You are viewing an old version of this page. Return to the latest version.

No categories assigned

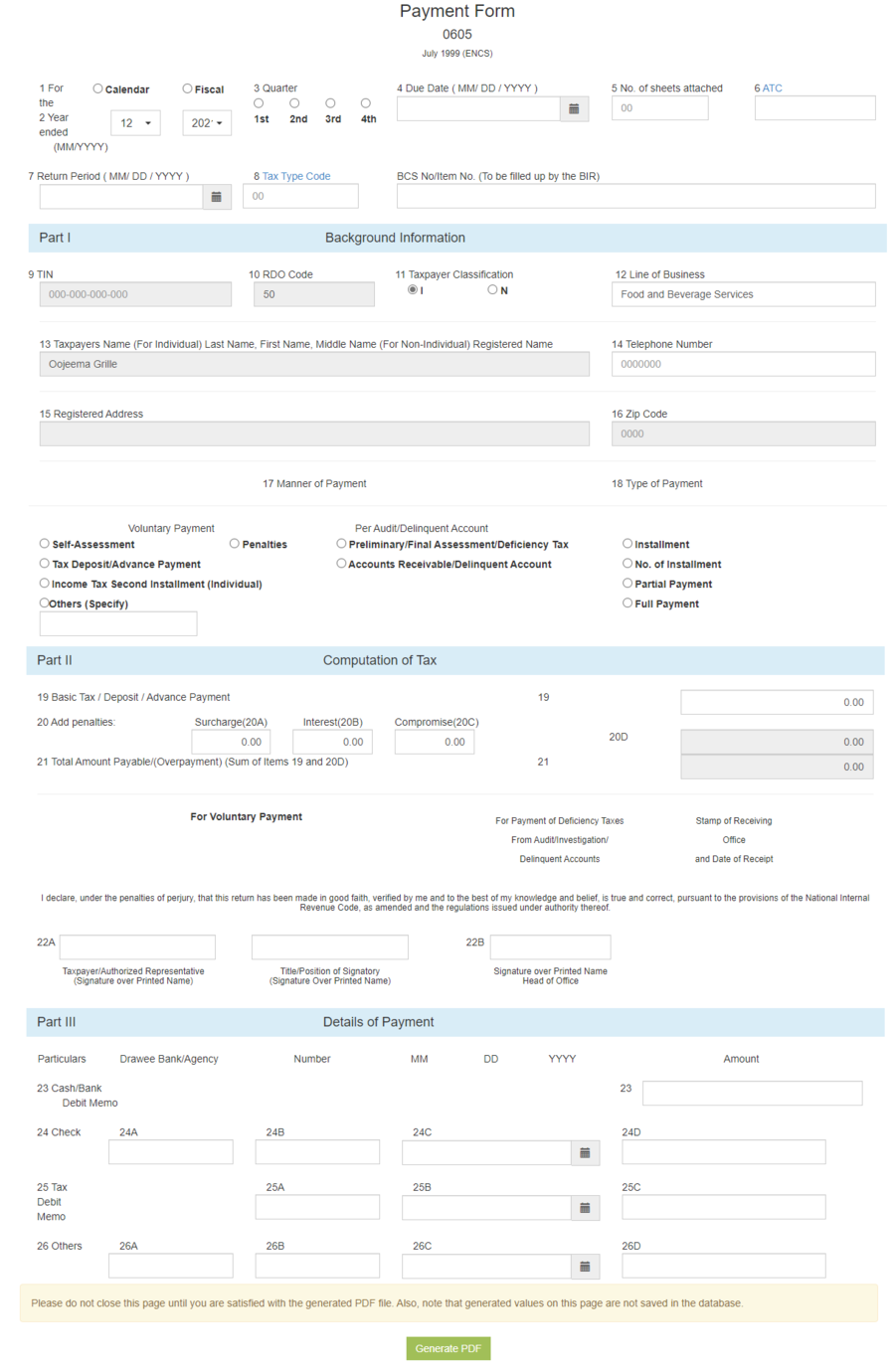

BIR Form 0605

-

- Last edited 4 years ago by Gelo

-

BIR Form 0605

BIR Form 0605 is use to pay taxes and fees which do not require the use of a tax return such as second installment payment for income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits, installment payments, etc.

| Field | Description |

|---|---|

| 1. Calendar | Refers to the type of Calendar Year of the Business.

|

| 2. Year End | The last month of the Calendar Year of the Business |

| 3. Quarter | Refers to the which quarter of the year.

|

| 4. Due Date | Due date of the form when it should be submitted.

|

| 5. Number of Sheets | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2550M

|

| 6. ATC | Alphanumeric Tax Code of the form to be submitted |

| 7. Return Period | The return period of the Tax Return |

| 8. Tax Type Code | Categorizes and controls the function of a tax detail transaction. |

| 9. TIN | Tax Identification Number of the Company/Branch |

| 10. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 11. Tax Payer Classification | Taxpayer Classification of an Individual/Business

|

| 12. Line of Business | Company's Nature of Business |

| 13. Tax Payer's Name | Registered Name for Non-Individual(Company) and Whole name for Individual |

| 14. Telephone Number | Contact Number of the Tax Payer |

| 15. Registered Address | The registered Address of the Tax Payer. |

| 16. Zip Code | Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer |

| 17. Manner of Payment | Refers how the payment will be paid if it is Voluntary or per Audit/Delinquent Account

|

| 18. Type of Payment | Nature of Payment

|

| 19. Basic Tax/ Deposit / Advance Payment | The amount to be Paid based from the manner and type of payment |

| 20. Penalties | Penalties to be applied if any

|

| 21. Total Amount Payable/Over Payment | Total Amount to be Paid base from the amount of Basic Tax/Deposit/Advance Payment(19) and Penalties(20) |

| 22. Tax payer/ Authorized Representative | Details of Tax Payer/ Authorized Representative

|

| 23. Cash / Bank Debit Memo | Amount to be paid using Cash or Debit Bank Memo |

| 24. Check | Amount to be paid using Check which includes the Bank Source, Check Number and Date Issued |

| 25. Tax Debit Memo | Amount details to be paid using Tax Debit Memo |

| 26. Others | Any details to be Applied |