You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "Tax Reports"

(Tag: Visual edit) |

(Tag: Visual edit) |

||

| (4 intermediate revisions by the same user not shown) | |||

| Line 2: | Line 2: | ||

[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]]</div> | [[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]]</div> | ||

| − | == Tax Reports == | + | ==Tax Reports== |

====Tax Reports Menu==== | ====Tax Reports Menu==== | ||

| − | + | '''Tax Reports''' refer to the <span style="color: rgb(51, 51, 51)">reports associated in any return, report, information return, or other document (including any related or supporting information) filed or required to be filed with any federal, state, or local governmental entity or other authority in connection with the determination, assessment or collection of any Tax (whether or not such Tax is imposed on any of the Seller) or the administration of any laws, regulations or administrative requirements relating to any Tax.</span> | |

| − | '''Tax Reports''' refer to the <span style="color: rgb(51, 51, 51)">reports associated in any return, report, information return, or other document (including any related or supporting information) filed or required to be filed with any federal, state, or local governmental entity or other authority in connection with the determination, assessment or collection of any Tax (whether or not such Tax is imposed on any of the Seller) or the administration of any laws, regulations or administrative requirements relating to any Tax.</span> | + | [[File:Reports - Tax Reports - Modules.png|border|center|1500x1500px]] |

| + | <br /> | ||

{| class="wikitable" style="margin: auto;" | {| class="wikitable" style="margin: auto;" | ||

|+<span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">In Oojeema, Tax Reports in</span> [[Reports]] <span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">Module includes:</span> | |+<span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">In Oojeema, Tax Reports in</span> [[Reports]] <span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">Module includes:</span> | ||

| Line 12: | Line 13: | ||

!Description | !Description | ||

|- | |- | ||

| − | |1. [ | + | |1. [[Sales Journal]] |

|Report for the recording of the sales on credit to customers(Customer's Receivables) | |Report for the recording of the sales on credit to customers(Customer's Receivables) | ||

|- | |- | ||

| − | |2. [ | + | |2. [[Purchase Journal]] |

|Report for the recording of the sales on credit to customers(Supplier's Receivables) | |Report for the recording of the sales on credit to customers(Supplier's Receivables) | ||

|- | |- | ||

| Line 59: | Line 60: | ||

|} | |} | ||

<br /> | <br /> | ||

| + | [[Category:Tax Reports]] | ||

Latest revision as of 12:27, 26 April 2022

Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax

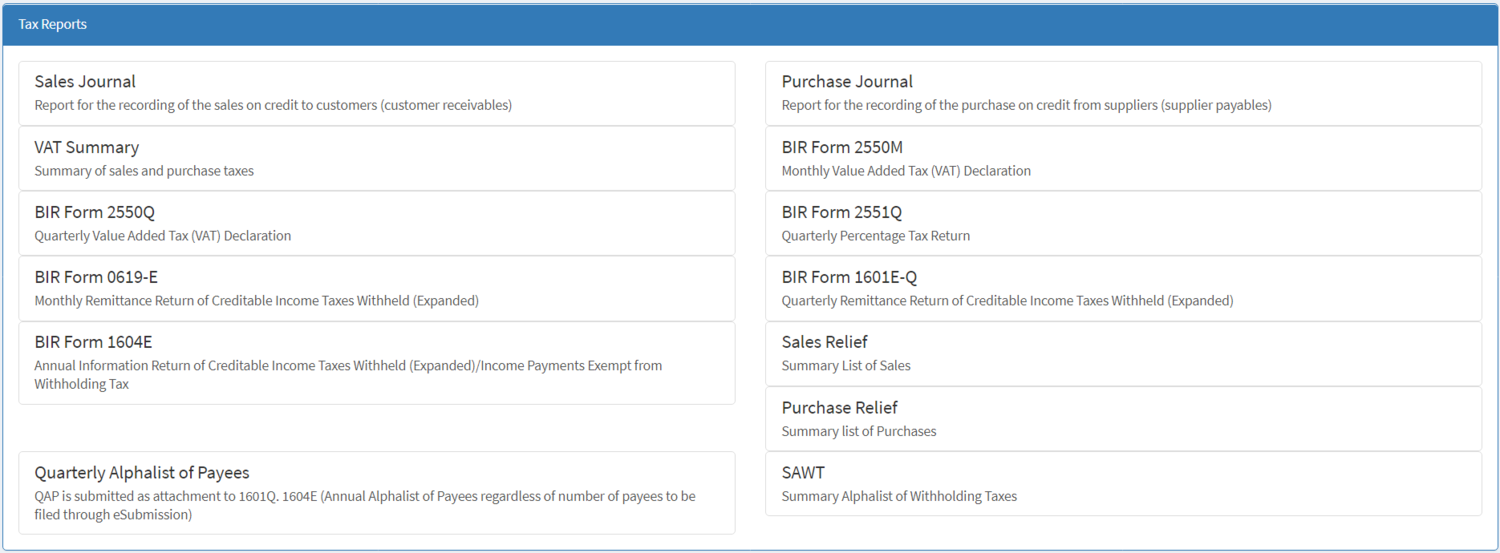

Tax Reports

Tax Reports Menu

Tax Reports refer to the reports associated in any return, report, information return, or other document (including any related or supporting information) filed or required to be filed with any federal, state, or local governmental entity or other authority in connection with the determination, assessment or collection of any Tax (whether or not such Tax is imposed on any of the Seller) or the administration of any laws, regulations or administrative requirements relating to any Tax.

| Field | Description |

|---|---|

| 1. Sales Journal | Report for the recording of the sales on credit to customers(Customer's Receivables) |

| 2. Purchase Journal | Report for the recording of the sales on credit to customers(Supplier's Receivables) |

| 3. VAT Summary | Summary of Sales and Purchase Taxes |

| 4. BIR Form 2550M | Monthly Value Added Tax (VAT) declaration |

| 5. BIR Form 2550Q | Quarterly Value Added Tax (VAT) declaration |

| 6. BIR Form 2551Q | Quarterly Percentage Tax Return |

| 7. BIR Form 0619-E | Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) |

| 8. BIR Form 1601E-Q | Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded) |

| 9. BIR Form 1604E | Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt from Withholding Tax |

| 10. Sales Relief | Summary List of Sales |

| 11. Purchase Relief | Summary List of Purchase |

| 12. SAWT(Summary Alphalist of Withholding Taxes) | serves as a consolidated alphalist of withholding agents from whom income was received and are subjected to withholding agents in the process. |

| Reports Modules(Reports) | |

|---|---|

| Reports | Financial Statement | Sales Reports | Tracking Reports | Tax Reports | Purchase Reports |

| Tax Report | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |