You are viewing an old version of this page. Return to the latest version.

Version of 11:45, 14 June 2021 by Gelo

No categories assigned

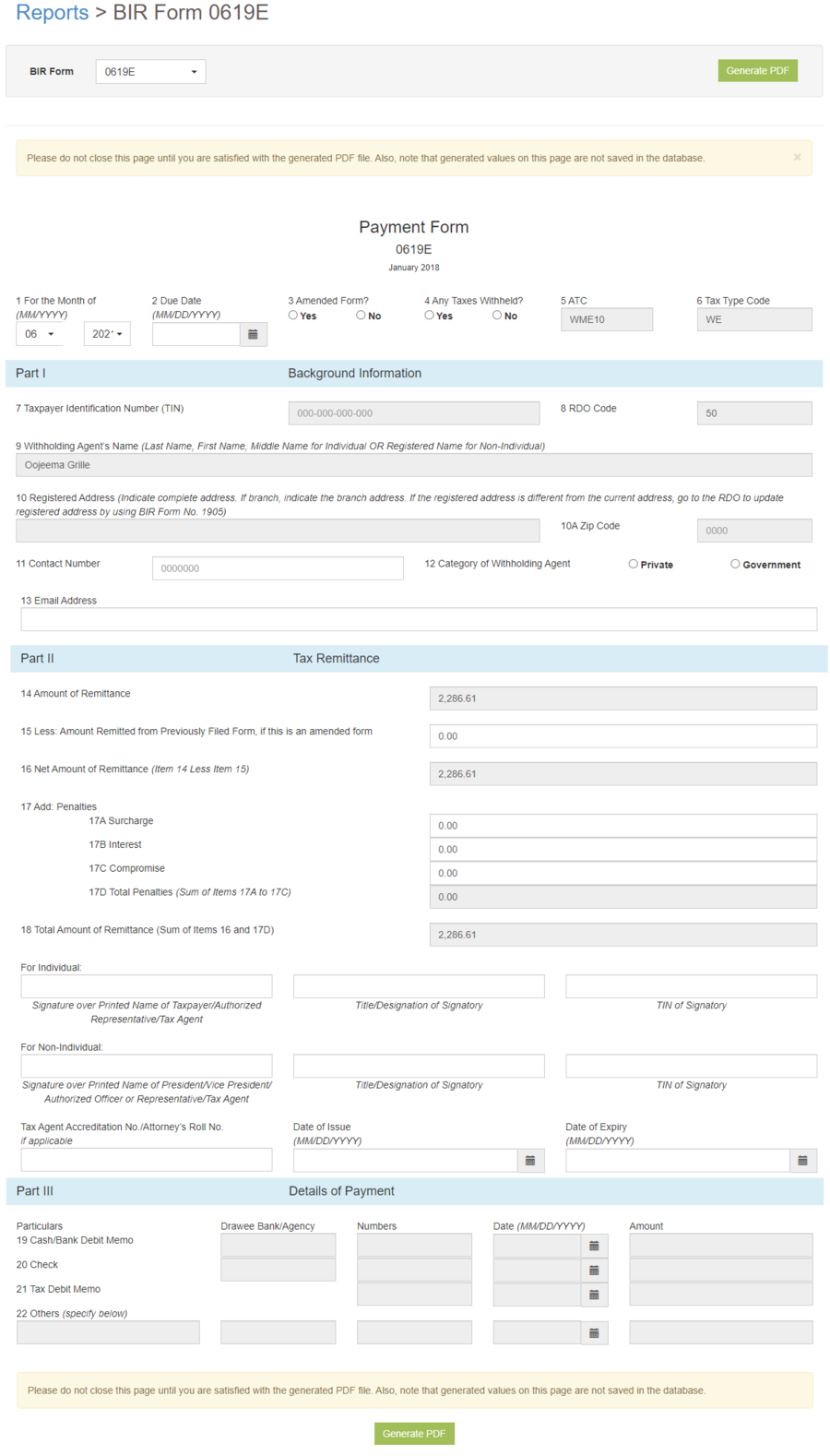

BIR Form 0619E

-

- Last edited 4 years ago by Gelo

-

BIR Form 0619E

BIR Form 0619-E also known as Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded). This is use to file creditable or expanded withholding taxes. These taxes are prescribed on specific incomes (e.g. professional talent fees, rental income, and payment to contractors).

| Field | Description |

|---|---|

| 1. Month Year | Month and year when the BIR Form 0619-E was issued. |

| 2. Due Date | Due date of the form when it should be submitted.

|

| 3. Amended Form | is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 4. Taxes Withheld | Any tax amount that an employer withholds from an employee's wages and pays directly to the government. |

| 5. ATC | Alphanumeric Tax Codes declared in the Form |

| 6. Tax Type Code | Reference code on Tax on the Form. |

| Part I - Background Information | |

| 7. TIN | Tax Identification Number of an Individual or Business |

| 8. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 9. Withholding Agent’s Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 10. Registered Address | The registered Address of the Tax Payer.

|

| 11. Contact Number | Contact Number of the Tax Payer(Individual/Business). |

| 12. Withholding Agent Category | Withholding Agent Category

|

| 13. Email Address | Email Address of the Tax Payer |

| Part II - Tax Remittance | |

| 14. Amount of Remittance | Amount of currency to be transferred back. |

| 15. Less : Amount Remitted from Previously Filed Form, if this is an amended form | Amount remitted from the last Form considering if the form submitted is amended form. |

| 16. Net Amount of Remittance | Total Amount of Remittance based from the amount of Remittance less from Amount Remitted from Previous form. |

| 17. Penalties | Penalties to be applied if there is any.

|

| 18. Total Amount of Remittance(Sum of 16 and 17D) | Total Amount of Remittance based from the Net Amount of Remittance and the Total Penalties implied. |

| For Individual | Information of Signatory

|

| For Non-Individual | Information of Signatory

|

| Tax Agent Accreditation No./Attorney’s Roll No.if applicable | Applicable if there is a personal lawyer in charge in the business/individual. Below are the further needed information if it is applicable.

|

| Part III - Details of Payment | |

| 19. Cash/Bank Debit Memo | Amount to be paid using Cash or Debit Bank Memo |

| 20. Check | Amount to be paid using Check which includes the Bank Source, Check Number and Date Issued |

| 21. Tax Debit Memo | Amount details to be paid using Tax Debit Memo |

| 22. Others (specify below) | Any details to be Applied |