Difference between revisions of "Receiving Payment"

(Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 5: | Line 5: | ||

<span class="ve-pasteProtect" style="font-size:12.0pt; | <span class="ve-pasteProtect" style="font-size:12.0pt; | ||

line-height:115%" data-ve-attributes="{"style":"font-size:12.0pt;\nline-height:115%"}">To receive payment for a customer’s multiple invoices:</span> | line-height:115%" data-ve-attributes="{"style":"font-size:12.0pt;\nline-height:115%"}">To receive payment for a customer’s multiple invoices:</span> | ||

| + | |||

| + | #On the menu bar, click on “<u>Sales</u>”. The Invoice list will be displayed. | ||

| + | #Click on “<u>Receive Payments</u>” button. Receive Payments pop-up form will be displayed. | ||

| + | #Fill out the form: | ||

| + | ##<u>Customer</u> – list of customers with unpaid invoices will be displayed for selection | ||

| + | ##<u>Date</u> - for Receipt Voucher transaction date selection ''(displays current date by default)'' | ||

| + | ##<u>Payment Mode</u> – for selection of payment mode | ||

| + | ##*Cash – enter “<u>Reference Number</u>” ''(if any)'' | ||

| + | ##*Cheque – requires entry of “<u>Cheque Number</u>” and “<u>Cheque Date</u>” | ||

| + | ##<u>CR</u> – for entry of certificate of receipt/acknowledgement receipt no. ''(if any, displays last entered CR)'' | ||

| + | ##<u>Paid To</u> – list of banks or cash accounts for selection, to where to deposit received payment | ||

| + | ##<u>Notes</u> - for entry of remarks / notes for the Receipt Voucher | ||

| + | ##<u>List of selected customer’s invoices</u> | ||

| + | ##*Tick corresponding invoice’s checkbox to receive payment from | ||

| + | ##*Enter Creditable Tax amount ''(if any)'' | ||

| + | ##*Enter amount received from the customer ''(displays invoice’s Total Amount Due by default, displays Total Amount Due less entered Creditable Tax amount (if there is an entered Creditable Tax amount))'' | ||

| + | #After filling-out the form, click “Save” button. Then the payment details with the Receipt Voucher Number will be displayed. You may print the voucher by clicking “<u>Print Voucher</u>” button. Otherwise, click “Close” to close the pop-up window. <br /> | ||

| + | |||

| + | ==Receiving Payment for a Specific Invoice== | ||

| + | <br />[[File:Oojeema Pro - Receive Payment (Specific Invoice).png|center|thumb|577x577px|link=https://docs.oojeema.com/File:Oojeema_Pro_-_Receive_Payment_(Specific_Invoice).png]] | ||

| + | |||

| + | |||

| + | <span class="ve-pasteProtect" style="font-size:12.0pt; | ||

| + | line-height:115%" data-ve-attributes="{"style":"font-size:12.0pt;\nline-height:115%"}">To receive payment for a customer’s specific invoice:</span> | ||

# On the menu bar, click on “<u>Sales</u>”. The Invoice list will be displayed. | # On the menu bar, click on “<u>Sales</u>”. The Invoice list will be displayed. | ||

| − | # | + | # On the Invoice list, click on the dropdown icon to the left of the invoice you want to receive payment from, then select “Receive Payment”. Or view the invoice you want to receive payment from, then click “Receive Payment” button. |

| − | + | # Receipt Voucher form will be displayed. Fill out the form: | |

| − | ## <u> | + | ## <u>Payment Date</u> - for Receipt Voucher transaction date selection ''(displays current date by default)'' |

| − | |||

## <u>Payment Mode</u> – for selection of payment mode | ## <u>Payment Mode</u> – for selection of payment mode | ||

##* Cash – enter “<u>Reference Number</u>” ''(if any)'' | ##* Cash – enter “<u>Reference Number</u>” ''(if any)'' | ||

##* Cheque – requires entry of “<u>Cheque Number</u>” and “<u>Cheque Date</u>” | ##* Cheque – requires entry of “<u>Cheque Number</u>” and “<u>Cheque Date</u>” | ||

| + | ##* Credit Card – enter card number on “<u>Cheque Number</u>” ''(if any)'', card date on “<u>Cheque Date</u>” ''(if any)'' and credit card charge amount on “<u>Credit Card Charge</u>” ''(if any)'' | ||

| + | ## <u>Payment Amount</u> – for entry of amount received from customer ''(displays invoice’s Total Amount Due by default, displays Total Amount Due less entered Creditable Tax amount (if there is an entered Creditable Tax amount), less Credit Card Charge also if entered credit card charge)'' | ||

| + | ## <u>Paid To</u> – list of banks or cash accounts for selection, to where to deposit received payment | ||

## <u>CR</u> – for entry of certificate of receipt/acknowledgement receipt no. ''(if any, displays last entered CR)'' | ## <u>CR</u> – for entry of certificate of receipt/acknowledgement receipt no. ''(if any, displays last entered CR)'' | ||

| − | ## <u> | + | ## <u>Creditable Tax Amt</u> – for entry of creditable tax amount ''(if any)'' |

## <u>Notes</u> - for entry of remarks / notes for the Receipt Voucher | ## <u>Notes</u> - for entry of remarks / notes for the Receipt Voucher | ||

| − | + | # After filling-out the form, click “<u>Save</u>” button. The payment details will be displayed on the “<u>Received Payments</u>” section at the bottom of “<u>View Invoice</u>” page. Otherwise, click “<u>Clear</u>” to reset the Receipt Voucher details to default. | |

| − | |||

| − | |||

| − | |||

| − | # After filling-out the form, click | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | < | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | < | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | < | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==Managing Received Payment== | ==Managing Received Payment== | ||

<span class="ve-pasteProtect" style="font-size:12.0pt;line-height:115%; | <span class="ve-pasteProtect" style="font-size:12.0pt;line-height:115%; | ||

Latest revision as of 16:23, 9 December 2020

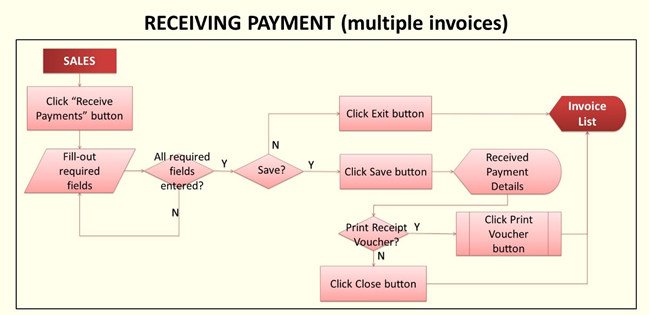

Receiving Payment for Multiple Invoices to a Customer

To receive payment for a customer’s multiple invoices:

- On the menu bar, click on “Sales”. The Invoice list will be displayed.

- Click on “Receive Payments” button. Receive Payments pop-up form will be displayed.

- Fill out the form:

- Customer – list of customers with unpaid invoices will be displayed for selection

- Date - for Receipt Voucher transaction date selection (displays current date by default)

- Payment Mode – for selection of payment mode

- Cash – enter “Reference Number” (if any)

- Cheque – requires entry of “Cheque Number” and “Cheque Date”

- CR – for entry of certificate of receipt/acknowledgement receipt no. (if any, displays last entered CR)

- Paid To – list of banks or cash accounts for selection, to where to deposit received payment

- Notes - for entry of remarks / notes for the Receipt Voucher

- List of selected customer’s invoices

- Tick corresponding invoice’s checkbox to receive payment from

- Enter Creditable Tax amount (if any)

- Enter amount received from the customer (displays invoice’s Total Amount Due by default, displays Total Amount Due less entered Creditable Tax amount (if there is an entered Creditable Tax amount))

- After filling-out the form, click “Save” button. Then the payment details with the Receipt Voucher Number will be displayed. You may print the voucher by clicking “Print Voucher” button. Otherwise, click “Close” to close the pop-up window.

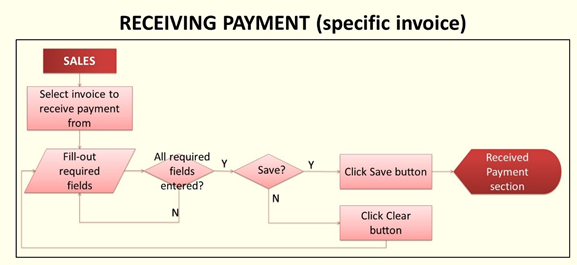

Receiving Payment for a Specific Invoice

To receive payment for a customer’s specific invoice:

- On the menu bar, click on “Sales”. The Invoice list will be displayed.

- On the Invoice list, click on the dropdown icon to the left of the invoice you want to receive payment from, then select “Receive Payment”. Or view the invoice you want to receive payment from, then click “Receive Payment” button.

- Receipt Voucher form will be displayed. Fill out the form:

- Payment Date - for Receipt Voucher transaction date selection (displays current date by default)

- Payment Mode – for selection of payment mode

- Cash – enter “Reference Number” (if any)

- Cheque – requires entry of “Cheque Number” and “Cheque Date”

- Credit Card – enter card number on “Cheque Number” (if any), card date on “Cheque Date” (if any) and credit card charge amount on “Credit Card Charge” (if any)

- Payment Amount – for entry of amount received from customer (displays invoice’s Total Amount Due by default, displays Total Amount Due less entered Creditable Tax amount (if there is an entered Creditable Tax amount), less Credit Card Charge also if entered credit card charge)

- Paid To – list of banks or cash accounts for selection, to where to deposit received payment

- CR – for entry of certificate of receipt/acknowledgement receipt no. (if any, displays last entered CR)

- Creditable Tax Amt – for entry of creditable tax amount (if any)

- Notes - for entry of remarks / notes for the Receipt Voucher

- After filling-out the form, click “Save” button. The payment details will be displayed on the “Received Payments” section at the bottom of “View Invoice” page. Otherwise, click “Clear” to reset the Receipt Voucher details to default.

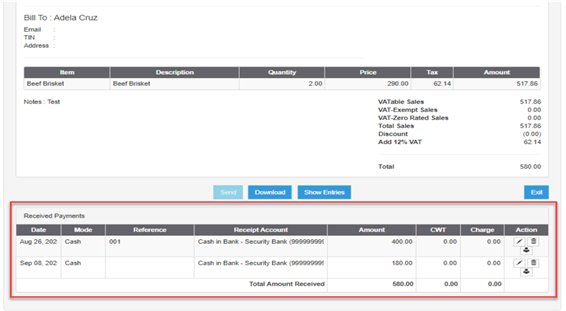

Managing Received Payment

Received payments per Invoice can be viewed, edited, deleted or print Receipt Voucher thru the “Received Payments” section at the bottom of each invoice’s view page.