You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "BIR Form 0619-E"

(Tag: Visual edit) |

(Changed categories.) |

||

| Line 117: | Line 117: | ||

| style="" |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | | style="" |[[Sales Journal]]<nowiki> | </nowiki>[[Purchase Journal]]<nowiki> | </nowiki>[[VAT Summary]]<nowiki> | </nowiki>[[BIR Form 2550M]]<nowiki> | </nowiki>[[BIR Form 2550Q]]<nowiki> | </nowiki>[[BIR Form 2551Q]]<nowiki> | </nowiki>[[BIR Form 0619-E]]<nowiki> | </nowiki>[[BIR Form 1601E-Q]]<nowiki> | </nowiki>[[BIR Form 1604E]]<nowiki> | </nowiki>[[Sales Relief]]<nowiki> | </nowiki>[[Purchase Relief]]<nowiki> | </nowiki>[[SAWT|Summary Alphalist of Withholding Tax]] | ||

|} | |} | ||

| + | [[Category:Purchase]] | ||

| + | [[Category:Tax Reports]] | ||

Revision as of 11:01, 7 April 2022

BIR Form 0619-E

BIR Form 0619-E also known as Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded). This is use to file creditable or expanded withholding taxes. These taxes are prescribed on specific incomes (e.g. professional talent fees, rental income, and payment to contractors).

Requirements before Generating BIR Form 0619-E

- ATC Code

- Tax

- Accounts Payable

- Payment Voucher (with Withholding Tax)

Generate BIR Form 0619-E

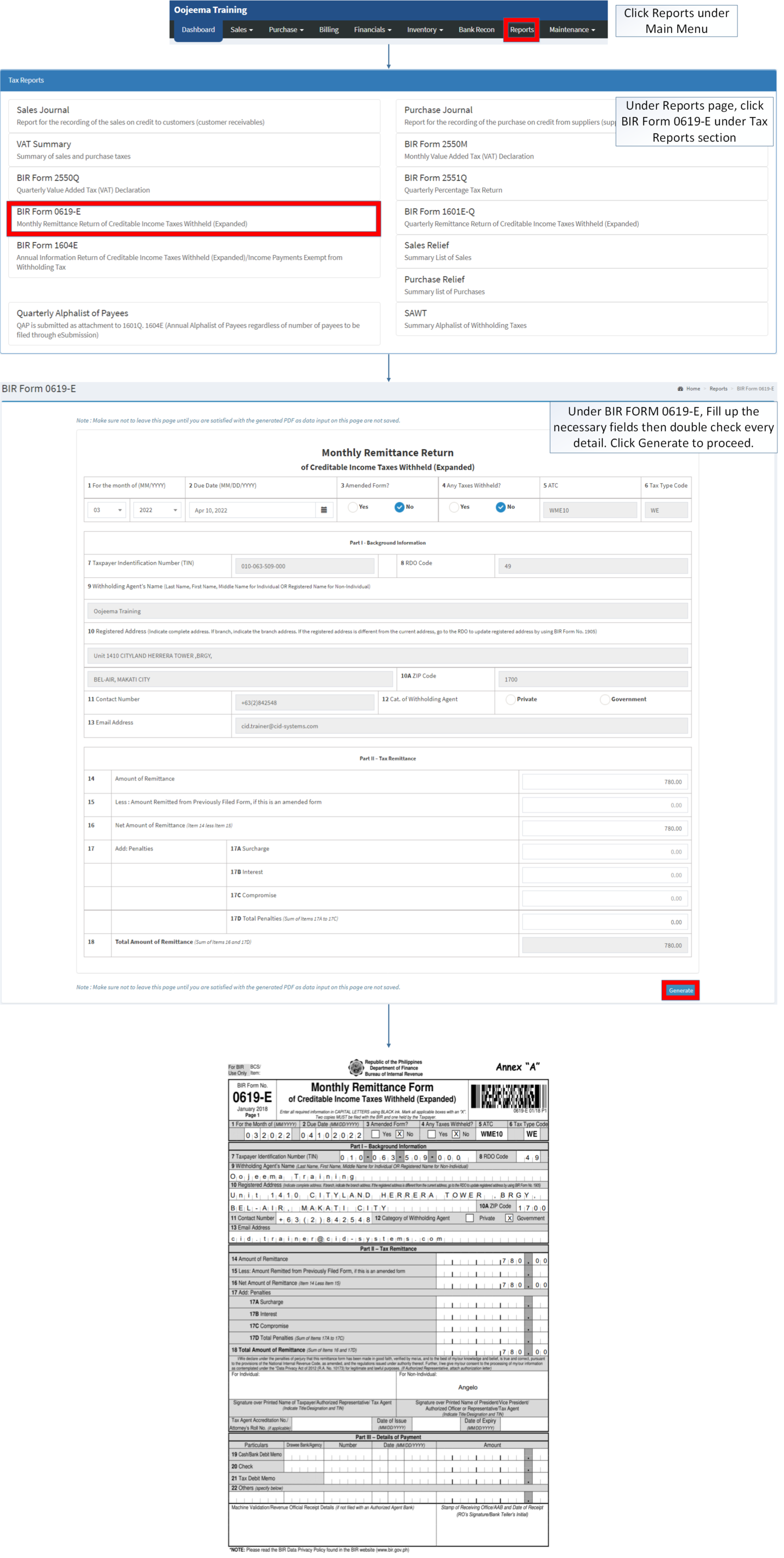

- Under Main Menu, Click Reports

- Under Reports Menu, Click BIR FORM 0619-E under Tax Reports.

- Under BIR FORM 0619-E, Fill up the necessary fields then double check every detail. Click Generate to proceed.

| Field | Description |

|---|---|

| 1. Month Year | Month and year when the BIR Form 0619-E was issued. |

| 2. Due Date | Due date of the form when it should be submitted.

|

| 3. Amended Form | is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 4. Taxes Withheld | Any tax amount that an employer withholds from an employee's wages and pays directly to the government. |

| 5. ATC | Alphanumeric Tax Codes declared in the Form |

| 6. Tax Type Code | Reference code on Tax on the Form. |

| Part I - Background Information | |

| 7. TIN | Tax Identification Number of an Individual or Business |

| 8. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 9. Withholding Agent’s Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 10. Registered Address | The registered Address of the Tax Payer.

|

| 11. Contact Number | Contact Number of the Tax Payer(Individual/Business). |

| 12. Withholding Agent Category | Withholding Agent Category

|

| 13. Email Address | Email Address of the Tax Payer |

| Part II - Tax Remittance | |

| 14. Amount of Remittance | Amount of currency to be transferred back. |

| 15. Less : Amount Remitted from Previously Filed Form, if this is an amended form | Amount remitted from the last Form considering if the form submitted is amended form. |

| 16. Net Amount of Remittance | Total Amount of Remittance based from the amount of Remittance less from Amount Remitted from Previous form. |

| 17. Penalties | Penalties to be applied if there is any.

|

| 18. Total Amount of Remittance(Sum of 16 and 17D) | Total Amount of Remittance based from the Net Amount of Remittance and the Total Penalties implied. |

Notes:

- Grey fields are auto-generated and will automatically adjust based on the input of the user.

| Modules | |

|---|---|

| Financials | Accounts Payable | Payment Voucher |

| Maintenance | ATC Code | Branch | Company | Tax |

| Reports Module(Reports) | |

| Reports | Tax Reports |

| Tax Reports | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |