You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "BIR Form 2550Q"

(Tag: Visual edit) |

(Changed categories.) |

||

| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | <div style="text-align: center;">[[Tax Reports]] | [[BIR Form 2550Q | + | <div style="text-align: center;">[[Tax Reports]] | [[BIR Form 2550Q]]</div> |

==BIR Form 2550Q== | ==BIR Form 2550Q== | ||

'''BIR Form 2550Q''' refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a quarterly basis(Every 3 months). | '''BIR Form 2550Q''' refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a quarterly basis(Every 3 months). | ||

| − | [[File:BIR Form 2550Q.png|center| | + | [[File:Tax Reports - BIR Form 2550Q - Menu.png|border|center|3030x3030px]] |

| − | |||

| − | + | =====<span class="mw-headline" id="Generating_BIR_FORM_2550M_Records" style="box-sizing: inherit;"><span class="mw-headline" id="Generating_BIR_FORM_2550M_Records" style="box-sizing: inherit;">'''<span style="box-sizing: inherit; font-size: 12pt; line-height: 17.12px;">Generating BIR FORM 2550Q Records</span>'''</span></span>===== | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | #Under Main Menu, Click '''[[Reports]]''' | |

| + | #Under Reports Menu, Click '''[[BIR Form 2550Q|BIR FORM 2550Q]]''' under [[Tax Reports]] | ||

| + | #Under '''[[BIR Form 2550Q|BIR FORM 2550Q]]''', Fill up the necessary fields then double check every detail. Click Generate to proceed. | ||

| + | |||

| + | [[File:Tax Reports - BIR Form 2550Q - Generate.png|border|center|4759x4759px]] | ||

| + | <br /> | ||

| + | {| class="wikitable" | ||

| + | |+BIR Form 2550Q terms on Oojeema Prime | ||

| + | !Fields | ||

| + | !Description | ||

| + | |- | ||

| + | |1. '''Month Year''' | ||

| + | |Month and year when the BIR Form 2550Q was issued. | ||

| + | |- | ||

| + | |2. '''Quarter''' | ||

| + | |Refers to the which quarter of the year. | ||

| + | |||

| + | *For Calendar Year | ||

| + | **First Quarter - January to March | ||

| + | **Second Quarter - April to June | ||

| + | **Third Quarter - July to September | ||

| + | **Fourth Quarter - October to December | ||

| + | *For Fiscal Year | ||

| + | **Every three months starting from the Fiscal Year. | ||

| + | |- | ||

| + | |3. '''Return Period''' | ||

| + | |The month range of the specific quarter. | ||

| + | |- | ||

| + | |4. '''Amended Return''' | ||

| + | |Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. | ||

| + | |- | ||

| + | |5. '''Short Period''' | ||

| + | |A return for a short period, that is, for a taxable year consisting of a period of less than 12 months. This can be due to company being dissolved. | ||

| + | |- | ||

| + | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Part I - Background Information''' | ||

| + | |- | ||

| + | |6. '''TIN''' | ||

| + | |Tax Identification Number of an Individual or Business | ||

| + | |- | ||

| + | |7. '''RDO Code''' | ||

| + | |Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. | ||

| + | |- | ||

| + | |8. '''No. of Sheets Attached''' | ||

| + | |(Optional) | ||

| + | Number of Attached Sheets declared when submitting the BIR Form 2550Q | ||

| + | |- | ||

| + | |9. '''Line of Business''' | ||

| + | |Nature of Business of the Company | ||

| + | |- | ||

| + | |10. '''Tax Payer's Name''' | ||

| + | |Registered Name for Non-Individual(Company) or Whole Name for Individual. | ||

| + | |- | ||

| + | |11. '''Telephone Number''' | ||

| + | |Contact Number of the Tax Payer | ||

| + | |- | ||

| + | |12. '''Registered Address''' | ||

| + | |The registered Address of the Tax Payer. | ||

| + | |- | ||

| + | |13. '''ZIP Code''' | ||

| + | |Zone Improvement Plan Code of the registered Address of the Tax Payer. | ||

| + | |- | ||

| + | |14. '''Tax Relief''' | ||

| + | |(Optional) | ||

| + | Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty. | ||

| + | |- | ||

| + | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Part II - Computation of Tax''' | ||

| + | |- | ||

| + | |15. '''Vatable Sales/Receipt-Private''' | ||

| + | |Sales that the business will have to charge VAT on if it is registered for VAT. | ||

| + | |- | ||

| + | |16. '''Sale to Government''' | ||

| + | |<span style="color: rgb(34, 34, 34)">VAT transactions applied to the Government</span> | ||

| + | |- | ||

| + | |17. '''Zero Rated Sales/Receipts''' | ||

| + | |<span style="color: rgb(34, 34, 34)">Sales that does not impose any VAT</span> | ||

| + | |- | ||

| + | |18. '''Exempt Sales/Receipts''' | ||

| + | |<span style="color: rgb(34, 34, 34)">Sales that does not impose any VAT</span> | ||

| + | |- | ||

| + | |19. '''Total Sales/Receipts and Output Tax Due''' | ||

| + | |Total Value of Tax Types Mentioned from Vatable Sales up to Exempt Sales. | ||

| + | |- | ||

| + | |20. '''Less: Allowable Input Tax''' | ||

| + | | | ||

| + | *'''20A Input Tax Carried Over from Previous Quarter''' - any negative amount from the total amount payable from the previous return or quarter. | ||

| + | *'''20B Input Tax Deferred on Capital Goods Exceeding P1Million from Previous Quarter''' - Input Tax value of Capital Goods to be defer from last Quarter that exceeds 1 Million Pesos. | ||

| + | *'''20C Transitional Input Tax''' - Tax Value amount from items that is Non VAT to VAT. | ||

| + | *'''20D Presumptive Input Tax''' - Tax Value amount from domestic purchases or importations. | ||

| + | *'''20E Others''' - Any Other Tax to be deducted. | ||

| + | *'''20F Total (Sum of Item 20A, 20B, 20C, 20D & 20E)''' - Total Allowable Input Tax to be deducted. | ||

| + | |- | ||

| + | |21. '''Current Transactions''' | ||

| + | | | ||

| + | *'''21A/B Purchase of Capital Goods not exceeding P1Million (see sch.2)''' - amount of creditable input tax for Capital Goods Purchases that will not exceed to 1 Million Pesos. | ||

| + | *'''21C/D Purchase of Capital Goods exceeding P1Million (see sch.2)''' - Input Tax value of Purchased Capital Goods to be defer that exceeds 1 Million Pesos. | ||

| + | *'''21E/F Domestic Purchases of Goods other than capital goods''' - Input Tax Value for Domestic Purchases of Goods excluding the Capital Goods. | ||

| + | *'''21G/H Importation of Goods Other than Capital Goods''' - Input Tax Value for Importation of Goods excluding the Capital Goods. | ||

| + | *'''21I/J Domestic Purchases of Services''' - Input Tax for Purchases of Services. | ||

| + | *'''21K/L Services rendered by Non-residents''' - Input Tax of Services rendered from foreign individuals. | ||

| + | *'''21M Purchases Not Qualified for Input Tax''' - Any purchases that does not applied to any form of tax | ||

| + | *'''21N/O Others''' - Any declared miscellaneous transactions. | ||

| + | *'''21P Total Current Purchases (Sum of item 21A,21C,21E,21G,21I,21K,21M&21N)''' - Overall Total of Current Declared Transactions | ||

| + | |- | ||

| + | |22. <span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">'''Total Available Input Tax (Sum of Item 20F, 21B, 21D, 21F, 21H, 21J, 21L,&21O)'''</span> | ||

| + | |<span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">Overall Total of Available Input Tax declared.</span> | ||

| + | |- | ||

| + | |23. <span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">'''Less: Deductions from Input Tax'''</span> | ||

| + | | | ||

| + | *'''23A Input Tax on Purchases of Capital Goods exceeding P1Million deferred for succeeding period (Sch.3)''' - Any Tax to be applied for defer Capital Good Expenses that will be carry over for the next set of periods | ||

| + | *'''23B Input Tax on Sale to Govt. closed to expense (Sch.4)''' - Set of Input taxes that is directly and indirectly attributable sale to the Government. | ||

| + | *'''23C Input Tax allocable to Exempt Sales (Sch.5)''' - Set of Input taxes that is directly and indirectly attributable to Exempt Sales | ||

| + | *'''23D VAT Refund/TCC claimed''' - any Value Added Tax Refund to be claimed | ||

| + | *'''23E Others''' - Any declared miscellaneous taxes to be deducted. | ||

| + | *'''23F Total (Sum of Item 23A, 23B,23C,23D & 23E)''' - Total Amount of Input Tax to be Deducted | ||

| + | |- | ||

| + | |24. '''Total Allowable Input Tax (Item 22 less Item 23F)''' | ||

| + | |Remaining Available Input Tax based from the Total Input Tax Less the deductions Declared from input tax. | ||

| + | |- | ||

| + | |25. '''Net VAT Payable (Item 19B less Item 24)''' | ||

| + | |Net Amount of Value Added Tax Payable based from Total Sales/Receipts and Output Tax Due less the Total Allowable Input Tax. | ||

| + | |- | ||

| + | |26. <span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">'''Less: Tax Credits/Payments'''</span> | ||

| + | | | ||

| + | *'''26A Monthly VAT Payments - previous two months''' - Monthly VAT payments from previous two months base from the last two BIR Form 2550M submitted. | ||

| + | *'''26B Creditable Value-Added Tax Withheld (Sch. 6)''' - Creditable withholding tax is an advance income tax of the payee. This would mean that even before filing the income tax return in the Philippines, the taxpayer had already remitted portion of its income tax liability through the payor who withheld and remitted the same to the BIR. | ||

| + | *'''26C Advance Payments for Sugar and Flour Industries (Sch.7)''' - Any tax to be paid in advance for Sugar and Flour Industries. | ||

| + | *'''26D VAT Withheld on Sales to Government (Sch.8)''' - Any Value added Tax Credits withheld on Sales to Government | ||

| + | *'''26E VAT paid in return previously filed, if this is an amended return''' - Value added Tax paid in case the form to be submitted is for an Amended Return | ||

| + | *'''26F Advance Payments made (please attach proof of payments - BIR Form No. 0605)''' - Any Advance payments applied based from BIR Form 0605 | ||

| + | *'''26G Others''' | ||

| + | *'''26H Total Tax Credits/Payments (Sum of Item 26A,26B,26C,26D,26E, 26F & 26G)''' - Total Tax Credits to be deducted | ||

| + | |- | ||

| + | |27. '''Tax Still Payable/(Overpayment)(Item 25 less Item 26H)''' | ||

| + | |Remaining Tax Payable base from Net VAT Payable less the Total Tax Credits/Payments. | ||

| + | |- | ||

| + | |28. '''Penalties''' | ||

| + | |<span style="color: rgb(34, 34, 34)">Penalties to be applied if any</span> | ||

| + | |||

| + | *'''Surcharge(28A)''' | ||

| + | *'''Interest(28B)''' | ||

| + | *'''Compromise(28C)''' | ||

| + | |- | ||

| + | |29. '''Total Amount Payable/(Overpayment) (Sum of Item 27 & 28D)''' | ||

| + | |Remaining Tax Payable base from Net VAT Payable less the Tax Credits Applied. | ||

| + | |- | ||

| + | |30. '''President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer''' | ||

| + | |President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer Details | ||

| − | * | + | *Title/Position of Signatory |

| − | * | + | *Tin of Signatory |

| + | *Tax Agent Acc#/Atty's Roll #. (if applicable) | ||

| + | *Date of Issue | ||

| + | *Date of Expiry | ||

| + | |- | ||

| + | |31. '''Treasurer/Assistant Treasurer (Signature Over Printed Name)''' | ||

| + | |Treasurer/Assistant Treasurer Details | ||

| − | + | *Treasurer/Assistant Treasurer (Signature Over Printed Name) | |

| − | + | *Title/Position of Signatory | |

| + | *TIN of Signatory | ||

| + | |} | ||

Notes: | Notes: | ||

| − | * | + | *Grey fields are auto-generated and will automatically adjust based on the input of the user. |

| − | |||

| − | |||

{| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | {| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | ||

|+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | |+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | ||

| Line 115: | Line 177: | ||

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |Maintenance | | style="" |Maintenance | ||

| − | | style="" |[[ATC Code | + | | style="" |[[ATC Code]]<nowiki> | </nowiki>[[Company]]<nowiki> | </nowiki>[[Tax]] |

| − | |- | + | |- |

| − | + | |Sales | |

| − | + | |[[Sales Invoice]] | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| colspan="2" style="vertical-align:middle;text-align:center;" |'''Reports Module([[Reports]])''' | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Reports Module([[Reports]])''' | ||

| Line 132: | Line 189: | ||

| style="" |Tax Reports | | style="" |Tax Reports | ||

| style="" |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | | style="" |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|} | |} | ||

| + | [[Category:Purchase]] | ||

| + | [[Category:Financials]] | ||

| + | [[Category:Sales]] | ||

| + | [[Category:Tax Reports]] | ||

Latest revision as of 10:50, 7 April 2022

BIR Form 2550Q

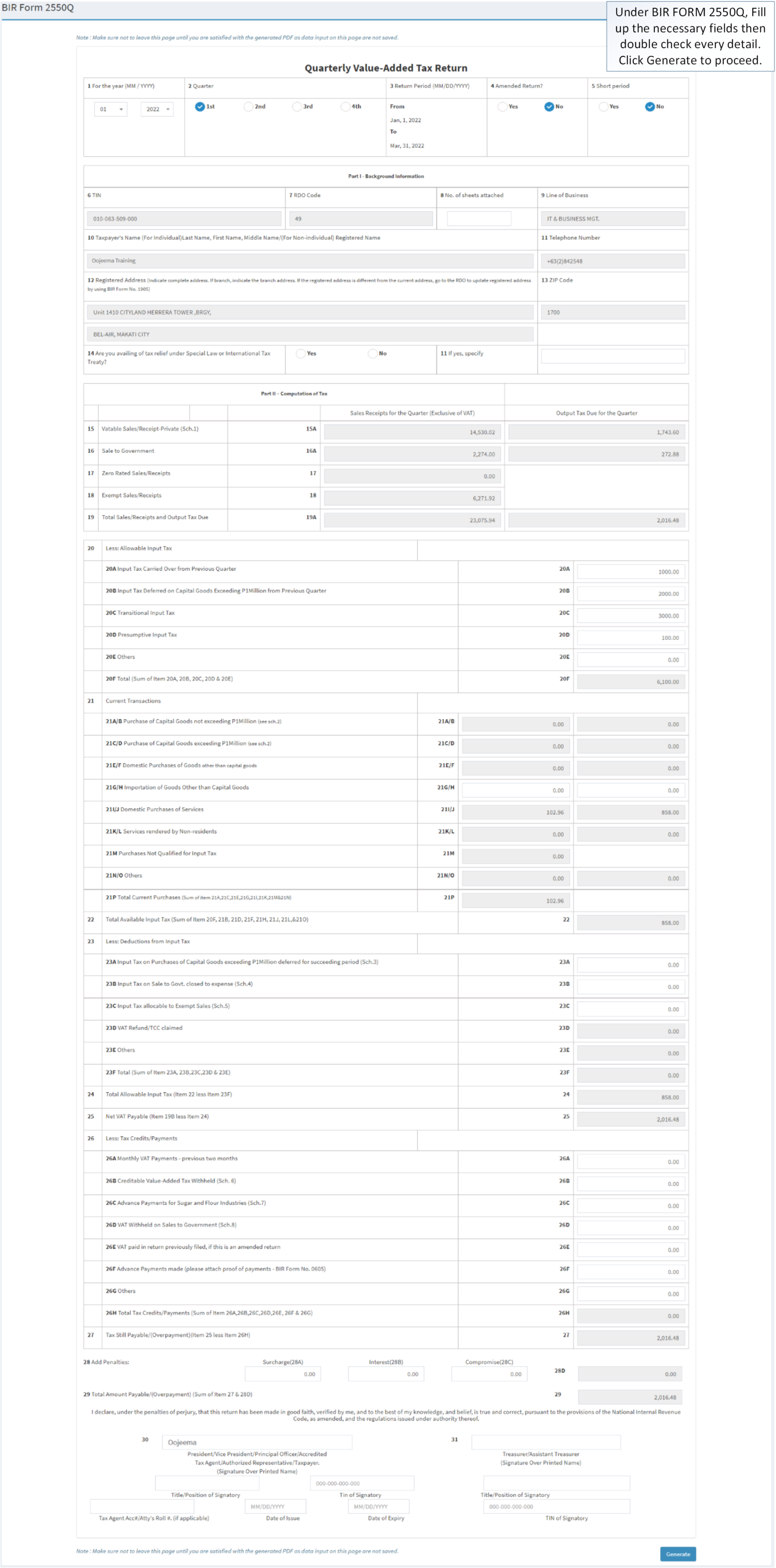

BIR Form 2550Q refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a quarterly basis(Every 3 months).

Generating BIR FORM 2550Q Records

- Under Main Menu, Click Reports

- Under Reports Menu, Click BIR FORM 2550Q under Tax Reports

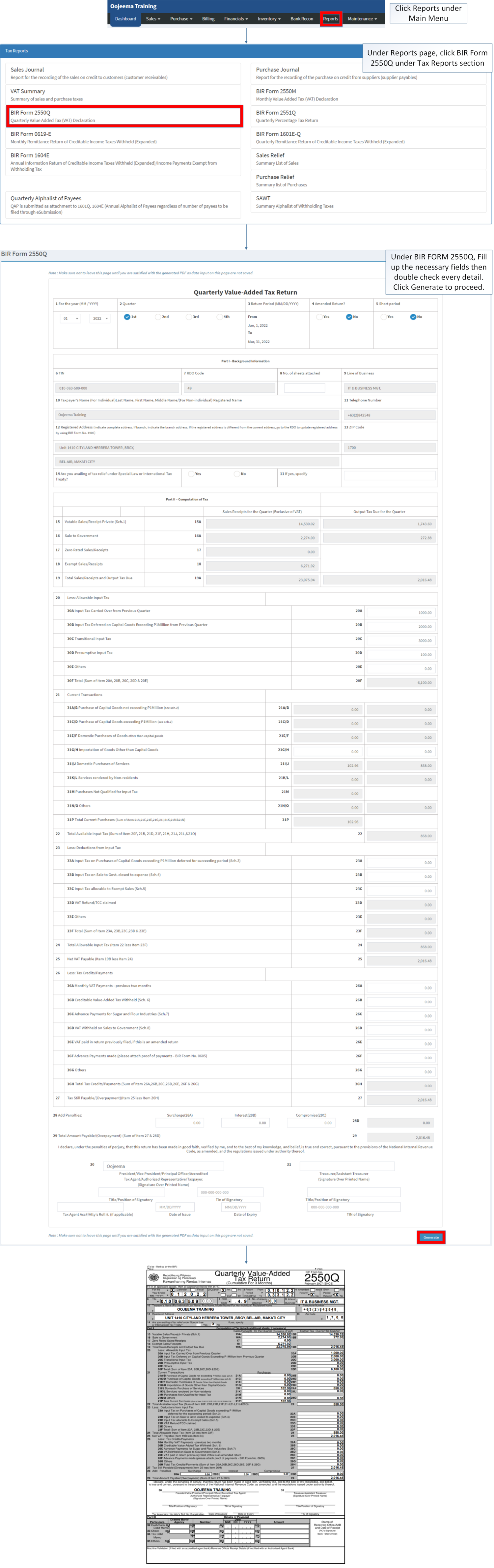

- Under BIR FORM 2550Q, Fill up the necessary fields then double check every detail. Click Generate to proceed.

| Fields | Description |

|---|---|

| 1. Month Year | Month and year when the BIR Form 2550Q was issued. |

| 2. Quarter | Refers to the which quarter of the year.

|

| 3. Return Period | The month range of the specific quarter. |

| 4. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 5. Short Period | A return for a short period, that is, for a taxable year consisting of a period of less than 12 months. This can be due to company being dissolved. |

| Part I - Background Information | |

| 6. TIN | Tax Identification Number of an Individual or Business |

| 7. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 8. No. of Sheets Attached | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2550Q |

| 9. Line of Business | Nature of Business of the Company |

| 10. Tax Payer's Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 11. Telephone Number | Contact Number of the Tax Payer |

| 12. Registered Address | The registered Address of the Tax Payer. |

| 13. ZIP Code | Zone Improvement Plan Code of the registered Address of the Tax Payer. |

| 14. Tax Relief | (Optional)

Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty. |

| Part II - Computation of Tax | |

| 15. Vatable Sales/Receipt-Private | Sales that the business will have to charge VAT on if it is registered for VAT. |

| 16. Sale to Government | VAT transactions applied to the Government |

| 17. Zero Rated Sales/Receipts | Sales that does not impose any VAT |

| 18. Exempt Sales/Receipts | Sales that does not impose any VAT |

| 19. Total Sales/Receipts and Output Tax Due | Total Value of Tax Types Mentioned from Vatable Sales up to Exempt Sales. |

| 20. Less: Allowable Input Tax |

|

| 21. Current Transactions |

|

| 22. Total Available Input Tax (Sum of Item 20F, 21B, 21D, 21F, 21H, 21J, 21L,&21O) | Overall Total of Available Input Tax declared. |

| 23. Less: Deductions from Input Tax |

|

| 24. Total Allowable Input Tax (Item 22 less Item 23F) | Remaining Available Input Tax based from the Total Input Tax Less the deductions Declared from input tax. |

| 25. Net VAT Payable (Item 19B less Item 24) | Net Amount of Value Added Tax Payable based from Total Sales/Receipts and Output Tax Due less the Total Allowable Input Tax. |

| 26. Less: Tax Credits/Payments |

|

| 27. Tax Still Payable/(Overpayment)(Item 25 less Item 26H) | Remaining Tax Payable base from Net VAT Payable less the Total Tax Credits/Payments. |

| 28. Penalties | Penalties to be applied if any

|

| 29. Total Amount Payable/(Overpayment) (Sum of Item 27 & 28D) | Remaining Tax Payable base from Net VAT Payable less the Tax Credits Applied. |

| 30. President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer | President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer Details

|

| 31. Treasurer/Assistant Treasurer (Signature Over Printed Name) | Treasurer/Assistant Treasurer Details

|

Notes:

- Grey fields are auto-generated and will automatically adjust based on the input of the user.

| Modules | |

|---|---|

| Maintenance | ATC Code | Company | Tax |

| Sales | Sales Invoice |

| Reports Module(Reports) | |

| Reports | Tax Reports |

| Tax Reports | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |