You are viewing an old version of this page. Return to the latest version.

No categories assigned

Purchase Relief

-

- Last edited 3 years ago by Gelo

-

Contents

Purchase Relief

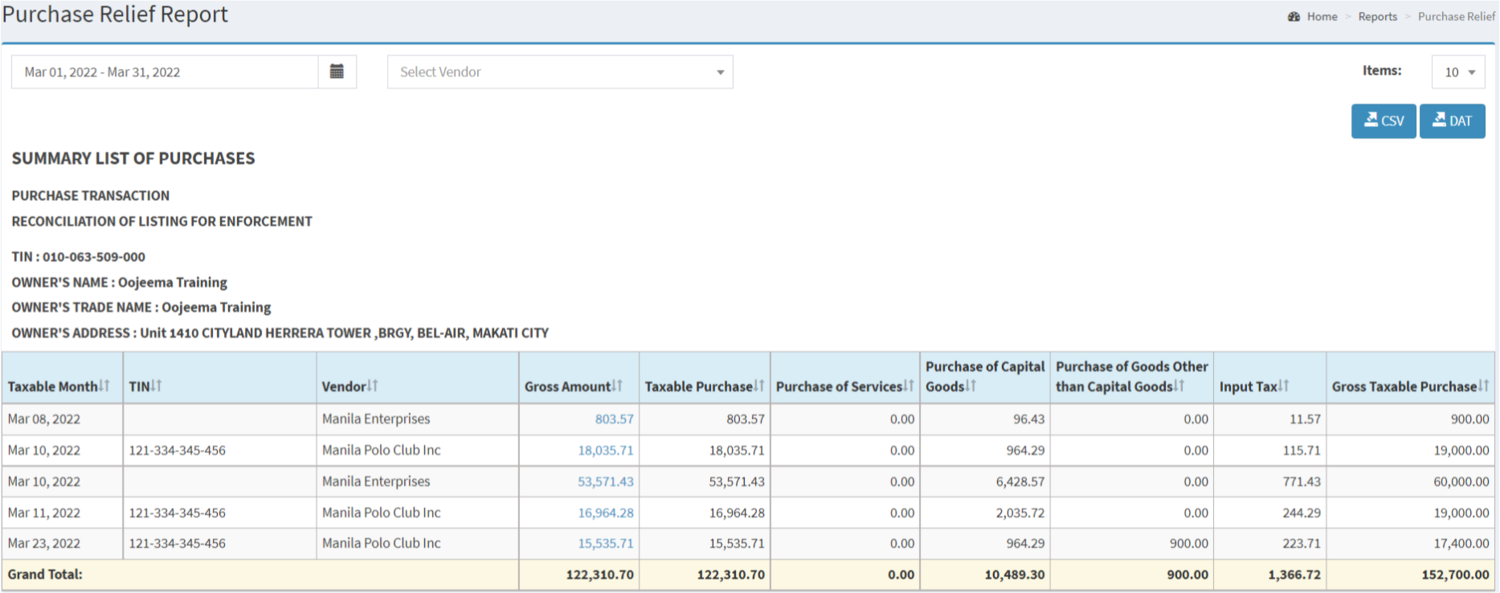

Purchase Relief Report

Purchase Relief Report refers to the Summary List of Purchases that are taxable and non taxable within the certain period.

Requirements before using Purchase Relief Report

The user should have the following records in order to use the Purchase Relief Report

| Fields | Description |

|---|---|

| 1. Record Filters(Date Range, Suppliers, Item List) | This refers to the set of filters for precise searching of records.

|

| 2. Exports | Refers on how the records want to be exported(by CSV or DAT) |

| 3. Company Details | Refers to the basic information of the Company. |

| 4. Taxable Month | Month filtered for transaction records. |

| 5. TIN | Tax Identification Number of the Supplier |

| 6. Vendor | Supplier recorded on the transaction |

| 7. Gross Amount | Amount of purchase without VAT in the transaction. |

| 8. Taxable Purchase | Purchase of a taxable product or service where the business doesn't receive sales tax for the item/service at time of closing the sale. |

| 9. Purchase of Services | Amount of purchases with regards to the services and activities provided by vendor. |

| 10. Purchase of Capital Goods | Amount of purchase based from the capital goods/physical assets bought by the Company. |

| 11. Purchase of Goods other than Capital Goods | Amount of purchase based from items aside from capital goods. |

| 12. Output Tax | The Tax amount Applied on the Taxable purchase based on what Tax is charge on the transaction |

| 13. Gross Purchase Sales | The total amount of Purchases based from the Purchases and Taxes applied. |

Notes:

- Clicking Gross Sales Transactions amount will redirect the user to the Accounts Payable transaction.

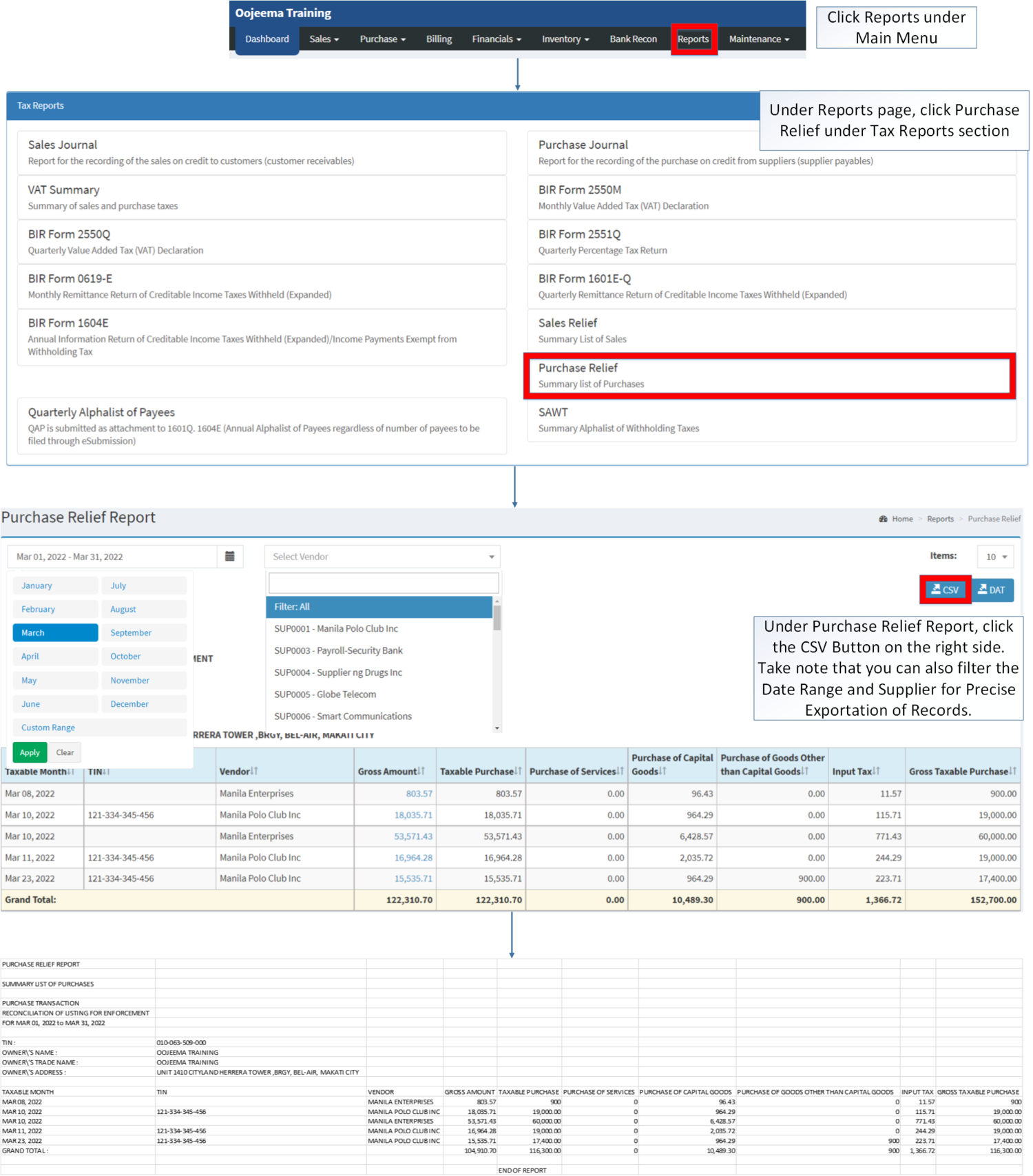

Exporting Purchase Relief Report CSV

- Click Reports Under the Main Menu.

- Under Reports Menu, Click Purchase Relief Report under Tax Reports.

- Under Purchase Relief Report, click the CSV Button on the right side. Take note that you can also filter the Date Range and Customer for Precise Exportation of Records.

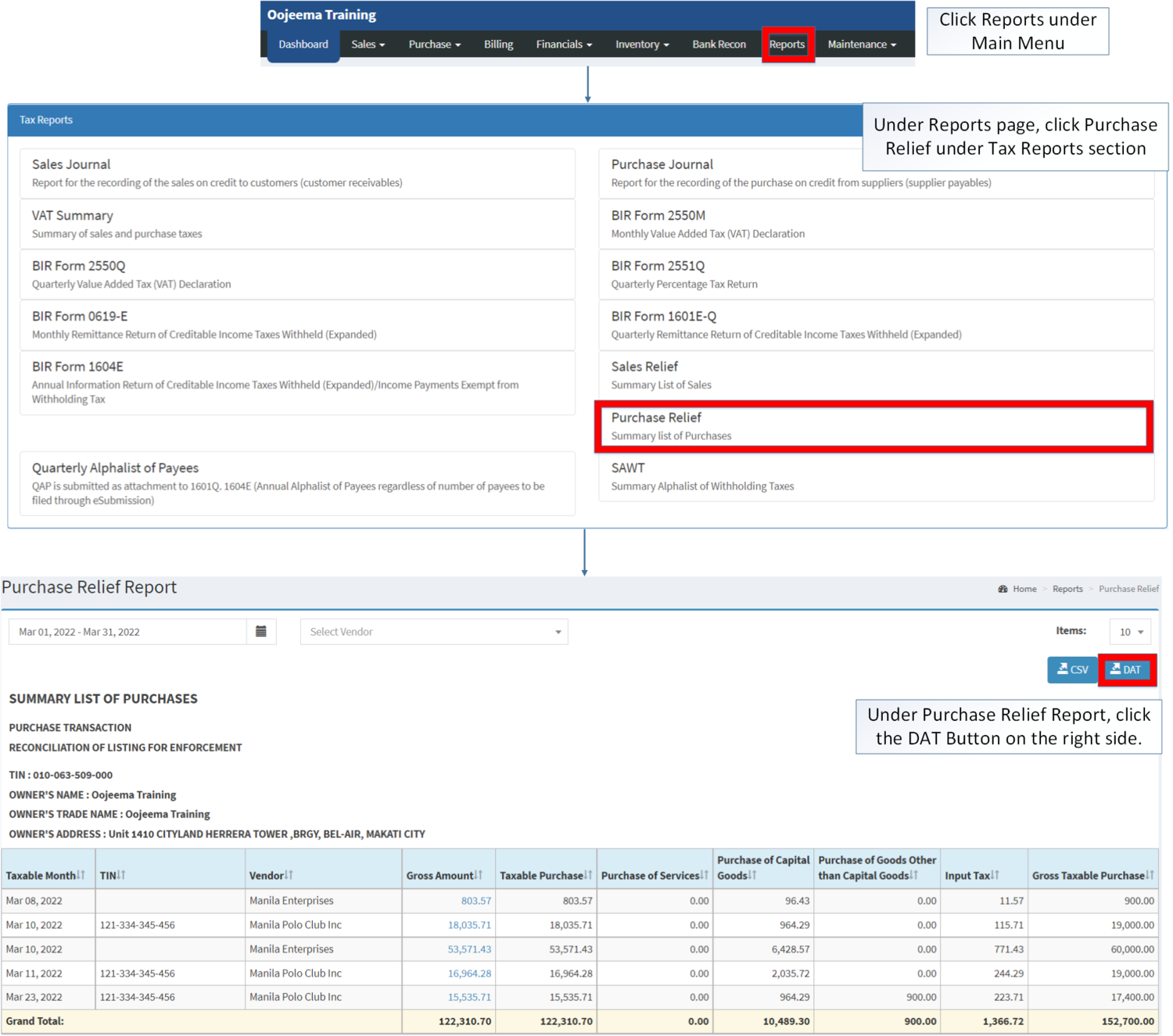

Exporting Purchase Relief Report DAT

- Click Reports Under the Main Menu.

- Under Reports Menu, Click Purchase Relief Report under Tax Reports.

- Under Purchase Relief Report, click the DAT Button on the right side.

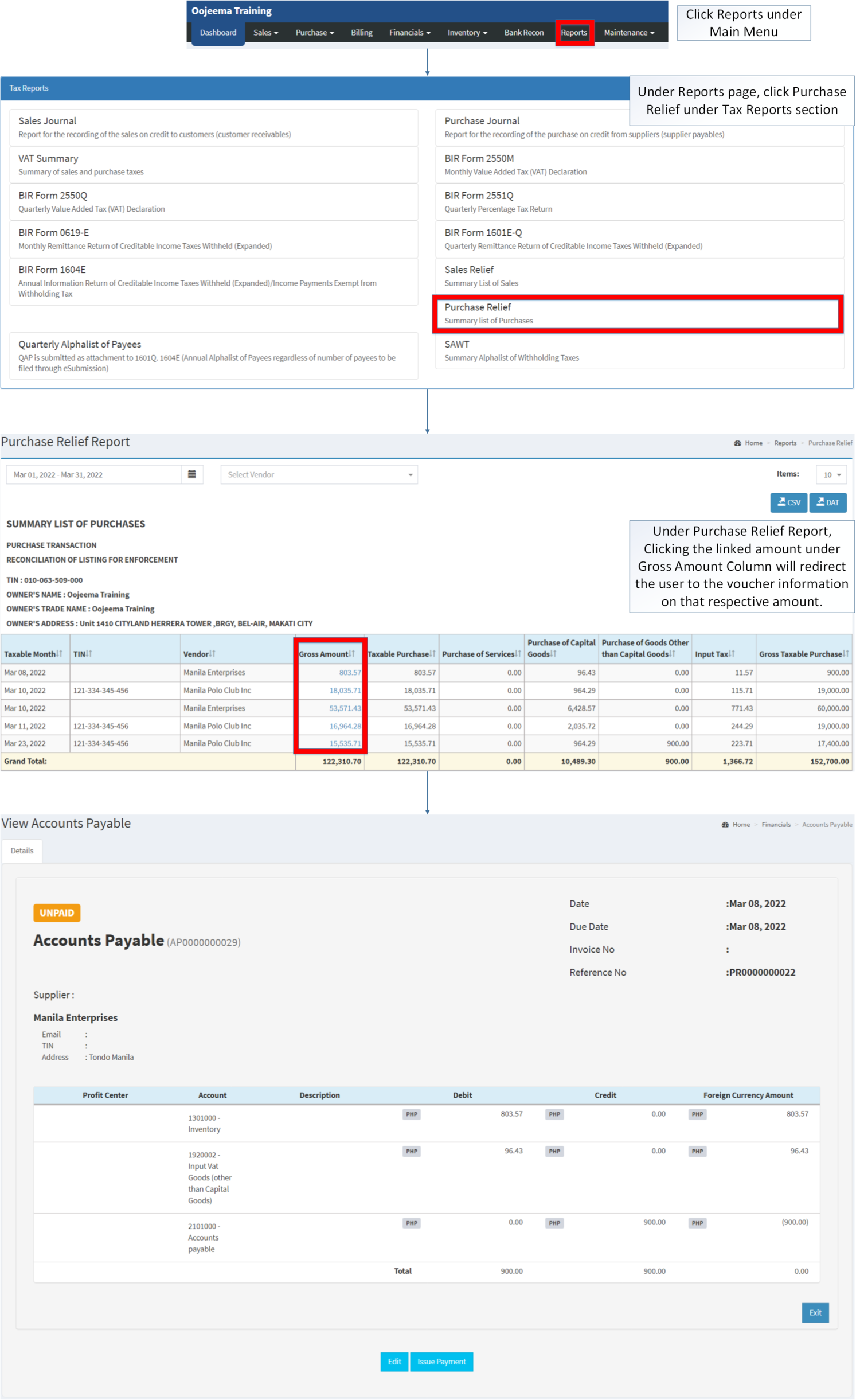

Viewing Detailed Gross Amount in Purchase Relief Report

- Under the Main Menu, Click Reports

- Under Reports Menu, Click Purchase Relief Report under Tax Reports.

- Under Purchase Relief Report, Click the linked amount under Gross Amount Column in order to redirect you to the voucher information on that respective amount.

| Modules | |

|---|---|

| Financials | Accounts Payable | Payment Voucher |

| Maintenance | Company | Supplier | Tax |

| Reports Module(Reports) | |

| Reports | Tax Reports |

| Tax Reports | Sales Journal | Purchase Journal | VAT Summary | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551Q | BIR Form 0619-E | BIR Form 1601E-Q | BIR Form 1604E | Sales Relief | Purchase Relief | Summary Alphalist of Withholding Tax |