You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "Petty Cash"

(Tag: Visual edit) |

(Changed categories.) |

||

| Line 314: | Line 314: | ||

|[[Supplier]]<nowiki> | </nowiki>[[Chart of Account]]<nowiki> | </nowiki>[[Tax]] | |[[Supplier]]<nowiki> | </nowiki>[[Chart of Account]]<nowiki> | </nowiki>[[Tax]] | ||

|} | |} | ||

| + | [[Category:Tax Reports]] | ||

| + | [[Category:Financials]] | ||

Revision as of 14:59, 7 April 2022

Contents

Petty Cash

Allows the user to create a petty cash for paying expenses.

Requirements before using Petty Cash

- The user should setup the following Maintenance Module in order to proceed on using the Petty Cash

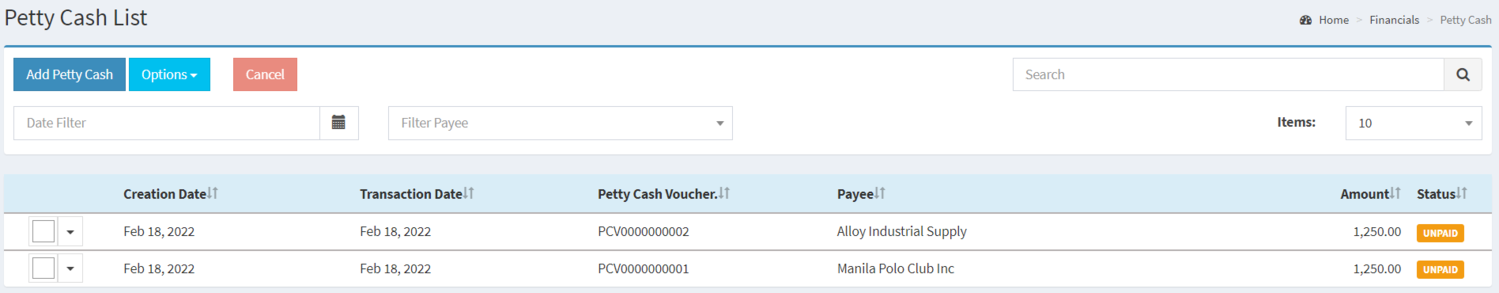

Petty Cash Record List

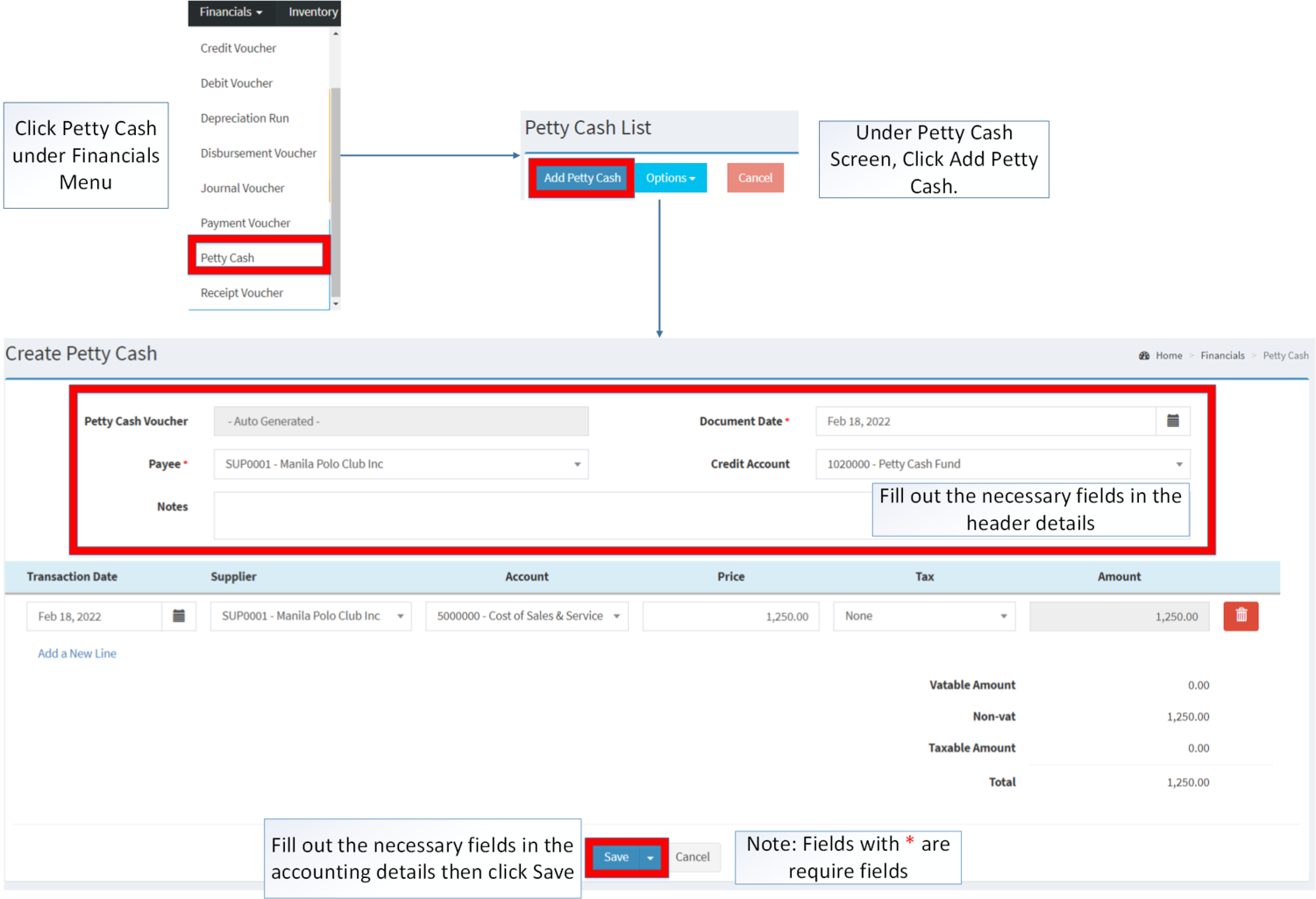

Adding Petty Cash

- Click Petty Cash under Financials Menu

- Under Petty Cash Screen, Click Add Petty Cash

- Fill up the necessary Fields in the header details

- Fill up the necessary Fields on the Accounting Details then Click Save.

| Field | Description | Expected Values |

|---|---|---|

| 1.Petty Cash Voucher | •Auto Generated Petty Cash reference number upon creation | •Alphanumeric (Auto-Generated) |

| 2.Payee | •Name of Payee | •Suppliers List from Supplier Maintenance Module |

| 3.Document Date | •Date when the transaction was created | •Date |

| 4.Credit Account | •Account to be charged for credit on the transaction | •Account list in the Chart of Accounts Maintenance Module |

| 5.Notes | •Other Remarks on the Transaction | •Alphanumeric |

| 6.Transaction Date | •Date of Transaction | •Date |

| 7.Supplier | •Name of Supplier | •Supplier List in the Supplier Maintenance Module |

| 8.Account | •Account to be charged on the transaction | •Account list in the Chart of Accounts Maintenance Module |

| 9.Price | •Price to be paid in the transaction | •Amount/Number |

| 10.Tax | •Type of Tax to be applied on the Transaction | •Tax List provided in the Tax Maintenance Module |

| 11.Amount | •Total amount in the transaction line on each account | •Number |

Notes:

- Account should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Chart of Account Maintenance Module.

- Supplier/Payee should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Supplier Maintenance Module

- Tax should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Tax Maintenance Module

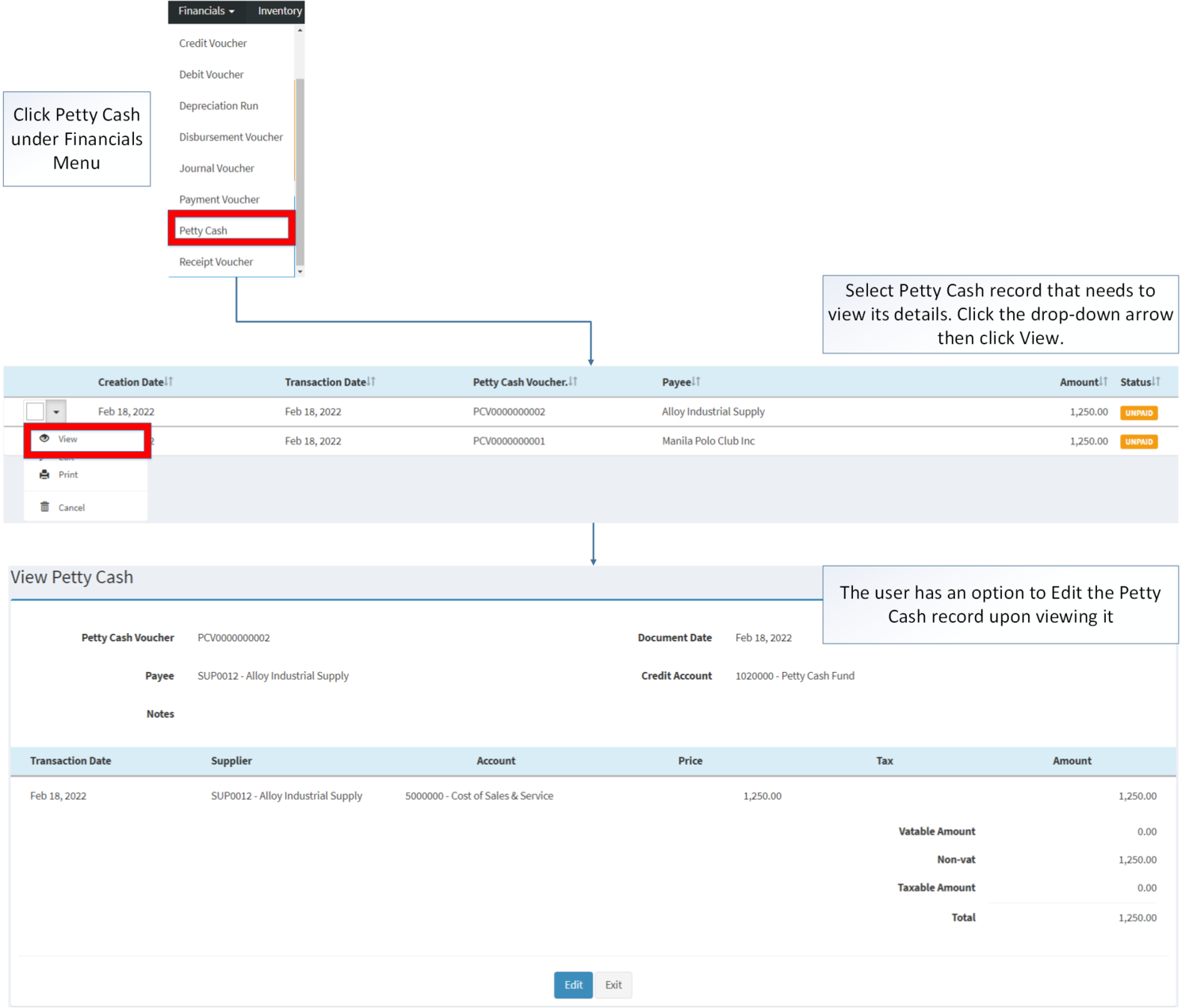

Viewing Petty Cash

- Click Petty Cash under Financials Menu

- Select the Petty Cash that needs to view its details. Click the drop-down arrow then click View

- The user has an option to Edit the Petty Cash record upon viewing it

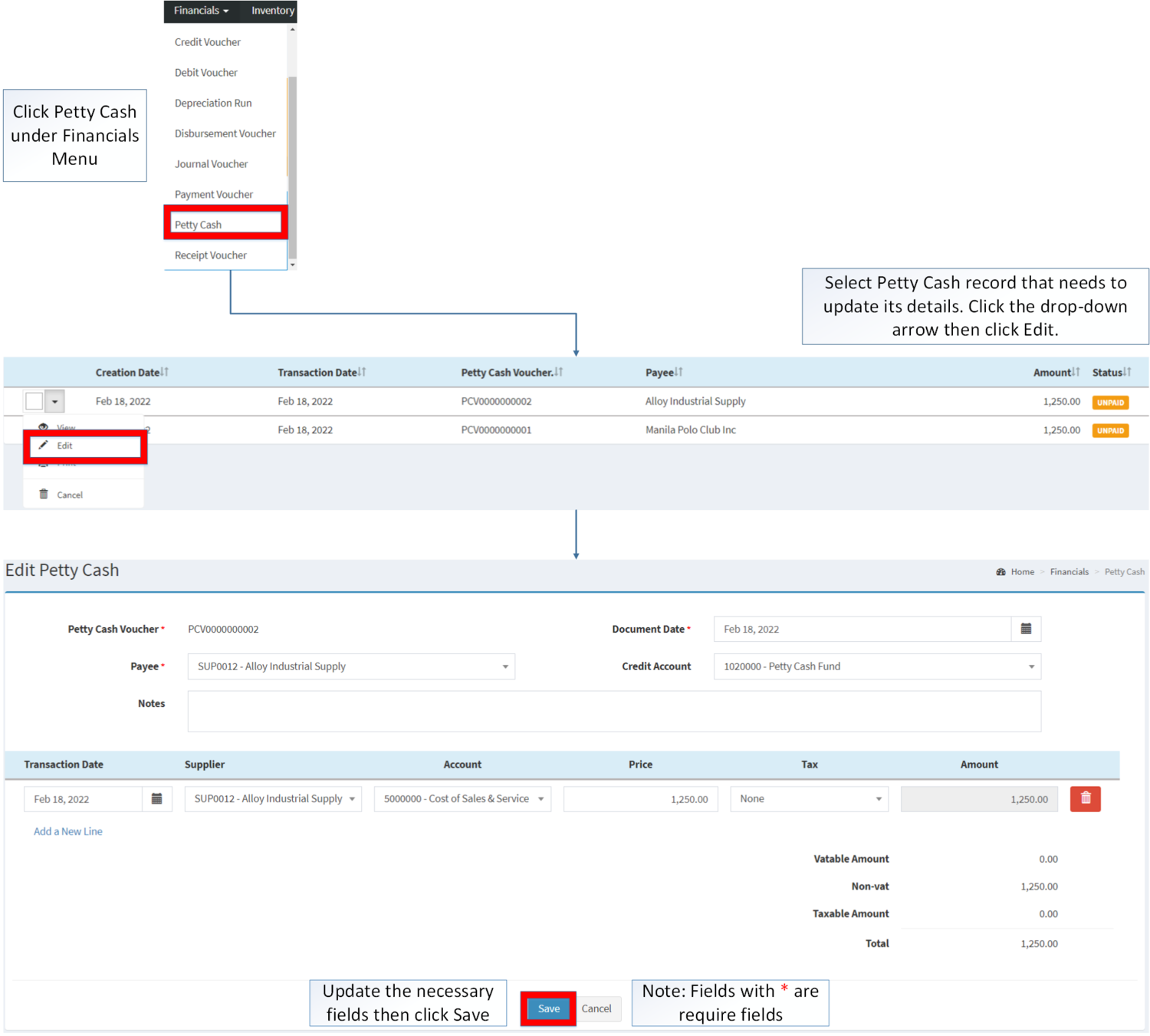

Editing Petty Cash

- Go to Financials then click Petty Cash

- Select the Petty Cash that needs an update. Click the drop-down arrow then click Edit

- Update the necessary fields then click Save

| Field | Description | Expected Values |

|---|---|---|

| 1.Petty Cash Voucher | •Auto Generated Petty Cash reference number upon creation | •Alphanumeric (Auto-Generated) |

| 2.Payee | •Name of Payee | •Suppliers List from Supplier Maintenance Module |

| 3.Document Date | •Date when the transaction was created | •Date |

| 4.Credit Account | •Account to be charged for credit on the transaction | •Account list in the Chart of Accounts Maintenance Module |

| 5.Notes | •Other Remarks on the Transaction | •Alphanumeric |

| 6.Transaction Date | •Date of Transaction | •Date |

| 7.Supplier | •Name of Supplier | •Supplier List in the Supplier Maintenance Module |

| 8.Account | •Account to be charged on the transaction | •Account list in the Chart of Accounts Maintenance Module |

| 9.Price | •Price to be paid in the transaction | •Amount/Number |

| 10.Tax | •Type of Tax to be applied on the Transaction | •Tax List provided in the Tax Maintenance Module |

| 11.Amount | •Total amount in the transaction line on each account | •Number |

Notes:

- Supplier/Payee should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Supplier Maintenance Module

- Past Transactions with INACTIVE status prior to its deactivation can still be used.

- Tax should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Tax Maintenance Module

- Past Transactions with INACTIVE status prior to its deactivation can still be used.

- Account should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Chart of Account Maintenance Module.

- The user can only edit the Petty Cash Transaction if it is still in UNPAID status.

- The user must Unpost and cancel the Payment Voucher first in order to edit the Petty Cash Record.

- The Petty Cash will change its status to PAID if it is paid under Payment Voucher.

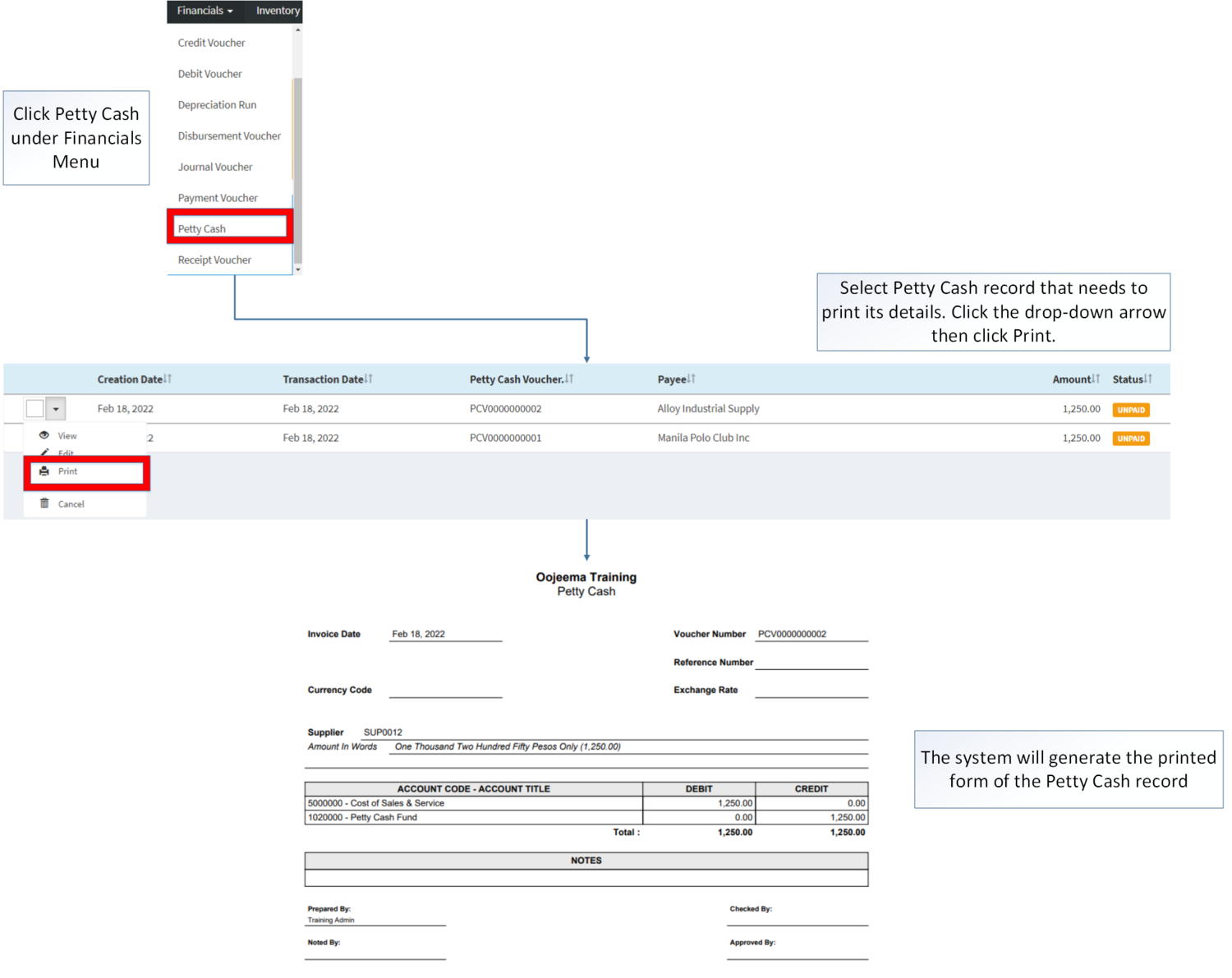

Printing Petty Cash

- Click Petty Cash under Financials Menu

- Select the Petty Cash that needs to print its details. Click the Drop-down Arrow then press Print.

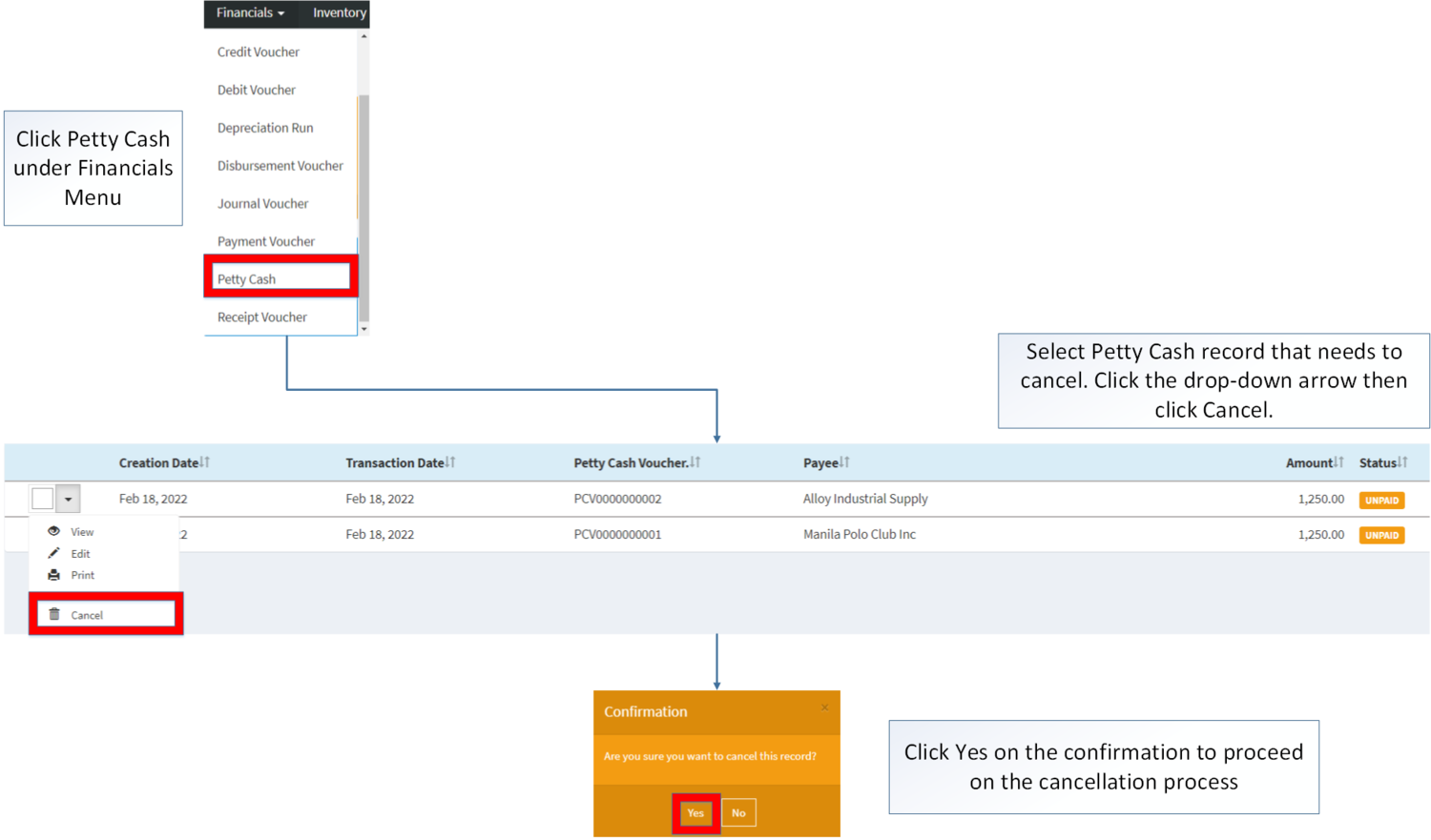

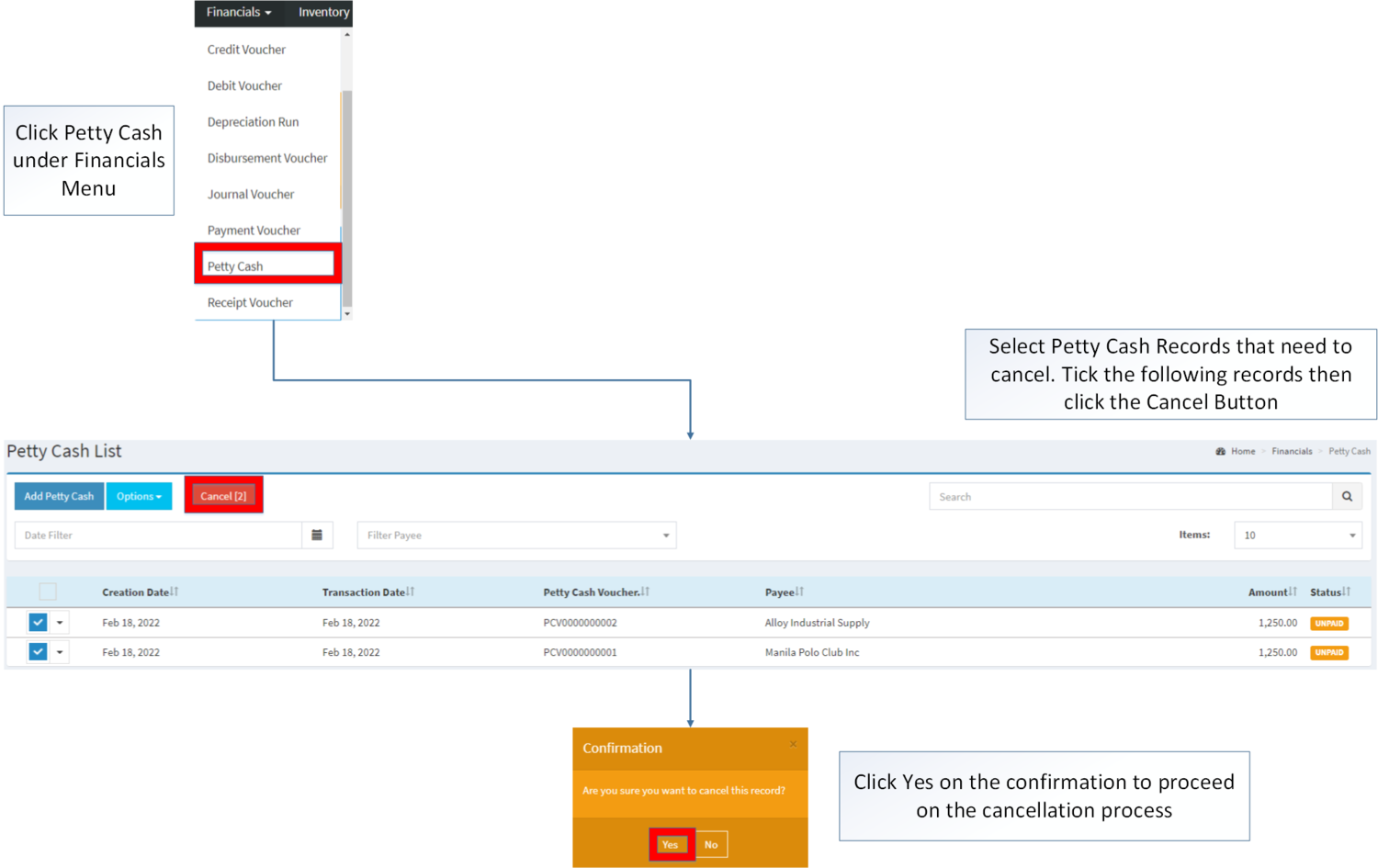

Cancelling Petty Cash

Petty Cash can be canceled in two ways:

- Using drop-down arrow of a record can be used in single record cancellation

- Using Cancel Button for cancelling multiple records

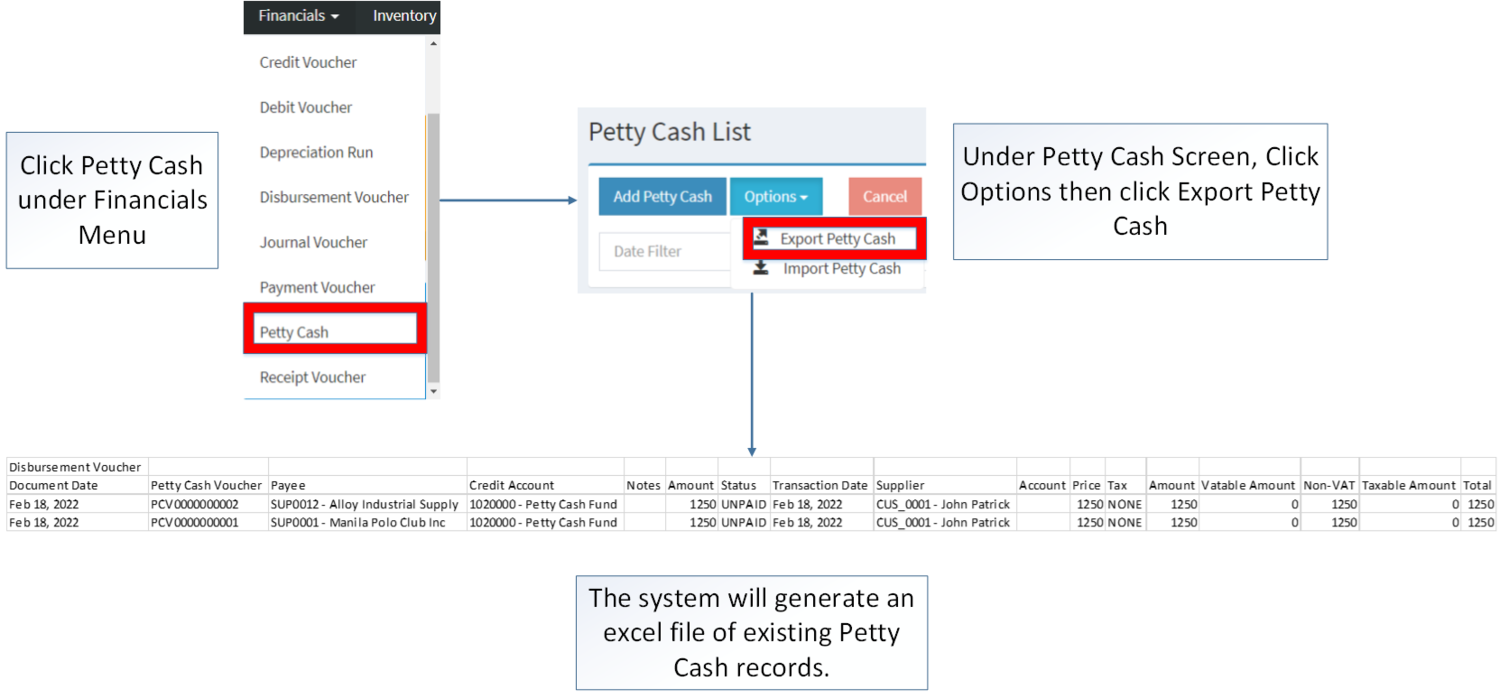

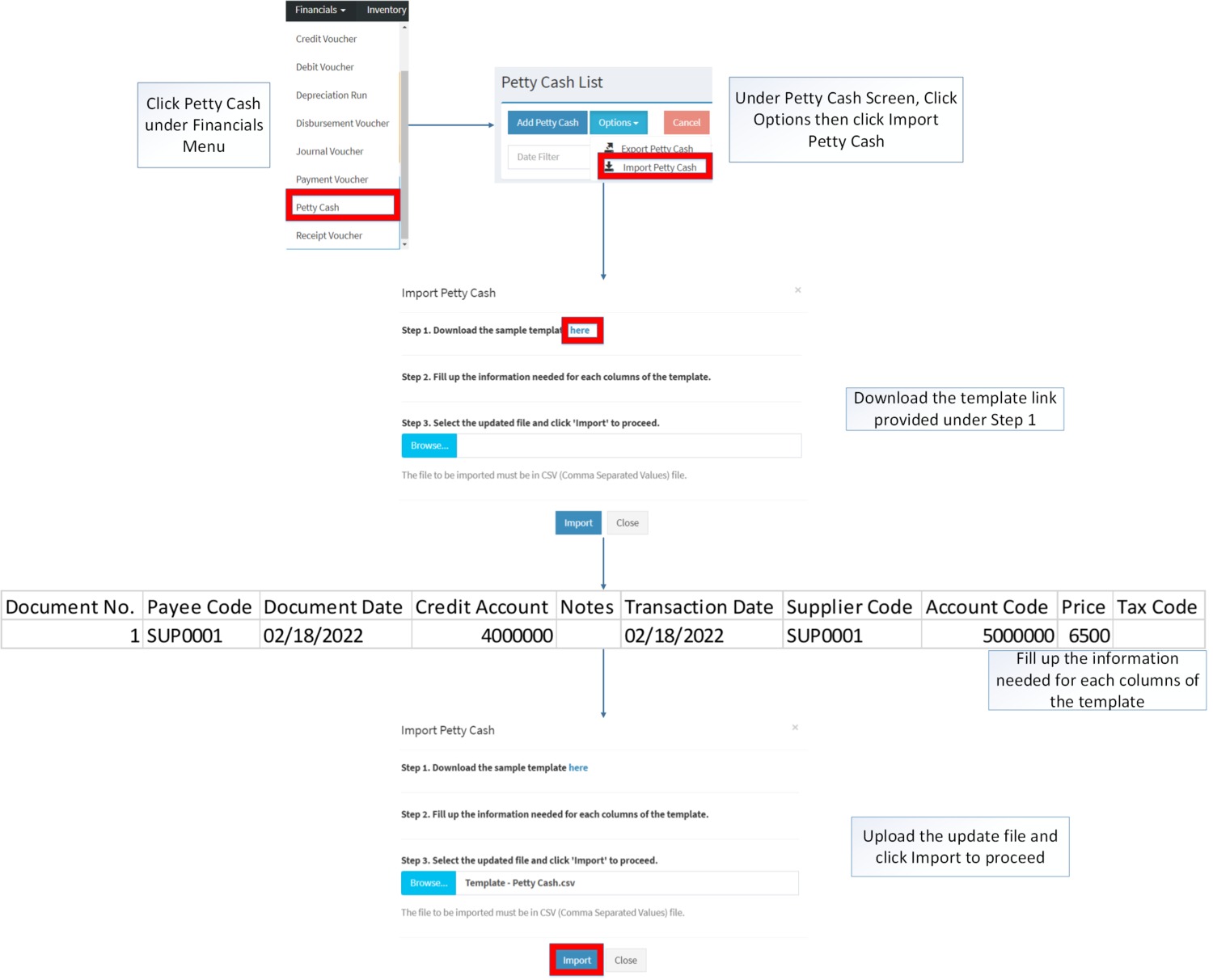

Importing and Exporting Petty Cash

1. Under Petty Cash Screen, Click Options

2. Under Options, The user may Export or Import The Record

- When Exporting the records, the user may also use the filter options such as Date Filter, Search Bar and Source filter for precise searching and exporting of records.

- When Importing the records, the user should follow the following steps provided in the Importing Petty Cash Screen such as

| Field | Description of Data Output | Allowed Inputs | Input Restrictions | Required (Y/N) |

|---|---|---|---|---|

| 1.Document No. | Manual Entry of Document no of Journal Voucher | *Numeric | *Other characters not mentioned in the allowed Inputs | Y |

| 2.Payee | Name of Payee | *Supplier Code provided in Supplier Maintenance Module | *Any inputs not mentioned in the allowed inputs | Y |

| 3.Document Date | Manual Entry of the Document Date when the transaction was created | *Numeric

*Dash "-" *Backslash "\" |

*Other special characters not mentioned | Y |

| 4.Credit Account | Account to be charged for credit on the transaction | *Account Code provided in Chart of Account Maintenance Module | *Any inputs not mentioned in the allowed inputs | Y |

| 5.Notes | Other Remarks on the Transaction | *Alphanumeric

*Special Characters |

*None | N |

| 6.Transaction Date | Date of Transaction | *Numeric

*Dash "-" *Backslash "\" |

*Other special characters not mentioned | Y |

| 7.Supplier Code | Supplier Code of the Supplier | *Supplier Code provided in Supplier Maintenance Module | *Any inputs not mentioned in the allowed inputs | Y |

| 8.Account Code | Account to be charged on the transaction | *Account Code provided in Chart of Account Maintenance Module | *Any inputs not mentioned in the allowed inputs | Y |

| 9.Price | Price to be paid in the transaction | *Numeric | *Any input except Numeric | Y |

| 10.Tax Code | Type of Tax to be applied on the Transaction | *Tax Code provided in Tax Maintenance Module | *Any inputs not mentioned in the allowed inputs | N |

Petty Cash Record Options

| Status | View | Edit | Cancel | |

|---|---|---|---|---|

| UNPAID | ☑ | ☑ | ☑ | ☑ |

| PAID | ☑ | ☑ | ||

| CANCELLED | ☑ | ☑ |

Notes:

- The user can Edit the Petty Cash Record while viewing

- The user can only edit it while the status of the Petty Cash is UNPAID

- The Record will change its status from UNPAID to PAID ones the petty cash payment in Payment Voucher is POSTED

- Petty Cash can only be cancelled if it is still on UNPAID Status.

- The user must Unpost and cancel the Payment Voucher first in order to cancel the Petty Cash Record.

| Modules | |

|---|---|

| Financials | Financials | Petty Cash | Payment Voucher |

| Maintenance | Supplier | Chart of Account | Tax |