You are viewing an old version of this page. Return to the latest version.

No categories assigned

Pro Purchase Relief

-

- Last edited 4 years ago by Gelo

-

Purchase Relief

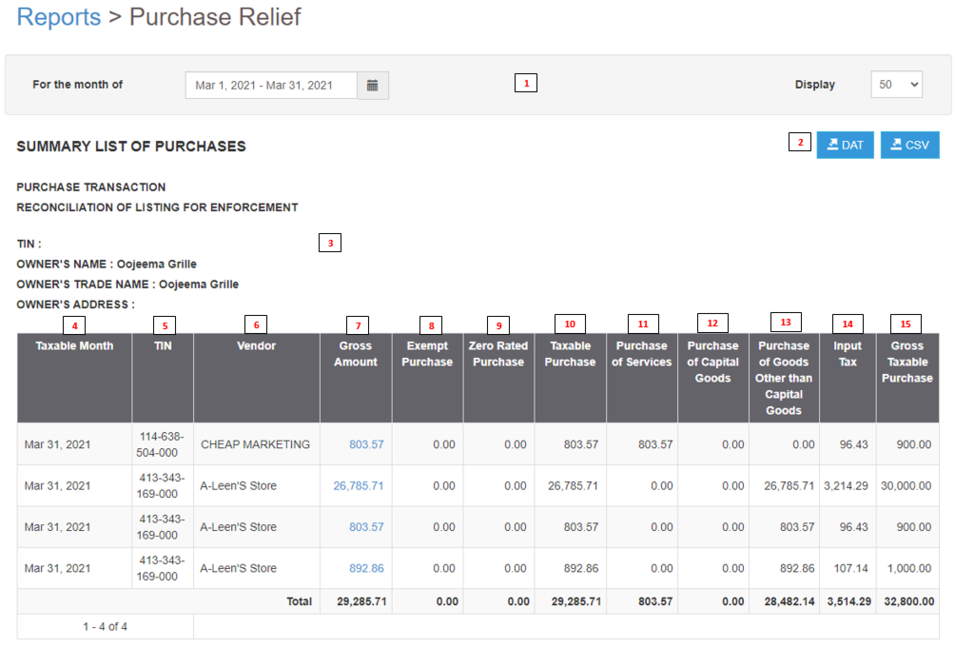

Purchase Relief Report refers to the summary list of purchases within a certain period.

| Fields | Description |

|---|---|

| 1. Record Filters(Date Range, Suppliers, Item List) | This refers to the set of filters for precise searching of records.

|

| 2. Exports | Refers on how the records want to be exported(by CSV or DAT) |

| 3. Company Details | Refers to the basic information of the Company. |

| 4. Taxable Month | Month filtered for transaction records. |

| 5. TIN | Tax Identification Number of the Vendor |

| 6. Vendor | Vendor recorded on the transaction |

| 7. Gross Amount | Amount of purchase without VAT in the transaction. |

| 8. Exempt Purchase | Amount purchase exempted. |

| 9. Zero Rated Purchase | Amount of the purchase when Zero Rated Purchase is applied |

| 10. Taxable Purchase | Purchase of a taxable product or service where the business doesn't receive sales tax for the item/service at time of closing the sale. |

| 11. Purchase of Services | Amount of purchases with regards to the services and activities provided by vendor. |

| 12. Purchase of Capital Goods | Amount of purchase based from the capital goods/physical assets bought by the Company. |

| 13. Purchase of Goods other than Capital Goods | Amount of purchase based from items aside from capital goods. |

| 14. Output Tax | The Tax amount Applied on the Taxable purchase based on what Tax is charge on the transaction |

| 15. Gross Purchase Sales | The total amount of Purchases based from the Purchases and Taxes applied. |