You are viewing an old version of this page. Return to the latest version.

No categories assigned

Tax

-

- Last edited 3 years ago by Gelo

-

Contents

Tax

This maintenance screen allows the user to configure and add tax types to be used on their transactions.

Requirements before using Tax

- The user should setup the following Maintenance Module in order to proceed on using the Tax

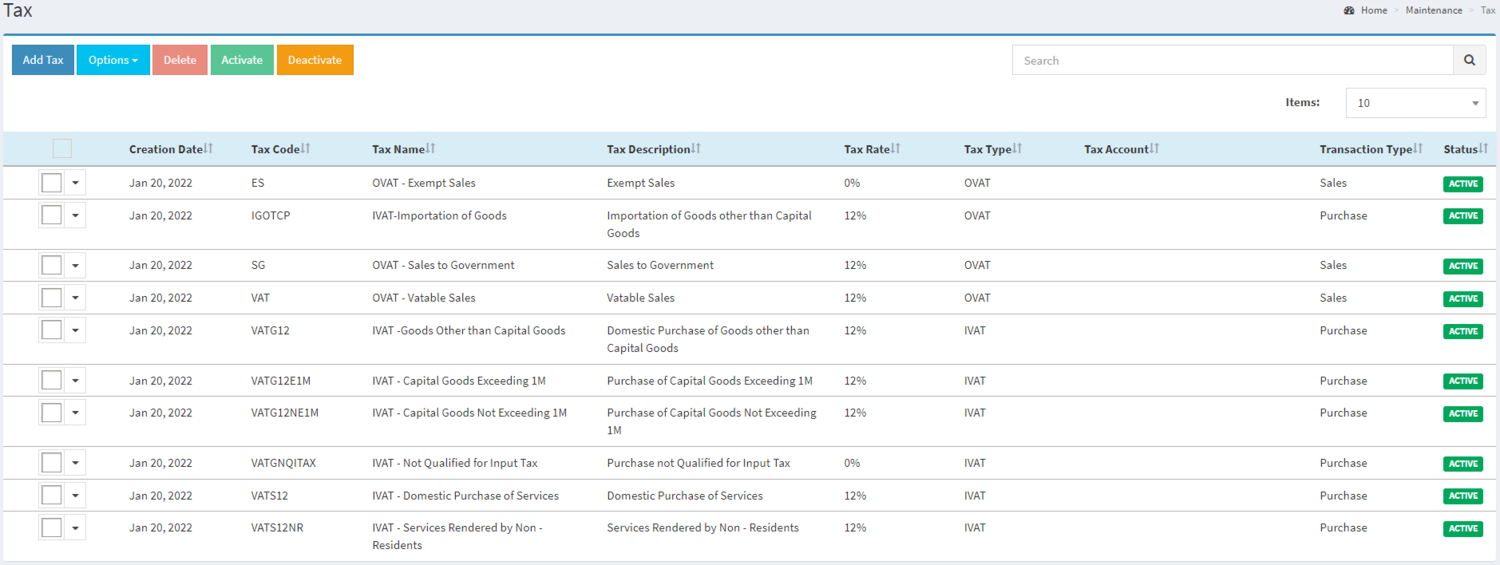

Tax Record List

Notes:

- Tax, as long as its status is ACTIVE can be used in the following modules:

- Sales Quotation

- Sales Order

- Sales Invoice

- Purchase Order

- Accounts Payable

- Accounts Receivable

- Accounts Receivable generated from Sales Invoice cannot be edited

- Past Transactions with INACTIVE tax can still be used prior to its deactivation but for new transactions, INACTIVE tax cannot be used.

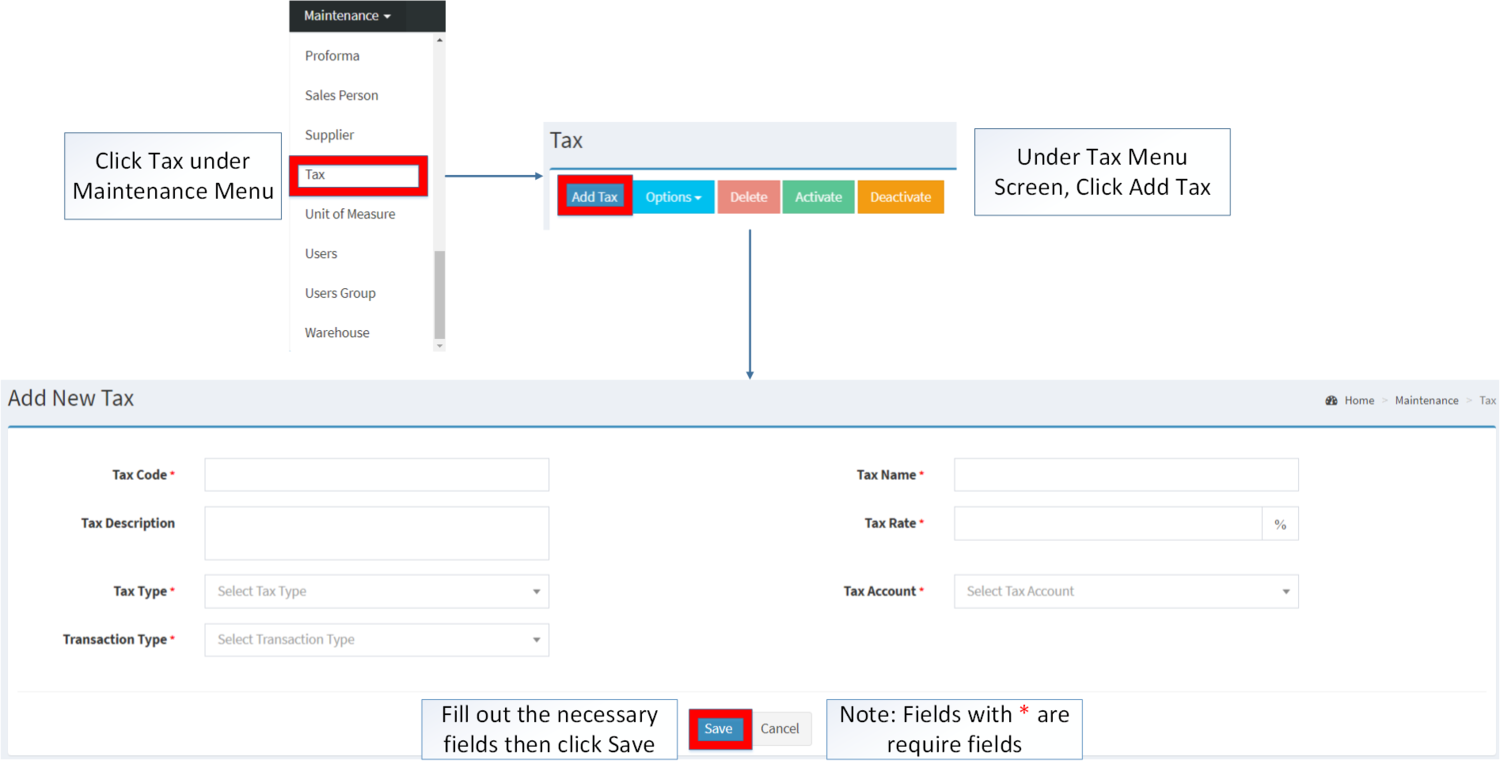

Adding Tax Record

- Go to Maintenance then click Tax

- Click Add Tax Button

- Fill up the necessary fields. Please make sure that all tabs are filled out then click Save.

| Field | Description | Expected Output |

|---|---|---|

| 1.Tax Code | •Reference Code for Tax | •Alphanumeric |

| 2.Tax Name | •Name of Tax | •Alphanumeric |

| 3.Tax Description | •Description of Tax | •Alphanumeric |

| 4.Tax Rate | •Rate to be Apply when applying tax | •Number |

| 5.Tax Type | •Nature of Tax | •Tax Type Field List |

| 6.Tax Account | •Account to be applied when applying tax | •Account List under Chart of Account Maintenance Module |

| 7.Transaction Type | •Type of Transaction when applying Tax | •Sales/Purchase/Both |

Notes:

- Tax Code is a unique required field in the Module. This field cannot be edited once the Tax Record is created.

- Tax Count is a required field. Accounts can be used from Chart of Account as long as the status of that account is ACTIVE

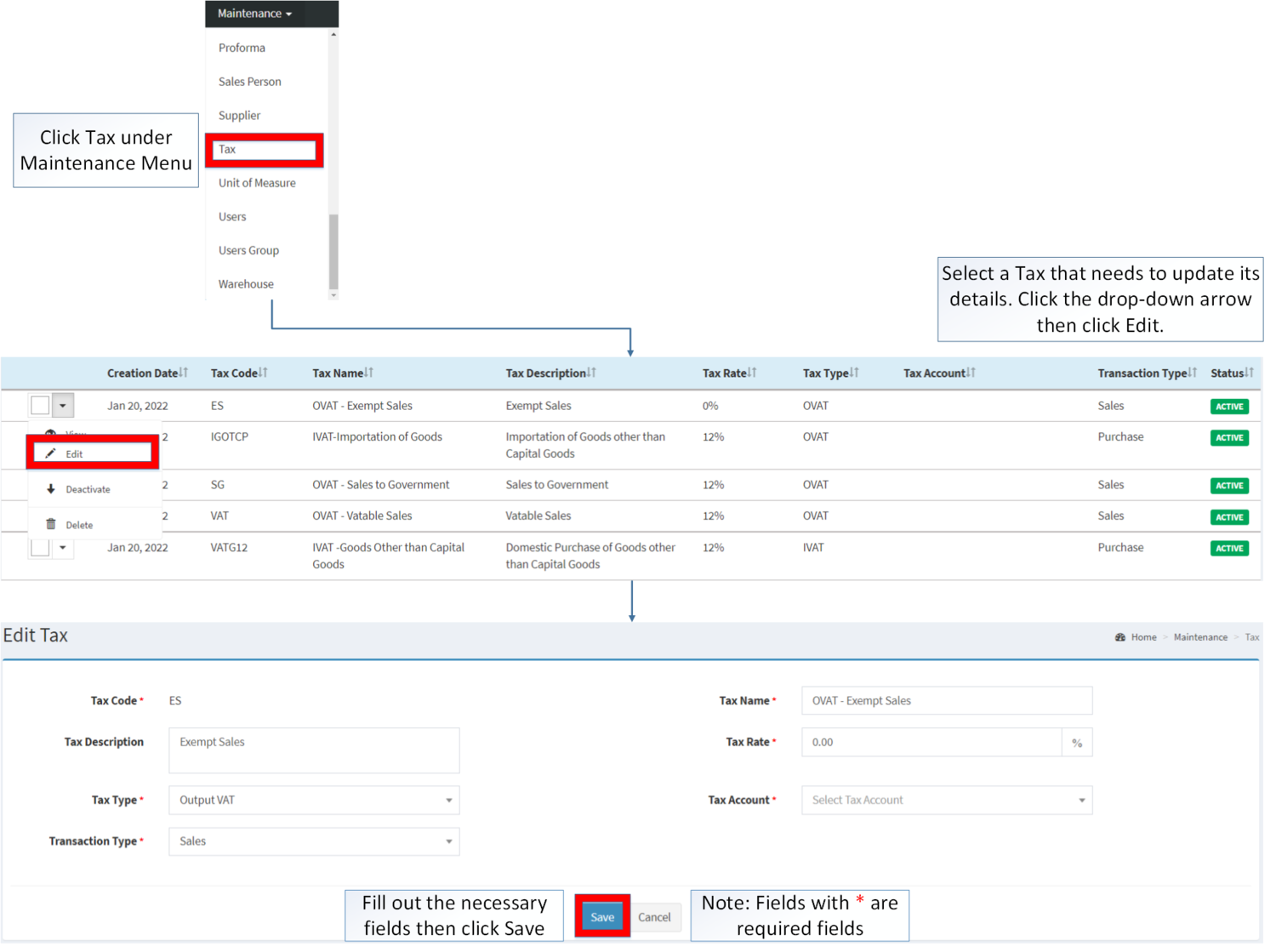

Editing Tax Record

- Go to Maintenance then click Tax

- Select the Tax that needs an update. Click the drop-down arrow then click Edit

- Update the necessary Fields and Click Save

| Field | Description | Expected Output |

|---|---|---|

| 1.Tax Name | •Name of Tax | •Alphanumeric |

| 2.Tax Description | •Description of Tax | •Alphanumeric |

| 3.Tax Rate | •Rate to be Apply when applying tax | •Number |

| 4.Tax Type | •Nature of Tax | •Tax Type Field List |

| 5.Tax Account | •Account to be applied when applying tax | •Account List under Chart of Account Maintenance Module |

| 6.Transaction Type | •Type of Transaction when applying Tax | •Sales/Purchase/Both |

Notes:

- Tax Count is a required field. Accounts can be used from Chart of Accounts as long as the status of that account is ACTIVE

- The status of Accounts can be seen in Chart of Account Maintenance Module

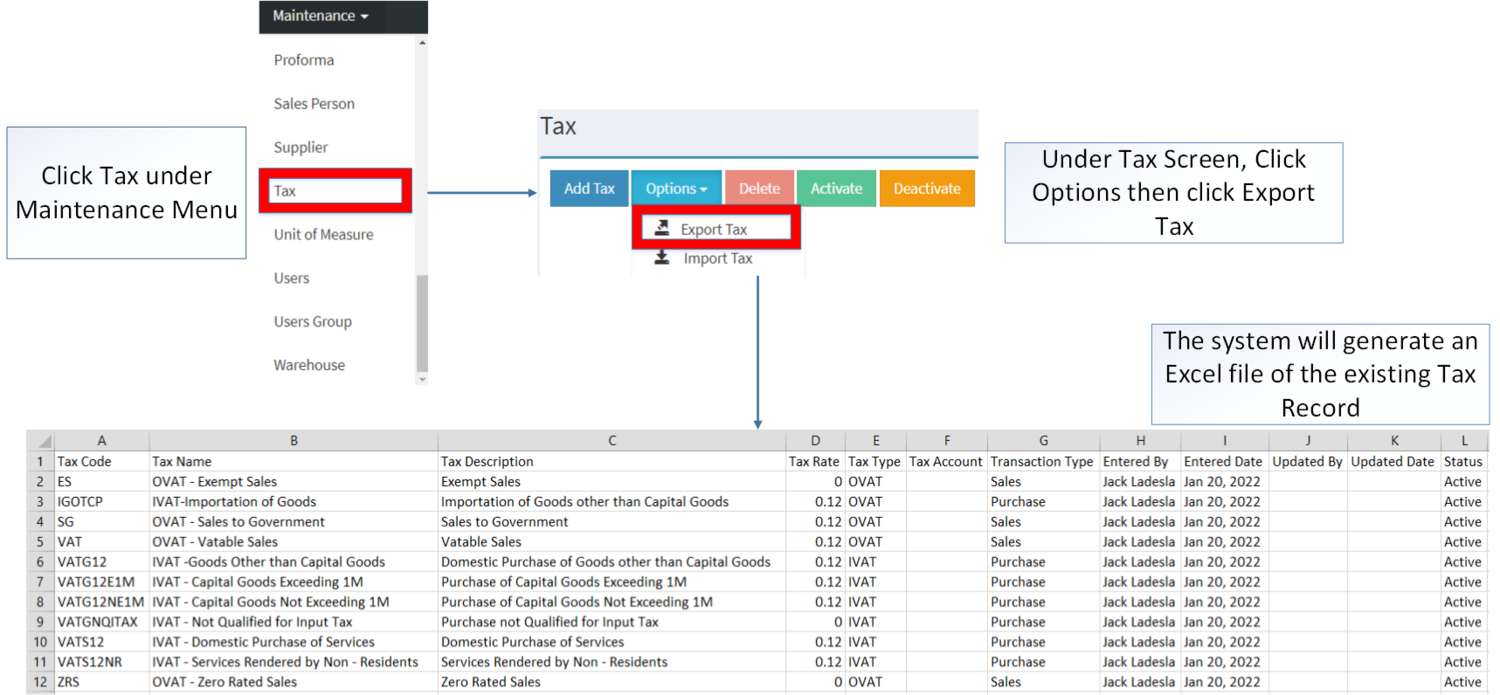

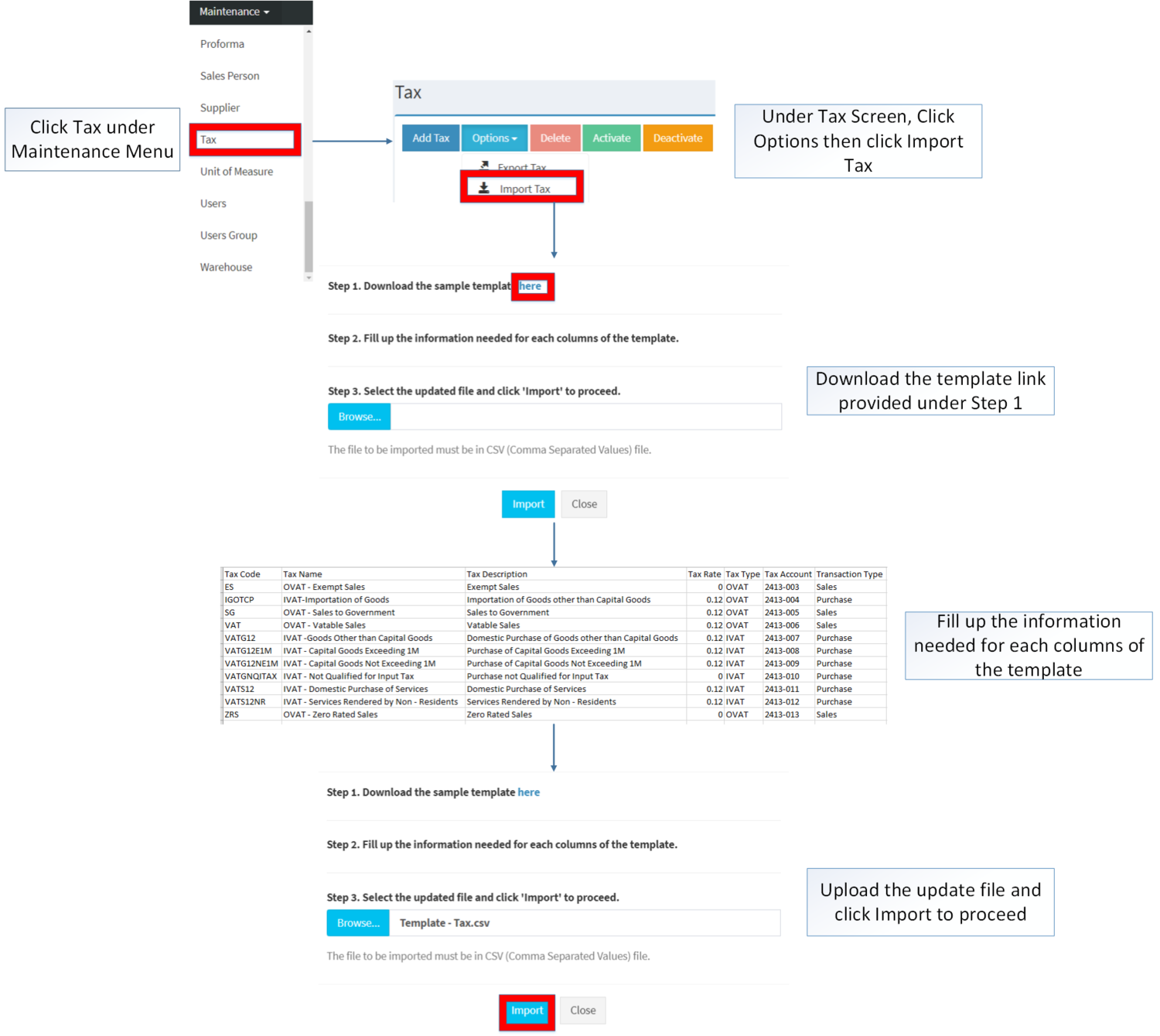

Importing and Exporting Option

1. Under Tax Maintenance Screen, Click Options

2. Under Options, The user may Export or Import The Record

- When Exporting the records, the user may also use the filter options through tabs for precise searching and exporting of records.

- When Importing the records, the user should follow the following steps provided in the Importing Tax Screen such as

- Downloading the template link provided under Step 1.

- Filling up the information needed for each columns of the template

- Uploading the updated Template

| Field | Description | Allowed Inputs | Input Restrictions | Required Field? |

|---|---|---|---|---|

| 1.Tax Code | Reference Code for Tax | *Alphanumeric

*Special Characters |

*Up to 10 characters | Yes |

| 2.Tax Name | Name of Tax | *Alphanumeric

*Special Characters |

*Up to 50 characters | Yes |

| 3.Tax Description | Description of Tax | *Alphanumeric

*Special Characters |

*Up to 100 characters | No |

| 4.Tax Rate | Rate to be Apply when applying tax | *Numeric(1-100) | *Any input greater than 100

*Alphabet *Special Characters |

Yes |

| 5.Tax Type | Nature of Tax | *Input Tax

*Output Tax *Percentage Tax *Withholding Tax |

*Any inputs not mentioned in the allowed inputs | Yes |

| 6.Tax Account | Account to be applied when applying tax | *Account Code under Account List provided in Chart of Account Maintenance Module | *Any inputs not mentioned in the allowed inputs | Yes |

| 7.Transaction Type | Type of Transaction when applying Tax | *Sales

*Purchase *Both |

*Any inputs not mentioned in the allowed inputs | Yes |

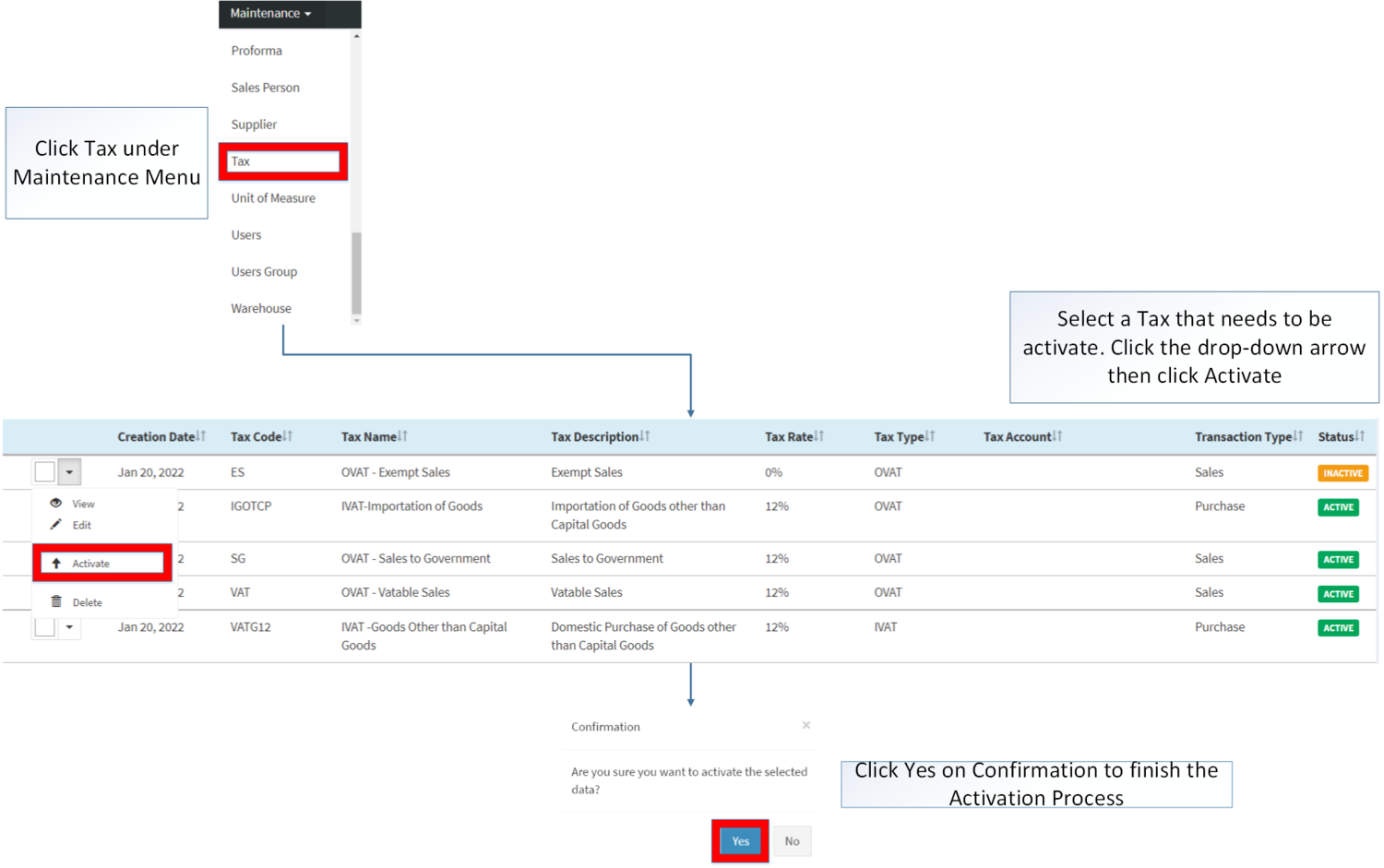

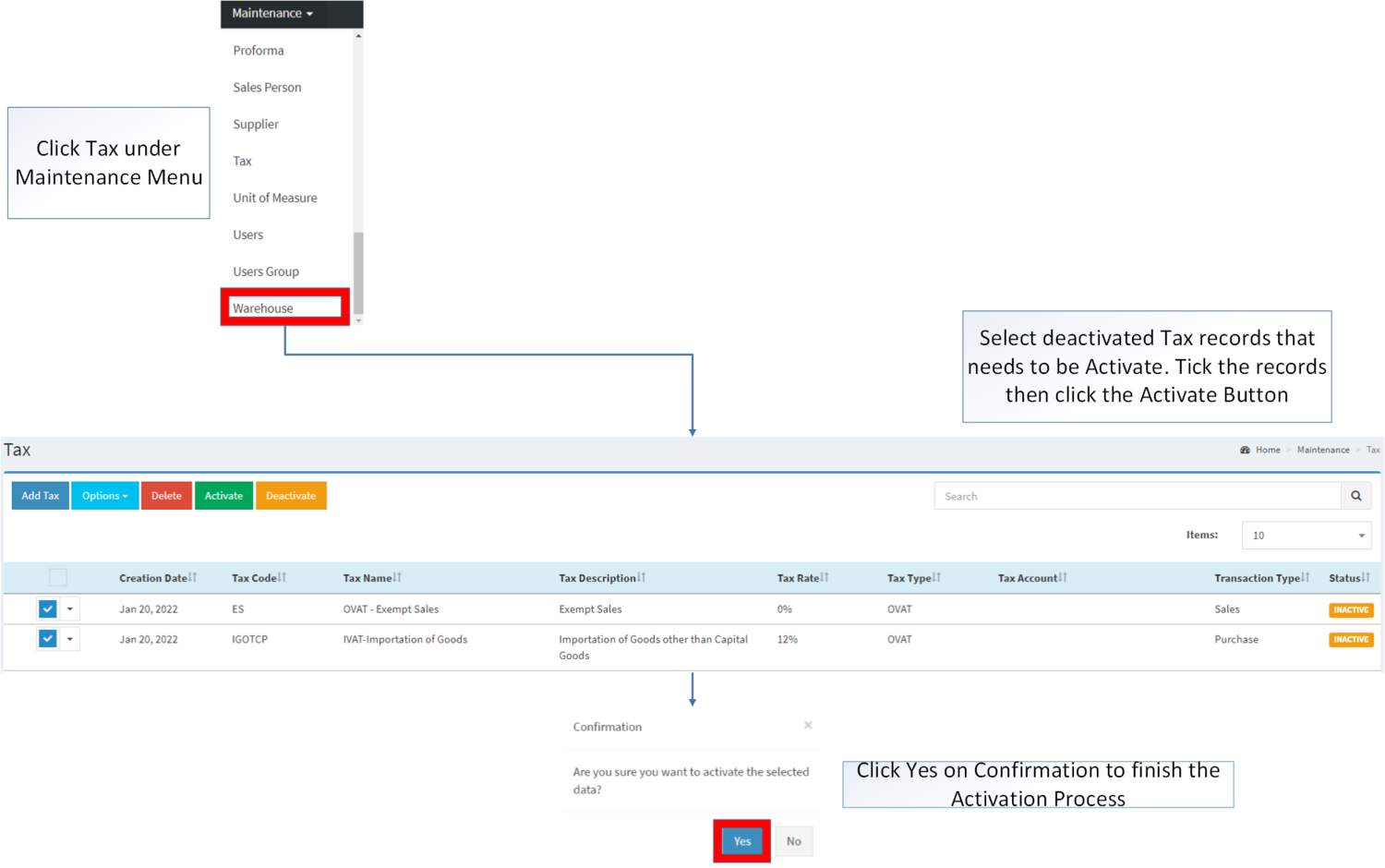

Activating Tax Record

Tax can be Activated in two ways:

- Using drop-down arrow of a record can be used in single record Activation

- Using Activate Button for activating multiple record

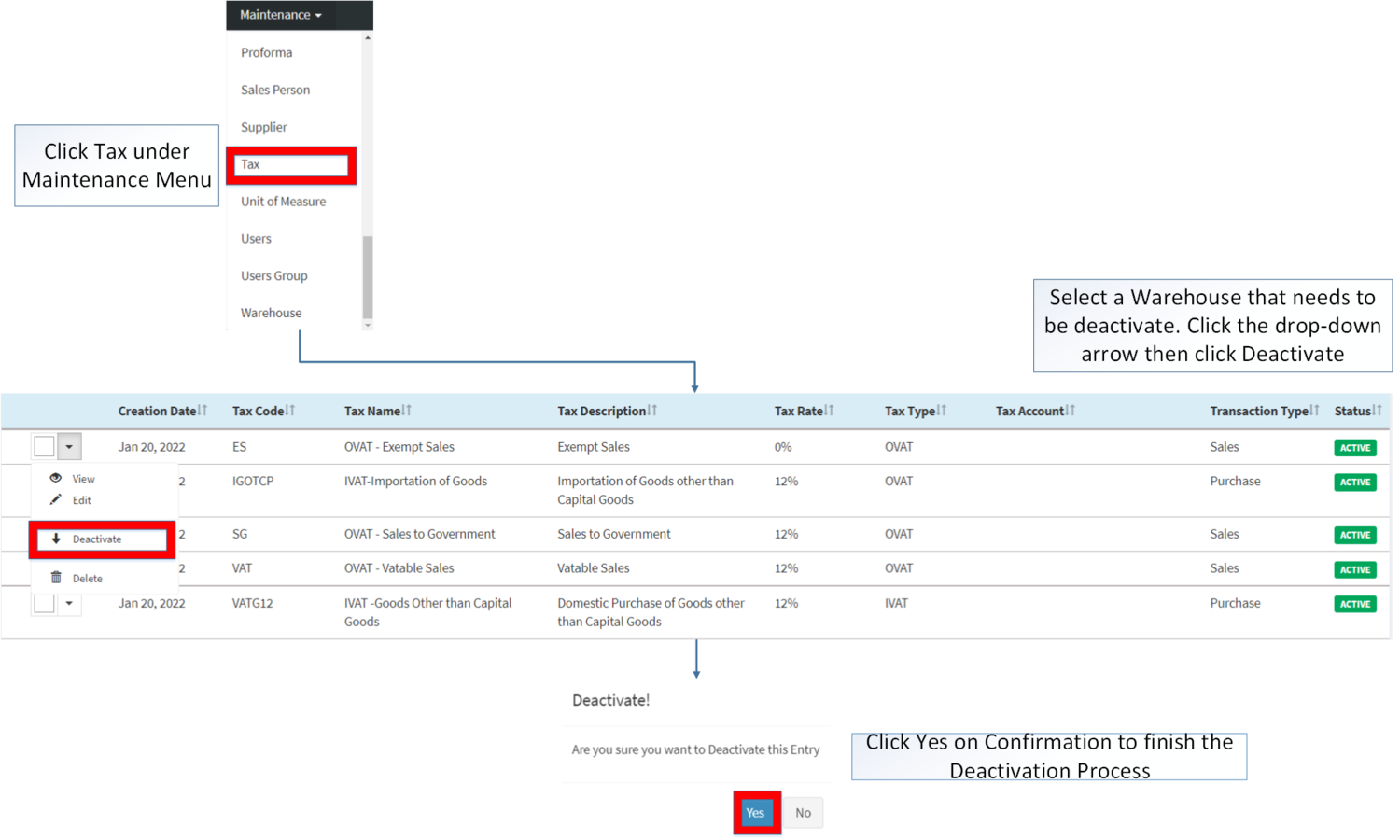

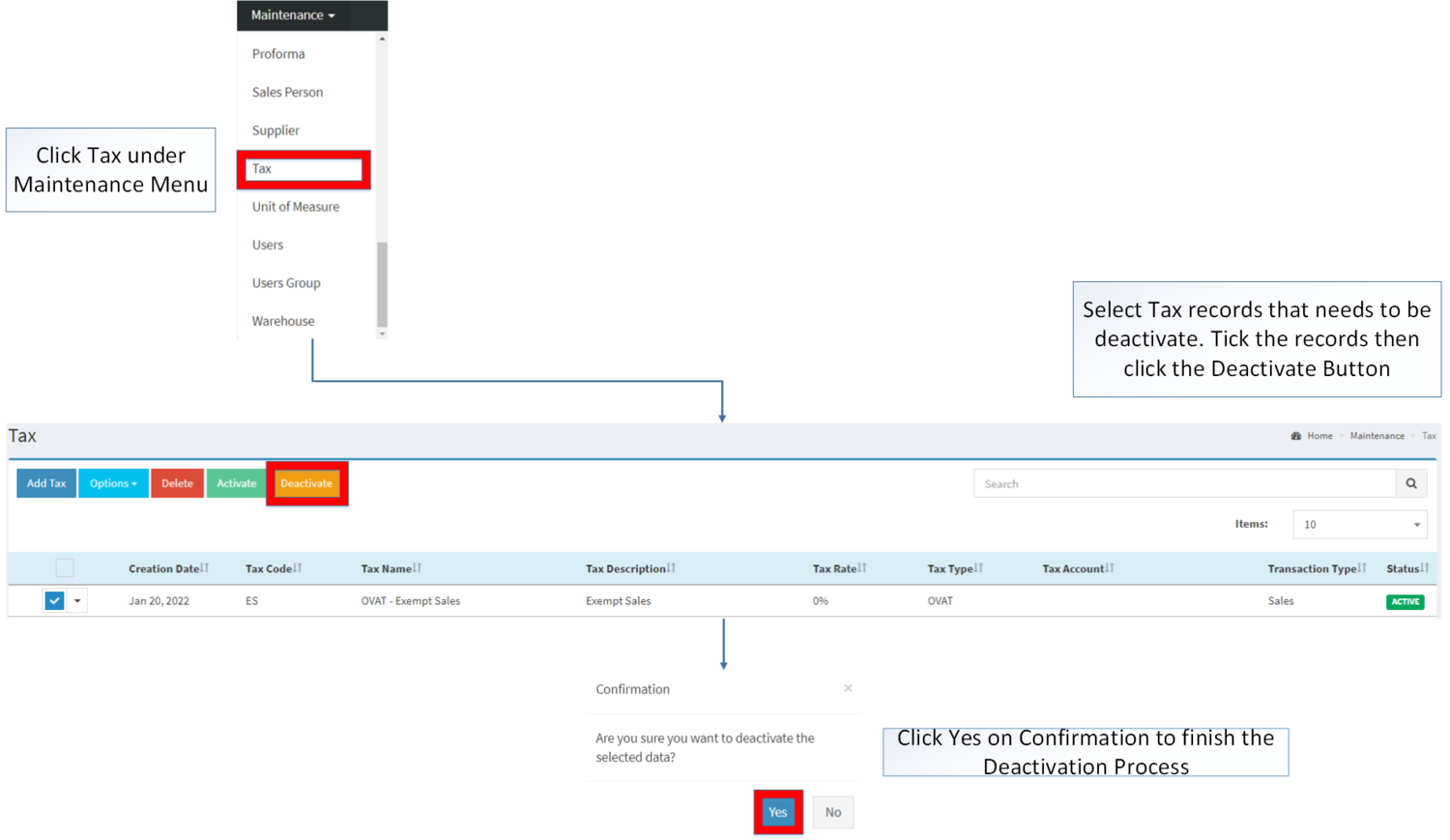

Deactivating Tax Record

Tax can be deactivated in two ways:

- Using drop-down arrow of a record can be used in single record deactivation

- Using Deactivate Button for deactivating multiple record

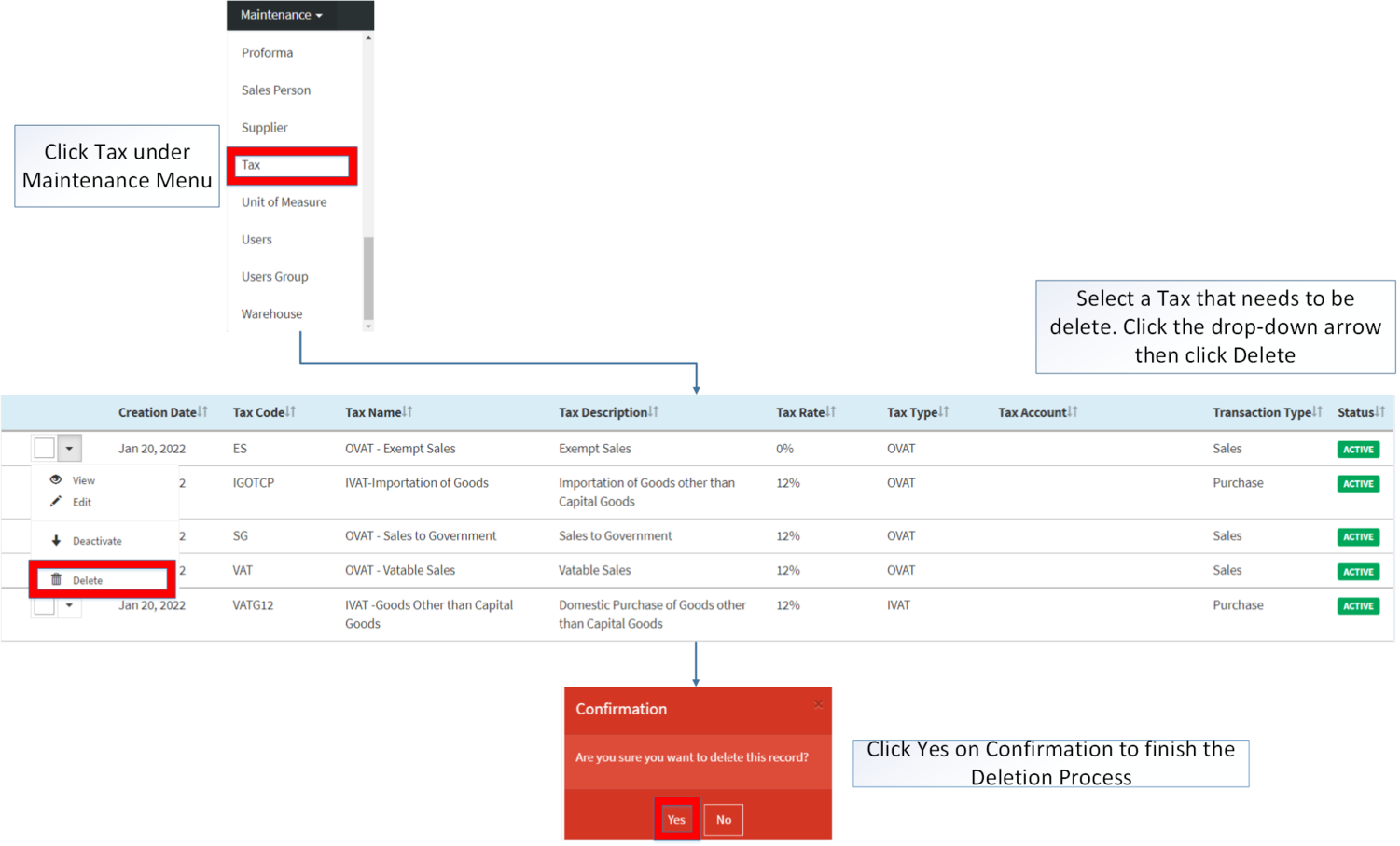

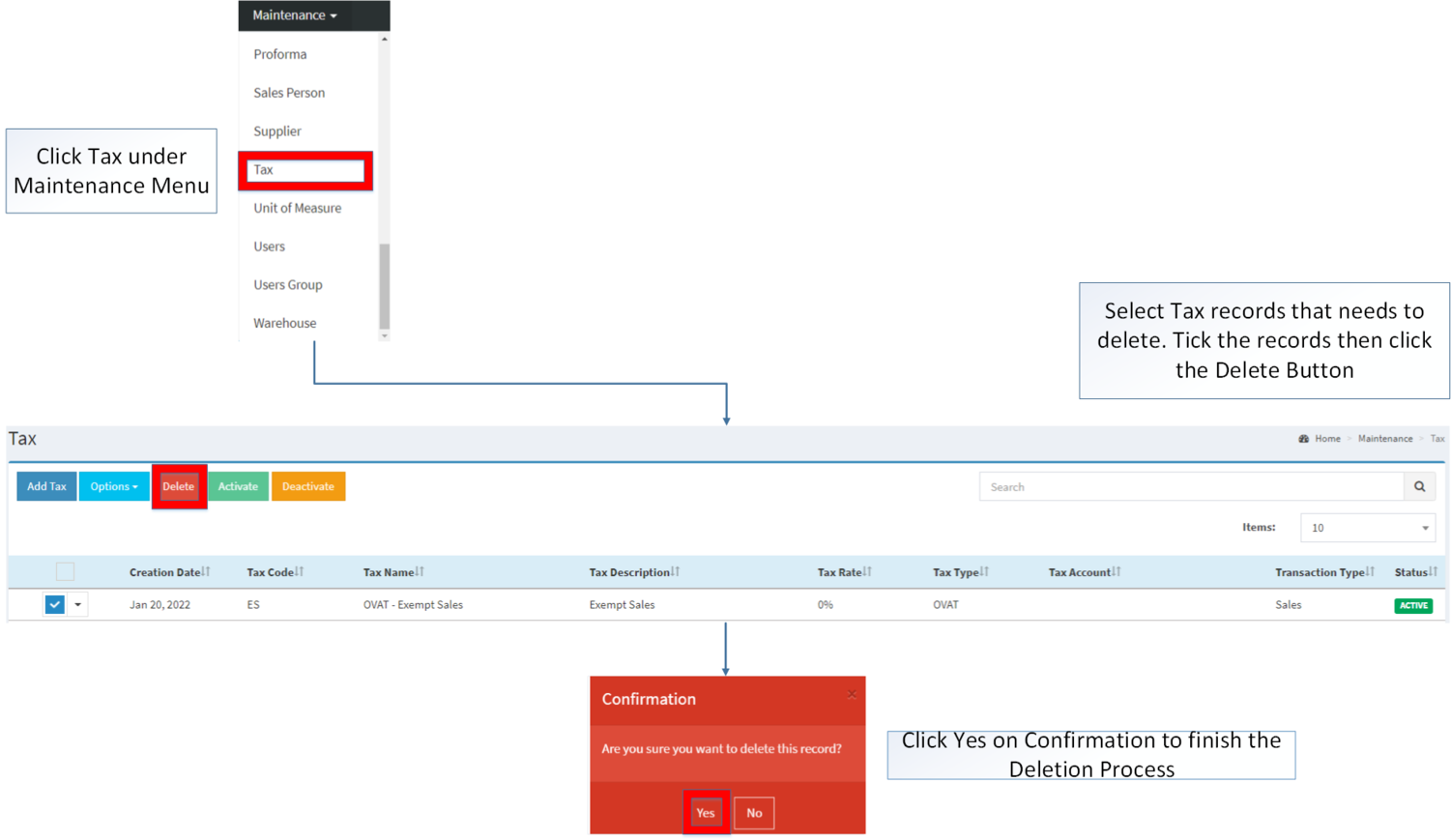

Deleting Tax Record

Tax can be deleted in two ways:

- Using drop-down arrow of a record can be used in single record deletion

- Using Delete Button for deleting multiple record

Tax Record Option

| Status | View | Edit | Deactivate | Activate | Delete |

|---|---|---|---|---|---|

| ACTIVE | ☑ | ☑ | ☑ | ☑ | |

| INACTIVE | ☑ | ☑ | ☑ | ☑ |

Notes:

- The user can edit the details while viewing the record.

- Tax that has been in transactions or other maintenance modules cannot be deleted.

- INACTIVE Tax cannot be used in the transaction but the INACTIVE Tax on the past transactions can still use it.

- Activating/Deactivating and Deleting of Records can be done in two ways.

- For single records, the user may use the drop down arrow then the action that need to perform.

- For multiple records, the user may tick the records then click the action button that need to perform

- Click the Yes in the confirmation to proceed on the action taken.

| Modules | |

|---|---|

| Maintenance | Maintenance | Tax | Chart of Account |

| Sales | Sales Quotation | Sales Order | Sales Invoice |

| Purchase | Purchase Order |

| Financials | Accounts Payable | Accounts Receivable |