You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "SAWT"

(Tag: Visual edit) |

(Changed categories.) |

||

| (8 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | <div style="text-align: center;">[[Tax Reports]] | [[SAWT]] | + | <div style="text-align: center;"> |

| + | [[Tax Reports]] | [[SAWT]] | ||

| + | </div> | ||

| − | == Summary Alphalist of Withholding Taxes == | + | ==Summary Alphalist of Withholding Taxes== |

| − | |||

| + | '''Summary Alphalist of Withholding Tax(SAWT)''' at Source serves as a consolidated Alphalist of withholding agents from whom income was received and are subjected to withholding agents in the process. | ||

| + | [[File:Tax Reports - SAWT - Record List.png|border|center|1500x1500px]] | ||

| + | <br /> | ||

| + | {| class="wikitable" style="margin: auto;" | ||

| + | |+SAWT Terms in Oojeema Prime | ||

| + | !Field | ||

| + | !Descriptions | ||

| + | |- | ||

| + | |1. '''Record Filters'''(Date Range, Item List) | ||

| + | |This refers to the set of filters for precise searching of records. | ||

| + | |||

| + | *Date Range is set automatically by the current month by default. | ||

| + | *Item List is set by 10 records per page by default. | ||

| + | |- | ||

| + | |2. '''Exports''' | ||

| + | |Refers on how the records want to be exported(by CSV or DAT) | ||

| + | |- | ||

| + | |3. '''Company Details''' | ||

| + | |Refers to the basic information of the [[Company]]. | ||

| + | |- | ||

| + | |4. '''SEQ. No''' | ||

| + | |Sequence Number of the summary | ||

| + | |- | ||

| + | |5. '''Tin No.''' | ||

| + | |Tax Identification Number of the SEQ No. | ||

| + | |- | ||

| + | |6. '''Corporation''' | ||

| + | |Corporation under SEQ No. | ||

| + | |- | ||

| + | |7. '''Individual''' | ||

| + | |The person liable under the assigned SEQ No. | ||

| + | |- | ||

| + | |8. '''ATC Code''' | ||

| + | |Alphanumeric Tax Code under SEQ No. | ||

| + | |- | ||

| + | |9. '''Nature of Payment''' | ||

| + | |Payment issued on the SEQ No. if it is on Cash or Cheque | ||

| + | |- | ||

| + | |10. '''Payment Amount''' | ||

| + | |Payment amount corresponding to its Nature of Payment | ||

| + | |- | ||

| + | |11. '''Tax Rate''' | ||

| + | |Tax Applied based on the ATC Code of the SEQ No. | ||

| + | |- | ||

| + | |12. '''Tax Withheld''' | ||

| + | |Tax Value associated on the payment amount. | ||

| + | |} | ||

| + | |||

| + | =====<span class="mw-headline" id="Exporting_Summary_Alphalist_of_Withholding_Taxes" style="box-sizing: inherit;">Exporting Summary Alphalist of Withholding Taxes</span>===== | ||

| − | '''Summary Alphalist of Withholding Tax | + | #Click [[Reports]] under Main Menu |

| + | #Under Reports Page, Click '''[[SAWT]]''' under [[Tax Reports]] Section. | ||

| + | #Under [[SAWT]], click the '''CSV Button''' on the right side. Take note that you can also filter the date range for Precise Exportation of Records. | ||

| + | |||

| + | [[File:Tax Reports - SAWT - Export.png|border|center|1600x1600px]] | ||

| + | <br /> | ||

| + | =====<span class="mw-headline" id="Exporting_DAT_file_of_SAWT" style="box-sizing: inherit;">Exporting DAT file of Summary Alphalist of Withholding Taxes</span>===== | ||

| + | |||

| + | #Click [[Reports]] under Main Menu | ||

| + | #Under Reports Menu, Click '''[[SAWT]]''' under [[Tax Reports]]. | ||

| + | #Under [[SAWT]], click the '''DAT''' '''Button''' on the right side. | ||

| + | #Select SAWT Form then click select. The system will generate a DAT file base from the options selected. | ||

| − | SAWT | + | [[File:Tax Reports - SAWT - Export DAT.png|border|center|1500x1500px]] |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

Notes: | Notes: | ||

| − | * | + | *DAT file is used for filing the EBIR entries. |

| − | {| class="wikitable" style=" | + | {| class="wikitable" style="margin: auto;" |

|+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | |+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | ||

! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Modules''' | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Modules''' | ||

| + | |- | ||

| + | |Sales | ||

| + | |[[Sales Invoice]] | ||

| + | |- | ||

| + | |Financials | ||

| + | |[[Accounts Receivable]]<nowiki> | </nowiki>[[Receipt Voucher]] | ||

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |Maintenance | | style="" |Maintenance | ||

| − | | style="" |[[ATC Code | + | | style="" |[[ATC Code]]<nowiki> | </nowiki>[[Company]]<nowiki> | </nowiki>[[Customer]]<nowiki> | </nowiki>[[Tax]] |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|- | |- | ||

| colspan="2" style="vertical-align:middle;text-align:center;" |'''Reports Module([[Reports]])''' | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Reports Module([[Reports]])''' | ||

| Line 50: | Line 95: | ||

|Tax Reports | |Tax Reports | ||

|[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|} | |} | ||

| + | [[Category:Financials]] | ||

| + | [[Category:Sales]] | ||

| + | [[Category:Tax Reports]] | ||

Latest revision as of 11:09, 7 April 2022

Summary Alphalist of Withholding Taxes

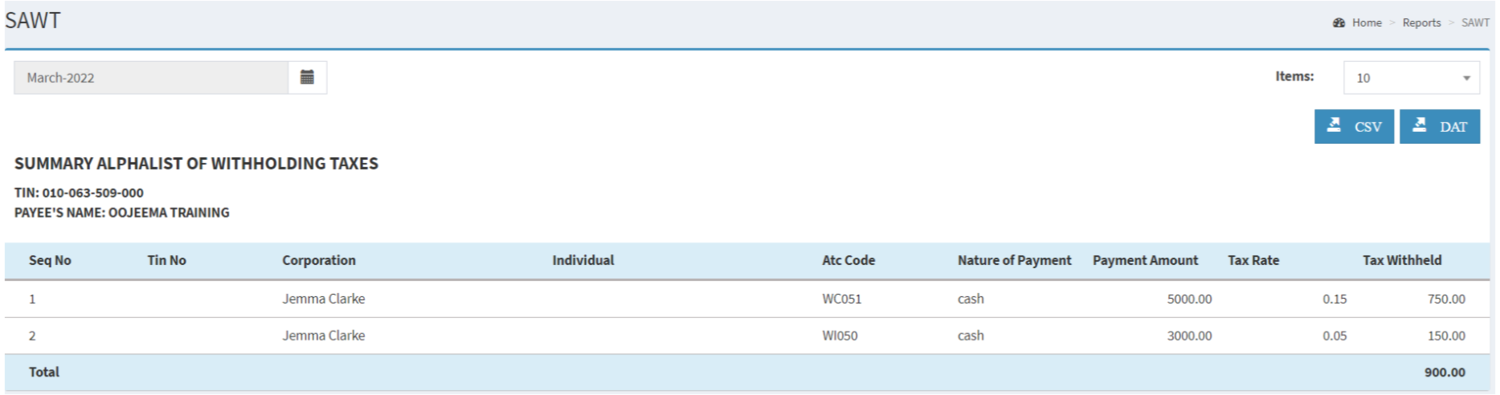

Summary Alphalist of Withholding Tax(SAWT) at Source serves as a consolidated Alphalist of withholding agents from whom income was received and are subjected to withholding agents in the process.

| Field | Descriptions |

|---|---|

| 1. Record Filters(Date Range, Item List) | This refers to the set of filters for precise searching of records.

|

| 2. Exports | Refers on how the records want to be exported(by CSV or DAT) |

| 3. Company Details | Refers to the basic information of the Company. |

| 4. SEQ. No | Sequence Number of the summary |

| 5. Tin No. | Tax Identification Number of the SEQ No. |

| 6. Corporation | Corporation under SEQ No. |

| 7. Individual | The person liable under the assigned SEQ No. |

| 8. ATC Code | Alphanumeric Tax Code under SEQ No. |

| 9. Nature of Payment | Payment issued on the SEQ No. if it is on Cash or Cheque |

| 10. Payment Amount | Payment amount corresponding to its Nature of Payment |

| 11. Tax Rate | Tax Applied based on the ATC Code of the SEQ No. |

| 12. Tax Withheld | Tax Value associated on the payment amount. |

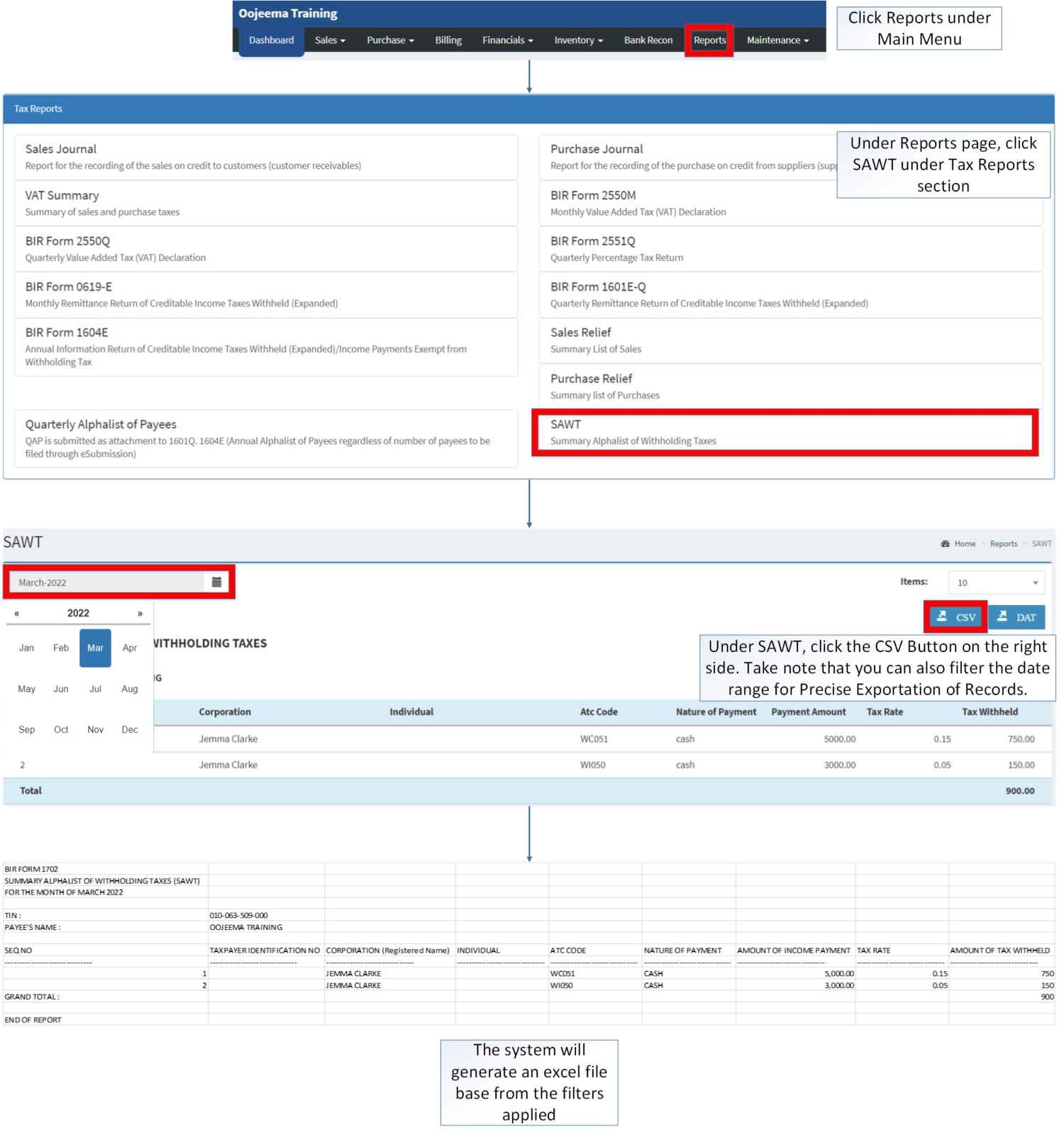

Exporting Summary Alphalist of Withholding Taxes

- Click Reports under Main Menu

- Under Reports Page, Click SAWT under Tax Reports Section.

- Under SAWT, click the CSV Button on the right side. Take note that you can also filter the date range for Precise Exportation of Records.

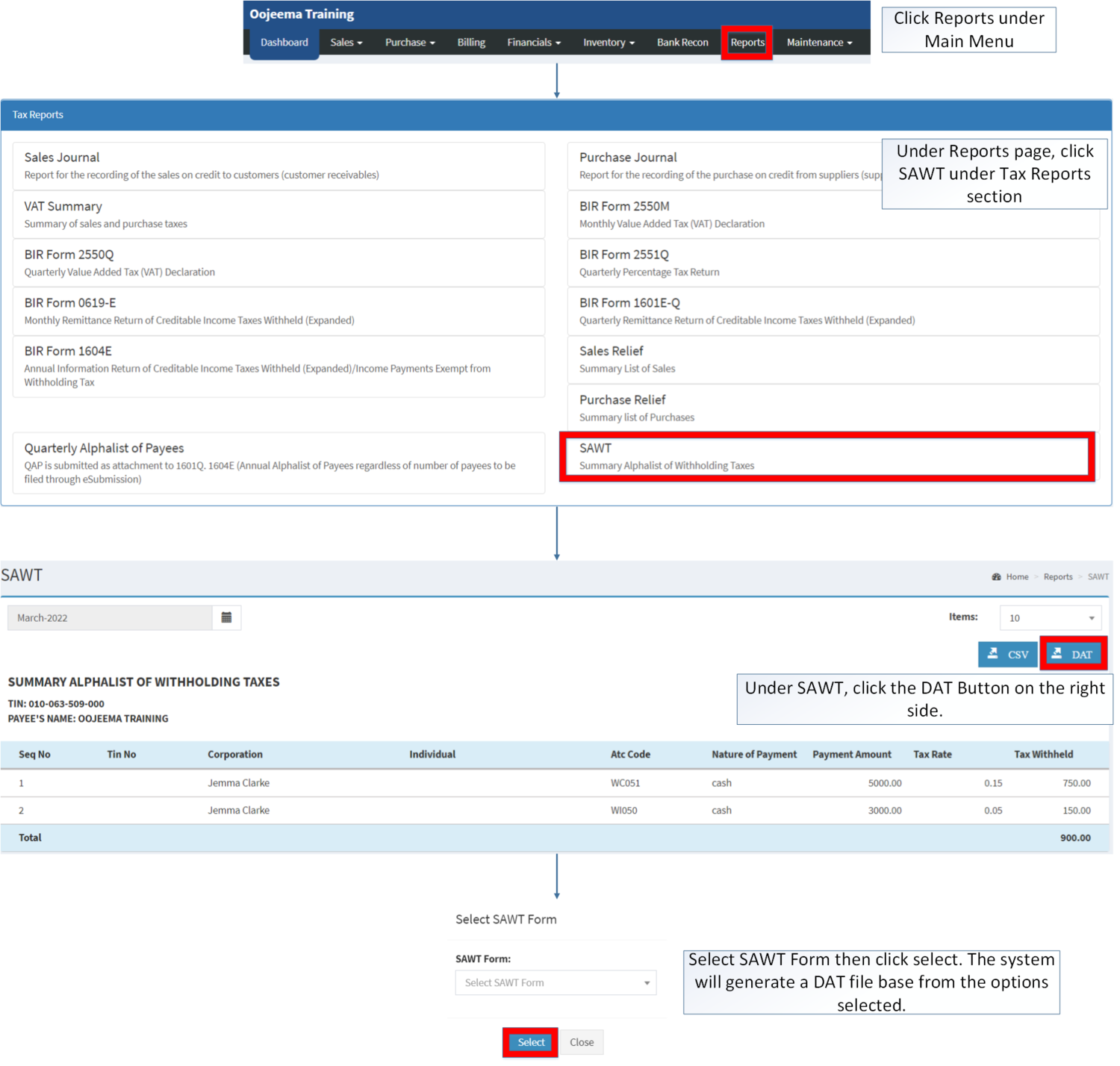

Exporting DAT file of Summary Alphalist of Withholding Taxes

- Click Reports under Main Menu

- Under Reports Menu, Click SAWT under Tax Reports.

- Under SAWT, click the DAT Button on the right side.

- Select SAWT Form then click select. The system will generate a DAT file base from the options selected.

Notes:

- DAT file is used for filing the EBIR entries.

| Modules | |

|---|---|

| Sales | Sales Invoice |

| Financials | Accounts Receivable | Receipt Voucher |

| Maintenance | ATC Code | Company | Customer | Tax |

| Reports Module(Reports) | |

| Reports | Tax Reports |

| Tax Reports | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |