Difference between revisions of "ATC Code"

(Tag: 2017 source edit) |

(Tag: Visual edit) |

||

| (One intermediate revision by the same user not shown) | |||

| Line 24: | Line 24: | ||

<br /> | <br /> | ||

{| class="wikitable" style="margin: auto;" | {| class="wikitable" style="margin: auto;" | ||

| − | !Field | + | !'''Field''' |

| − | !Description | + | !'''Description''' |

| − | ! | + | !'''Allowed Inputs''' |

| + | !'''Restricted Inputs''' | ||

| + | !'''Character Limit''' | ||

| + | !'''Required Field?''' | ||

|- | |- | ||

|1.ATC Code | |1.ATC Code | ||

|•Reference Code for ATC | |•Reference Code for ATC | ||

| − | | | + | |*Alphanumeric |

| + | <nowiki>*</nowiki>Dash "-" | ||

| + | |||

| + | <nowiki>*</nowiki>Underscore "_" | ||

| + | | style="vertical-align:middle;text-align:center;" |Other Special Characters | ||

| + | | style="vertical-align:middle;text-align:center;" |10 | ||

| + | | style="vertical-align:middle;text-align:center;" |Yes | ||

|- | |- | ||

|2.Tax Code | |2.Tax Code | ||

|•Tax Code Reference for the ATC Code | |•Tax Code Reference for the ATC Code | ||

| − | | | + | |*Alphanumeric |

| + | <nowiki>*</nowiki>Dash "-" | ||

| + | |||

| + | <nowiki>*</nowiki>Underscore "_" | ||

| + | | style="vertical-align:middle;text-align:center;" |Other Special Characters | ||

| + | | style="vertical-align:middle;text-align:center;" |10 | ||

| + | | style="vertical-align:middle;text-align:center;" |Yes | ||

|- | |- | ||

|3.Description | |3.Description | ||

|•Description of the ATC Code | |•Description of the ATC Code | ||

| − | | | + | |*Alphanumeric |

| + | <nowiki>*</nowiki>Special Characters | ||

| + | | style="vertical-align:middle;text-align:center;" |None | ||

| + | | style="vertical-align:middle;text-align:center;" |50 | ||

| + | | style="vertical-align:middle;text-align:center;" |Yes | ||

|- | |- | ||

|4.Tax Rate | |4.Tax Rate | ||

|•Tax Percentage Rate to be Applied on the ATC Code | |•Tax Percentage Rate to be Applied on the ATC Code | ||

| − | | | + | |*Numeric |

| + | | style="vertical-align:middle;text-align:center;" |Any inputs except numbers | ||

| + | | style="vertical-align:middle;text-align:center;" |5 | ||

| + | | style="vertical-align:middle;text-align:center;" |Yes | ||

|- | |- | ||

|5.EWT | |5.EWT | ||

|•Expanded Withholding Tax | |•Expanded Withholding Tax | ||

| − | | | + | |*EWT List provided in the field |

| + | | style="vertical-align:middle;text-align:center;" |Any inputs not included in the list | ||

| + | | style="vertical-align:middle;text-align:center;" |N/A | ||

| + | | style="vertical-align:middle;text-align:center;" |Yes | ||

|- | |- | ||

|6.CWT | |6.CWT | ||

|•Credit Withholding Tax | |•Credit Withholding Tax | ||

| − | | | + | |*CWT List provided in the field |

| + | | style="vertical-align:middle;text-align:center;" |Any inputs not included in the list | ||

| + | | style="vertical-align:middle;text-align:center;" |N/A | ||

| + | | style="vertical-align:middle;text-align:center;" |Yes | ||

|} | |} | ||

| Line 69: | Line 97: | ||

[[File:Maintenance - ATC Codes - Edit.png|border|center|1500x1500px]] | [[File:Maintenance - ATC Codes - Edit.png|border|center|1500x1500px]] | ||

<br /> | <br /> | ||

| − | {| class="wikitable" style="margin: auto;" | + | {| class="wikitable" style="margin: auto;" data-ve-attributes="{"style":"margin: auto;"}" |

| − | !Field | + | !'''Field''' |

| − | !Description | + | !'''Description''' |

| − | ! | + | !'''Allowed Inputs''' |

| + | !'''Restricted Inputs''' | ||

| + | !'''Character Limit''' | ||

| + | !'''Required Field?''' | ||

|- | |- | ||

|1.ATC Code | |1.ATC Code | ||

| − | |•Reference Code | + | |•Reference Code for ATC |

| − | | | + | |*Alphanumeric |

| + | <nowiki>*</nowiki>Dash "-" | ||

| + | |||

| + | <nowiki>*</nowiki>Underscore "_" | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Other Special Characters | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |10 | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | ||

|- | |- | ||

|2.Tax Code | |2.Tax Code | ||

|•Tax Code Reference for the ATC Code | |•Tax Code Reference for the ATC Code | ||

| − | | | + | |*Alphanumeric |

| + | <nowiki>*</nowiki>Dash "-" | ||

| + | |||

| + | <nowiki>*</nowiki>Underscore "_" | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Other Special Characters | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |10 | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | ||

|- | |- | ||

|3.Description | |3.Description | ||

|•Description of the ATC Code | |•Description of the ATC Code | ||

| − | | | + | |*Alphanumeric |

| + | <nowiki>*</nowiki>Special Characters | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |None | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |50 | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | ||

|- | |- | ||

|4.Tax Rate | |4.Tax Rate | ||

|•Tax Percentage Rate to be Applied on the ATC Code | |•Tax Percentage Rate to be Applied on the ATC Code | ||

| − | | | + | |*Numeric |

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Any inputs except numbers | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |5 | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | ||

|- | |- | ||

|5.EWT | |5.EWT | ||

|•Expanded Withholding Tax | |•Expanded Withholding Tax | ||

| − | | | + | |*EWT List provided in the field |

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Any inputs not included in the list | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |N/A | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | ||

|- | |- | ||

|6.CWT | |6.CWT | ||

|•Credit Withholding Tax | |•Credit Withholding Tax | ||

| − | | | + | |*CWT List provided in the field |

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Any inputs not included in the list | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |N/A | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | ||

|} | |} | ||

======Importing and Exporting ATC codes====== | ======Importing and Exporting ATC codes====== | ||

| Line 115: | Line 171: | ||

[[File:Maintenance - ATC Codes - Import.png|border|center|1500x1500px]] | [[File:Maintenance - ATC Codes - Import.png|border|center|1500x1500px]] | ||

<br /> | <br /> | ||

| − | {| class="wikitable" style=" | + | {| class="wikitable" style="margin: auto;" data-ve-attributes="{"style":"margin: auto;"}" |

| − | + | !'''Field''' | |

| − | ! | + | !'''Description''' |

| − | ! | + | !'''Allowed Inputs''' |

| − | ! | + | !'''Restricted Inputs''' |

| − | ! | + | !'''Character Limit''' |

| − | ! | + | !'''Required Field?''' |

| − | |- | + | |- |

| − | + | |1.ATC Code | |

| − | | | + | |•Reference Code for ATC |

| − | + | |*Alphanumeric | |

<nowiki>*</nowiki>Dash "-" | <nowiki>*</nowiki>Dash "-" | ||

<nowiki>*</nowiki>Underscore "_" | <nowiki>*</nowiki>Underscore "_" | ||

| − | | style="" | | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Other Special Characters |

| − | | style="vertical-align:middle;text-align:center;" | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |10 |

| − | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | |

| − | + | |- | |

| − | | style="" | + | |2.Tax Code |

| − | + | |•Tax Code Reference for the ATC Code | |

| − | + | |*Alphanumeric | |

| − | |||

| − | |- | ||

| − | | | ||

| − | | | ||

| − | |||

<nowiki>*</nowiki>Dash "-" | <nowiki>*</nowiki>Dash "-" | ||

<nowiki>*</nowiki>Underscore "_" | <nowiki>*</nowiki>Underscore "_" | ||

| − | | style="" | | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Other Special Characters |

| − | | style="vertical-align:middle;text-align:center;" | | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |10 |

| − | | | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes |

| − | + | |- | |

| − | | | + | |3.Description |

| − | + | |•Description of the ATC Code | |

| − | <nowiki>*</nowiki>Special | + | |*Alphanumeric |

| − | | style="" | | + | <nowiki>*</nowiki>Special Characters |

| − | | style="vertical-align:middle;text-align:center;" |Yes | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |None |

| − | |- style=" | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |50 |

| − | | style="" |5 | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes |

| − | | style="" | | + | |- |

| − | + | |4.Tax Rate | |

| − | | style="" | | + | |•Tax Percentage Rate to be Applied on the ATC Code |

| − | | style="vertical-align:middle;text-align:center;" | | + | |*Numeric |

| − | | | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Any inputs except numbers |

| − | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |5 | |

| − | | | + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes |

| − | + | |- | |

| − | | style="" | | + | |5.EWT |

| − | | style="vertical-align:middle;text-align:center;" |Yes | + | |•Expanded Withholding Tax |

| + | |*EWT List provided in the field | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Any inputs not included in the list | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |N/A | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | ||

| + | |- | ||

| + | |6.CWT | ||

| + | |•Credit Withholding Tax | ||

| + | |*CWT List provided in the field | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Any inputs not included in the list | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |N/A | ||

| + | | style="vertical-align:middle;text-align:center;" data-ve-attributes="{"style":"vertical-align:middle;text-align:center;"}" |Yes | ||

|}<br /> | |}<br /> | ||

| Line 248: | Line 310: | ||

|[[Payment Voucher]]<nowiki> | </nowiki>[[Receipt Voucher]] | |[[Payment Voucher]]<nowiki> | </nowiki>[[Receipt Voucher]] | ||

|}<br /> | |}<br /> | ||

| + | [[Category:Maintenance]] | ||

Latest revision as of 11:01, 12 April 2022

Contents

ATC Codes

Alphanumber Tax Codes or ATC Codes or ATCs are codes used to identify the type of tax that has to be paid.

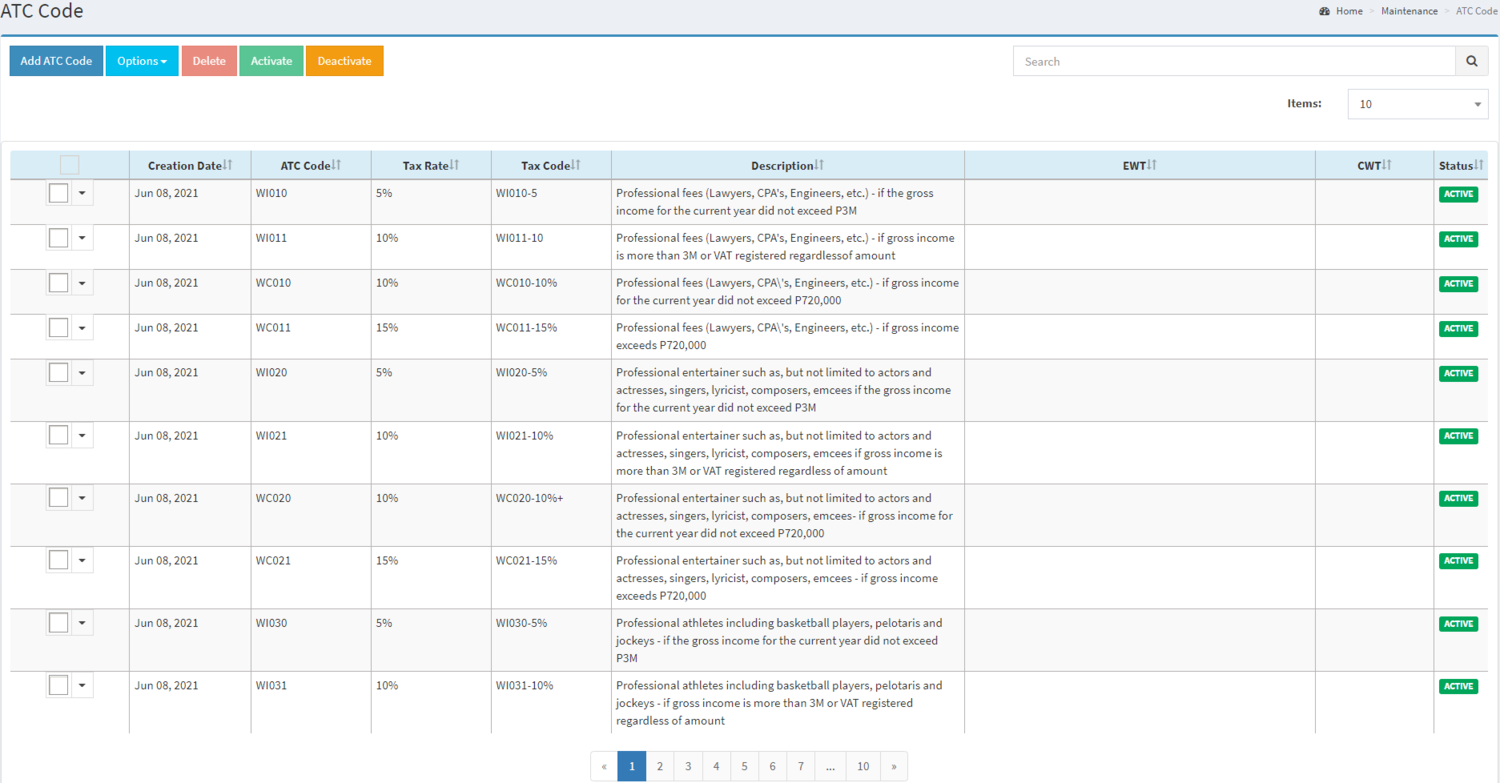

ATC Code Record List

Notes:

- Deactivating ATC Codes restricts the user to use the ATC code in Receipt Voucher.

- Deactivating ATC Codes restricts the user to apply Withholding tax in Payment Voucher

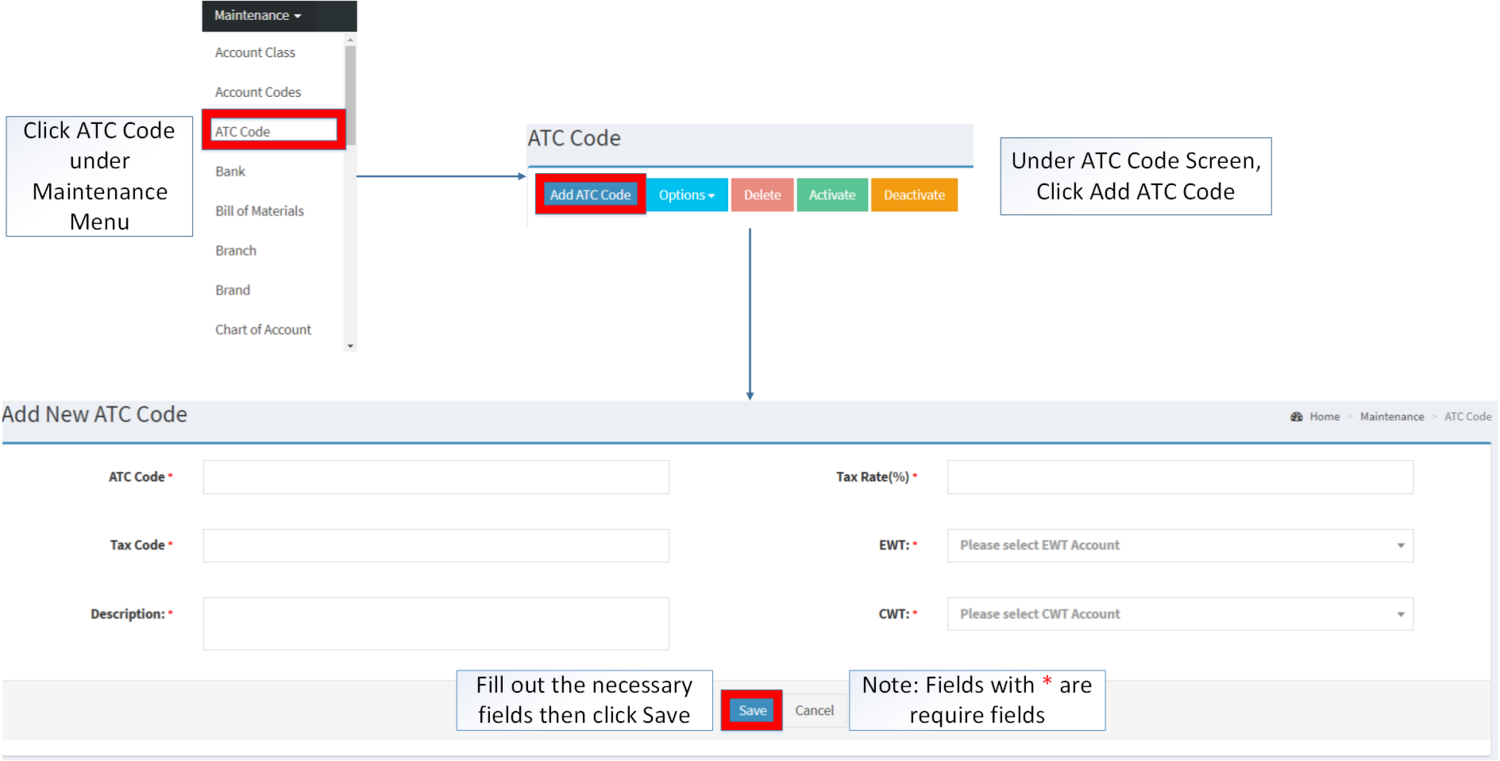

Adding ATC codes

- Click ATC Codes under Maintenance Module

- Under ATC Codes Menu Screen, Click Add ATC Codes

- Fill out the necessary fields then click Save.

| Field | Description | Allowed Inputs | Restricted Inputs | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.ATC Code | •Reference Code for ATC | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 2.Tax Code | •Tax Code Reference for the ATC Code | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 3.Description | •Description of the ATC Code | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | *Numeric | Any inputs except numbers | 5 | Yes |

| 5.EWT | •Expanded Withholding Tax | *EWT List provided in the field | Any inputs not included in the list | N/A | Yes |

| 6.CWT | •Credit Withholding Tax | *CWT List provided in the field | Any inputs not included in the list | N/A | Yes |

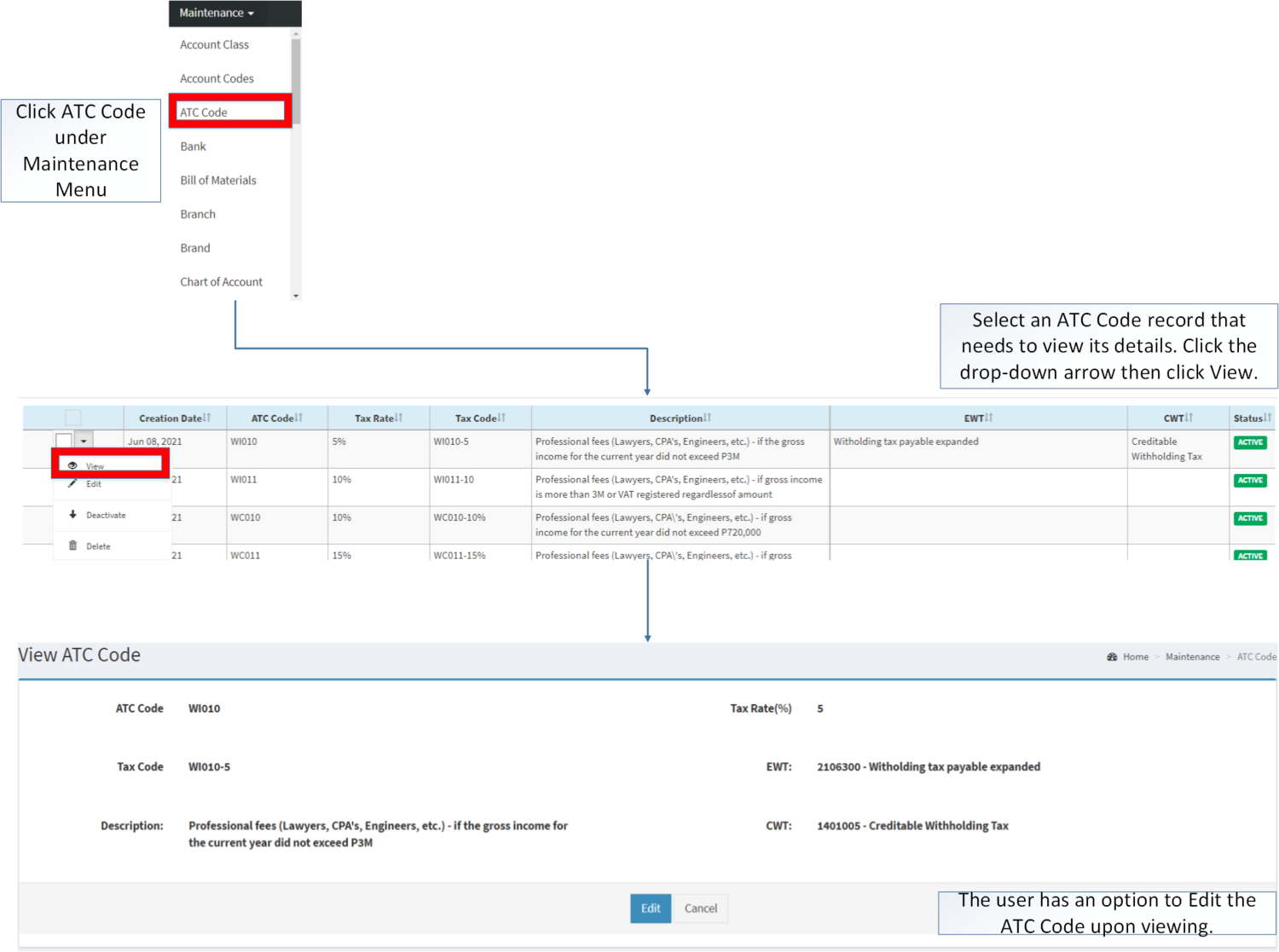

Viewing ATC codes

- Click ATC Codes under Maintenance Module

- Select a ATC Codes that needs to view its details. Click the drop-down arrow then click View.

- The user has an option to Edit the ATC Code upon viewing.

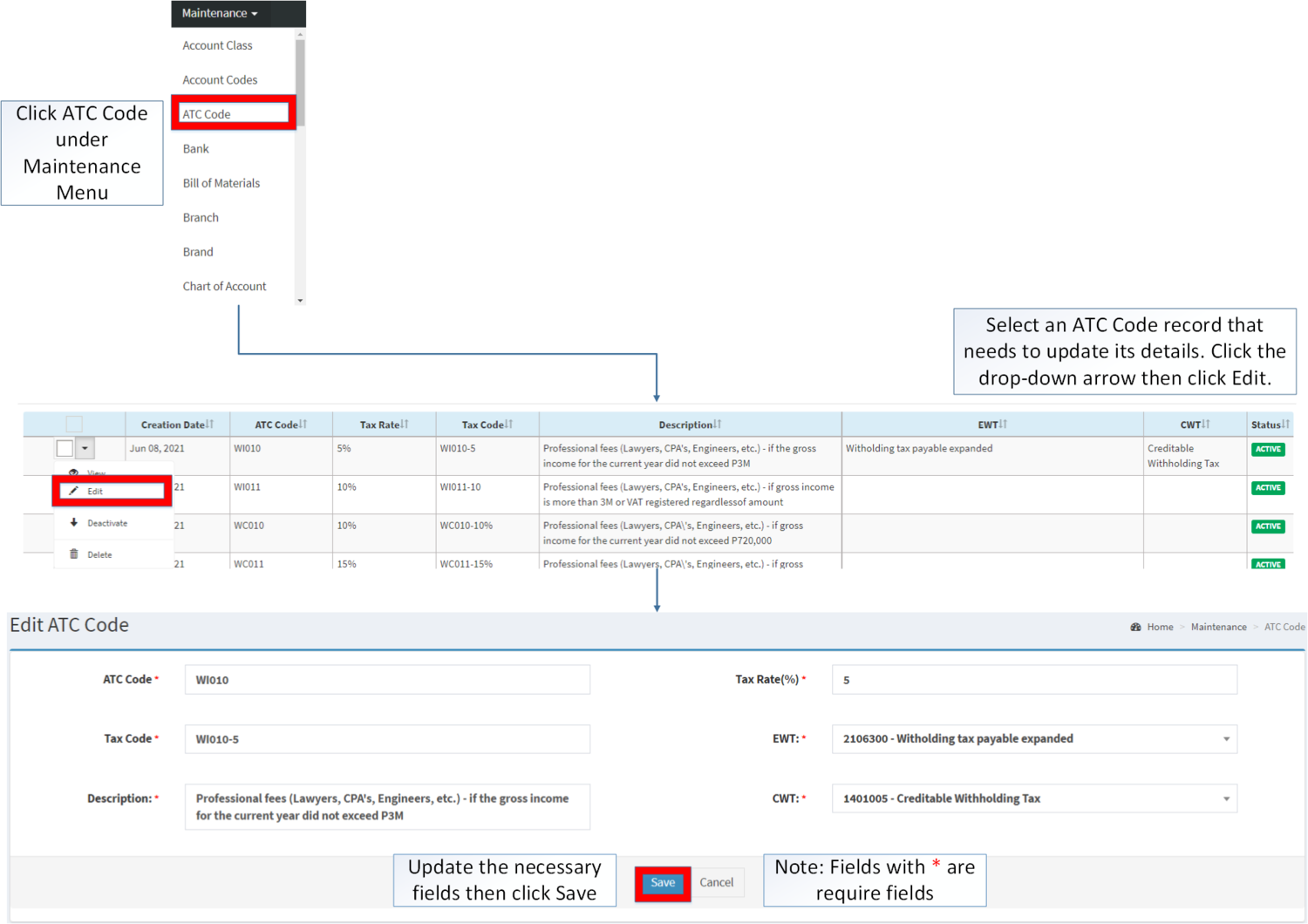

Editing ATC codes

1. Click ATC Codes under Maintenance Module

2. Select a ATC Codes that needs to update its details. Click the drop-down arrow then click Edit.

3. Update the necessary fields then click Save.

| Field | Description | Allowed Inputs | Restricted Inputs | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.ATC Code | •Reference Code for ATC | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 2.Tax Code | •Tax Code Reference for the ATC Code | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 3.Description | •Description of the ATC Code | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | *Numeric | Any inputs except numbers | 5 | Yes |

| 5.EWT | •Expanded Withholding Tax | *EWT List provided in the field | Any inputs not included in the list | N/A | Yes |

| 6.CWT | •Credit Withholding Tax | *CWT List provided in the field | Any inputs not included in the list | N/A | Yes |

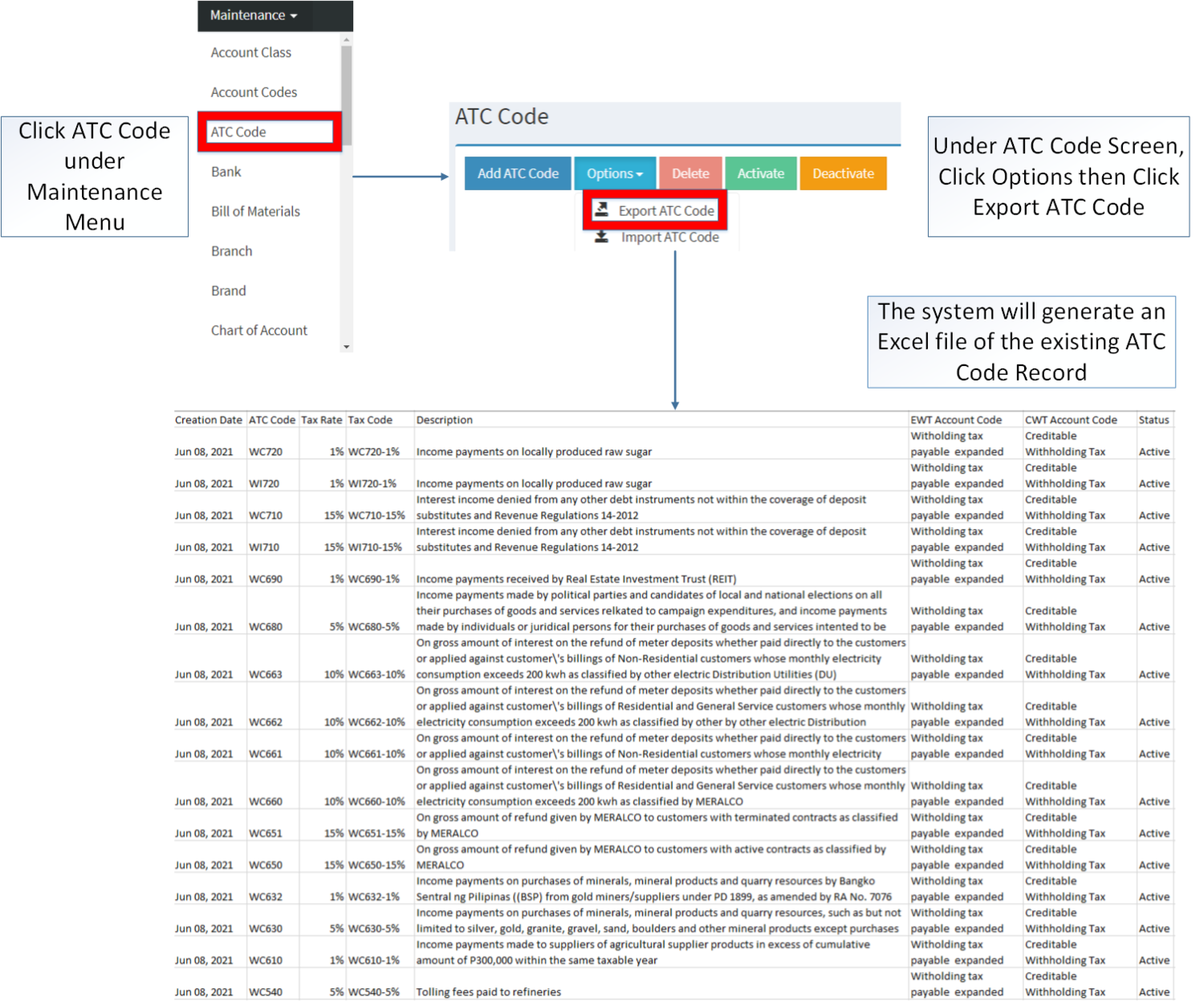

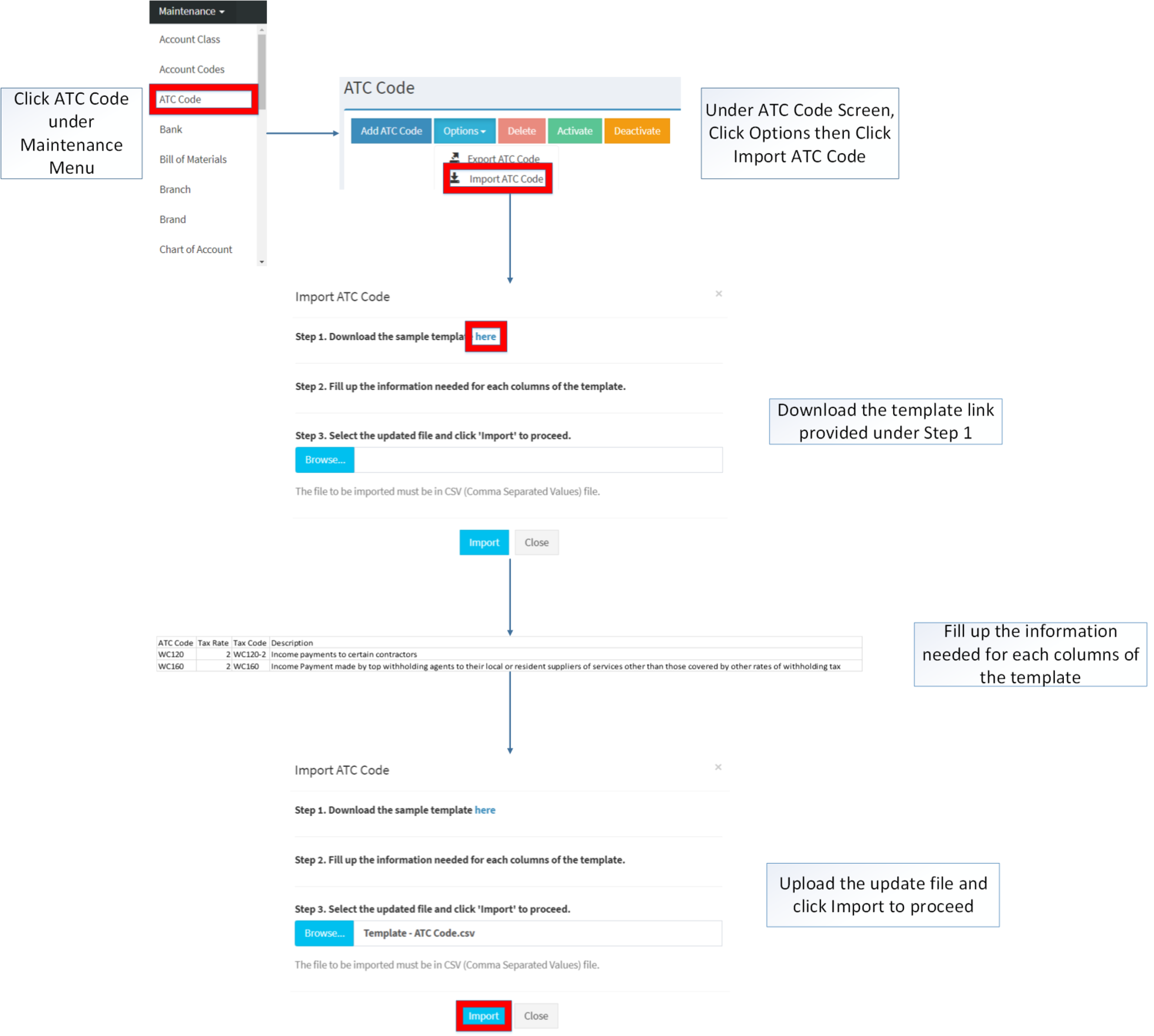

Importing and Exporting ATC codes

1. Under ATC Codes Screen, Click Options

2. Under Options, The user may Export or Import The Record

- When Exporting the records, the user may also use the filter options through tabs for precise searching and exporting of records.

- When Importing the records, the user should follow the following steps provided in the Importing ATC Codes Screen such as

- Downloading the template link provided under Step 1.

- Filling up the information needed for each columns of the template

- Uploading the updated Template

| Field | Description | Allowed Inputs | Restricted Inputs | Character Limit | Required Field? |

|---|---|---|---|---|---|

| 1.ATC Code | •Reference Code for ATC | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 2.Tax Code | •Tax Code Reference for the ATC Code | *Alphanumeric

*Dash "-" *Underscore "_" |

Other Special Characters | 10 | Yes |

| 3.Description | •Description of the ATC Code | *Alphanumeric

*Special Characters |

None | 50 | Yes |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | *Numeric | Any inputs except numbers | 5 | Yes |

| 5.EWT | •Expanded Withholding Tax | *EWT List provided in the field | Any inputs not included in the list | N/A | Yes |

| 6.CWT | •Credit Withholding Tax | *CWT List provided in the field | Any inputs not included in the list | N/A | Yes |

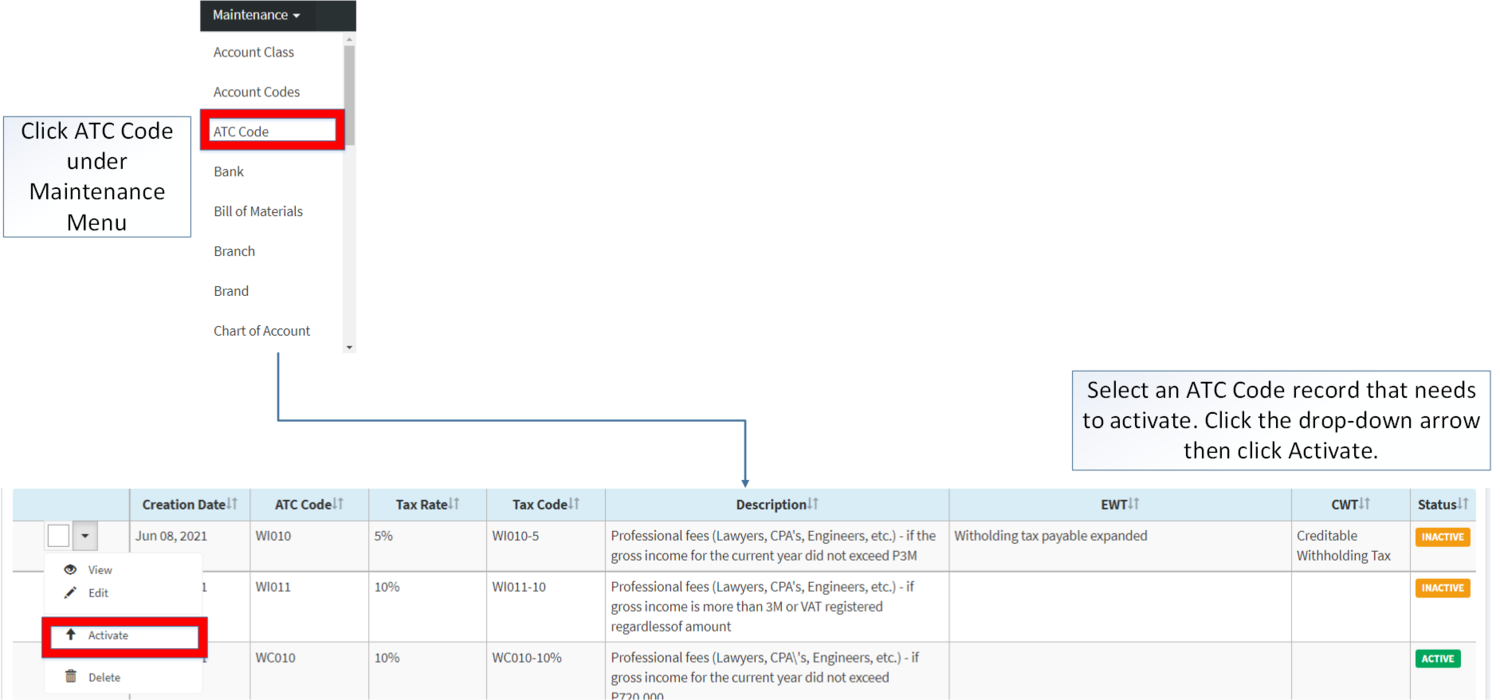

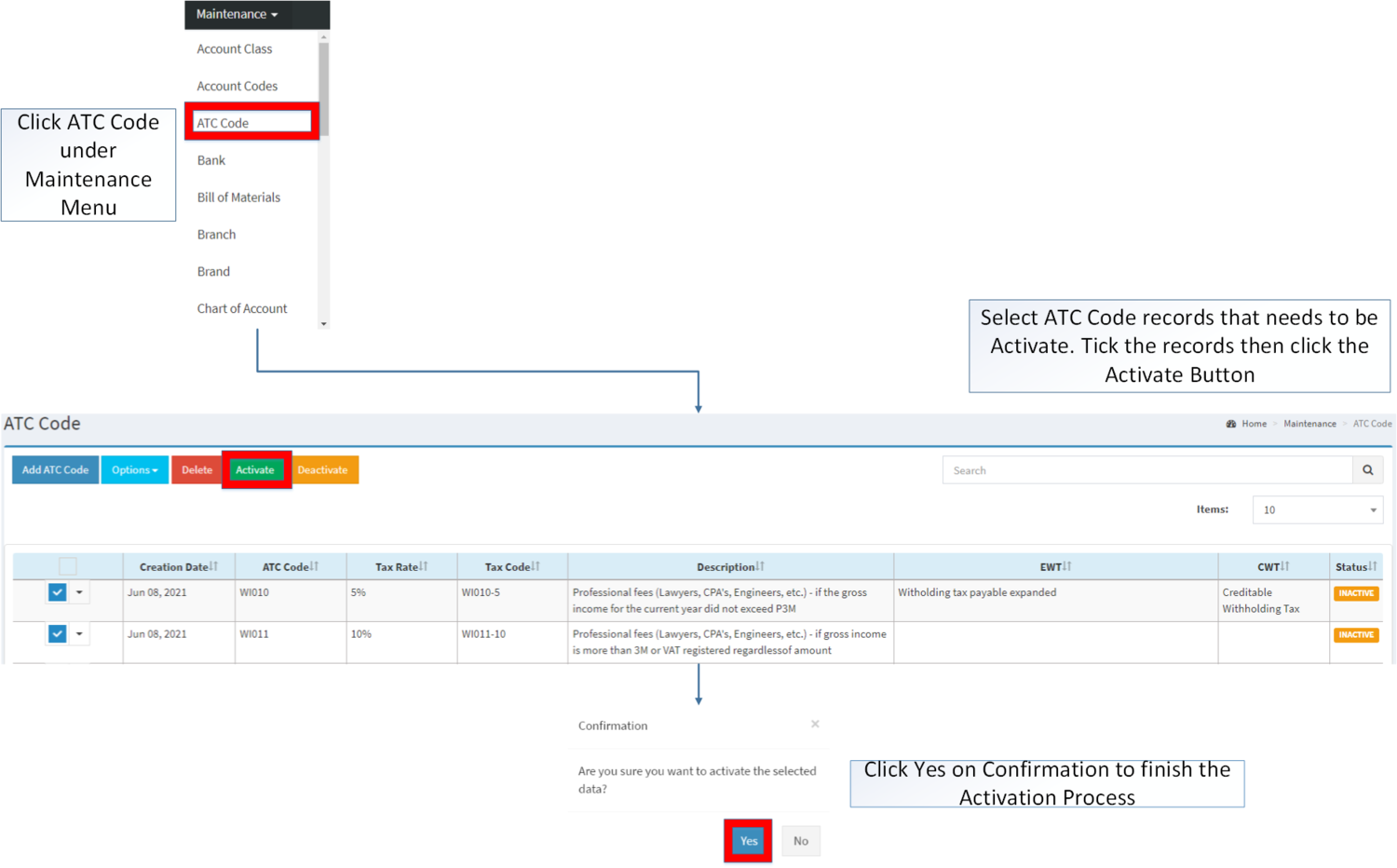

Activating ATC Code Record

ATC Code can be Activated in two ways:

- Using drop-down arrow of a record can be used in single record Activation

- Using Activate Button for activating multiple record

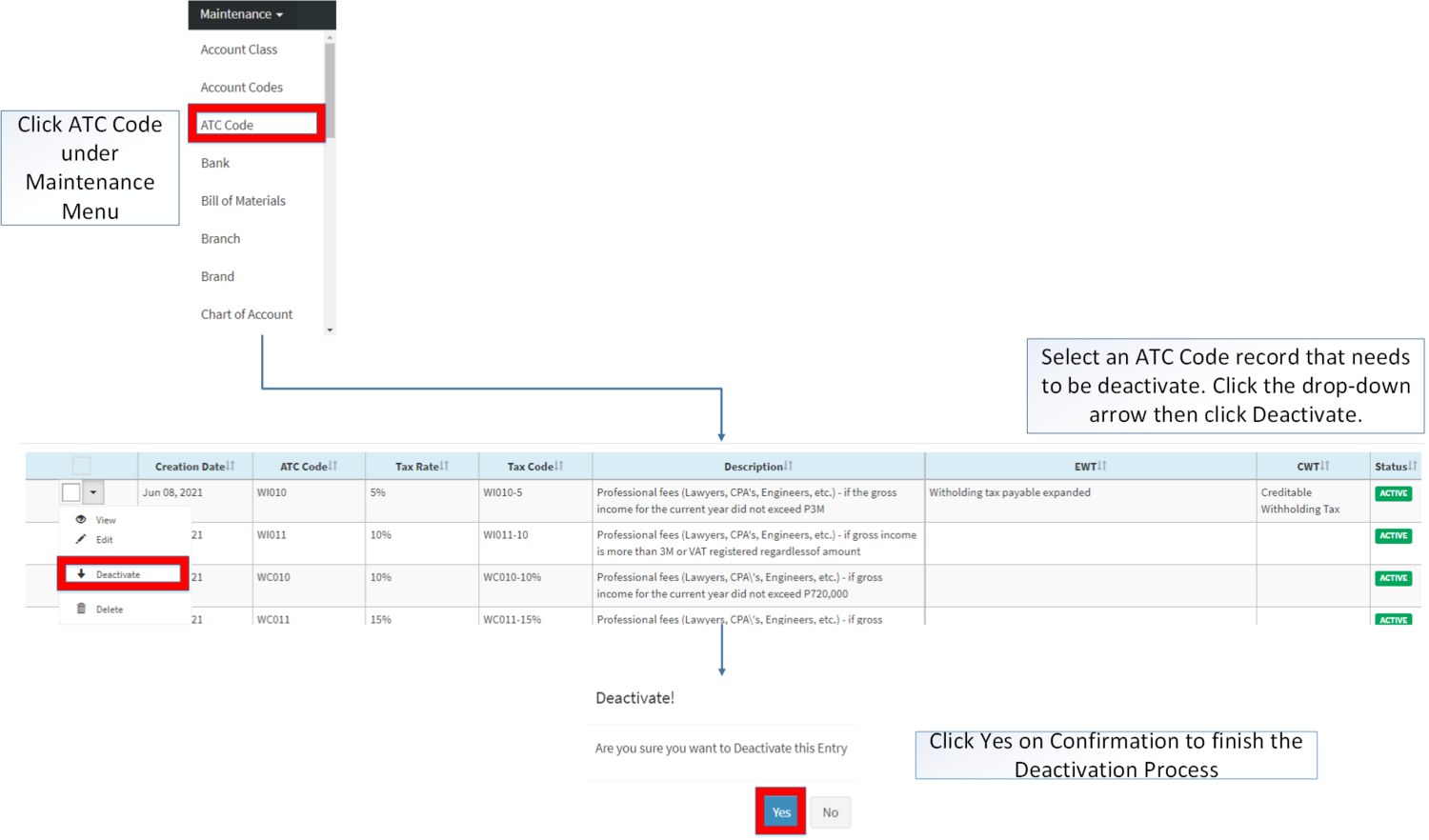

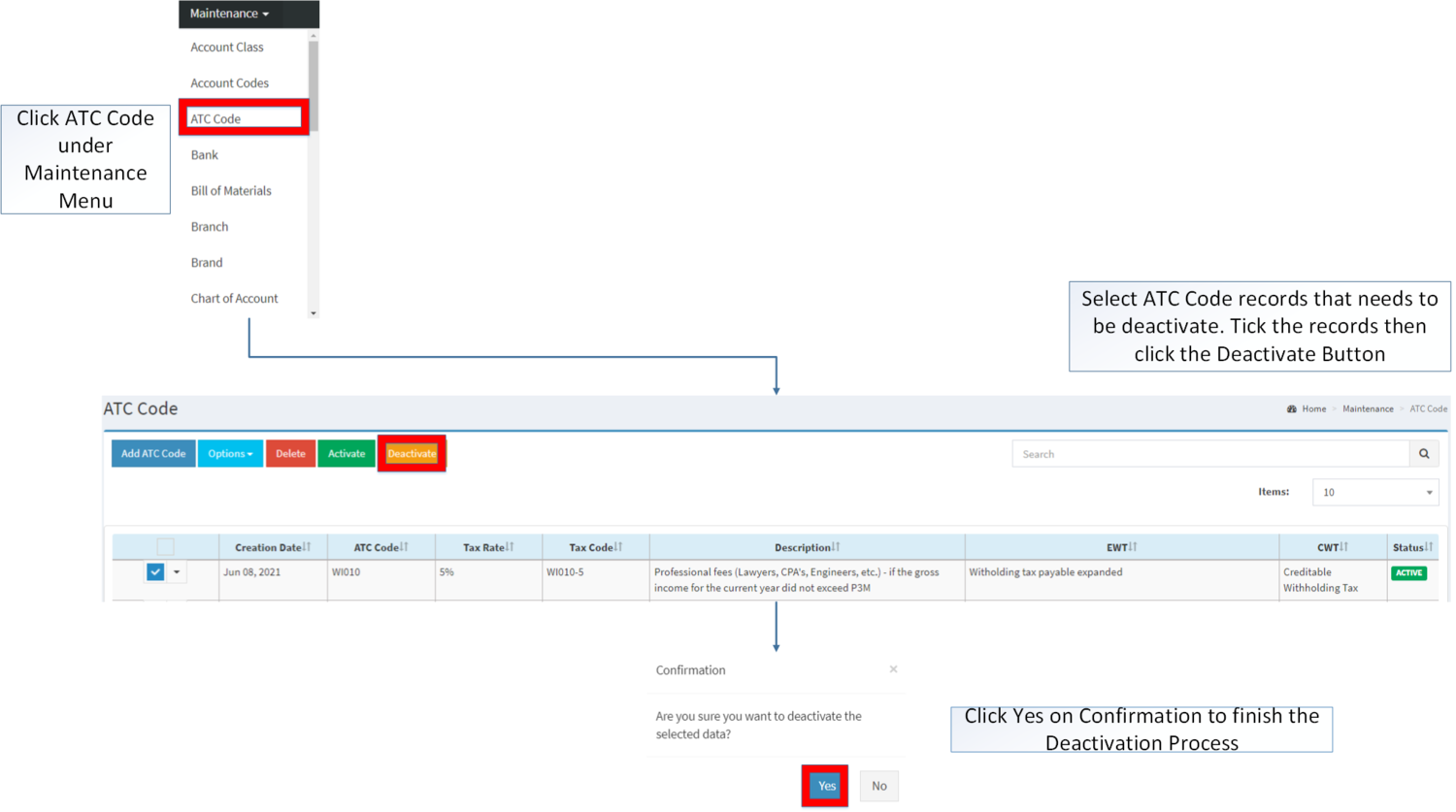

Deactivating ATC Code Record

ATC Code can be deactivated in two ways:

- Using drop-down arrow of a record can be used in single record deactivation

- Using Deactivate Button for deactivating multiple record

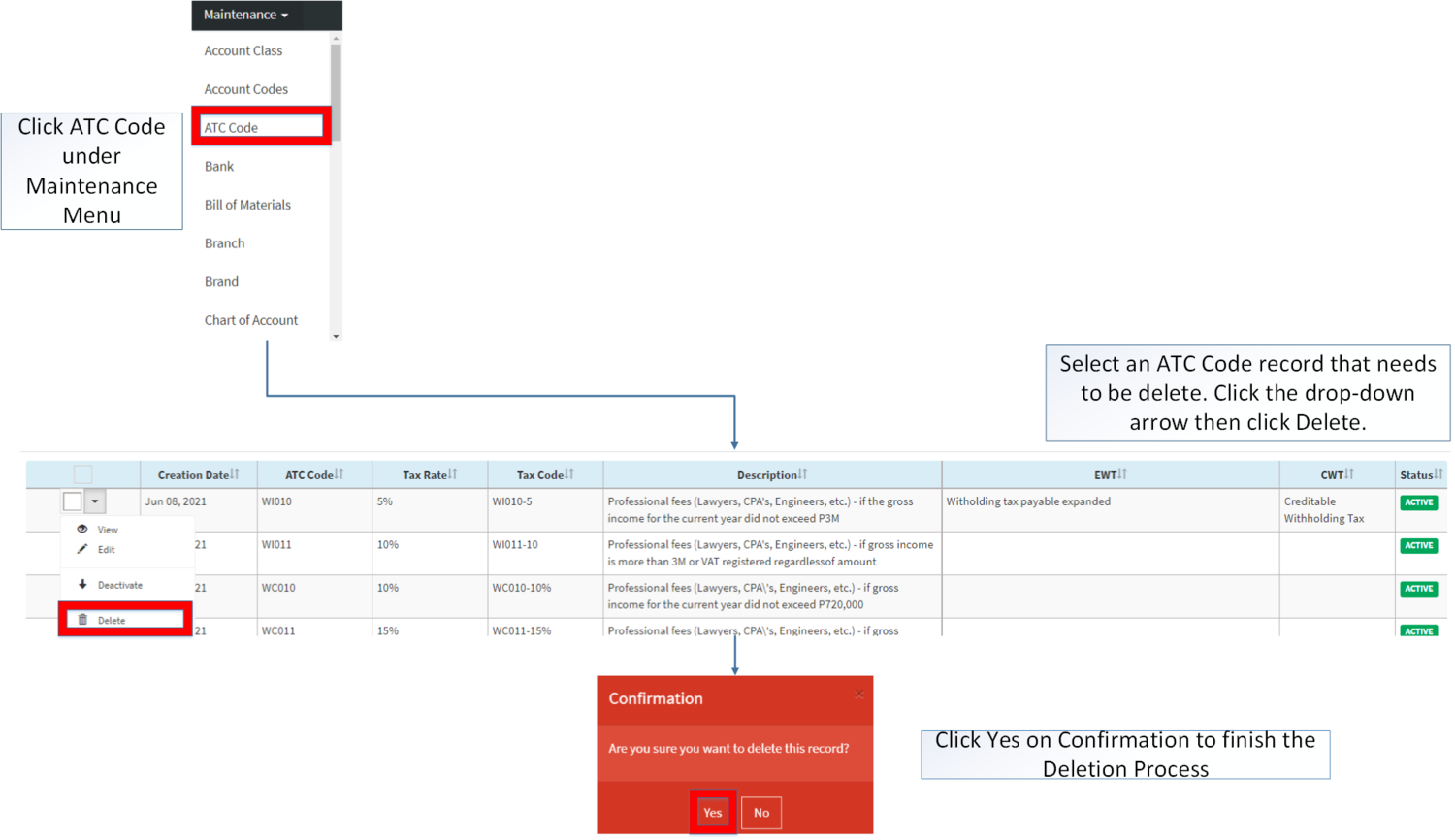

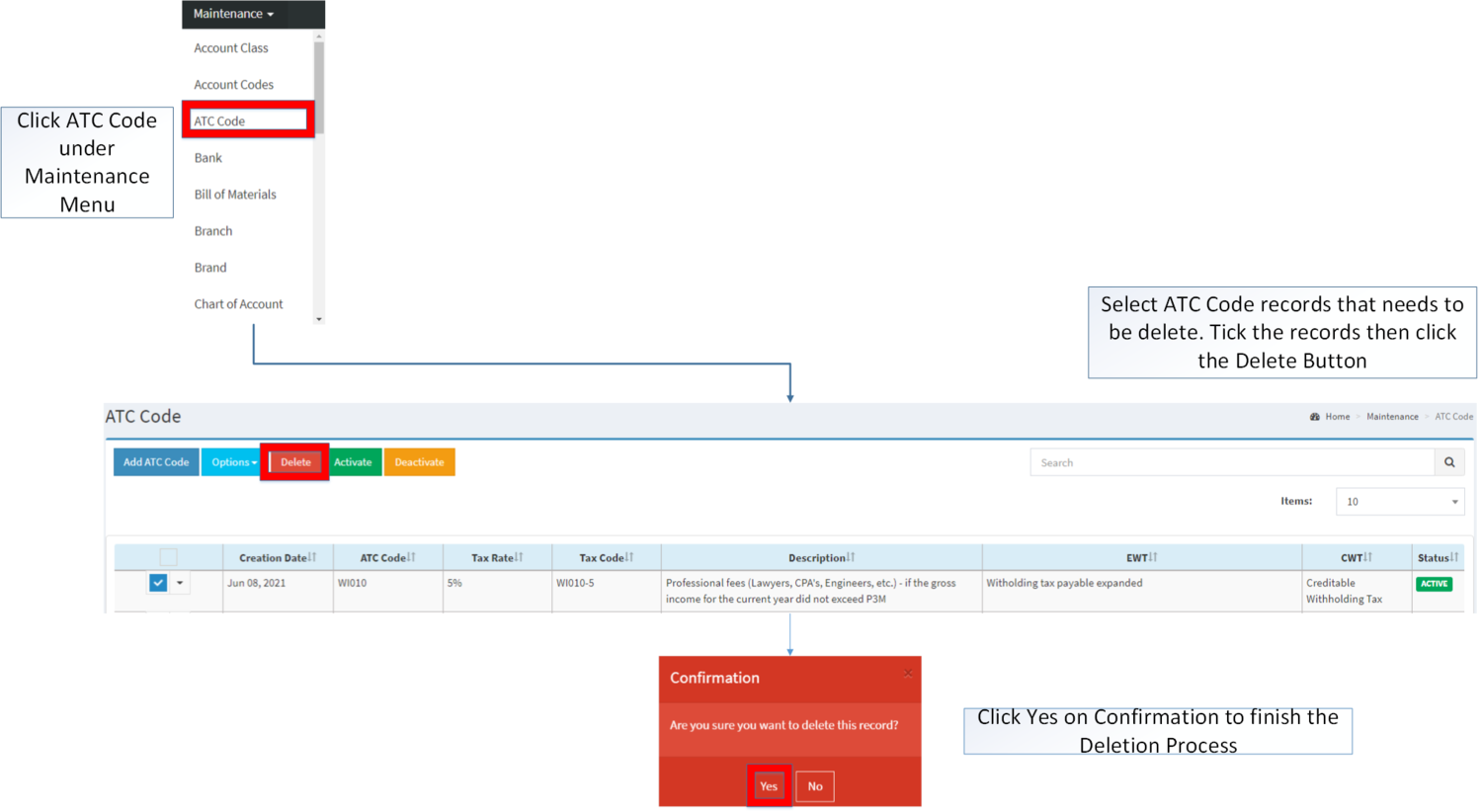

Deleting ATC Code Record

ATC Code can be deleted in two ways:

- Using drop-down arrow of a record can be used in single record deletion

- Using Delete Button for deleting multiple record

ATC record options

| Status | View | Edit | Deactivate | Activate | Delete |

|---|---|---|---|---|---|

| ACTIVE | ☑ | ☑ | ☑ | ☑ | |

| INACTIVE | ☑ | ☑ | ☑ | ☑ |

- The user may Edit the ATC Code while under view mode.

- Inactive Chart of Accounts Record cannot be used in ATC Code

- Used ATC Code cannot be deleted.

- Activating/Deactivating and Deleting of Records can be done in two ways.

- For single records, the user may use the drop down arrow then the action that need to perform.

- For multiple records, the user may tick the records then click the action button that need to perform

- Click the Yes in the confirmation to proceed on the action taken.

| Modules | |

|---|---|

| Maintenance | Maintenance | Chart of Account | ATC Code | Tax |

| Financials | Payment Voucher | Receipt Voucher |