You are viewing an old version of this page. Return to the latest version.

No categories assigned

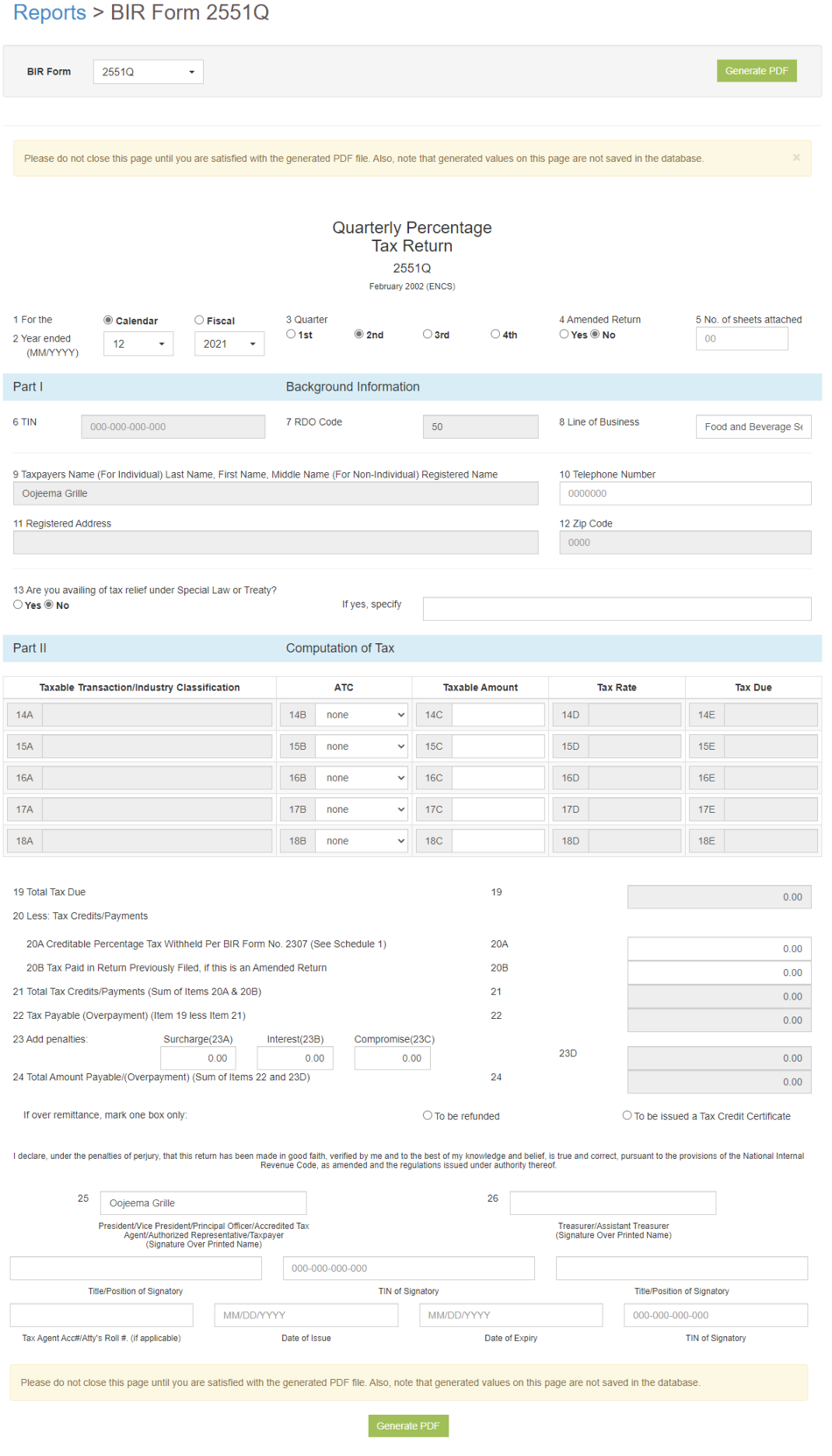

BIR Form 2551Q

-

- Last edited 4 years ago by Gelo

-

BIR FORM 2551Q

BIR Form 2551Q refers to the Quarterly Percentage Tax Return. These taxes imposed on individuals or businesses who sell goods or services which are exempted from VAT.

| Fields | Description |

|---|---|

| 1. Month Year | Month and year when the BIR Form 2551Q was issued. |

| 2. Year Ended | Refers to the last day of the Year. |

| 3. Quarter | Refers to the which quarter of the year.

|

| 4. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 5. No. of Sheets Attached | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2551Q |

| Part I - Background Information | |

| 6. TIN | Tax Identification Number of an Individual or Business |

| 7. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 8. Tax Payer's Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 9. Registered Address | The registered Address of the Tax Payer.

|

| 10. Contact Number | Contact Number of the Tax Payer(Individual/Business). |

| 11. Email Address | Email Address of the Tax Payer |

| 12. Tax Relief | (Optional)

Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty |

| 13. Income Tax Rate | (Optional)

Only for individual taxpayers whose sales/receipts are subject to Percentage Tax under Section 116 of the Tax Code

|

| Part II - Computation of Tax | |

| 14. Total Tax Due | The total Tax due based from the breakdown of Schedule 1 Computation of Tax Sheet. |

| 15. Creditable Percentage Tax Withheld Per BIR FORM No. 2307 | This certificate exhibits the income that is subjugated to Expanded Withholding Tax (EWT) that is paid by a withholding agent. |

| 16. Tax Paid in Return Previously Filed, if this is an Amended Return | Tax Paid Return based from the Amended Return of the previous Form. |

| 17. Other Tax Credit/Payment | Any Tax Credit or Payment to be deducted. |

| 18. Total Tax Credits/Payments (Sum of Items 15 & 17) | Total Tax Credits/Payments to be deducted to Total Tax Due |

| 19. Tax Payable (Overpayment) (Item 14 less Item 18) | Total Tax Payable based from the Total Tax Due less the total credits/payments. |

| 20 - 22. Penalties | List of Penalties:

|

| 23. Total Penalties (Sum of Items 20 to 22) | Total Penalties applied if any. |

| 24. Total Amount Payable(Overpayment)(Sum of Items 19 and 23) | Total Amount Payable based from Tax Payable and Total Penalties.

|

| 25. President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name) |

President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details

25.

|

| 26. Treasurer/Assistant Treasurer (Signature Over Printed Name) | Treasurer/Assistant Treasurer details

25.

|