You are viewing an old version of this page. Return to the latest version.

Version of 14:04, 15 June 2021 by Gelo

No categories assigned

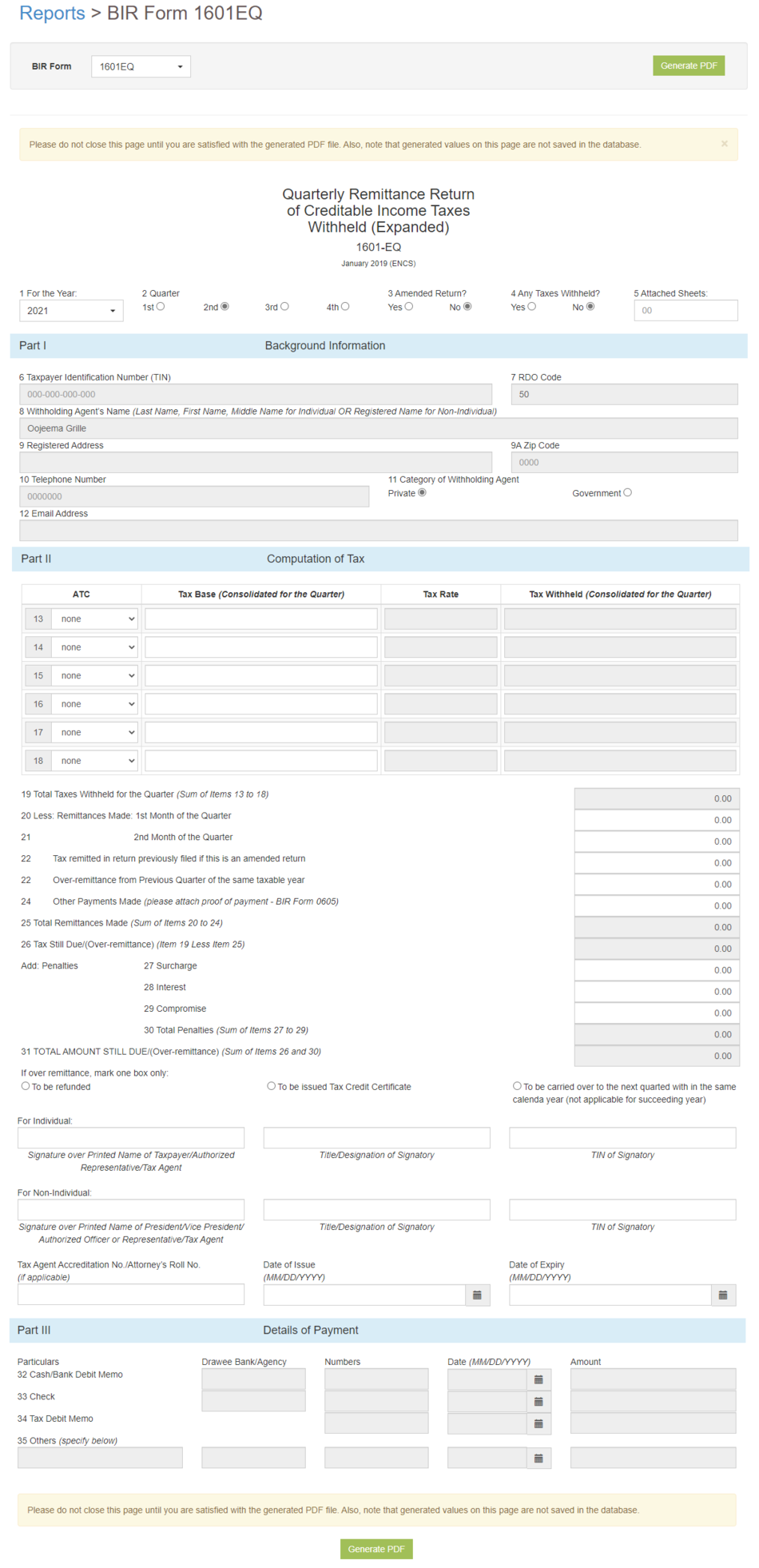

Pro BIR Form 1601EQ

-

- Last edited 4 years ago by Gelo

-

BIR Form 1601E-Q

BIR Form 0619-E also known as Quarterly Remittance Form of Creditable Income Taxes Withheld (Expanded). This is use to file creditable or expanded withholding taxes per quarter. These taxes are prescribed on specific incomes (e.g. professional talent fees, rental income, and payment to contractors).

BIR Form 0619-E terms on Oojeema Pro

| Field | Description |

|---|---|

| 1. Year | Year when the BIR Form 0619E-Q was issued. |

| 2. Quarter | For Calendar Year

For Fiscal Year

|

| 3. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 4. Taxes Withheld | Taxes Withheld is any tax amount that an employer withholds from an employee's wages and pays directly to the government. |

| 5. No. of Sheets | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 1610E-Q |

| 6. TIN | Tax Identification Number of an Individual or Business |

| 7. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 8. Withholding Agent's Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 9. Registered Address | The registered Address of the Tax Payer

|

| 10. Contact Number | Contact Number of the Tax Payer(Individual/Business). |

| 11. Category of Withholding Agent | Private - if the type of business is a Private Company

Government - if the Agent is working on any Government Sector. |

| 12. Email Address | Email Address of the Tax Payer |

| 13 - 18.Computation of Tax(ATC) | The following are the fields to be filled up on the Computation of Tax

|

| 19. Total Taxes Withheld for the Quarter | Total Amount of Taxes Accumulated Based from the Computation of Tax |

| 20. Less: Remittances Made : 1st Month of the Quarter | Any Remittance Made from the 1st Month of the Quarter |

| 21. Less: Remittances Made : 2nd Month of the Quarter | Any Remittance Made from the 2nd Month of the Quarter |

| 22. Less: Tax Remitted in Return Previously Filed, if this is an Amended return | Tax Remitted to be applied from the Amended Return

|

| 23. Less: Over-remittance from Previous Quarter of the same taxable year | Any over remittance stated from the previous quarter of the same year. |

| 24. Other Payments Made (please attach proof of payment - BIR Form 0605) | Any other payments paid with relations to BIR Form 0605 |

| 25. Total Remittances Made (Sum of Items 20 to 24) | Total Remittance amount based from Remittance Made from the Previous months of the quarter, Tax Remitted if it is and Amended form and over remittances from the previous quarter. |

| 26. Tax Still Due/(Over-remittance) (Item 19 Less Item 24) | Tax Due remaining base from the Total Taxes withheld for the quarter less the Total Remittances Made. |

| 27 - 29. Penalties | Penalties to be applied to if there is any.

|

| 30. Total Penalties(Sum of Items 27, 28 and 29) | Total Penalties implied if any. |

| 31. Total Amount still due | Total Due based from Tax Still due and Penalties applied.

|

| 32. Cash / Bank Debit Memo | Amount to be paid using Cash or Debit Bank Memo |

| 33. Check | Amount to be paid using Check which includes the Bank Source, Check Number and Date Issued |

| 34. Tax Debit Memo | Amount details to be paid using Tax Debit Memo |

| 35. Others | Any details to be Applied |

Notes:

- Grey fields are auto-generated and will automatically adjust based on the input of the user.