Bank Reconciliation

-

- Last edited 3 years ago by Gelo

-

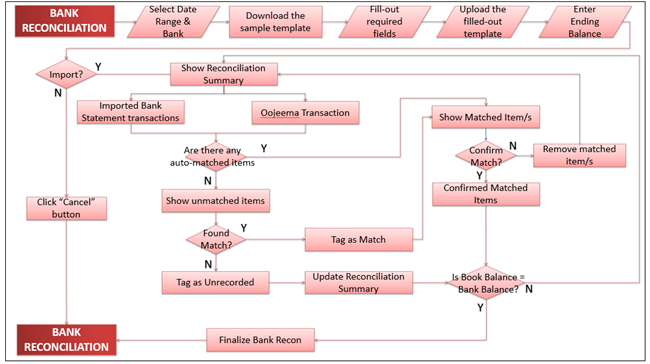

To reconcile bank accounts with entered Oojeema transactions:

Note: Must finalize the latest open range before new range can be finalized

1. On the system header menu, click “Bank Reconciliation”

2. The Import Bank Statement form will be displayed. Fill it out:

a. Select Date Range – Selection of Date Range for reconciliation (Monthly, Quarterly and Yearly)

b. Select Bank – for selection of bank account (list from Bank maintenance) to be reconciled

c. Sample Template – for downloading the Bank Statement template

d. Select file to Import – for selection of filled-out bank statement file via user’s file browser

a. Ending Balance – for entry of bank account to be reconciled ending balance; pertains to the ending bank balance from the statement provided by the bank. (Income – Expense = Ending Balance)

2. After filling-out the form, click “Import” button to import the bank statement and continue the reconciliation. Otherwise, click “Cancel” button, to discard entries and exit the form.

3. Upon clicking the “Import” button, the Tag and Match form will be displayed. It shows matched bank transactions and entered Oojeema transactions for confirmation (if any), unmatched bank transactions and entered Oojeema transactions for tagging/finding match (if applicable), and also the Reconciliation Summary.

a. Reconciliation Summary

• Balance per Bank – retrieves and displays entered Ending Balance of the imported bank statement

• Add: Deposit in Transit – sum of the amount of all the transactions tagged as “Deposit in Transit”

• Total (Balance per Bank) – system calculated: sum of Balance per Bank and Deposit in Transit

• Less: Outstanding Check – sum of the amount of all the transactions tagged as “Outstanding Check”

• Adjusted Bank Balance – system calculated: Total Bank Balance amount less Outstanding Checks amount

• Balance per Book – retrieves and displays sum of posted transaction balance amount from Oojeema’s General Ledger transactions

• Add: Unrecorded Deposit – sum of the amount of all the transactions tagged as “Unrecorded Deposit”

• Total (Balance per Book) – system calculated: sum of Balance per Book and Unrecorded Deposit

• Less: Unrecorded Withdrawal – sum of the amount of all the transactions tagged as “Unrecorded Withdrawal”

• Adjusted Book Balance – system calculated: Total Book Balance less Unrecorded Withdrawal

b. Bank Statement List – shows list of transactions found in the imported bank statement but no matched Oojeema transactions.

• To find matching Oojeema transaction, click on the “Find match” button beside the selected bank transaction to look for match. The Find Match modal will appear displaying list of possible Oojeema transaction match (if any). User can “Tag as Match” a selected Oojeema transaction on the list, if it matches the selected bank transaction, or “Tag as Unrecorded Deposit” (for bank transaction with “Income” Account Nature) or “Tag as Unrecorded Withdrawal” (for bank transaction with “Expense” Account Nature), if no Oojeema transaction matches.

o Unrecorded deposit amount will be reflected on the Reconciliation Summary: “Add: Unrecorded Deposit”

o Unrecorded withdrawal amount will be reflected on the Reconciliation Summary: “Less: Unrecorded Withdrawal”

a. Oojeema Transactions – shows list of Oojeema entered transactions but no matched transactions from the imported bank statement.

• To find matching bank transaction, click on the “Find match” button beside the selected Oojeema transaction to look for match. The Find Match modal will appear displaying list of possible bank transaction match (if any). User can “Tag as Match” a selected bank transaction on the list, if it matches the selected Oojeema transaction, or “Tag as Deposit in Transit” (for Oojeema transaction with “Income” Account Nature) or “Tag as Outstanding Cheque” (for Oojeema transaction with “Expense” Account Nature), if no bank transaction matches.

o Deposit in Transit amount will be added on the Reconciliation Summary: “Add: Deposit in Transit”

o Outstanding Cheque amount will be reflected on the Reconciliation Summary: “Less: Outstanding Check”

a. Confirmed Matched Items – shows list of all confirmed system-matched transactions.

• To discard confirmed system-matched transaction, click the “Remove” button beside the selected transaction to discard. Discarded confirmed system-matched transaction will be removed from the Confirmed Matched Items section tab list and will be displayed back to either “Bank Statement List” or “Oojeema Transaction” section tab (depending on the source of the matched transaction).

b. Matched Items – shows list of system-matched transactions.

• To confirm system-matched transaction, click the “Confirm match” button beside the selected transaction to confirm. Confirmed system-matched transaction will be removed from the Matched Items section list and will be displayed on “Confirmed Matched Items” section tab.

• To discard system-matched transaction, click the “Remove” button beside the selected transaction to discard. Discarded system-matched transaction will be removed from the Matched Items section list and will be displayed back to either “Bank Statement List” or “Oojeema Transaction” section tab (depending on the source of the matched transaction).

2. When all transactions are tagged and balance (Total amount of Balance per Book is equal to the Total amount of Balance per Bank), system will enable the “Finalize Bank Reconciliation” button. Click the said button to finish reconciling. A confirmation message will be displayed upon clicking the said button.

Note: User can create a Journal Entry when the “Balance per Book” and “Balance per Bank” are not balanced/equal even if all tagging and matching was done.