You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "Sales Journal"

(Tag: Visual edit) |

(Changed categories.) |

||

| Line 100: | Line 100: | ||

|[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | ||

|} | |} | ||

| + | [[Category:Tax Reports]] | ||

| + | [[Category:Sales]] | ||

Revision as of 14:30, 6 April 2022

Contents

Sales Journal

Sales Journal Menu List

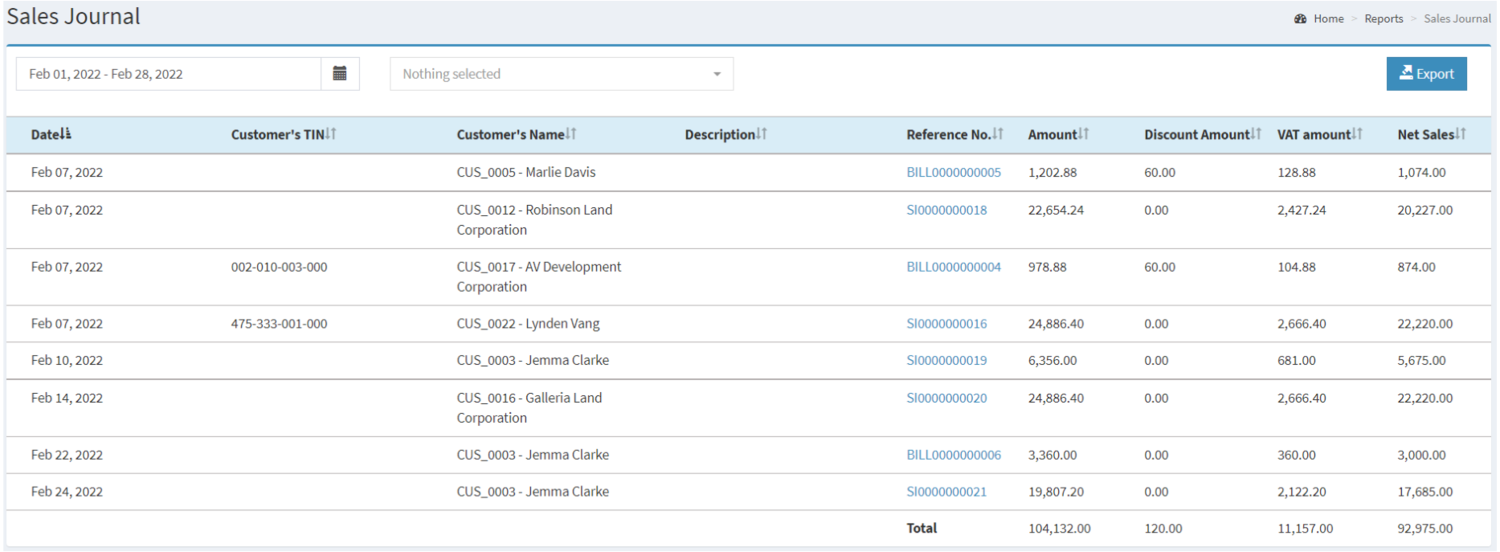

Sales Journal refers to the Report for the recording of the sales on credit to customers(Customer's Receivables)

Requirements before using Sales Journal

- The user should setup have the following records in order to proceed on using the Sales Journal

| Field | Description |

|---|---|

| 1. Record Filter(Date Range, Customer) | Set of record filters for precise searching of records.

|

| 2. Export | Allows the user to export the records in the report. |

| 3. Date | Date of the Transaction |

| 4. Customer's TIN | TIN number of the Customer |

| 5. Customer's Name | Name of the Customer |

| 6. Description | Any remarks on the Transaction/Invoice. |

| 7. Reference No. | Reference No of the Sales Invoice |

| 8. Amount | Amount in the Invoice.

|

| 9. Discount Amount | Discount amount applied on the Transaction. |

| 10. VAT Amount | Value Added Tax Amount Applied on the Transaction |

| 11. Net Sales | Amount Accumulated with VAT |

Notes:

- Customer must be ACTIVE status in order to View its Records in the Filter.

- Customer status can be seen in Customer Maintenance Module

- Customer status can be seen in Customer Maintenance Module

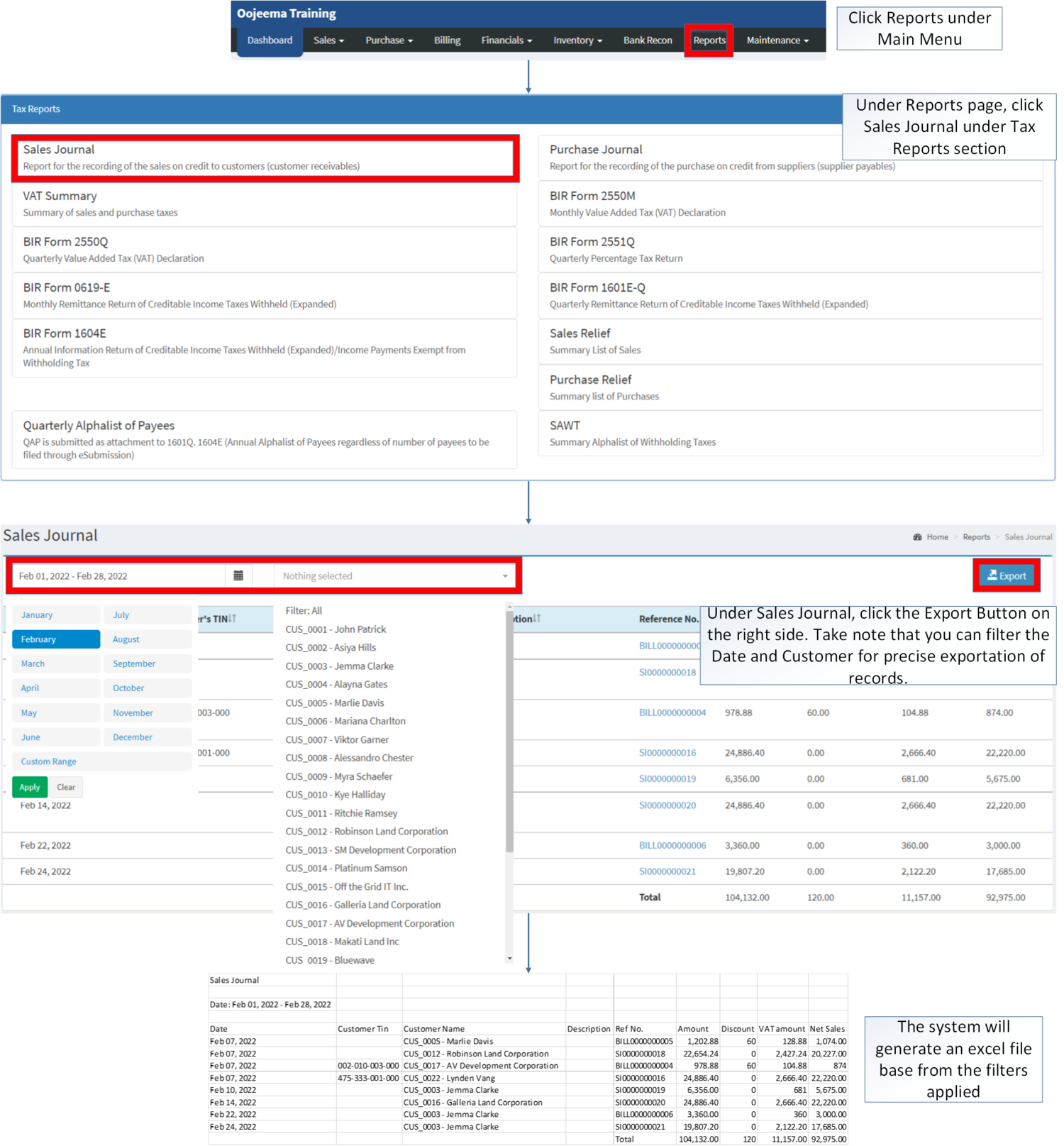

Exporting Sales Journal

- Click Reports under Main Menu

- Under Reports Page, Click Sales Journal under Tax Reports section.

- Under Sales Journal, click the Export Button on the right side. Take note that you can filter the Date and Customer for precise exportation of records.

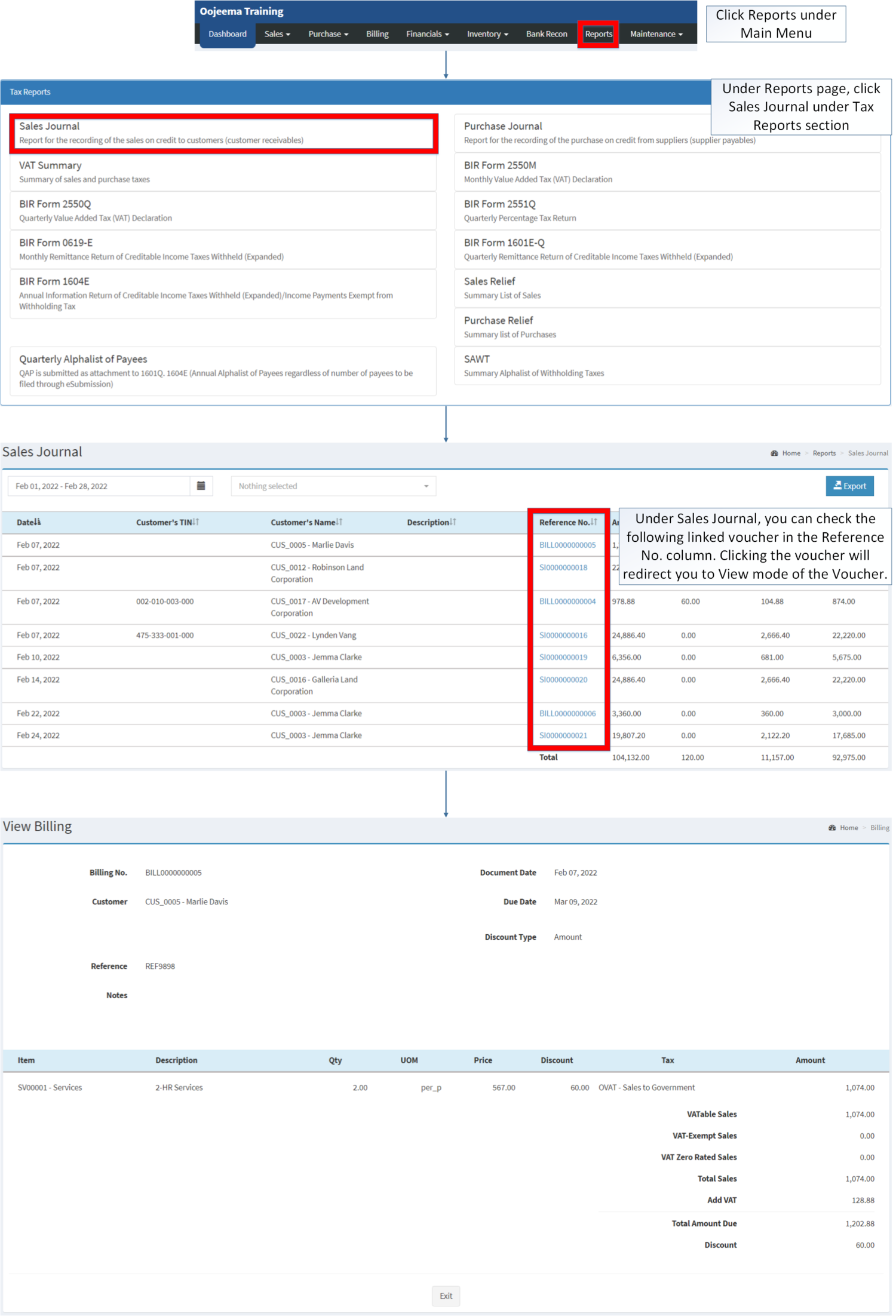

Viewing Reference Voucher on Sales Journal

- Click Reports under Main Menu

- Under Reports Menu, Click Sales Journal under Tax Reports.

- Under Sales Journal, you can check the following linked voucher in the Reference No. column. Clicking the voucher will redirect you to View mode of the Voucher.

| Modules | |

|---|---|

| Sales | Sales Invoice |

| Billing | Billing |

| Maintenance | Customer | Tax |

| Reports Module(Reports) | |

| Reports | Tax Reports |

| Tax Reports | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |