Difference between revisions of "Accounts Receivable Aging"

(Changed categories.) |

(Changed categories.) |

||

| Line 110: | Line 110: | ||

[[Category:Sales]] | [[Category:Sales]] | ||

[[Category:Sales Reports]] | [[Category:Sales Reports]] | ||

| + | [[Category:Billing]] | ||

Latest revision as of 10:04, 8 April 2022

Financial Statement | Accounts Receivable | Accounts Receivable Aging | AR Detailed Report | AR Transaction Report

Contents

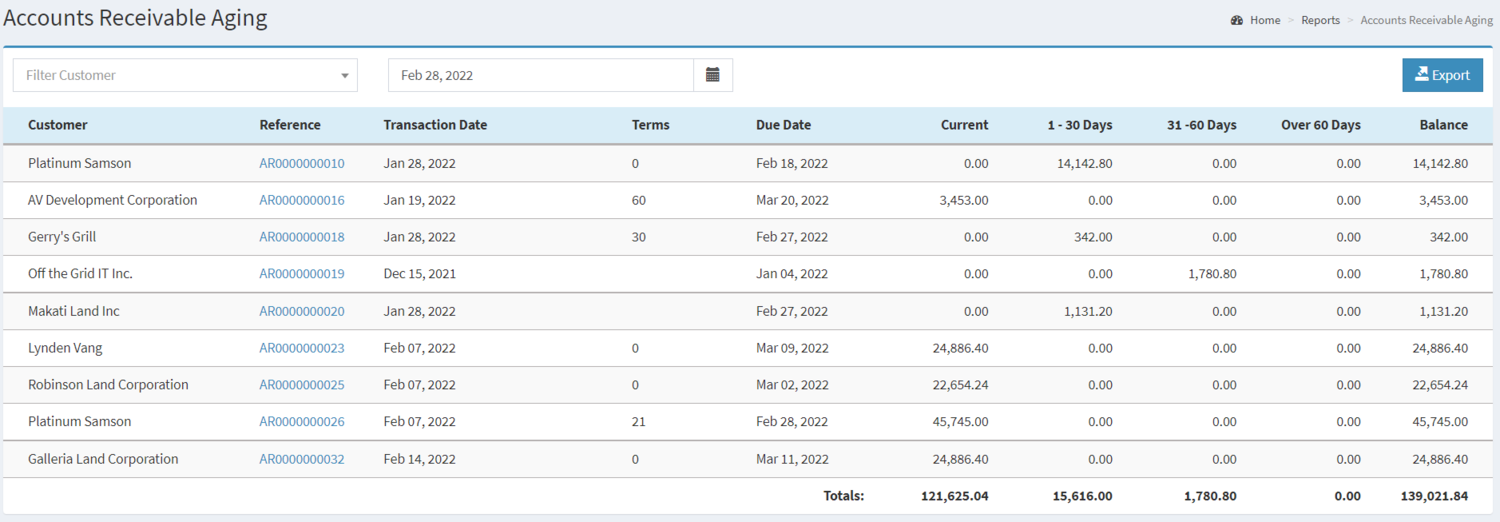

Accounts Receivable Aging

Accounts Receivable Aging Menu

Accounts Receivable Aging are list of Accounts Receivable that has not been paid by User. This report categorizes the set of invoice that has been outstanding over a specific period(can be within a month range, 2 months range or over 2 months)

Requirements before using Accounts Receivable Aging

- The user should setup and have the following records in order to proceed on using the Accounts Receivable Aging

| Field | Description |

|---|---|

| 1. Record Filter(Customer and Date) | Set of filter record for precise search of records.

|

| 2. Export | Allows the user to Export the report into Spreadsheet |

| 3. Customer | The customer assigned for the specific Receivables. |

| 4. Reference | The reference record for the Accounts Receivable of the Customer.

|

| 5. Transaction Date | The date when the Receivable is issued. |

| 6. Terms | the set default days on the customer for them to pay their outstanding balance on their receivables.

|

| 7. Due Date | The date on which the receivable should be paid.

|

| 8. Current | The balance to be paid on the receivables during the span of Transaction date up to Expiration Date. |

| 9. Aging Range | A range of days where the receivable exceeds to its due date.

|

| 10. Balance | The total amount to be paid on a specific Transaction. |

Notes:

- Customer record must be ACTIVE status in order to check its receivable aging records.

- Customer records can be seen in Customer Maintenance Module.

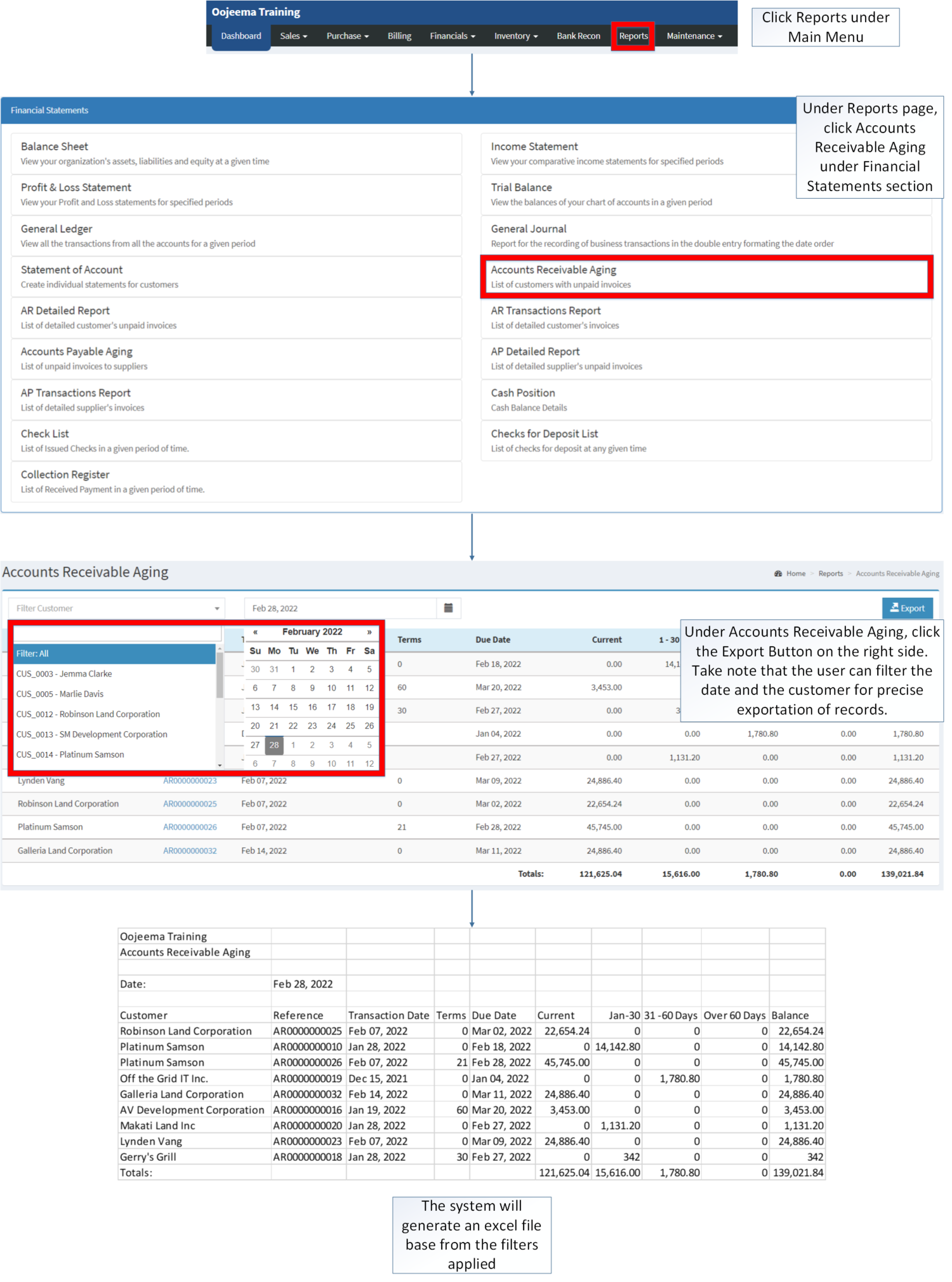

Filtering Records and Exporting Accounts Receivable Aging

- Click Reports under Main Menu

- Under Reports Page, Click Accounts Receivable Aging under Financial Statement Reports.

- Under Accounts Receivable Aging, click the Export Button on the right side. Take note that the user can filter the date and the customer for precise exportation of records.

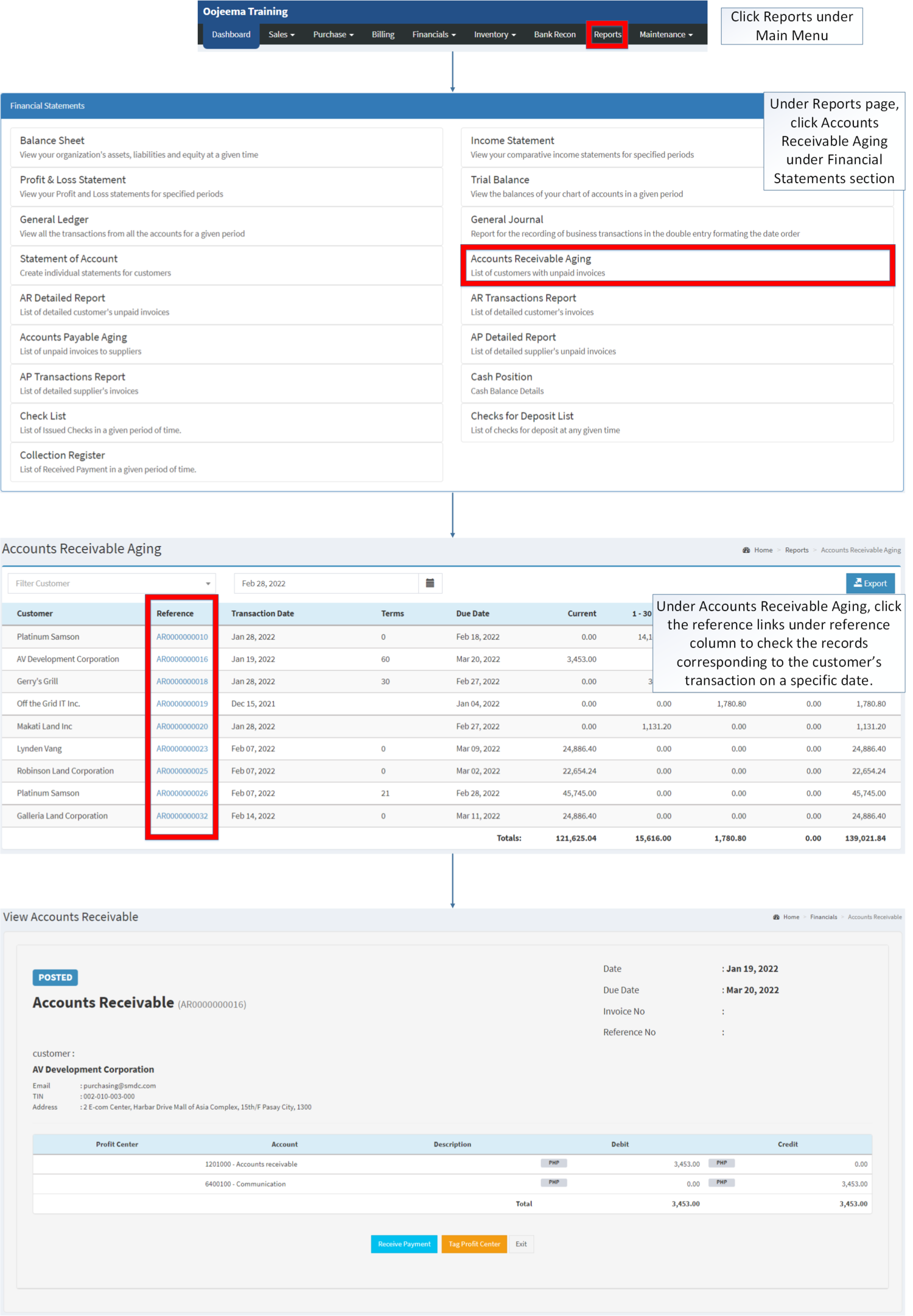

Viewing Vouchers on Accounts Receivable Aging

- Click Reports under Main Menu

- Under Reports Page, Click Accounts Receivable Aging under Financial Statement Reports.

- Under Accounts Receivable Aging, click the reference links under reference column to check the records corresponding to the customer’s transaction on a specific date.

- The user may Received the payment when viewing a specific Accounts Receivable record.

- The user may tag a Profit Center when viewing a specific Accounts Receivable record

- The user may only tag a Profit Center if the status is not yet Posted

| Modules | |

|---|---|

| Financials | Accounts Receivable | Receipt Voucher |

| Maintenance | Maintenance | Customer | Profit Center |

| Reports Module (Reports) | |

| Reports | Financial Statement |

| Financial Statements | Balance Sheet | Income Statement | Profit and Loss Statement | General Ledger | General Journal | Trial Balance | Statement of Account | Accounts Receivable Aging | AR Detailed Report | AR Transaction Report | Accounts Payable Aging | AP Detailed Report | AP Transaction Report | Cash Position | Check List | Deposit List | Collection Register |