You are viewing an old version of this page. Return to the latest version.

Version of 14:55, 11 June 2021 by Gelo

Difference between revisions of "Pro BIR Form 0605"

(Created page with "{{DISPLAYTITLE:BIR Form 0605}} == BIR Form 0605 == '''BIR Form 0605''' is use to pay taxes and fees which do not require the use of a tax return such as second installment pa...") (Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 1: | Line 1: | ||

{{DISPLAYTITLE:BIR Form 0605}} | {{DISPLAYTITLE:BIR Form 0605}} | ||

| − | == BIR Form 0605 == | + | ==BIR Form 0605== |

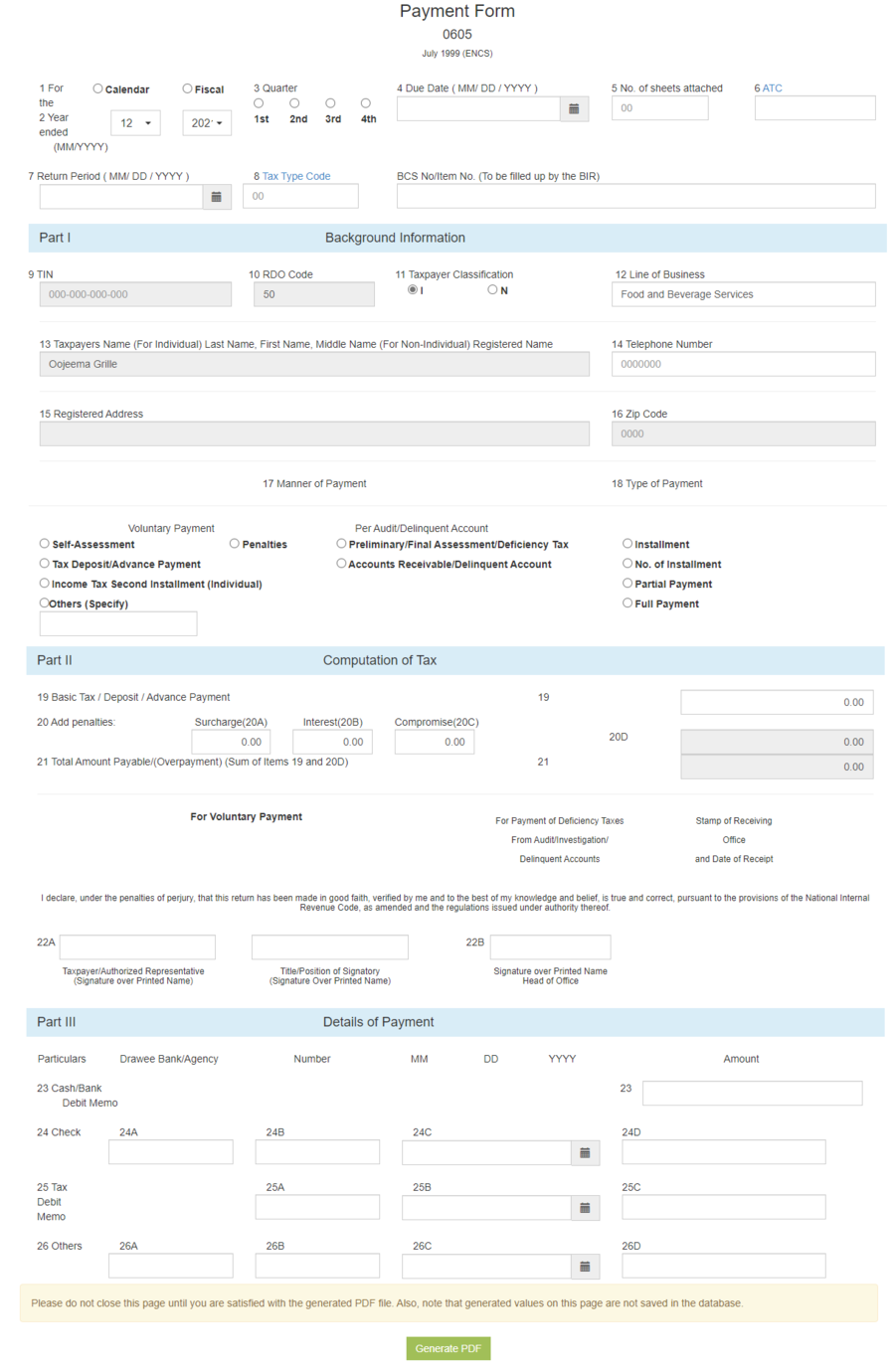

'''BIR Form 0605''' is use to pay taxes and fees which do not require the use of a tax return such as second installment payment for income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits, installment payments, etc. | '''BIR Form 0605''' is use to pay taxes and fees which do not require the use of a tax return such as second installment payment for income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits, installment payments, etc. | ||

| − | [[File:Pro BIR Form 0605.png|center|thumb|1380x1380px|BIR Form 0605]] | + | [[File:Pro BIR Form 0605.png|center|thumb|1380x1380px|BIR Form 0605]]<br /> |

| − | < | + | {| class="wikitable" |

| + | |+BIR Form 0605 Terms | ||

| + | ! style="width:30%;" |Field | ||

| + | !Description | ||

| + | |- style="height:60px;" | ||

| + | | style="width:30%;" |1. Calendar | ||

| + | |Refers to the type of Calendar Year of the Business. | ||

| + | |||

| + | * Calendar Year - follows the traditional start of the year (January) | ||

| + | * Fiscal Year - The starting month of the year will be depending on the Company | ||

| + | |- | ||

| + | | style="width:30%;" |2. Year End | ||

| + | |The last month of the Calendar Year of the Business | ||

| + | |- style="height:45px;" | ||

| + | | style="width:30%;" |3. Quarter | ||

| + | |<span style="color: rgb(34, 34, 34)">Refers to the which quarter of the year.</span> | ||

| + | |||

| + | * For Calendar Year | ||

| + | ** First Quarter - January to March | ||

| + | ** Second Quarter - April to June | ||

| + | ** Third Quarter - July to September | ||

| + | ** Fourth Quarter - October to December | ||

| + | * For Fiscal Year | ||

| + | ** Every three months starting from the Fiscal Year. | ||

| + | |- | ||

| + | | style="width:30%;" |4. Due Date | ||

| + | |<span style="color: rgb(34, 34, 34)">Due date of the form when it should be submitted.</span> | ||

| + | |||

| + | * It is always marked on the 10th Day of the following month | ||

| + | |- | ||

| + | | style="width:30%;" |5. Number of Sheets | ||

| + | |<span style="color: rgb(34, 34, 34)">(Optional)</span> | ||

| + | Number of Attached Sheets declared when submitting the BIR Form 2550M | ||

| + | |||

| + | * Number of sheets is needed when filing E-BIR and EFPS | ||

| + | |- | ||

| + | | style="width:30%;" |6. ATC | ||

| + | |Alphanumeric Tax Code of the form to be submitted | ||

| + | |- | ||

| + | | style="width:30%;" |7. Return Period | ||

| + | |The return period of the Tax Return | ||

| + | |- | ||

| + | | style="width:30%;" |8. Tax Type Code | ||

| + | |Categorizes and controls the function of a tax detail transaction. | ||

| + | |- | ||

| + | | style="width:30%;" |9. TIN | ||

| + | | <span style="color: rgb(34, 34, 34)">Tax Identification Number of the Company/Branch</span> | ||

| + | |- style="height:45px;" | ||

| + | | style="width:30%;" |10. RDO Code | ||

| + | |<span class="ve-pasteProtect" style="color: rgb(34, 34, 34)" data-ve-attributes="{"style":"color: rgb(34, 34, 34)"}">Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes.</span> | ||

| + | |- | ||

| + | | style="vertical-align:middle;text-align:left;width:30%;" |11. Tax Payer Classification | ||

| + | |Taxpayer Classification of an Individual/Business | ||

| + | |||

| + | * Individual | ||

| + | * Non-Individual | ||

| + | |- | ||

| + | | style="width:30%;" |12. Line of Business | ||

| + | |Company's Nature of Business | ||

| + | |- | ||

| + | | style="width:30%;" |13. Tax Payer's Name | ||

| + | |<span style="color: rgb(34, 34, 34)">Registered Name for Non-Individual(Company) and Whole name for Individual</span> | ||

| + | |- | ||

| + | | style="width:30%;" |14. Telephone Number | ||

| + | |<span style="color: rgb(34, 34, 34)">Contact Number of the Tax Payer</span> | ||

| + | |- | ||

| + | | style="width:30%;" |15. Registered Address | ||

| + | |The registered Address of the Tax Payer. | ||

| + | |- | ||

| + | | style="width:30%;" |16. Zip Code | ||

| + | | <span style="color: rgb(34, 34, 34)">Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer</span> | ||

| + | |- | ||

| + | | style="width:30%;" |17. Manner of Payment | ||

| + | |Refers how the payment will be paid if it is Voluntary or per Audit/Delinquent Account | ||

| + | |||

| + | * Voluntary | ||

| + | ** Self Assessment | ||

| + | ** Tax Deposit/Advance Payment | ||

| + | ** Income Tax Second Installment | ||

| + | ** Others | ||

| + | * Per Audit/Delinquent Account | ||

| + | ** Preliminary/Final Assessment/Deficiency Tax | ||

| + | ** Accounts Receivable/Delinquent Account | ||

| + | |- | ||

| + | | style="width:30%;" |18. Type of Payment | ||

| + | |Nature of Payment | ||

| + | |||

| + | * Installment | ||

| + | * No. of Installment | ||

| + | * Partial Payment | ||

| + | * Full Payment | ||

| + | |- | ||

| + | | style="width:30%;" |19. Basic Tax/ Deposit / Advance Payment | ||

| + | |The amount to be Paid based from the manner and type of payment | ||

| + | |- | ||

| + | | style="width:30%;" |20. Penalties | ||

| + | |<span style="color: rgb(34, 34, 34)">Penalties to be applied if any</span> | ||

| + | |||

| + | * '''Surcharge''' | ||

| + | * '''Interest''' | ||

| + | * '''Compromise''' | ||

| + | * '''Total Penalties''' | ||

| + | |- | ||

| + | | style="width:30%;" |21. Total Amount Payable/Over Payment | ||

| + | |Total Amount to be Paid base from the amount of Basic Tax/Deposit/Advance Payment(19) and Penalties(20) | ||

| + | |- | ||

| + | | style="width:30%;" |22. Tax payer/ Authorized Representative | ||

| + | |Details of Tax Payer/ Authorized Representative | ||

| + | |||

| + | * Tax Payer/ Authorized Representative Name | ||

| + | * Title/Position of Signatory | ||

| + | * Signature over Printed Name | ||

| + | |- | ||

| + | | style="width:30%;" |23. Cash / Bank Debit Memo | ||

| + | |Amount to be paid using Cash or Debit Bank Memo | ||

| + | |- | ||

| + | | style="width:30%;" |24. Check | ||

| + | |Amount to be paid using Check which includes the Bank Source, Check Number and Date Issued | ||

| + | |- | ||

| + | | style="width:30%;" |25. Tax Debit Memo | ||

| + | |Amount details to be paid using Tax Debit Memo | ||

| + | |- | ||

| + | | style="width:30%;" |26. Others | ||

| + | |Any details to be Applied | ||

| + | |} | ||

Revision as of 15:30, 11 June 2021

BIR Form 0605

BIR Form 0605 is use to pay taxes and fees which do not require the use of a tax return such as second installment payment for income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits, installment payments, etc.

| Field | Description |

|---|---|

| 1. Calendar | Refers to the type of Calendar Year of the Business.

|

| 2. Year End | The last month of the Calendar Year of the Business |

| 3. Quarter | Refers to the which quarter of the year.

|

| 4. Due Date | Due date of the form when it should be submitted.

|

| 5. Number of Sheets | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2550M

|

| 6. ATC | Alphanumeric Tax Code of the form to be submitted |

| 7. Return Period | The return period of the Tax Return |

| 8. Tax Type Code | Categorizes and controls the function of a tax detail transaction. |

| 9. TIN | Tax Identification Number of the Company/Branch |

| 10. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 11. Tax Payer Classification | Taxpayer Classification of an Individual/Business

|

| 12. Line of Business | Company's Nature of Business |

| 13. Tax Payer's Name | Registered Name for Non-Individual(Company) and Whole name for Individual |

| 14. Telephone Number | Contact Number of the Tax Payer |

| 15. Registered Address | The registered Address of the Tax Payer. |

| 16. Zip Code | Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer |

| 17. Manner of Payment | Refers how the payment will be paid if it is Voluntary or per Audit/Delinquent Account

|

| 18. Type of Payment | Nature of Payment

|

| 19. Basic Tax/ Deposit / Advance Payment | The amount to be Paid based from the manner and type of payment |

| 20. Penalties | Penalties to be applied if any

|

| 21. Total Amount Payable/Over Payment | Total Amount to be Paid base from the amount of Basic Tax/Deposit/Advance Payment(19) and Penalties(20) |

| 22. Tax payer/ Authorized Representative | Details of Tax Payer/ Authorized Representative

|

| 23. Cash / Bank Debit Memo | Amount to be paid using Cash or Debit Bank Memo |

| 24. Check | Amount to be paid using Check which includes the Bank Source, Check Number and Date Issued |

| 25. Tax Debit Memo | Amount details to be paid using Tax Debit Memo |

| 26. Others | Any details to be Applied |