Difference between revisions of "ATC Code"

(Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 165: | Line 165: | ||

*Using drop-down arrow of a record can be used in single record Activation | *Using drop-down arrow of a record can be used in single record Activation | ||

| − | [[File:Maintenance - ATC Codes - Activate1 | + | [[File:Maintenance - ATC Codes - Activate1.png|border|center|1500x1500px]] |

<br /> | <br /> | ||

*Using Activate Button for activating multiple record | *Using Activate Button for activating multiple record | ||

| − | [[File:Maintenance - ATC Codes - Activate2 | + | [[File:Maintenance - ATC Codes - Activate2.png|border|center|1500x1500px]] |

<br /> | <br /> | ||

Revision as of 14:49, 2 March 2022

Contents

ATC Codes

Alphanumber Tax Codes or ATC Codes or ATCs are codes used to identify the type of tax that has to be paid.

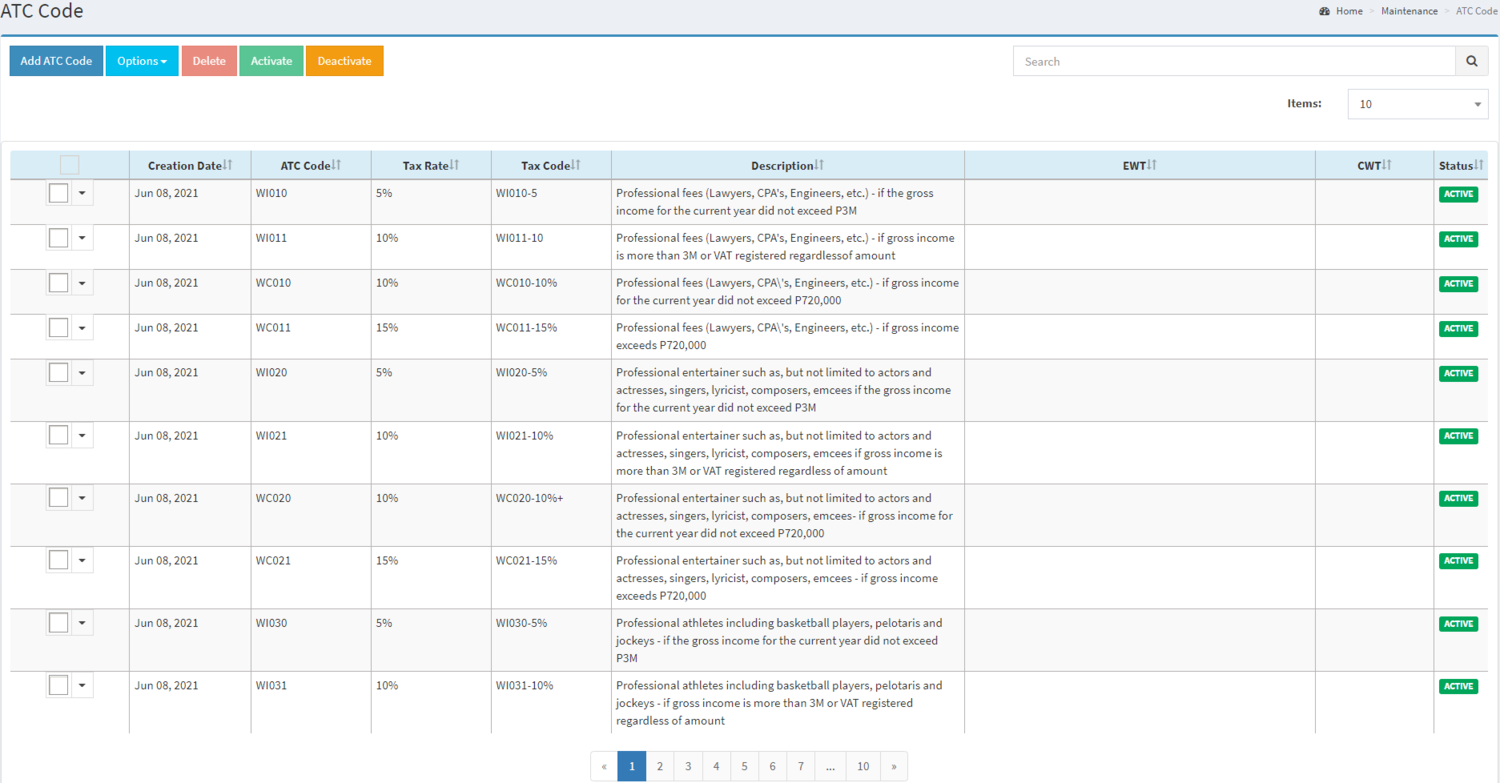

ATC Code Record List

Notes:

- Deactivating ATC Codes restricts the user to use the ATC code in Receipt Voucher.

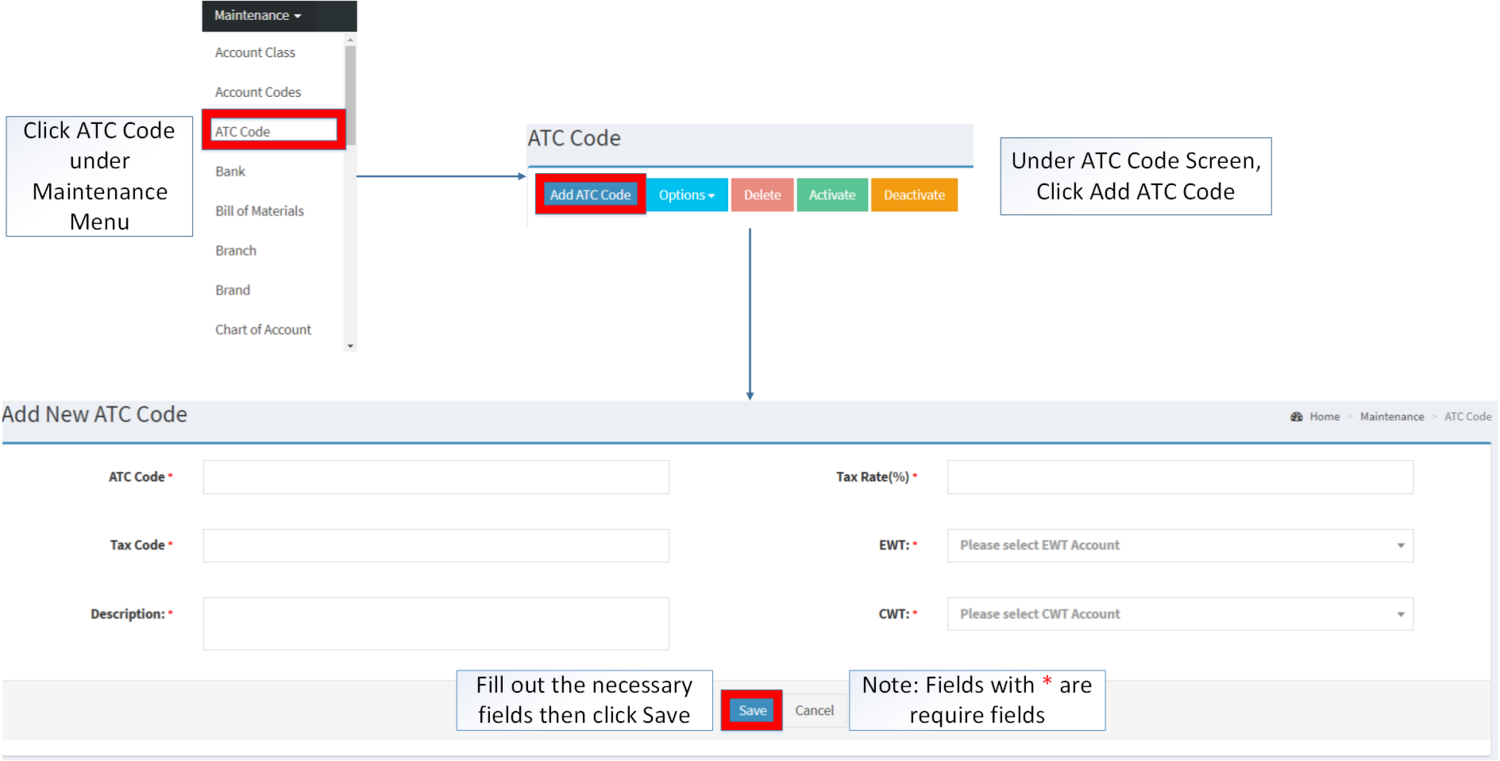

Adding ATC codes

1. Click ATC Codes under Maintenance Module

2. Under ATC Codes Menu Screen, Click Add ATC Codes

3. Fill out the necessary fields then click Save.

| Field | Description | Expected Values |

|---|---|---|

| 1.ATC Code | •Reference Code for ATC | •Alphanumeric |

| 2.Tax Code | •Tax Code Reference for the ATC Code | •Alphanumeric |

| 3.Description | •Description of the ATC Code | •Alphanumeric |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | •Numeric |

| 5.EWT | •Expanded Withholding Tax | •EWT List provided in the field |

| 6.CWT | •Credit Withholding Tax | •CWT List provided in the field |

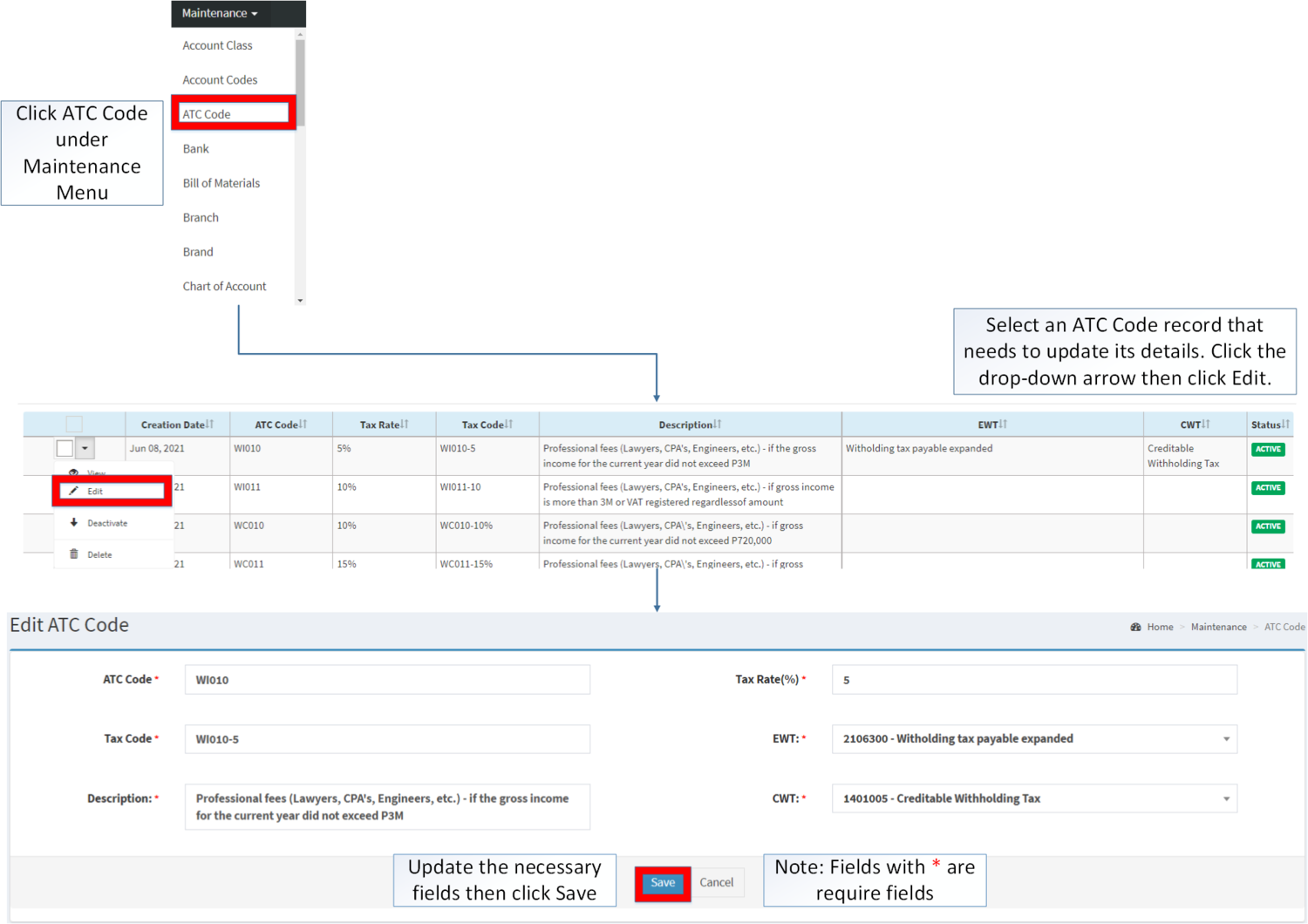

Editing ATC codes

1. Click ATC Codes under Maintenance Module

2. Select a ATC Codes that needs to update its details. Click the drop-down arrow then click Edit.

3. Update the necessary fields then click Save.

| Field | Description | Expected Values |

|---|---|---|

| 1.ATC Code | •Reference Code For ATC | •Alphanumeric |

| 2.Tax Code | •Tax Code Reference for the ATC Code | •Alphanumeric |

| 3.Description | •Description of the ATC Code | •Alphanumeric |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | •Numeric |

| 5.EWT | •Expanded Withholding Tax | •EWT List provided in the field |

| 6.CWT | •Credit Withholding Tax | •CWT List provided in the field |

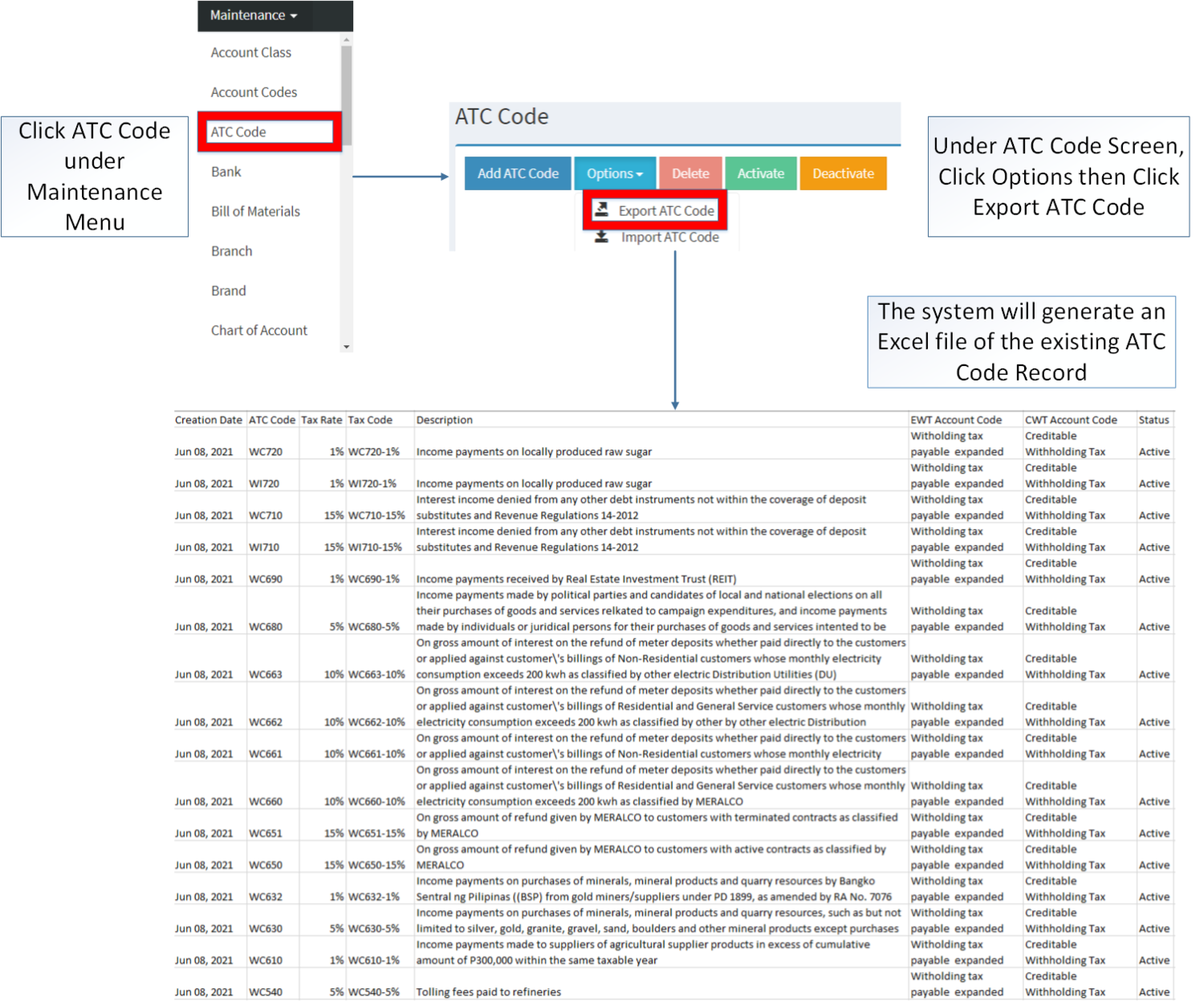

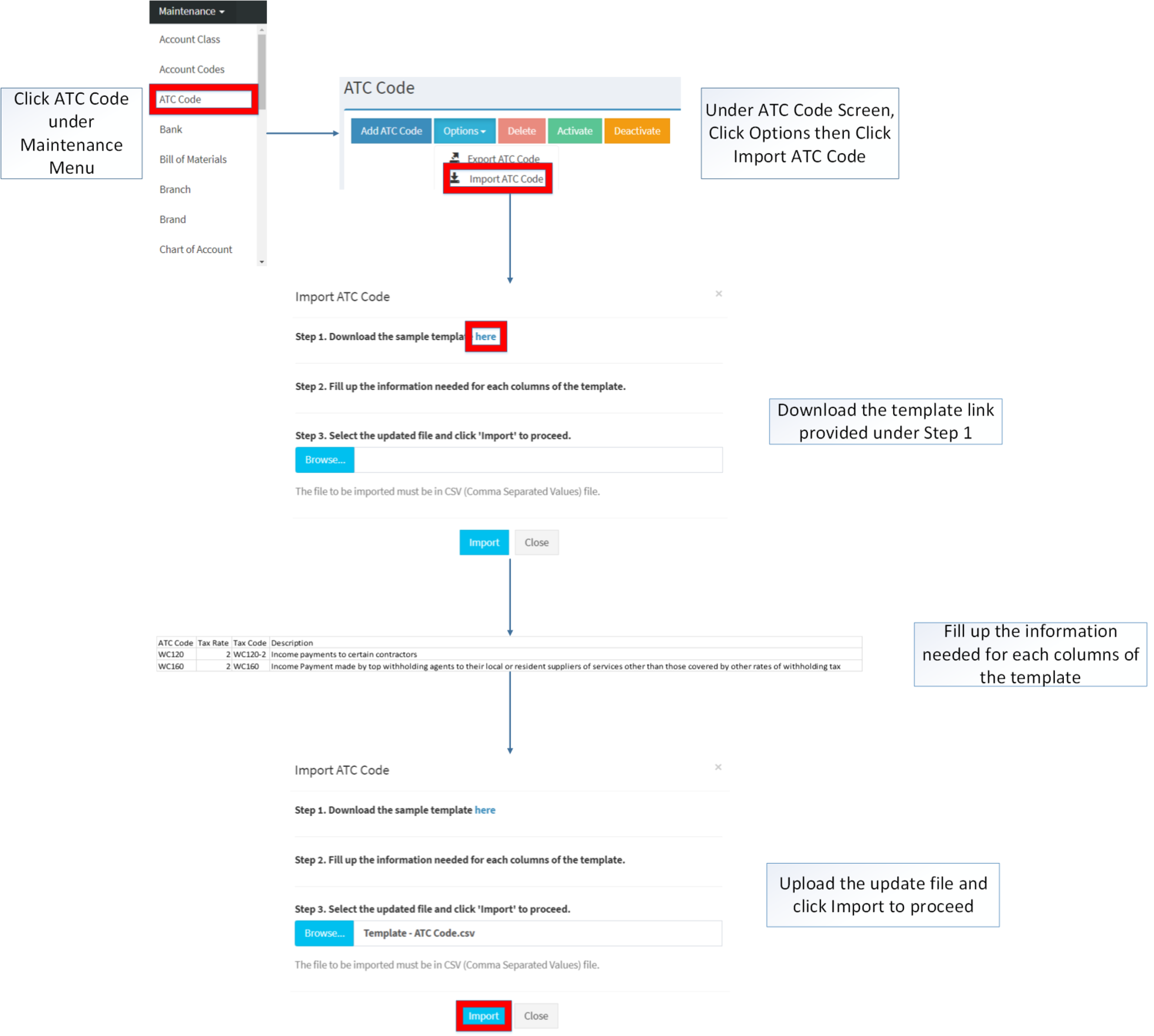

Importing and Exporting ATC codes

1. Under ATC Codes Screen, Click Options

2. Under Options, The user may Export or Import The Record

- When Exporting the records, the user may also use the filter options through tabs for precise searching and exporting of records.

- When Importing the records, the user should follow the following steps provided in the Importing ATC Codes Screen such as

- Downloading the template link provided under Step 1.

- Filling up the information needed for each columns of the template

- Uploading the updated Template

| Field | Description | Allowed Inputs | Input Restrictions | Required Field? |

|---|---|---|---|---|

| 1. ATC Code | Reference Code for ATC | *Alphanumeric

*Dash "-" *Underscore "_" |

*Other Special Characters | Yes |

| 2. Tax Rate | Tax Percentage to be applied on the ATC Code | *Numeric | *Any Inputs except numeric | Yes |

| 3. Tax Code | Tax Code Reference for the ATC Code | *Alphanumeric

*Dash "-" *Underscore "_" |

*Other Special Characters | Yes |

| 4. Description | Description of ATC Code | *Alphanumeric

*Special Character |

*None | Yes |

| 5. EWT Account Code | Account Code for Expanding Withholding Tax | *Liabilities Account Codes under Account List provided in Chart of Account Maintenance Module | *Any inputs not mentioned in the allowed inputs | Yes |

| 6. CWT Account Code | Account Code for Creditable Withholding Tax | *Account Code of Creditable Withholding Tax provided in Chart of Account Maintenance Module | *Any inputs not mentioned in the allowed inputs | Yes |

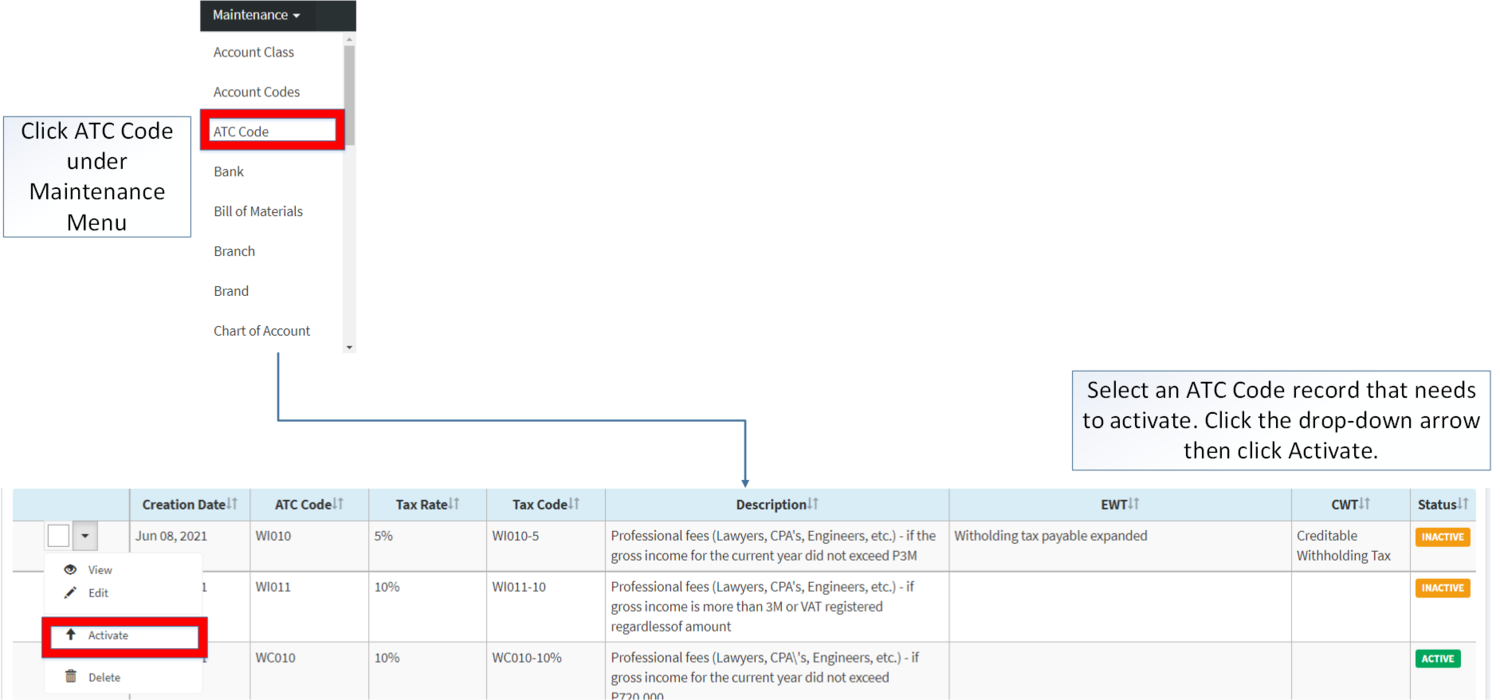

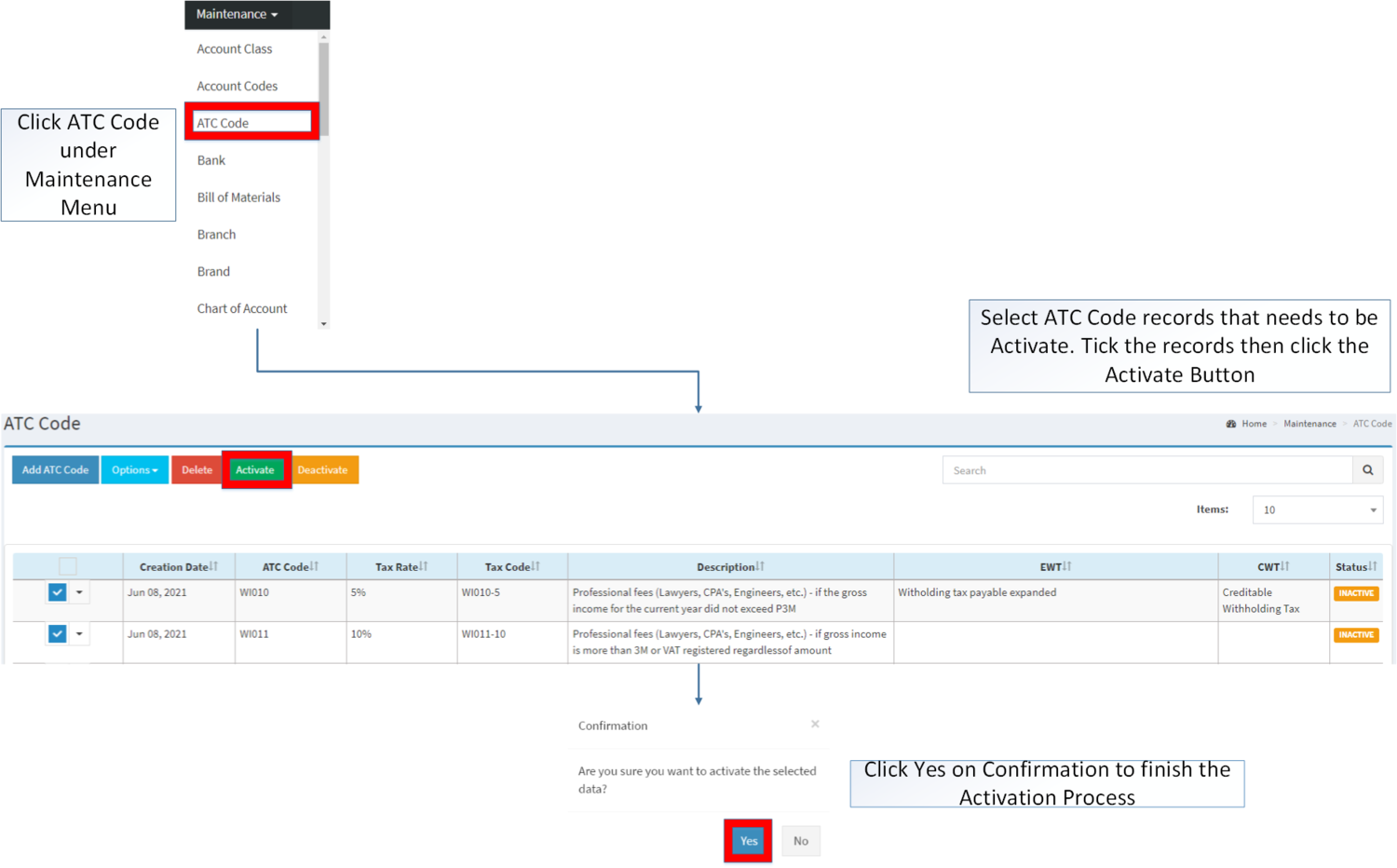

Activating ATC Code Record

ATC Code can be Activated in two ways:

- Using drop-down arrow of a record can be used in single record Activation

- Using Activate Button for activating multiple record

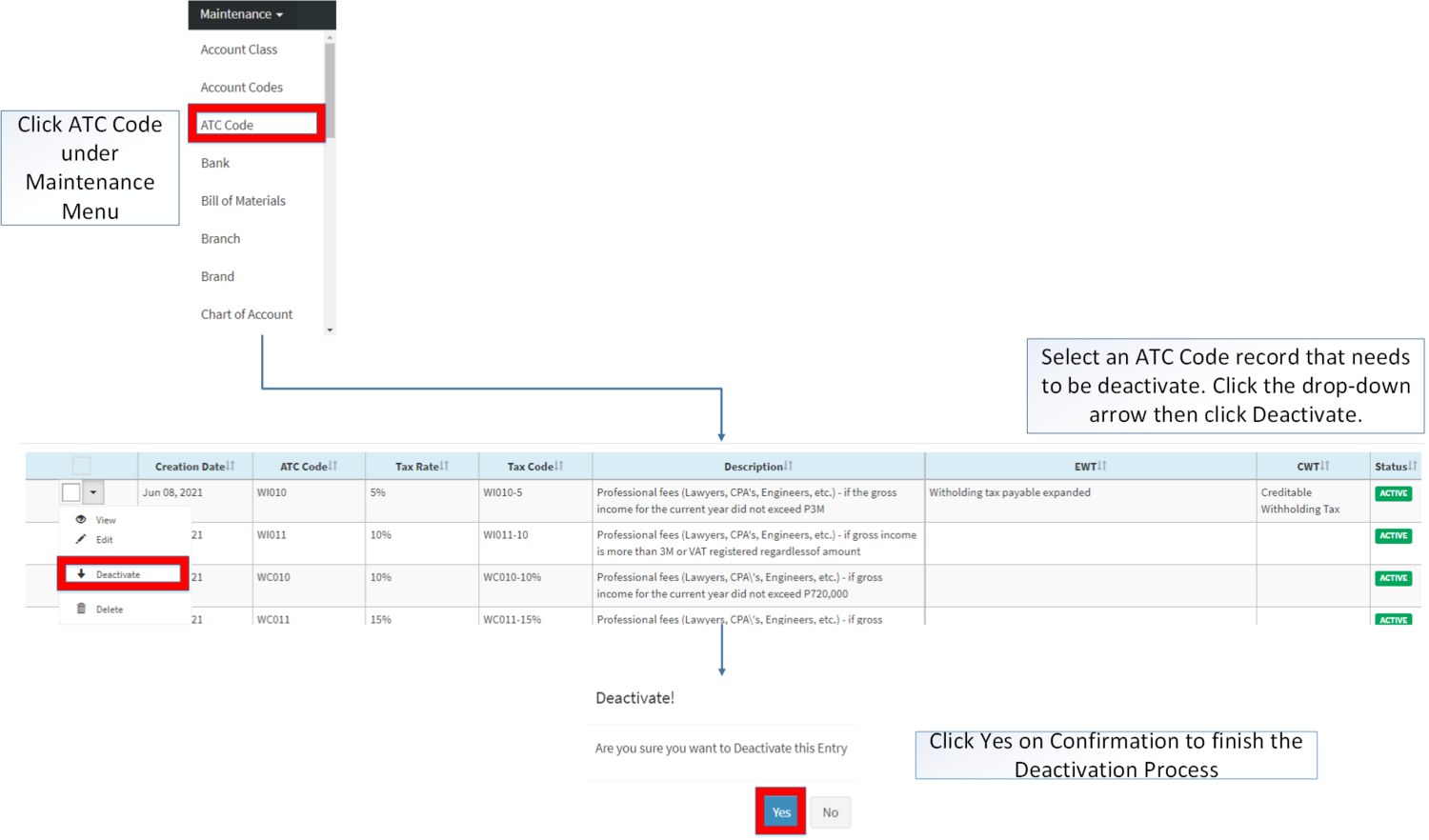

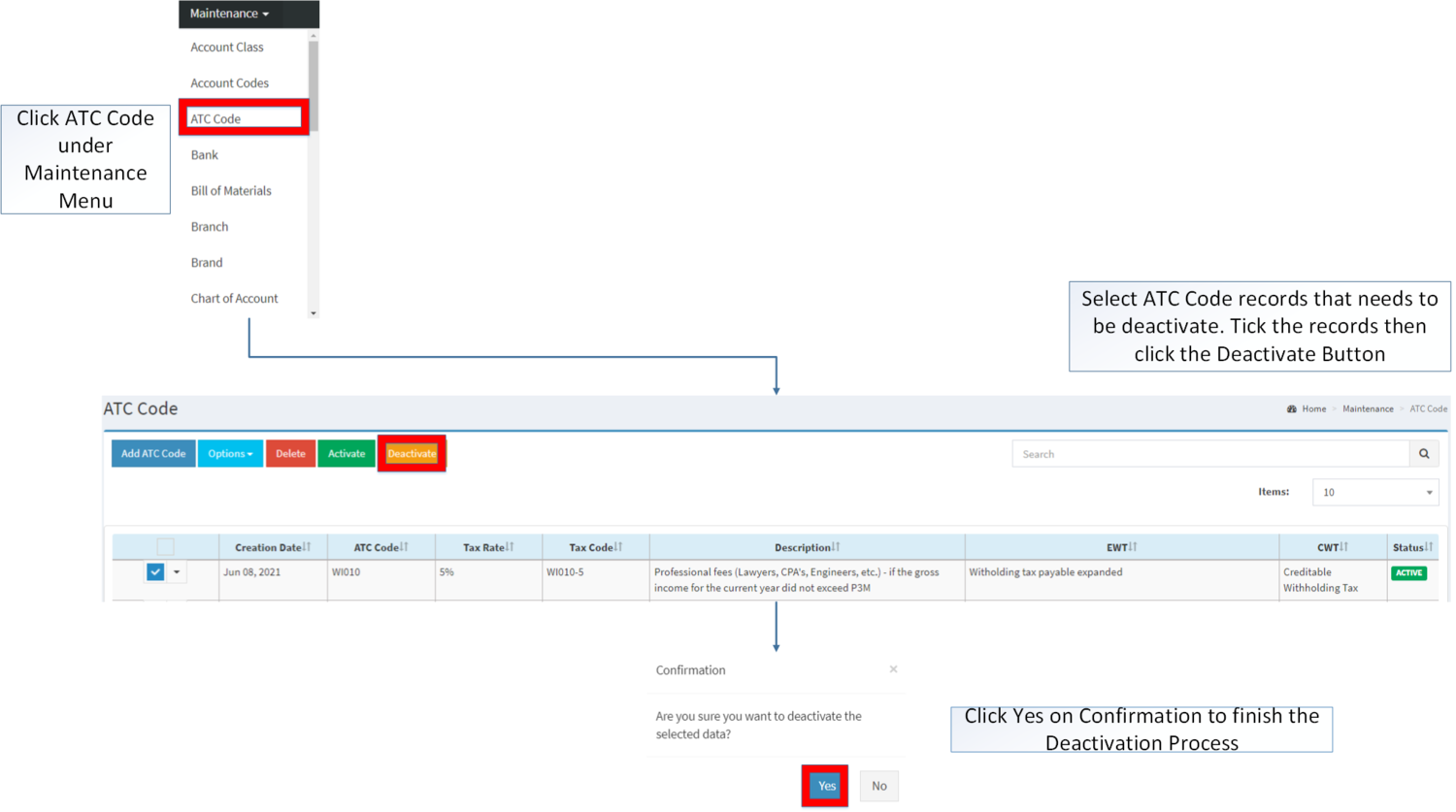

Deactivating ATC Code Record

ATC Code can be deactivated in two ways:

- Using drop-down arrow of a record can be used in single record deactivation

- Using Deactivate Button for deactivating multiple record

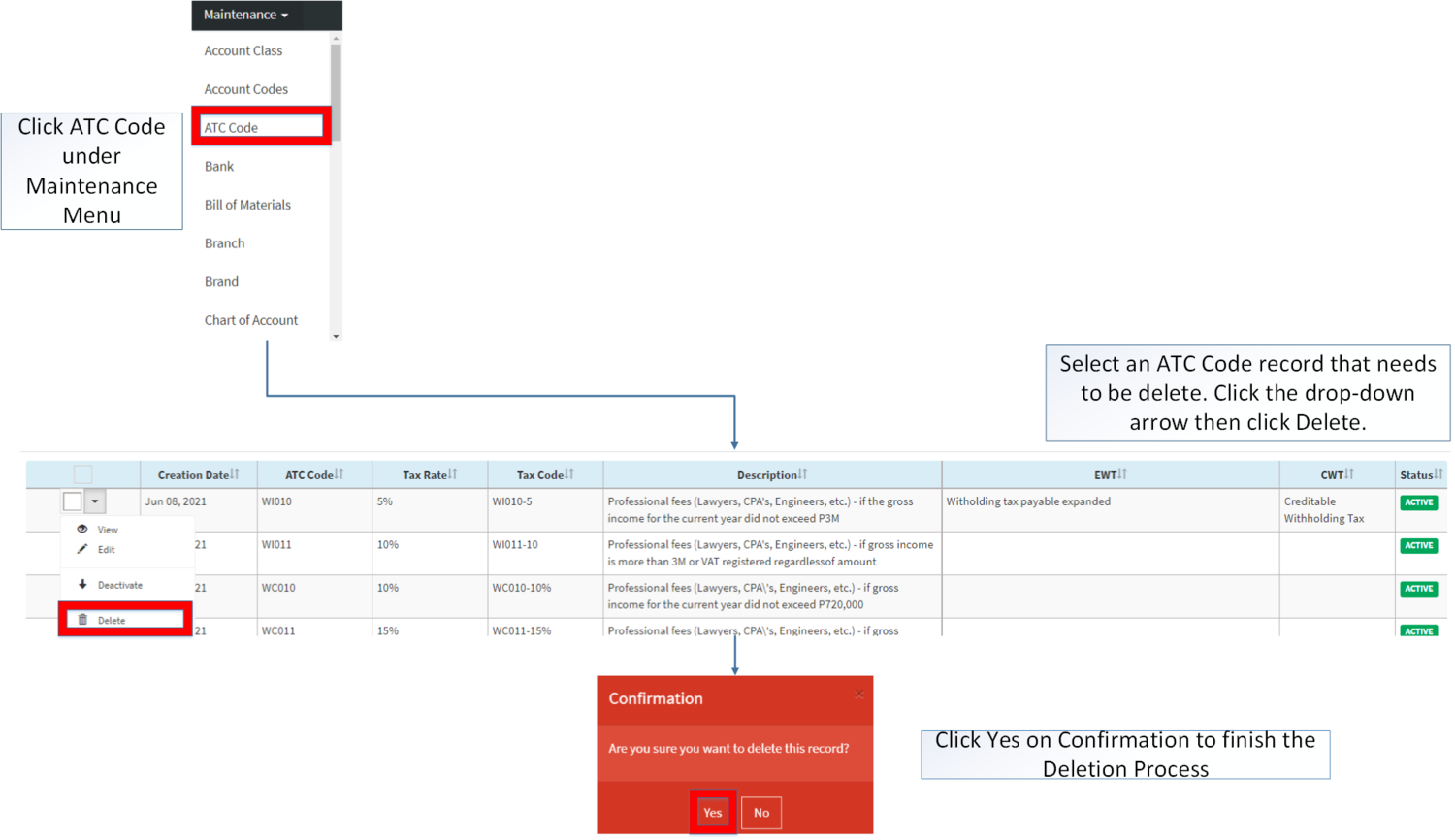

Deleting ATC Code Record

ATC Code can be deleted in two ways:

- Using drop-down arrow of a record can be used in single record deletion

- Using Delete Button for deleting multiple record

ATC record options

| Status | View | Edit | Deactivate | Activate | Delete |

|---|---|---|---|---|---|

| ACTIVE | ☑ | ☑ | ☑ | ☑ | |

| INACTIVE | ☑ | ☑ | ☑ | ☑ |

- The user may Edit the ATC Code while under view mode.

- Inactive Chart of Accounts Record cannot be used in ATC Code

- Used ATC Code cannot be deleted.

- Activating/Deactivating and Deleting of Records can be done in two ways.

- For single records, the user may use the drop down arrow then the action that need to perform.

- For multiple records, the user may tick the records then click the action button that need to perform

- Click the Yes in the confirmation to proceed on the action taken.

| Modules | |

|---|---|

| Maintenance | Maintenance | Chart of Account | ATC Code | Tax |

| Financials | Receipt Voucher |