You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "BIR Form 2550M"

(Tag: Visual edit) |

(Changed categories.) |

||

| (7 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

<div style="text-align: center;"> | <div style="text-align: center;"> | ||

| − | [[Tax Reports]] | [[BIR Form 2550M | + | [[Tax Reports]] | [[BIR Form 2550M]] |

</div> | </div> | ||

==BIR Form 2550M== | ==BIR Form 2550M== | ||

| − | '''BIR Form 2550M''' refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a monthly basis. [[File:BIR Form 2550M.png|center| | + | '''BIR Form 2550M''' refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a monthly basis. |

| + | [[File:Tax Reports - BIR Form 2550M - Menu.png|border|center|3510x3510px]] | ||

| + | <br /> | ||

| + | |||

| + | =====<span class="mw-headline" id="Generating_BIR_FORM_2550M_Records" style="box-sizing: inherit;">'''<span style="box-sizing: inherit; font-size: 12pt; line-height: 17.12px;">Generating BIR FORM 2550M Records</span>'''</span>===== | ||

| + | |||

| + | #Under Main Menu, Click '''[[Reports]]''' | ||

| + | #Under Reports Menu, Click '''[[BIR Form 2550M|BIR FORM 2550M]]''' under [[Tax Reports]]. | ||

| + | #Under [[BIR Form 2550M|BIR FORM 2550M]], Fill up the necessary fields then double check every detail. Click '''Generate''' to proceed. | ||

| + | |||

| + | [[File:Tax Reports - BIR Form 2550M - Generate.png|border|center|5228x5228px]] | ||

| + | <br /> | ||

{| class="wikitable" | {| class="wikitable" | ||

|+BIR Form 2550M Terms on Oojeema Prime System | |+BIR Form 2550M Terms on Oojeema Prime System | ||

| Line 20: | Line 31: | ||

Number of Attached Sheets declared when submitting the BIR Form 2550M | Number of Attached Sheets declared when submitting the BIR Form 2550M | ||

| − | * Number of sheets is needed when filing E-BIR and EFPS | + | *Number of sheets is needed when filing E-BIR and EFPS |

|- | |- | ||

| colspan="2" style="vertical-align:middle;text-align:center;" |'''Part I - Background Information''' | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Part I - Background Information''' | ||

| Line 67: | Line 78: | ||

|For Total Sales Receipt for the Month | |For Total Sales Receipt for the Month | ||

| − | * Total Sales from Item 12 to 15 | + | *Total Sales from Item 12 to 15 |

For Output Tax Due for the Month | For Output Tax Due for the Month | ||

| − | * Total Output Tax from Item 12 and 13 | + | *Total Output Tax from Item 12 and 13 |

|- | |- | ||

|17. '''Less: Allowable Input Tax''' | |17. '''Less: Allowable Input Tax''' | ||

| Line 157: | Line 168: | ||

*Grey fields are auto-generated and will automatically adjust based on the input of the user. | *Grey fields are auto-generated and will automatically adjust based on the input of the user. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

{| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | {| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | ||

|+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | |+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | ||

| Line 171: | Line 174: | ||

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |Maintenance | | style="" |Maintenance | ||

| − | | style="" |[[ATC Code]]<nowiki> | </nowiki>[[ | + | | style="" |[[ATC Code]]<nowiki> | </nowiki>[[Company]]<nowiki> | </nowiki>[[Tax]] |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| colspan="2" style="vertical-align:middle;text-align:center;" |'''Reports Module([[Reports]])''' | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Reports Module([[Reports]])''' | ||

| Line 188: | Line 183: | ||

| style="" |Tax Reports | | style="" |Tax Reports | ||

| style="" |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | | style="" |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|} | |} | ||

| + | |||

| + | |||

| + | |||

| + | [[Category:Financials]] | ||

| + | [[Category:Sales]] | ||

| + | [[Category:Purchase]] | ||

| + | [[Category:Tax Reports]] | ||

Latest revision as of 10:54, 7 April 2022

BIR Form 2550M

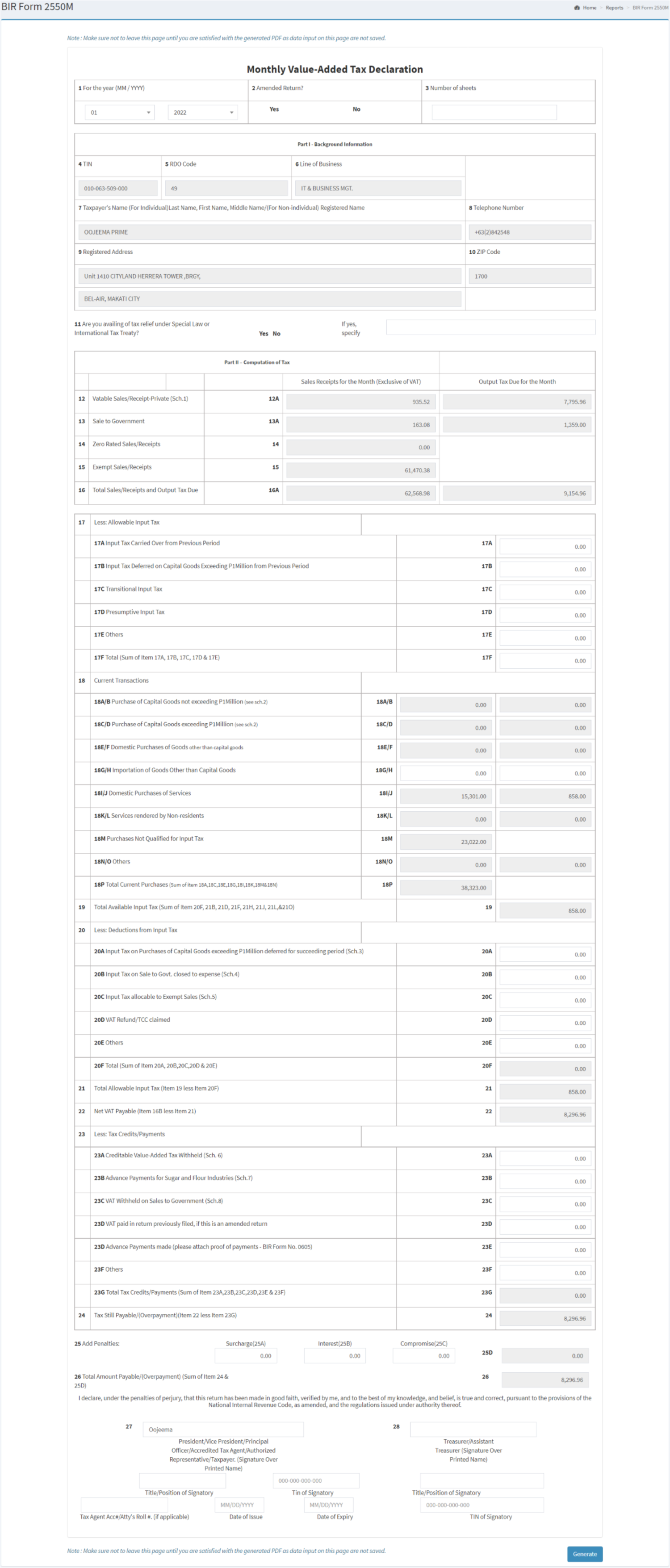

BIR Form 2550M refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a monthly basis.

Generating BIR FORM 2550M Records

- Under Main Menu, Click Reports

- Under Reports Menu, Click BIR FORM 2550M under Tax Reports.

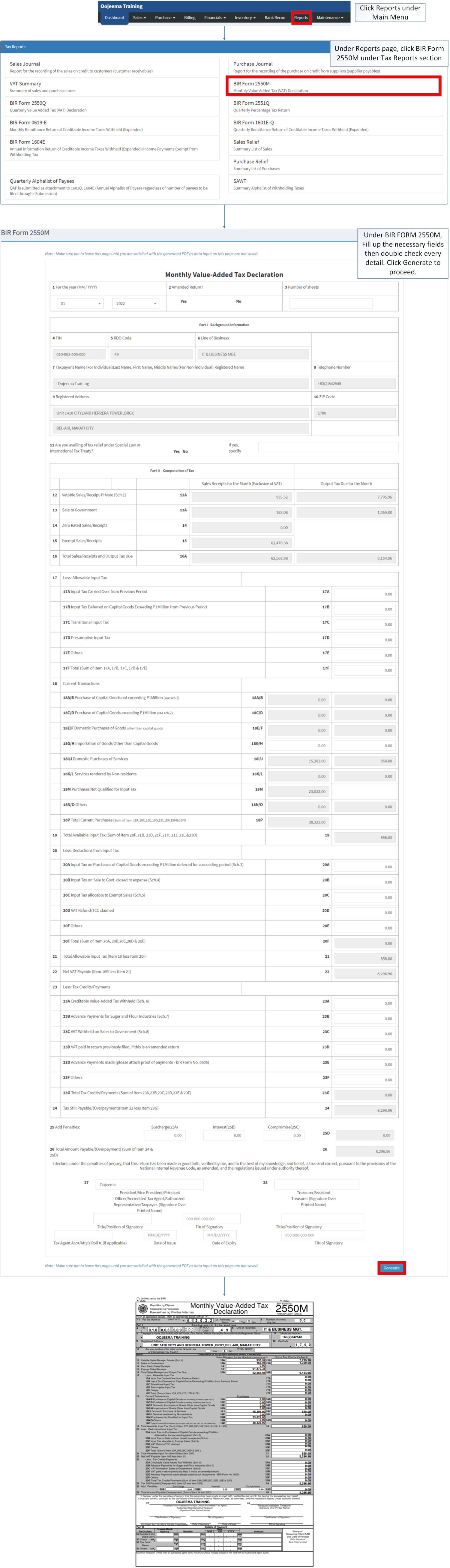

- Under BIR FORM 2550M, Fill up the necessary fields then double check every detail. Click Generate to proceed.

| Fields | Descriptions/Remarks |

|---|---|

| 1. Month/Year | Month and Year when the BIR Form 2550M is issued. |

| 2. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 3. Number of Sheets | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2550M

|

| Part I - Background Information | |

| 4. TIN | Tax Identification Number of the Company/Branch |

| 5. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 6. Line of Business | Nature of Business of the Company |

| 7. Tax Payer's Name | Registered Name for Non-Individual(Company) and Whole name for Individual |

| 8. Telephone Number | Contact Number of the Tax Payer |

| 9. Registered Address | The registered Address of the Tax Payer. |

| 10. Zip Code | Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer |

| 11. Tax Relief | (Optional)

Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty. |

| Part II - Computation of Tax | |

| 12. Vatable Sales/Receipt-Private | (Schedule 1)

Sales that the business will have to charge VAT on if it is registered for VAT. |

| 13. Sales To Government | VAT transactions applied to the Government |

| 14. Zero Rated Sales/Receipts | Sales that does not impose any VAT |

| 15. Exempt Sales/Receipts | Sales that does not impose any VAT |

| 16. Total Sales/Receipts and Output Tax Due | For Total Sales Receipt for the Month

For Output Tax Due for the Month

|

| 17. Less: Allowable Input Tax | List of Allowable Input Tax to be deducted

|

| 18. Current Transactions |

|

| 19. Total Available Input Tax(Sum of Item 17F, 18B, 18D, 18F, 18H, 18J, 18L,&18O) | Total Input Tax based from Total Allowable Input Tax(17F) and Items 18B, 18D, 18F, 18H, 18J, 18L and 18O. |

| 20. Less: Deductions from Input Tax |

|

| 21. Total Allowable Input Tax (Item 19 less Item 20F) | Remaining Available Input Tax based from the Total Input Tax Less the deductions Declared from input tax. |

| 22. Net VAT Payable (Item 16B less Item 21) | Net Amount of Value Added Tax Payable based from Total Sales/Receipts and Output Tax Due less the Total Allowable Input Tax. |

| 23. Less: Tax Credits/Payments |

|

| 24. Tax Still Payable/(Overpayment)(Item 22 less Item 23G) | Remaining Tax Payable base from Net VAT Payable less the Tax Credits Applied. |

| 25. Penalties | Penalties to be applied if any

|

| 26. Total Amount Payable/(Overpayment) (Sum of Item 24 & 25D) | Total Payable base from Tax Payable and Penalties. |

| 27. President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name) | President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details

|

| 28. Treasurer/Assistant Treasurer (Signature Over Printed Name) | Treasurer/Assistant Treasurer details

|

Notes:

- Grey fields are auto-generated and will automatically adjust based on the input of the user.

| Modules | |

|---|---|

| Maintenance | ATC Code | Company | Tax |

| Reports Module(Reports) | |

| Reports | Tax Reports |

| Tax Reports | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |