You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "Purchase Relief"

(Tag: Visual edit) |

(Changed categories.) |

||

| (8 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | <div style="text-align: center;">[[Tax Reports]] | [[Purchase Relief]] | [[Purchase Relief | + | <div style="text-align: center;">[[Tax Reports]] | [[Purchase Relief]] | [[Accounts Payable]] | [[Payment Voucher]]<br /></div> |

| + | |||

| + | ==Purchase Relief== | ||

| + | ======Purchase Relief Report====== | ||

| + | [[File:Tax Reports - Purchase Relief - Menu.png|border|center|1500x1500px]] | ||

| + | |||

| + | |||

| + | '''Purchase Relief Report''' <span style="color: rgb(51, 51, 51)">refers to the Summary List of Purchases that are taxable and non taxable within the certain period.</span> | ||

| + | |||

| + | ======<span class="mw-headline" id="Requirements_before_using_Sales_Relief_Report" style="box-sizing: inherit;">Requirements before using Purchase Relief Report</span>====== | ||

| + | The user should have the following records in order to use the Purchase Relief Report | ||

| + | |||

| + | *[[Accounts Payable]] | ||

| + | *[[Payment Voucher]] | ||

| + | *[[Company]] | ||

| + | *[[Supplier]] | ||

| + | *[[Tax]] | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |+<span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">Purchase Relief Report Terms on Oojeema System</span> | ||

| + | !Fields | ||

| + | !Description | ||

| + | |- | ||

| + | |1. '''Record Filters'''(Date Range, Suppliers, Item List) | ||

| + | |This refers to the set of filters for precise searching of records. | ||

| + | |||

| + | *Date Range is set automatically by the current month by default. | ||

| + | *Supplier is set to Filter: All by default | ||

| + | *Item List is set by 10 records per page by default. | ||

| + | |- | ||

| + | |2. '''Exports''' | ||

| + | |Refers on how the records want to be exported(by CSV or DAT) | ||

| + | |- | ||

| + | |3. '''Company Details''' | ||

| + | |Refers to the basic information of the [[Company]]. | ||

| + | |||

| + | *This can be updated by visiting the [[Company]] Maintenance Module. | ||

| + | *Company Details may vary depending on the [[Branch]] chosen which can be seen in Maintenance Module. | ||

| + | |- | ||

| + | |4. '''Taxable Month''' | ||

| + | |Month filtered for transaction records. | ||

| + | |- | ||

| + | |5. '''TIN''' | ||

| + | |Tax Identification Number of the [[Supplier]] | ||

| + | |- | ||

| + | |6. '''Vendor''' | ||

| + | |[[Supplier]] recorded on the transaction | ||

| + | |- | ||

| + | |7. '''Gross Amount''' | ||

| + | |Amount of purchase without VAT in the transaction. | ||

| + | |- | ||

| + | |8. '''Taxable Purchase''' | ||

| + | |Purchase of a taxable product or service where the business doesn't receive sales tax for the item/service at time of closing the sale. | ||

| + | |- | ||

| + | |9. '''Purchase of Services''' | ||

| + | |Amount of purchases with regards to the services and activities provided by vendor. | ||

| + | |- | ||

| + | |10. '''Purchase of Capital Goods''' | ||

| + | |Amount of purchase based from the capital goods/physical assets bought by the [[Company]]. | ||

| + | |- | ||

| + | |11. '''Purchase of Goods other than Capital Goods''' | ||

| + | |Amount of purchase based from items aside from capital goods. | ||

| + | |- | ||

| + | |12. '''Output Tax''' | ||

| + | |The Tax amount Applied on the Taxable purchase based on what Tax is charge on the transaction | ||

| + | |- | ||

| + | |13. '''Gross Purchase Sales''' | ||

| + | |The total amount of Purchases based from the Purchases and Taxes applied. | ||

| + | |} | ||

| + | Notes: | ||

| + | |||

| + | #Clicking Gross Sales Transactions amount will redirect the user to the [[Accounts Payable]] transaction. | ||

| + | |||

| + | =====<span class="mw-headline" id="Exporting_Purchase_Relief_Report" style="box-sizing: inherit;">Exporting Purchase Relief Report CSV</span>===== | ||

| + | |||

| + | #Click '''[[Reports]] U'''nder the Main Menu. | ||

| + | #Under Reports Page, Click '''[[Purchase Relief|Purchase Relief Report]]''' under [[Tax Reports]] section. | ||

| + | #Under [[Purchase Relief]] Report, click the '''CSV Button''' on the right side. Take note that you can also filter the Date Range and Customer for Precise Exportation of Records. | ||

| + | |||

| + | [[File:Tax Reports - Purchase Relief - Export CSV.png|border|center|1707x1707px]] | ||

| + | |||

| + | =====<span class="mw-headline ve-pasteProtect" id="Exporting_Purchase_Relief_Report" style="box-sizing: inherit;" data-ve-attributes="{"style":"box-sizing: inherit;"}">Exporting Purchase Relief Report</span> DAT===== | ||

| + | |||

| + | #Click [[Reports]] Under the Main Menu. | ||

| + | #Under Reports Page, Click '''[[Purchase Relief|Purchase Relief Report]]''' under [[Tax Reports]] section. | ||

| + | #Under [[Purchase Relief]] Report, click the '''DAT Button''' on the right side. | ||

| + | |||

| + | [[File:Tax Reports - Purchase Relief - Export DAT.png|border|center|1500x1500px]] | ||

| + | |||

| + | =====<span class="mw-headline" id="Viewing_Detailed_Gross_Sales_in_Purchase_Relief_Report" style="box-sizing: inherit;">Viewing Detailed Gross Amount in Purchase Relief Report</span>===== | ||

| + | |||

| + | #Under the Main Menu, Click '''[[Reports]]''' | ||

| + | #Under Reports Menu, Click '''[[Purchase Relief|Purchase Relief Report]]''' under [[Tax Reports]]. | ||

| + | #Under [[Purchase Relief]] Report, Clicking the linked amount under Gross Amount Column in order to redirect you to the voucher information on that respective amount. | ||

| + | |||

| + | [[File:Tax Reports - Purchase Relief - View.png|center|thumb|2441x2441px]] | ||

| + | <br /> | ||

{| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | {| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | ||

|+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | |+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | ||

| Line 8: | Line 104: | ||

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |Maintenance | | style="" |Maintenance | ||

| − | | style="" | | + | | style="" |[[Company]]<nowiki> | </nowiki>[[Supplier]]<nowiki> | </nowiki>[[Tax]] |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|- | |- | ||

| colspan="2" style="vertical-align:middle;text-align:center;" |'''Reports Module([[Reports]])''' | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Reports Module([[Reports]])''' | ||

| Line 25: | Line 113: | ||

|Tax Reports | |Tax Reports | ||

|[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | ||

| − | | | + | |} |

| − | + | [[Category:Purchase]] | |

| − | + | [[Category:Tax Reports]] | |

| − | + | [[Category:Financials]] | |

| − | |||

| − | |||

Latest revision as of 14:55, 6 April 2022

Contents

Purchase Relief

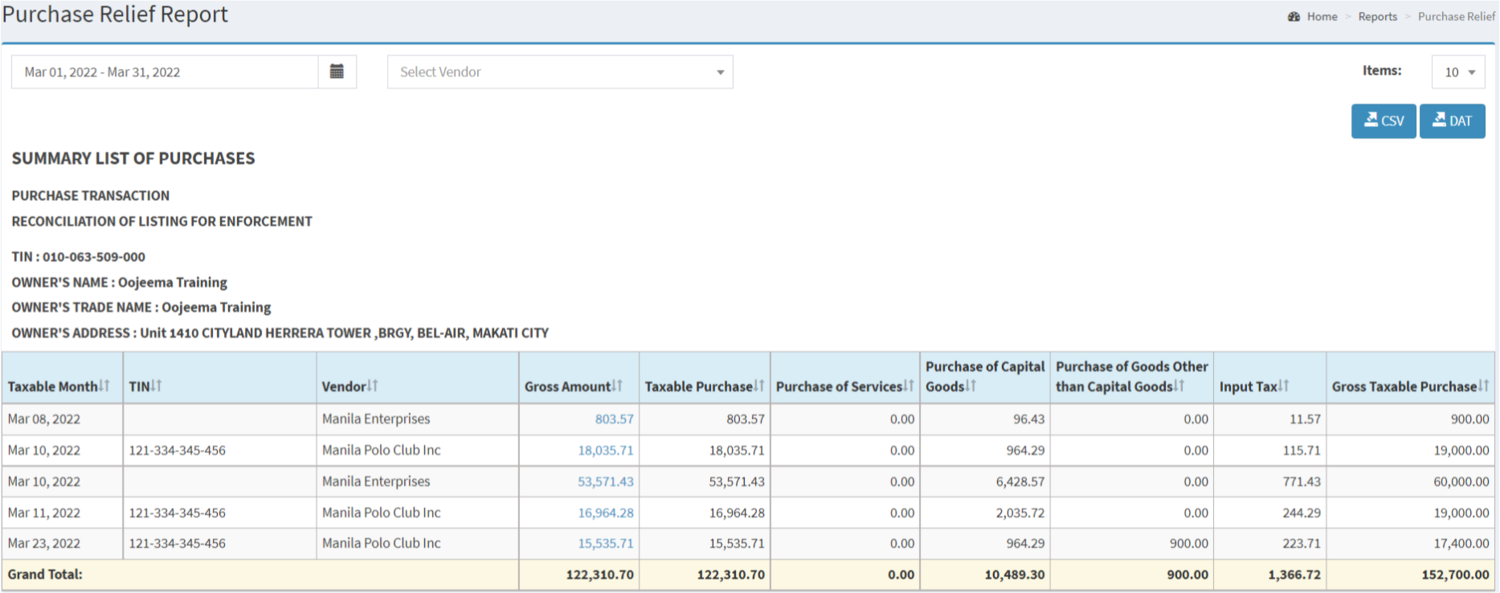

Purchase Relief Report

Purchase Relief Report refers to the Summary List of Purchases that are taxable and non taxable within the certain period.

Requirements before using Purchase Relief Report

The user should have the following records in order to use the Purchase Relief Report

| Fields | Description |

|---|---|

| 1. Record Filters(Date Range, Suppliers, Item List) | This refers to the set of filters for precise searching of records.

|

| 2. Exports | Refers on how the records want to be exported(by CSV or DAT) |

| 3. Company Details | Refers to the basic information of the Company. |

| 4. Taxable Month | Month filtered for transaction records. |

| 5. TIN | Tax Identification Number of the Supplier |

| 6. Vendor | Supplier recorded on the transaction |

| 7. Gross Amount | Amount of purchase without VAT in the transaction. |

| 8. Taxable Purchase | Purchase of a taxable product or service where the business doesn't receive sales tax for the item/service at time of closing the sale. |

| 9. Purchase of Services | Amount of purchases with regards to the services and activities provided by vendor. |

| 10. Purchase of Capital Goods | Amount of purchase based from the capital goods/physical assets bought by the Company. |

| 11. Purchase of Goods other than Capital Goods | Amount of purchase based from items aside from capital goods. |

| 12. Output Tax | The Tax amount Applied on the Taxable purchase based on what Tax is charge on the transaction |

| 13. Gross Purchase Sales | The total amount of Purchases based from the Purchases and Taxes applied. |

Notes:

- Clicking Gross Sales Transactions amount will redirect the user to the Accounts Payable transaction.

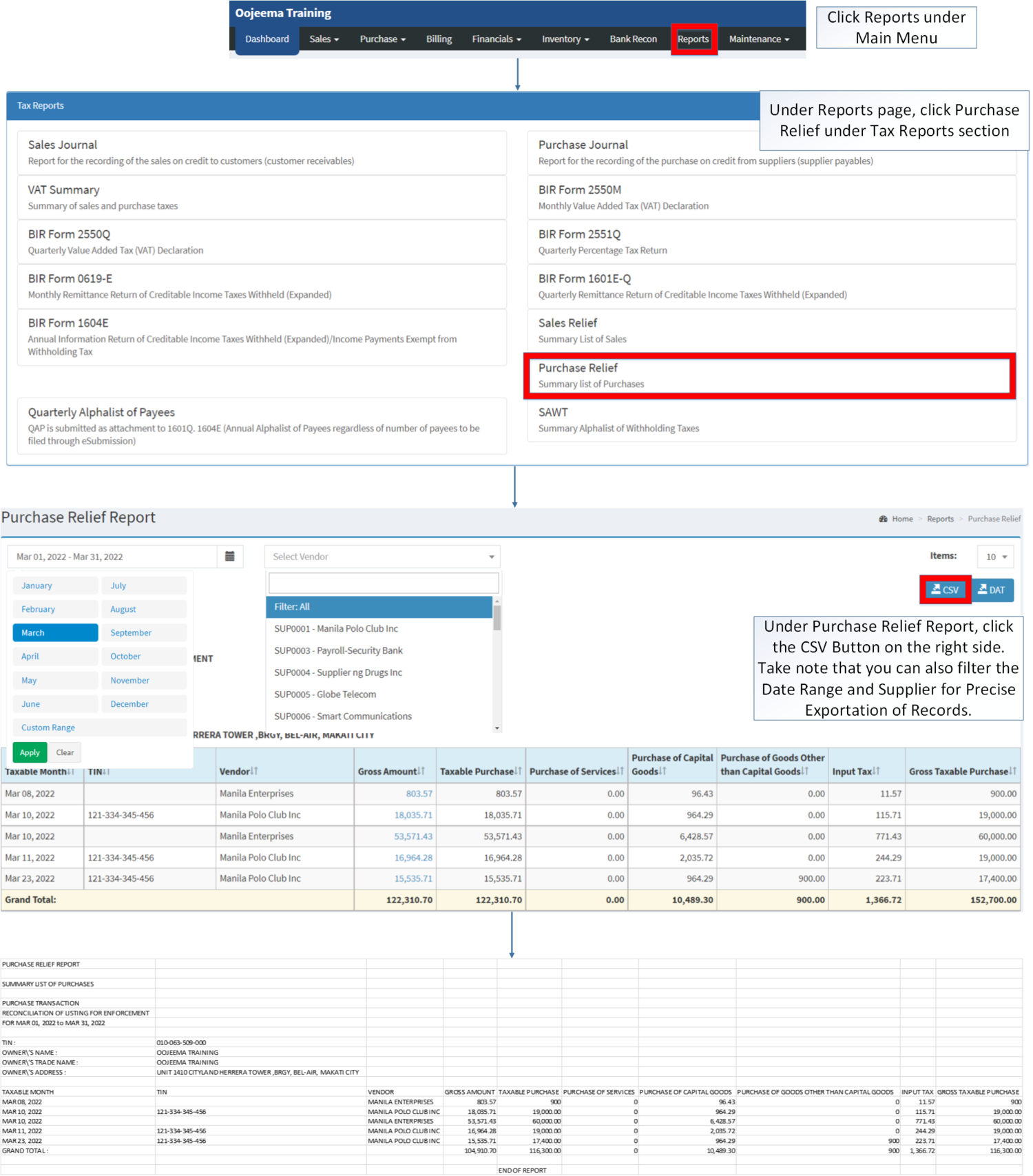

Exporting Purchase Relief Report CSV

- Click Reports Under the Main Menu.

- Under Reports Page, Click Purchase Relief Report under Tax Reports section.

- Under Purchase Relief Report, click the CSV Button on the right side. Take note that you can also filter the Date Range and Customer for Precise Exportation of Records.

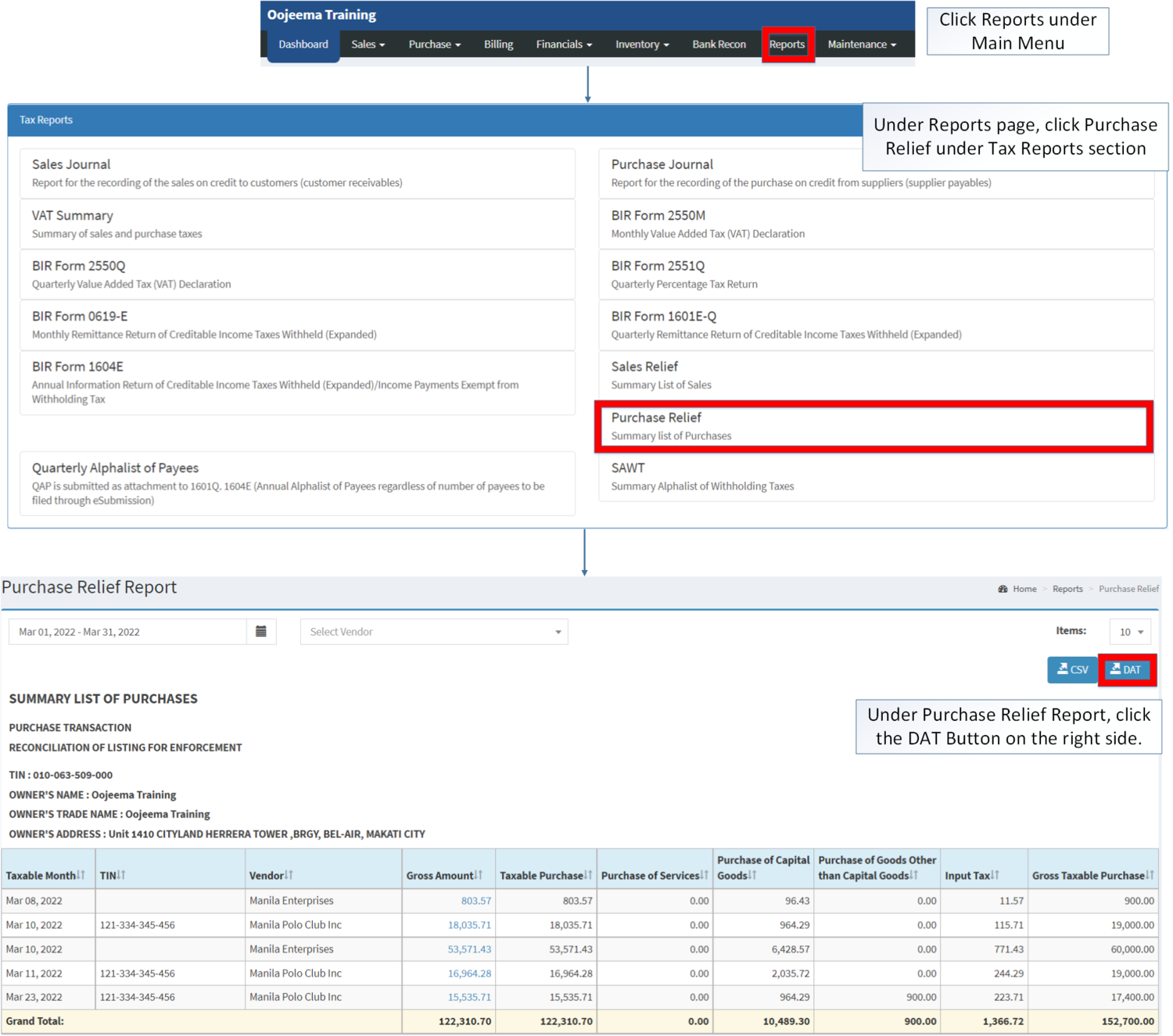

Exporting Purchase Relief Report DAT

- Click Reports Under the Main Menu.

- Under Reports Page, Click Purchase Relief Report under Tax Reports section.

- Under Purchase Relief Report, click the DAT Button on the right side.

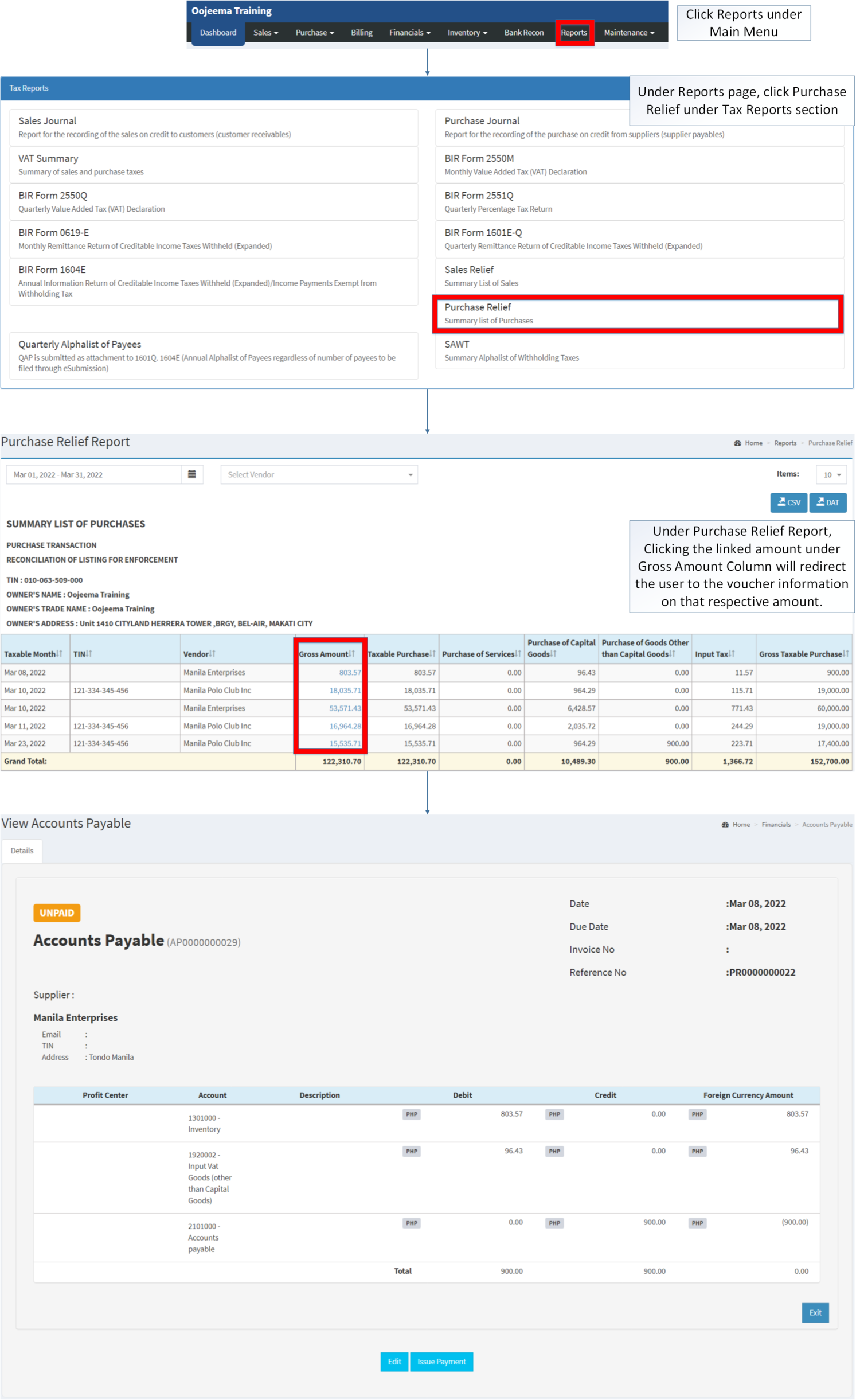

Viewing Detailed Gross Amount in Purchase Relief Report

- Under the Main Menu, Click Reports

- Under Reports Menu, Click Purchase Relief Report under Tax Reports.

- Under Purchase Relief Report, Clicking the linked amount under Gross Amount Column in order to redirect you to the voucher information on that respective amount.

| Modules | |

|---|---|

| Financials | Accounts Payable | Payment Voucher |

| Maintenance | Company | Supplier | Tax |

| Reports Module(Reports) | |

| Reports | Tax Reports |

| Tax Reports | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |