VAT Summary

-

- Last edited 3 years ago by Gelo

-

Contents

VAT Summary

VAT Summary refers to the summary of Sales and Purchases taxes which gives the user an overview if their hit their monthly target.

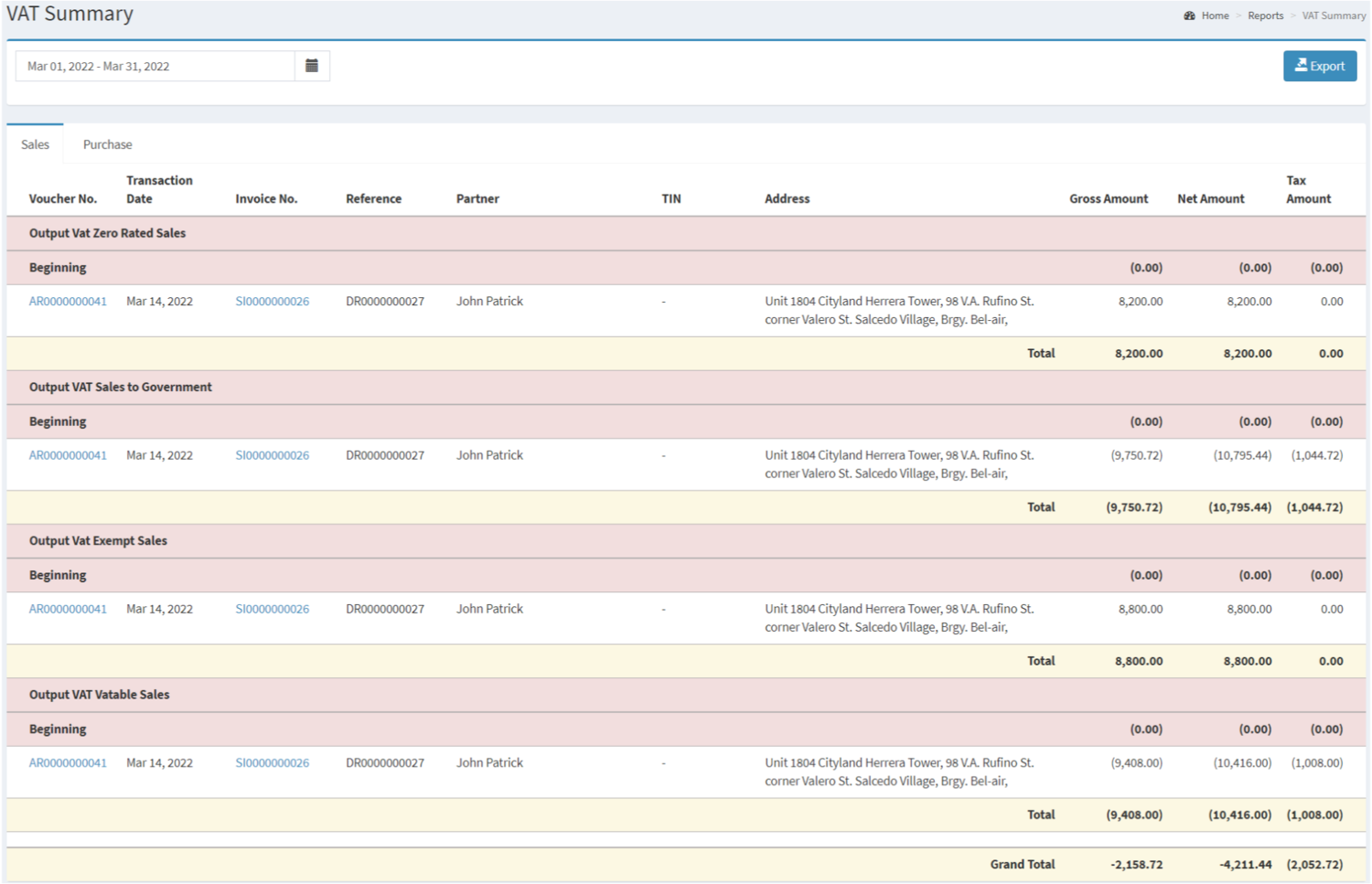

VAT Summary Menu List(Sales)

| Field | Description |

|---|---|

| 1. Date Filter | Date Range filter for VAT Summary monthly report. |

| 2. Export | Allows the user to export the Summary Report. |

| 3. VAT Summary Tab(Purchase, Sales) | Detailed Report for Sales and Purchase VAT Summary. |

| 4. Voucher No | Reference No. of the Sales Transaction |

| 5. Transaction Date | Date when the transaction is created |

| 6. Invoice No | The Invoice reference tagged in the Receivable |

| 7. Reference | Reference No indicated on the Sales Invoice. |

| 8. Partner | The Customer assigned in the Transaction. |

| 9. TIN | Tax Identification Number of the Customer. |

| 10. Address | Address of the Customer. |

| 11. Gross Amount | Whole amount in the Transaction. |

| 12. Net Amount | Amount in the Transaction after all deductions are applied. |

| 13. Tax Amount | Tax Amount Applied in the specific Transaction |

| 14. Tax Type | Type of Tax applied in the transaction. |

| 15. Beginning Balance | Starting Balance that is carried over last month. |

Notes:

- Clicking the Voucher No and the Invoice No. will redirect the user to the View function of the specific transaction.

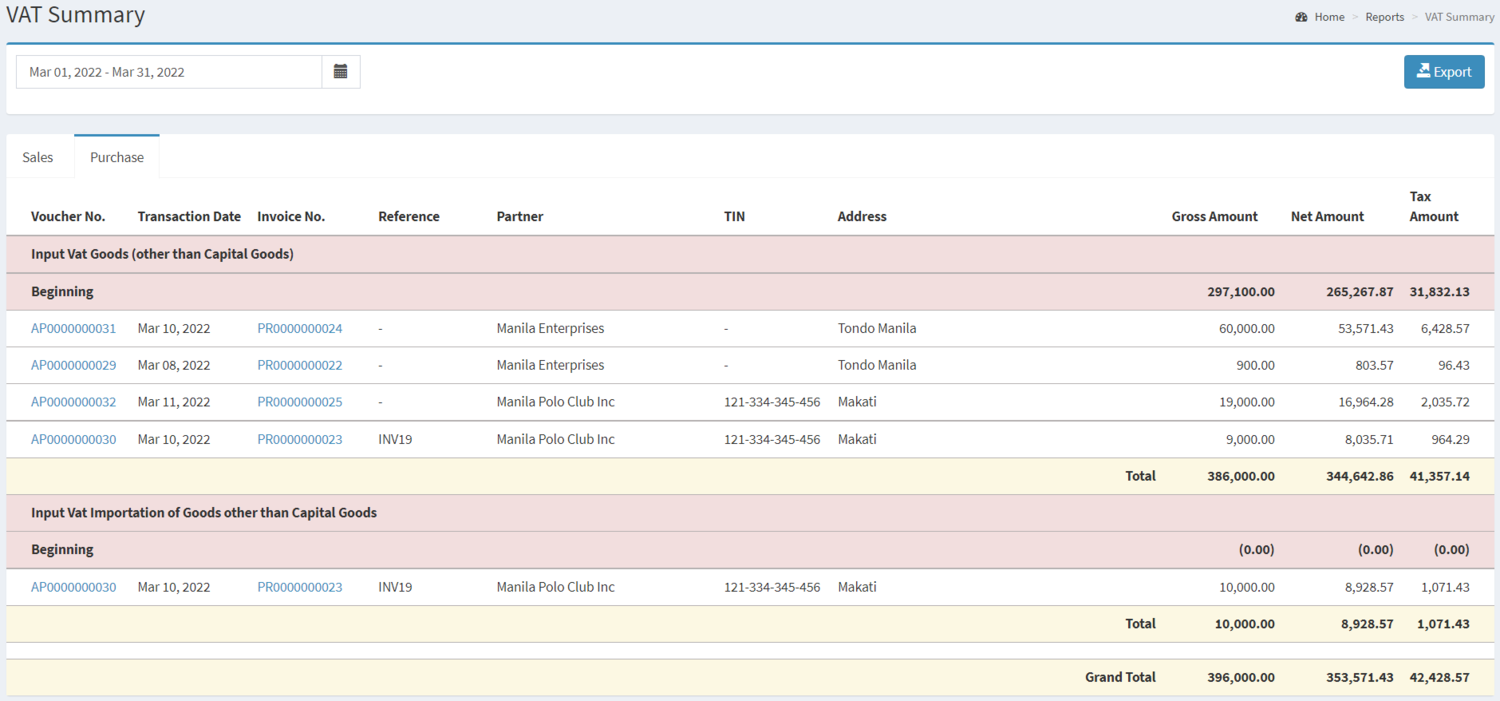

VAT Summary Menu List(Purchase)

| Field | Description |

|---|---|

| 1. Date Filter | Date Range filter for VAT Summary monthly report. |

| 2. Export | Allows the user to export the Summary Report. |

| 3. VAT Summary Tab(Purchase, Sales) | Detailed Report for Sales and Purchase VAT Summary. |

| 4. Voucher No | Reference No. of the Purchase Transaction |

| 5. Transaction Date | Date when the transaction is created |

| 6. Invoice No | The Invoice reference tagged in the Payable |

| 7. Reference | Reference No indicated on the Purchase Receipt. |

| 8. Partner | The Supplier assigned in the Transaction. |

| 9. TIN | Tax Identification Number of the Supplier. |

| 10. Address | Address of the Supplier |

| 11. Gross Amount | Whole amount in the Transaction. |

| 12. Net Amount | Amount in the Transaction after all deductions are applied. |

| 13. Tax Amount | Tax Amount Applied in the specific Transaction |

| 14. Tax Type | Type of Tax applied in the transaction. |

| 15. Beginning Balance | Starting Balance that is carried over last month. |

Notes:

- Clicking the Voucher No and the Invoice No. will redirect the user to the View function of the specific transaction.

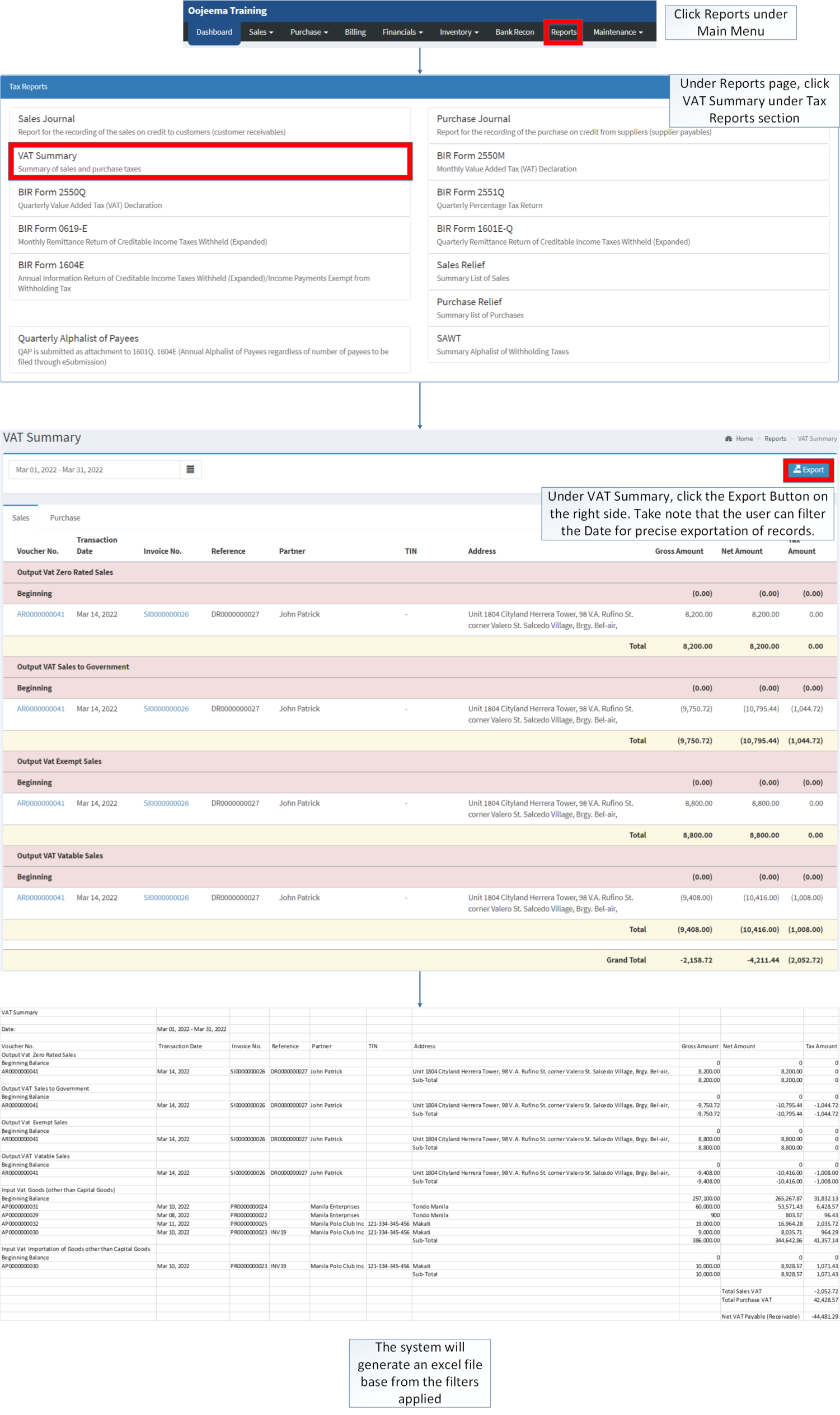

Exporting VAT Summary

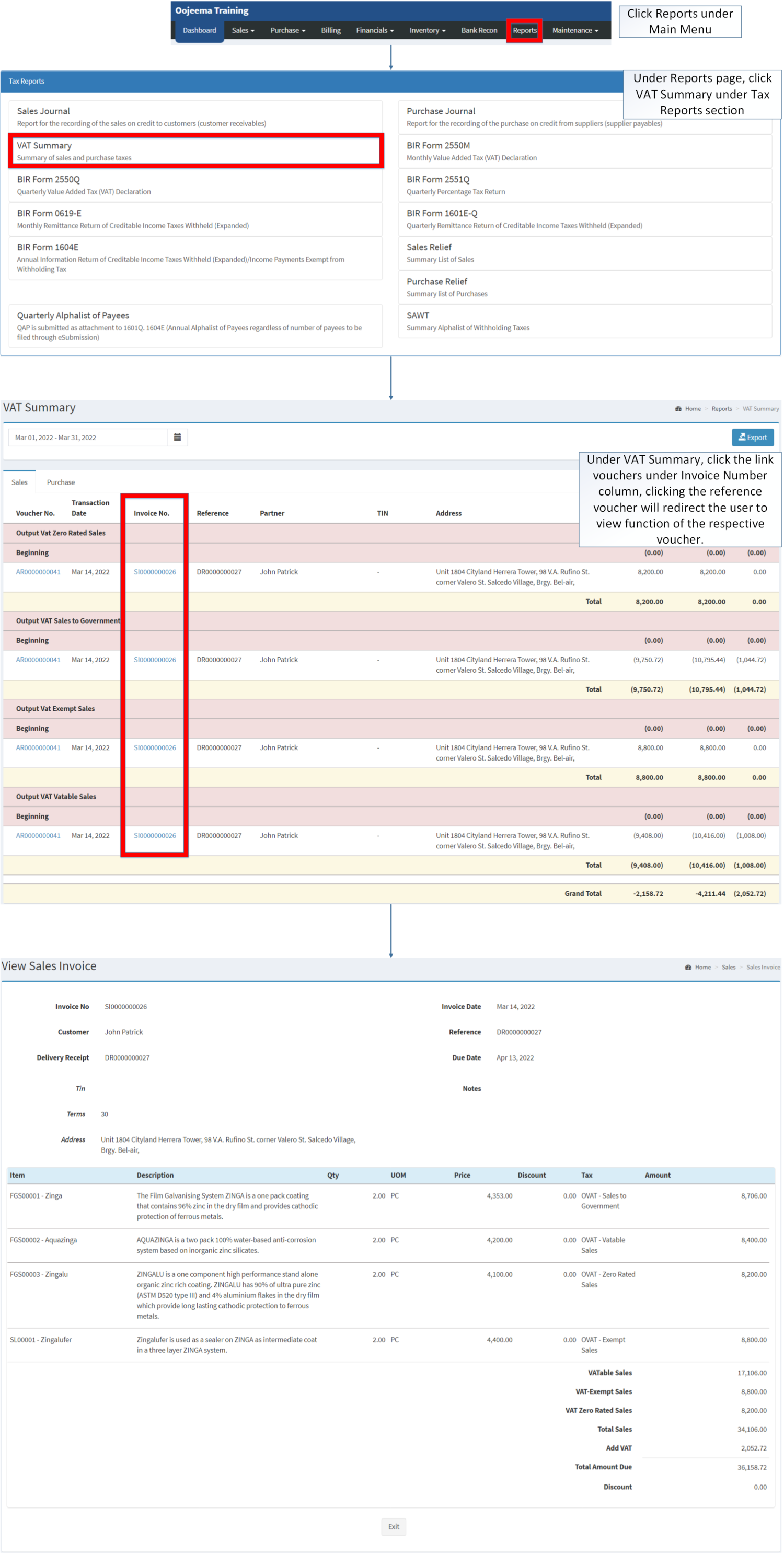

- Click Reports under Main Menu

- Under Reports Menu, Click VAT Summary under Tax Reports section.

- Under VAT Summary, click the Export Button on the right side. Take note that the user can filter the Date for precise exportation of records.

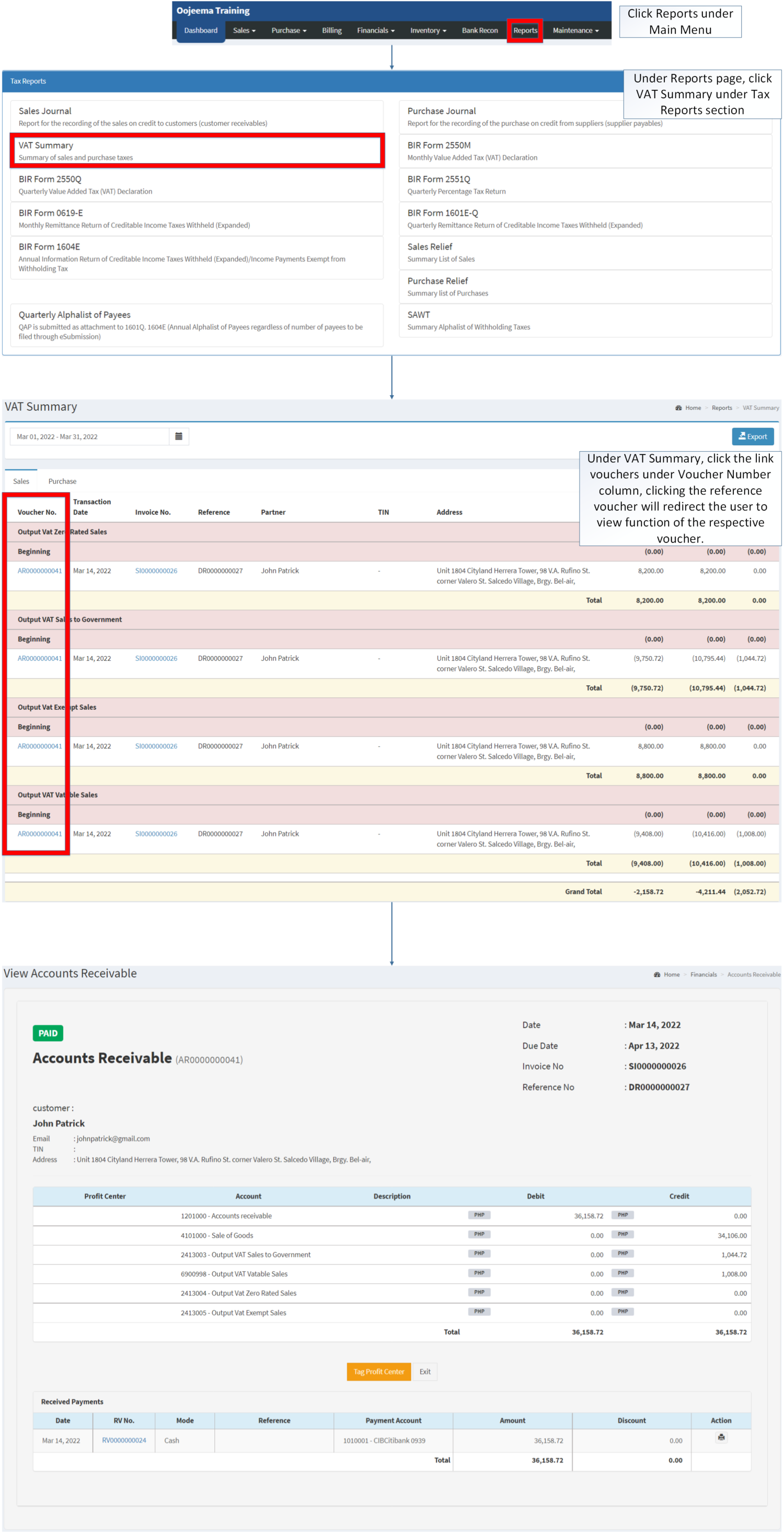

Viewing Vouchers on VAT Summary

- Click Reports under Main Menu

- Under Reports Page, Click VAT Summary under Tax Reports section.

- Under VAT Summary, click the link vouchers under Voucher Number column, clicking the reference voucher will redirect the user to view function of the respective voucher.

Note

- These are both applicable on Sales and Purchase Tab of the VAT Summary

Viewing Invoice Vouchers on VAT Summary

- Click Reports under Main Menu

- Under Reports Menu, Click VAT Summary under Tax Reports.

- Under VAT Summary, click the link vouchers under Invoice Number column, clicking the reference voucher will redirect the user to view function of the respective voucher.

Note

- These are both applicable on Sales and Purchase Tab of the VAT Summary.

| Modules | |

|---|---|

| Sales | Sales | Sales Invoice |

| Purchase | Purchase | Purchase Receipt |

| Financials | Accounts Receivable | Accounts Payable | Disbursement Voucher |

| Maintenance | Customer | Supplier | Tax |

| Reports Module(Reports) | |

| Reports | Tax Reports |

| Tax Reports | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |