You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "ATC Code"

(Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 6: | Line 6: | ||

[[File:ATC Code List Screen.png|alt=ATC list screen|center|thumb|ATC list screen]] | [[File:ATC Code List Screen.png|alt=ATC list screen|center|thumb|ATC list screen]] | ||

| + | Notes: | ||

| + | |||

| + | * Deactivating ATC Codes restricts the user to use the ATC code in Receipt Voucher.<br /> | ||

======Adding ATC codes====== | ======Adding ATC codes====== | ||

| − | [[File: | + | [[File:Adding ATC Code.png|alt=Add ATC code screen|center|thumb|863x863px|Adding ATC code screen]] |

| − | + | {| class="wikitable" | |

| + | !Field | ||

| + | !Description | ||

| + | !Expected Values | ||

| + | |- | ||

| + | |1.ATC Code | ||

| + | |•Reference Code For ATC | ||

| + | |•Alphanumeric | ||

| + | |- | ||

| + | |2.Tax Code | ||

| + | |•Tax Code Reference for the ATC Code | ||

| + | |•Alphanumeric | ||

| + | |- | ||

| + | |3.Description | ||

| + | |•Description of the ATC Code | ||

| + | |•Alphanumeric | ||

| + | |- | ||

| + | |4.Tax Rate | ||

| + | |•Tax Percentage Rate to be Applied on the ATC Code | ||

| + | |•Numeric | ||

| + | |- | ||

| + | |5.EWT | ||

| + | |•Expanded Withholding Tax | ||

| + | |•EWT List provided in the field | ||

| + | |- | ||

| + | |6.CWT | ||

| + | |•Credit Withholding Tax | ||

| + | |•CWT List provided in the field | ||

| + | |} | ||

| + | '''Editing ATC codes''' | ||

| + | [[File:Editing ATC Code.png|center|thumb|868x868px|Editing ATC Code]] | ||

| + | {| class="wikitable" | ||

| + | !Field | ||

| + | !Description | ||

| + | !Expected Values | ||

| + | |- | ||

| + | |1.ATC Code | ||

| + | |•Reference Code For ATC | ||

| + | |•Alphanumeric | ||

| + | |- | ||

| + | |2.Tax Code | ||

| + | |•Tax Code Reference for the ATC Code | ||

| + | |•Alphanumeric | ||

| + | |- | ||

| + | |3.Description | ||

| + | |•Description of the ATC Code | ||

| + | |•Alphanumeric | ||

| + | |- | ||

| + | |4.Tax Rate | ||

| + | |•Tax Percentage Rate to be Applied on the ATC Code | ||

| + | |•Numeric | ||

| + | |- | ||

| + | |5.EWT | ||

| + | |•Expanded Withholding Tax | ||

| + | |•EWT List provided in the field | ||

| + | |- | ||

| + | |6.CWT | ||

| + | |•Credit Withholding Tax | ||

| + | |•CWT List provided in the field | ||

| + | |} | ||

| + | |||

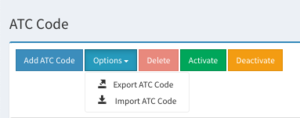

======ATC code options====== | ======ATC code options====== | ||

[[File:ATC Code options.png|alt=ATC code options|center|thumb|ATC code options]] | [[File:ATC Code options.png|alt=ATC code options|center|thumb|ATC code options]] | ||

Revision as of 14:32, 21 October 2020

Alphanumber Tax Codes or ATC Codes or ATCs are codes used to identify the type of tax that has to be paid.

Contents

ATC code list

Notes:

- Deactivating ATC Codes restricts the user to use the ATC code in Receipt Voucher.

Adding ATC codes

File:Adding ATC Code.png

Adding ATC code screen

| Field | Description | Expected Values |

|---|---|---|

| 1.ATC Code | •Reference Code For ATC | •Alphanumeric |

| 2.Tax Code | •Tax Code Reference for the ATC Code | •Alphanumeric |

| 3.Description | •Description of the ATC Code | •Alphanumeric |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | •Numeric |

| 5.EWT | •Expanded Withholding Tax | •EWT List provided in the field |

| 6.CWT | •Credit Withholding Tax | •CWT List provided in the field |

Editing ATC codes

File:Editing ATC Code.png

Editing ATC Code

| Field | Description | Expected Values |

|---|---|---|

| 1.ATC Code | •Reference Code For ATC | •Alphanumeric |

| 2.Tax Code | •Tax Code Reference for the ATC Code | •Alphanumeric |

| 3.Description | •Description of the ATC Code | •Alphanumeric |

| 4.Tax Rate | •Tax Percentage Rate to be Applied on the ATC Code | •Numeric |

| 5.EWT | •Expanded Withholding Tax | •EWT List provided in the field |

| 6.CWT | •Credit Withholding Tax | •CWT List provided in the field |

ATC code options

Importing ATC codes

File:ATC Code Import screen.png

ATC code import screen

ATC record options

File:ATC record options.png

ATC record options