You are viewing an old version of this page. Return to the latest version.

No categories assigned

Billing

-

- Last edited 3 years ago by Gelo

-

Contents

Billing

This module allows the user to create Billings for Job Order Transactions

Requirements before using Billing

- The user should setup the following Maintenance Module in order to proceed on using the Billing.

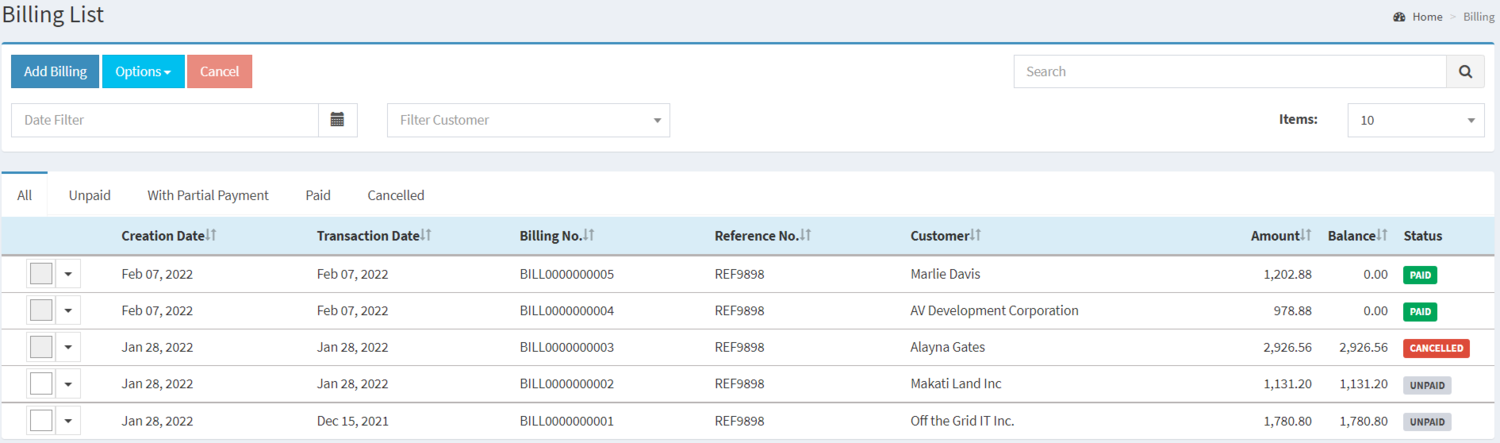

Billing Record List

| Status | Description |

|---|---|

| UNPAID | If the Billing Record is newly created and not yet paid |

| WITH PARTIAL PAYMENT | If the Billing Payment is paid partially |

| PAID | If the Billing Record is fully paid and Posted |

| CANCELLED | If the Billing is cancelled. |

Creating Billing Record

- Click Billing under Main Menu

- Under Billing Screen, Click Add Billing

- Fill up the necessary fields on the header part

- Fill up the necessary fields in the item details

- Click Save

| Field | Description | Expected Values |

|---|---|---|

| 1.Billing No. | •Billing reference number that is auto generated upon creation | •Alphanumeric(Auto-Generated) |

| 2.Customer | •Name of Customer | •Customer List provided in the Customer Maintenance Module |

| 3.Reference | •Reference code for the Billing Transaction | •Alphanumeric |

| 4.Document Date | •Date when the document was created | •Date |

| 5.Due Date | •Due date of Billing Transaction | •Date |

| 6.Discount Type | •Discount Type for the items in the transaction | •Amount/Percentage |

| 7.Notes | •Other Remarks for the transaction | •Alphanumeric |

| 8.Item | •Item List to be placed in the transaction | •Item List Provided in the Item Master Maintenance Module |

| 9.Description | •Any remarks/description | •Alphanumeric |

| 10.Quantity | •Quantity of items applied in the transaction | •Number |

| 11.Unit of Measure(UOM) | •Unit of Measure of the Item | •Unit of Measure List provided in the Unit of Measure Maintenance Module |

| 12.Price | •Price of the items | •Number |

| 13.Discount | •Discount Value to be applied in the Billing | •Discount Amount depending on Discount Type |

| 14.Tax | •Tax Type of the item in the transaction | •Tax Type List provided in the Tax Maintenance Module |

| 15.Amount | •Total amount of the Item Line based from the Price, Discounts and Taxes applied | •Numeric(Auto-Generated) |

Notes:

- The user can only edit the Billing if it is on UNPAID status.

- PAID Billing can only be edited if the Receipt Voucher is Unposted.

- Accounts Receivable will be auto-generated upon Billing creation.

- The receivable should be post first before receiving payment via Receipt Voucher.

- Item should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen under Item Master Maintenance Module.

- Customer should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen under Customer Maintenance Module.

- Tax should on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen under Tax Maintenance Module.

- For detailed steps on how to create a Billing, you can visit the Billing Job Aids which can be found here

Editing Billing

- Click Billing under Main Menu

- Under Billing Screen, Select a Billing record that needs to update its details, click the drop-down arrow then click Edit

- Update the necessary fields then click Save.

Printing Billing

- Click Billing under Main Menu

- Under Billing Screen, Select a Billing record that needs to print its details, click the drop-down arrow then click Print

Cancelling Billing Record

Billing can be cancelled in two ways:

- Using drop-down arrow of a record can be used in single record cancellation

- Using Cancel Button for cancelling multiple records

Exporting Billing

- Under Billing Screen, Click Options

- Under Options, The user may Export the record

- When Exporting the records, the user may also use the filter options such as Date Filter, Search Bar and Customer filter for precise searching and exporting of records.

Issuing Payment on Billing

| Field | Description | Expected Values |

|---|---|---|

| 1.Customer | •Name of Customer | •Customer List provided in the Customer Maintenance Module |

| 2.Reference | •Reference code for the Billing Transaction | •Alphanumeric |

| 3.Document Date | •Date when the document was created | •Date |

| 4.Due Date | •Due date of Billing Transaction | •Date |

| 5.Discount Type | •Discount Type for the items in the transaction | •Amount/Percentage |

| 6.Notes | •Other Remarks for the transaction | •Alphanumeric |

| 7.Item | •Item List to be placed in the transaction | •Item List Provided in the Item Master Maintenance Module |

| 8.Description | •Any remarks/description | •Alphanumeric |

| 9.Quantity | •Quantity of items applied in the transaction | •Numeric |

| 10.Unit of Measure(UOM) | •Unit of Measure of the Item | •Unit of Measure List provided in the Unit of Measure Maintenance Module |

| 11.Price | •Price of the items | •Numeric |

| 12.Discount | •Discount Value to be applied in the Billing | •Discount Amount depending on Discount Type |

| 13.Tax | •Tax Type of the item in the transaction | •Tax Type List provided in the Tax Maintenance Module |

| 14.Amount | •Total amount of the Item Line based from the Price, Discounts and Taxes applied | •Numeric(Auto-Generated) |

Notes:

- The user can only edit the Billing if it is on UNPAID status.

- PAID Billing can only be edited if the Receipt Voucher is Unposted.

- Accounts Receivable will be auto-generated upon Billing creation.

- The receivable should be post first before receiving payment via Receipt Voucher.

- Item should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen under Item Master Maintenance Module.

- Customer should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen under Customer Maintenance Module.

- Tax should on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen under Tax Maintenance Module.

Billing Record Options

| Modules | |

|---|---|

| BIlling | Billing |

| Financials | Accounts Receivable | Receipt Voucher |

| Maintenance | Customer | Item Master | Price List | Unit of Measure | Tax | Unit of Measure |