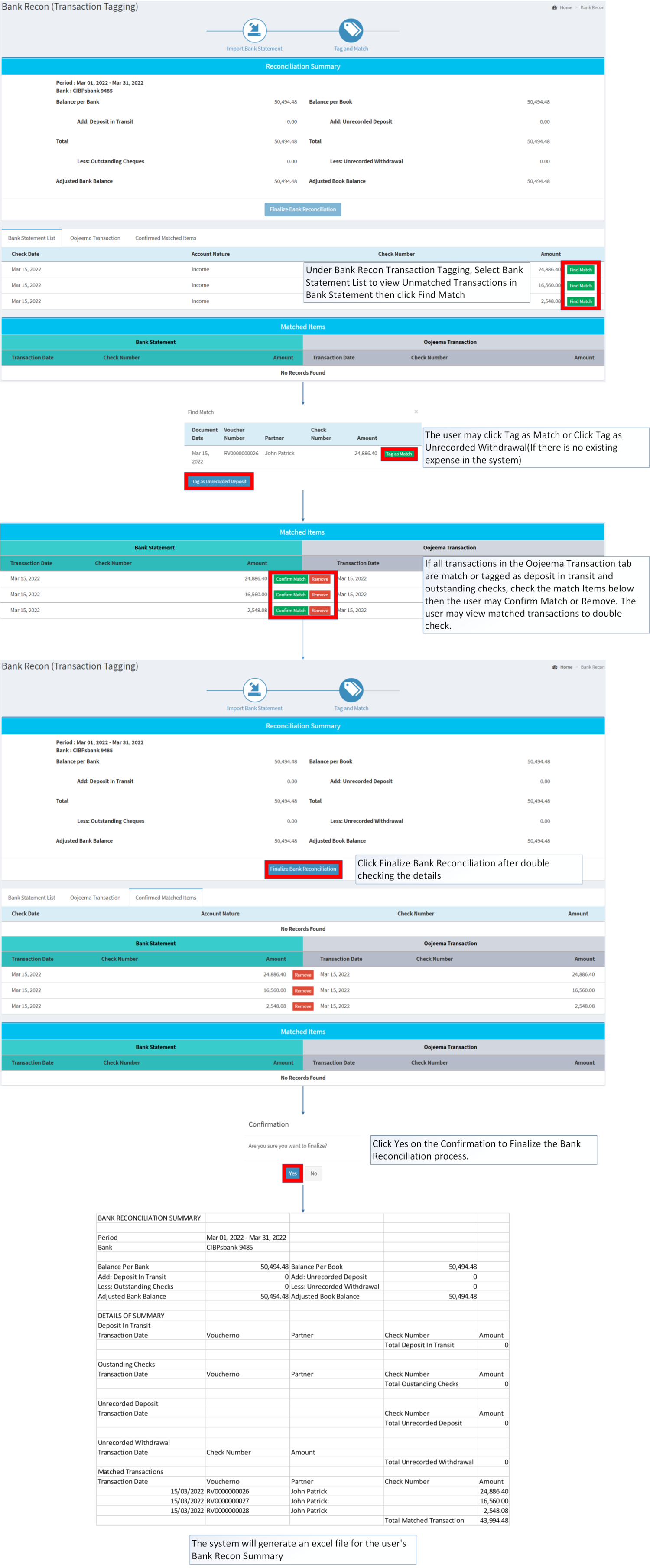

- Under Bank Recon Transaction Tagging, Select Bank Statement List to view Unmatched Transactions in Bank Statement then click Find Match (This can be done also in Oojeema Transaction Tab)

- The user may click Tag as Match or Click Tag as Unrecorded Withdrawal(If there is no existing expense in the system)

- If all transactions in the Oojeema Transaction tab are match or tagged as deposit in transit and outstanding checks, check the match Items below then the user may Confirm Match or Remove. The user may view matched transactions to double check.

- Click Finalize Bank Reconciliation after double checking the details

- Click Yes on the Confirmation to Finalize the Bank Reconciliation process.

- The system will generate an excel file for the user's Bank Recon Summary

Notes:

- The system will temporary save the Bank Recon and will ask the user if they want to continue the unfinished bank recon statements. The user can perform another Bank Recon once they cancelled the unfinished bank recon statements

- Bank should be ACTIVE in maintenance module in order for it to reflect in the Page

- If transaction has entered check no. on Bank Statement template, system will automatically matches the transactions.

- Make sure the Payment Voucher and Receipt Voucher

| Modules | |

|---|---|

| Sales | Sales | Sales Quotation | Sales Order | Delivery Receipt | Sales Invoice |

| Purchase | Purchase | Import Purchase Order | Purchase Order | Purchase Requisition | Purchase Receipt |

| Financials | Accounts Receivable | Accounts Payable | Payment Voucher | Receipt Voucher |

| Maintenance | ATC Code | Bank | Customer | Supplier | Item Master | Profit Center | Tax | Warehouse |

| Reports | |

| Bank Recon Summary | Bank Reconciliation Summary |