You are viewing an old version of this page. Return to the latest version.

No categories assigned

Accounts Receivable

-

- Last edited 3 years ago by Gelo

-

Contents

- 1 Accounts Receivable

- 1.1 Requirements before using Accounts Receivable

- 1.2 Accounts Receivable Record List

- 1.3 Adding Accounts Receivable

- 1.4 Editing Accounts Receivable

- 1.5 Printing Accounts Receivable

- 1.6 Posting Accounts Receivable

- 1.7 Unposting Accounts Receivable

- 1.8 Receiving Payment in Accounts Receivable

- 1.9 Cancelling Accounts Receivable Record

- 1.10 Importing and Exporting Accounts Receivable

- 1.11 Accounts Receivable Record Option

Accounts Receivable

Allows the user to create a transaction for the balance due to a firm for goods and services delivered or used but not yet paid for by customers.

Requirements before using Accounts Receivable

- The user should setup the following Maintenance Module in order to proceed on using the Accounts Receivable

| Status | Description |

|---|---|

| UNPAID | If the Accounts Receivable has been created |

| POSTED | If the Accounts Receivable is Posted and ready to receive its payment |

| WITH PARTIAL PAYMENT | If the Accounts Receivable is Paid Partially |

| PAID | If the Accounts Receivable is completely Paid |

| CANCELLED | If the Accounts Receivable is cancelled |

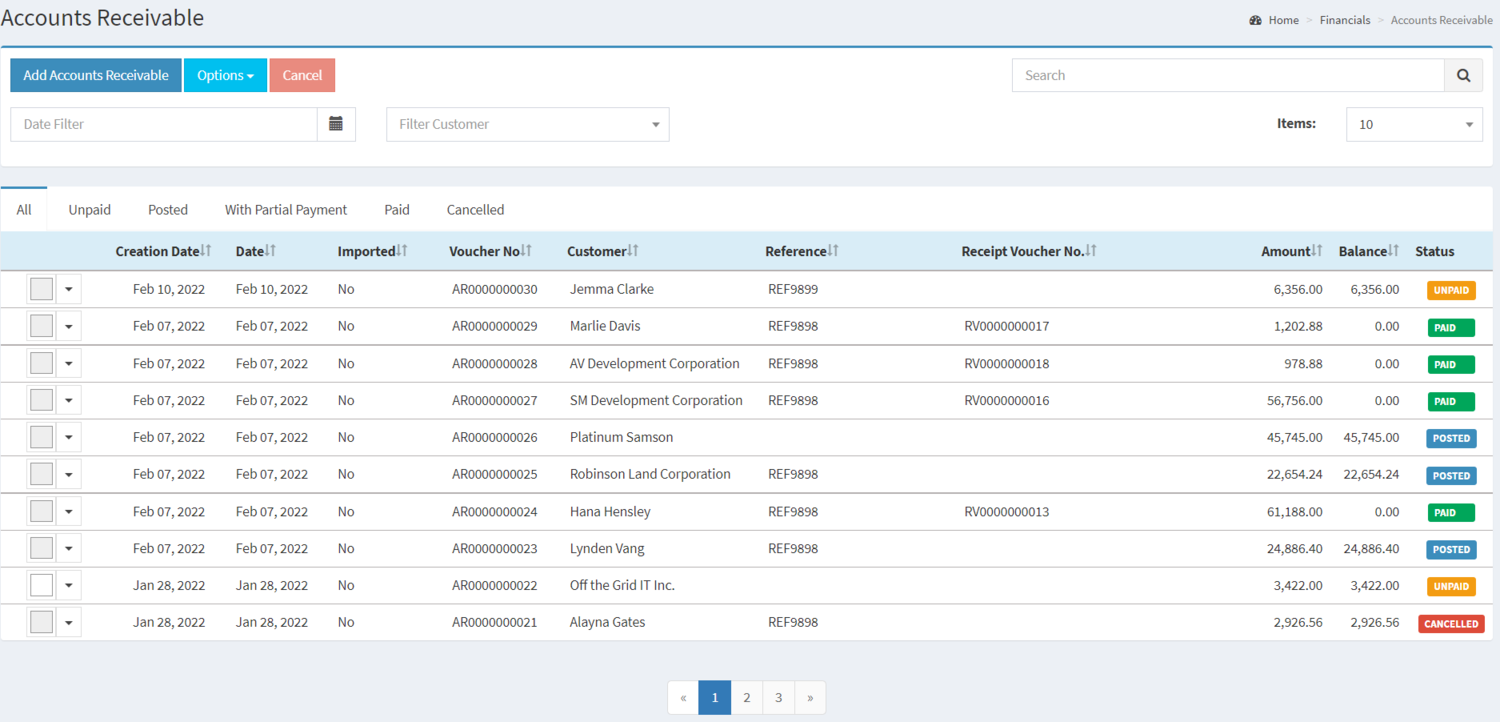

Accounts Receivable Record List

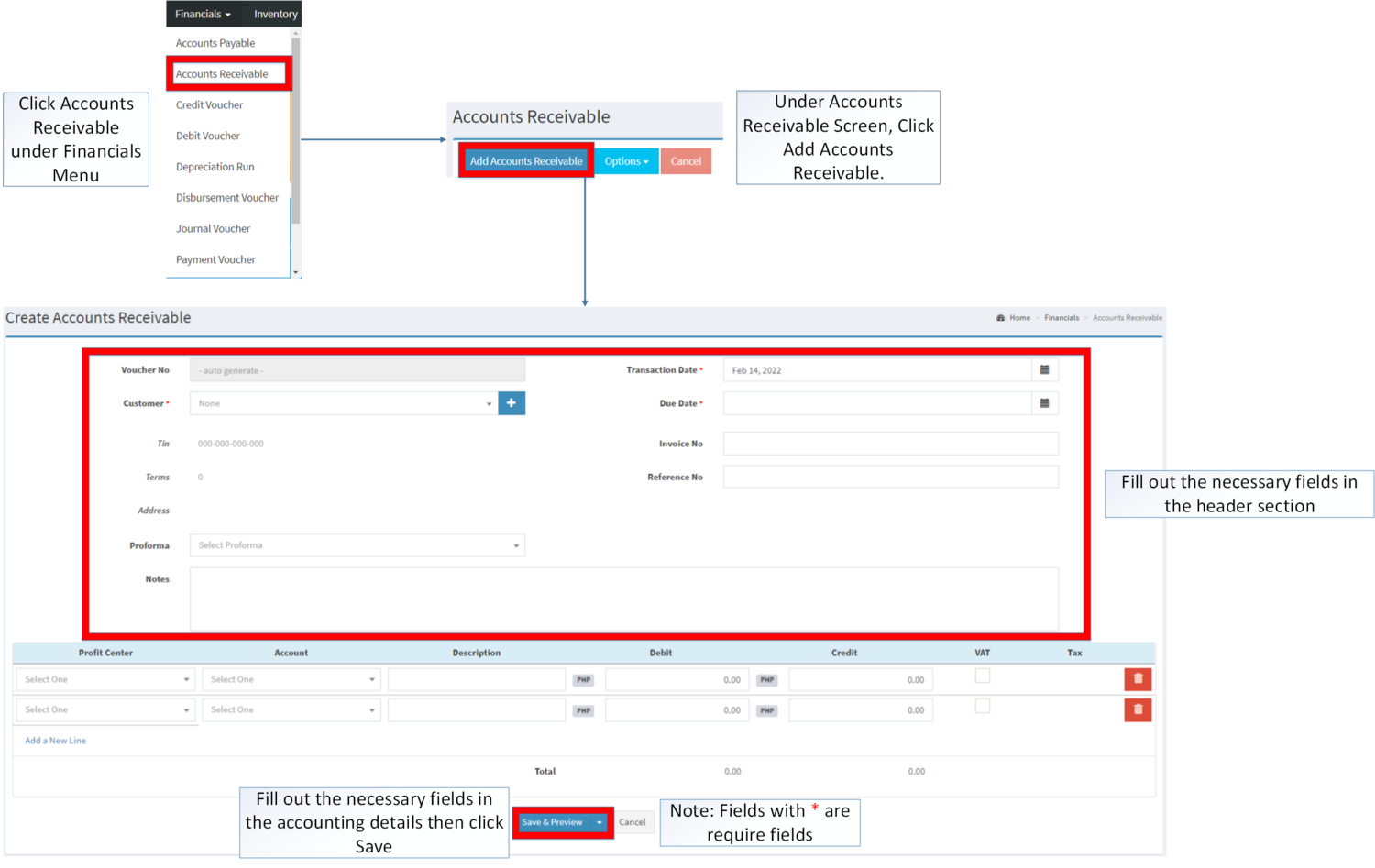

Adding Accounts Receivable

- Go to Financials then click Accounts Receivable

- Click Add Accounts Receivable

- Fill up the necessary fields in the Header Part

- Fill up the necessary fields in the Accounting Details then Click Save

| Field | Description | Expected Values |

|---|---|---|

| 1. Voucher No. | •Voucher Reference number generated upon creation | •Alphanumeric(Auto-Generated) |

| 2.Customers | •Name of Customer | •Customer List provided in the Customer Maintenance Module |

| 3.Tax Identification Number(TIN) | •TIN of the Customer | •Number(Auto-Generated base from Customer's Profile) |

| 4.Terms | •Days on completing the sale | •Number(Auto-Generated base from the

Customer's Profile) |

| 5.Address | •Address of the Customer | •Alphanumeric(Auto-Generated base from the Customer's Profile) |

| 6.Proforma | •Financial statements is to facilitate comparisons of historic data and projections of future performance. | •Proforma list provided in the Proforma Maintenance Module |

| 7.Transaction Date | •Date when the Payable Transaction was created | •Date |

| 8.Due Date | •Due date of Payable Transaction | •Date |

| 9.Invoice No | •Invoice number reference for the transaction | •Alphanumeric |

| 10.Reference No | •Reference No for the transaction | •Number |

| 11.Notes | •Other Remarks on the Transaction | •Alphanumeric |

| 12.Account | •Account to be charged for credit and debit amount on the transaction | •Account list in the Chart of Accounts Maintenance Module |

| 13.Description | •Any remarks or Notes in the Account Line of the transaction | •Alphanumeric |

| 14.Debit | •Debit Amount for the Transaction | •Number |

| 15.Credit | •Credit Amount for the Transaction | •Number |

| 16.Value Added Tax(VAT) | •VAT to be applied in the amount on the accounting details in the transaction | •Tick/Untick |

| 17.Tax | •Type of Tax to be applied when the VAT is ticked | •Tax List provided in the Tax Maintenance Module |

Notes:

- Accounts Receivable Transactions are auto-generated when it is created from Billing and Delivery Receipt with Sales Invoice in it.

- Account should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Chart of Account Maintenance Module.

- Proforma should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Proforma Maintenance Module

- Customer should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Customers Maintenance Module

- Tax should be on ACTIVE status when using it upon creating or editing a transaction.

- This can be seen in Tax Maintenance Module

- This will be only available in the transaction when the VAT column is checked.

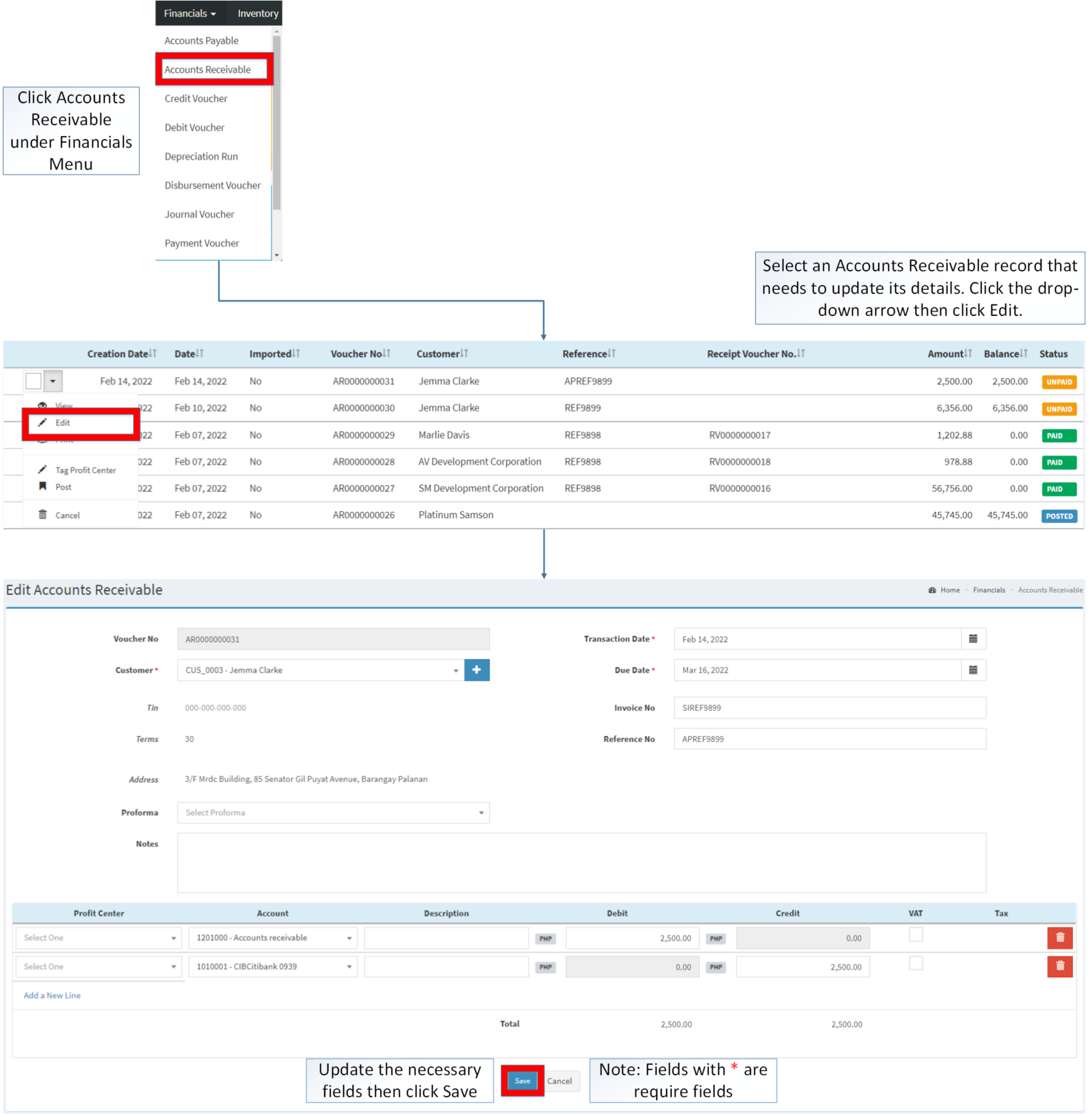

Editing Accounts Receivable

- Click Financials then click Accounts Receivable

- Select the Accounts Receivable that needs an update. Click the Drop-down Arrow then press Edit.

- Update the necessary information then click Save.

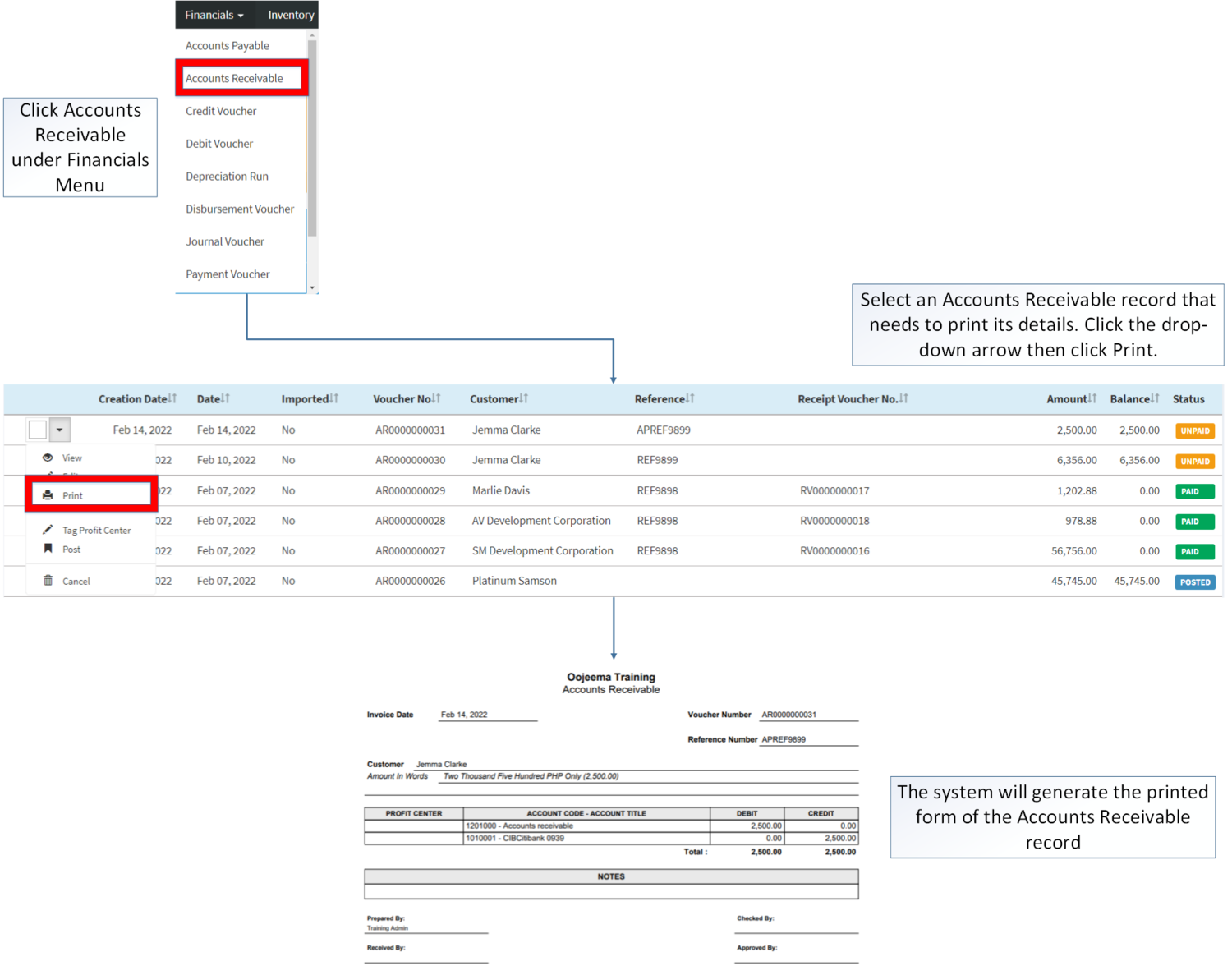

Printing Accounts Receivable

- Click Financials then click Accounts Receivable

- Select the Accounts Receivable that needs to print its details. Click the Drop-down Arrow then press Print.

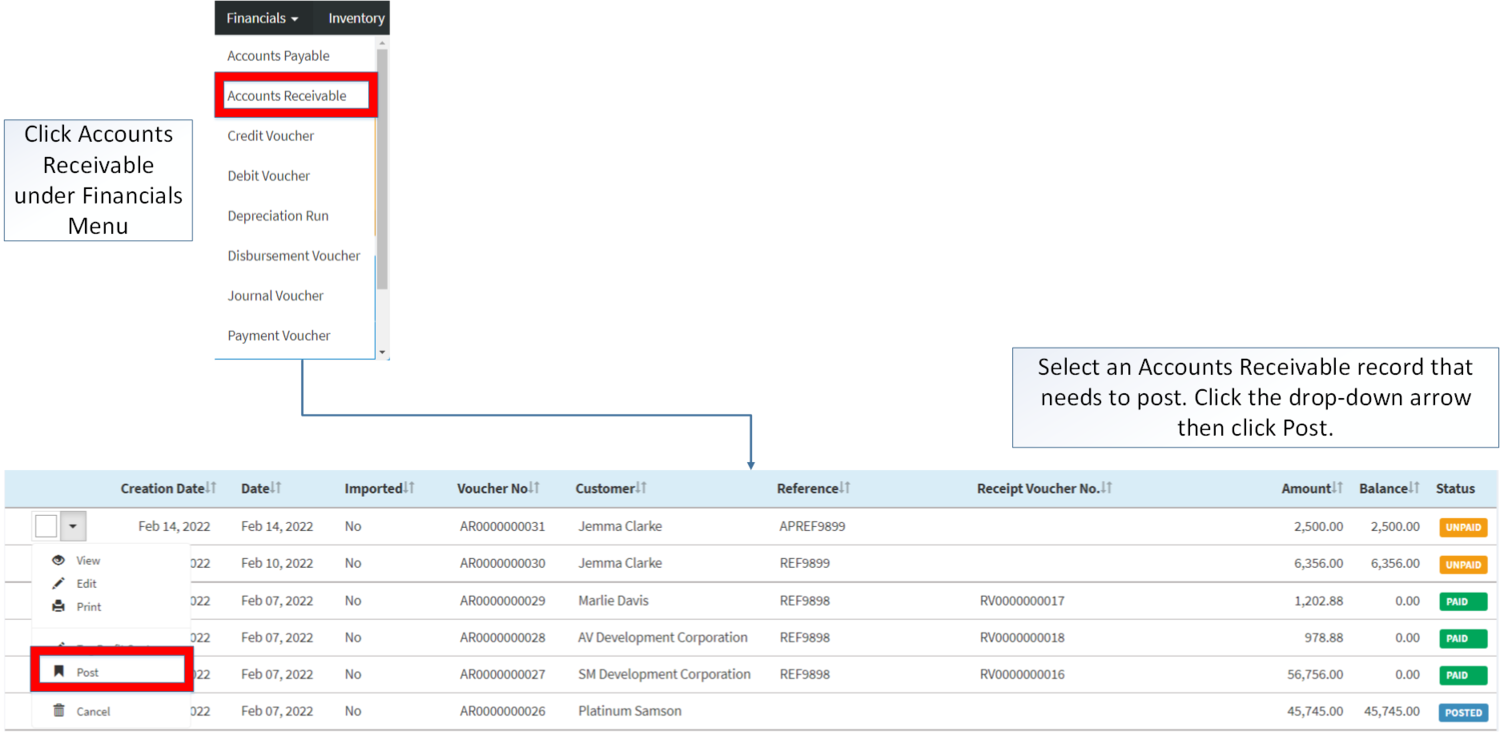

Posting Accounts Receivable

- Click Financials then click Accounts Receivable

- Select the Accounts Receivable that needs to post its details. Click the drop-down arrow then click Post

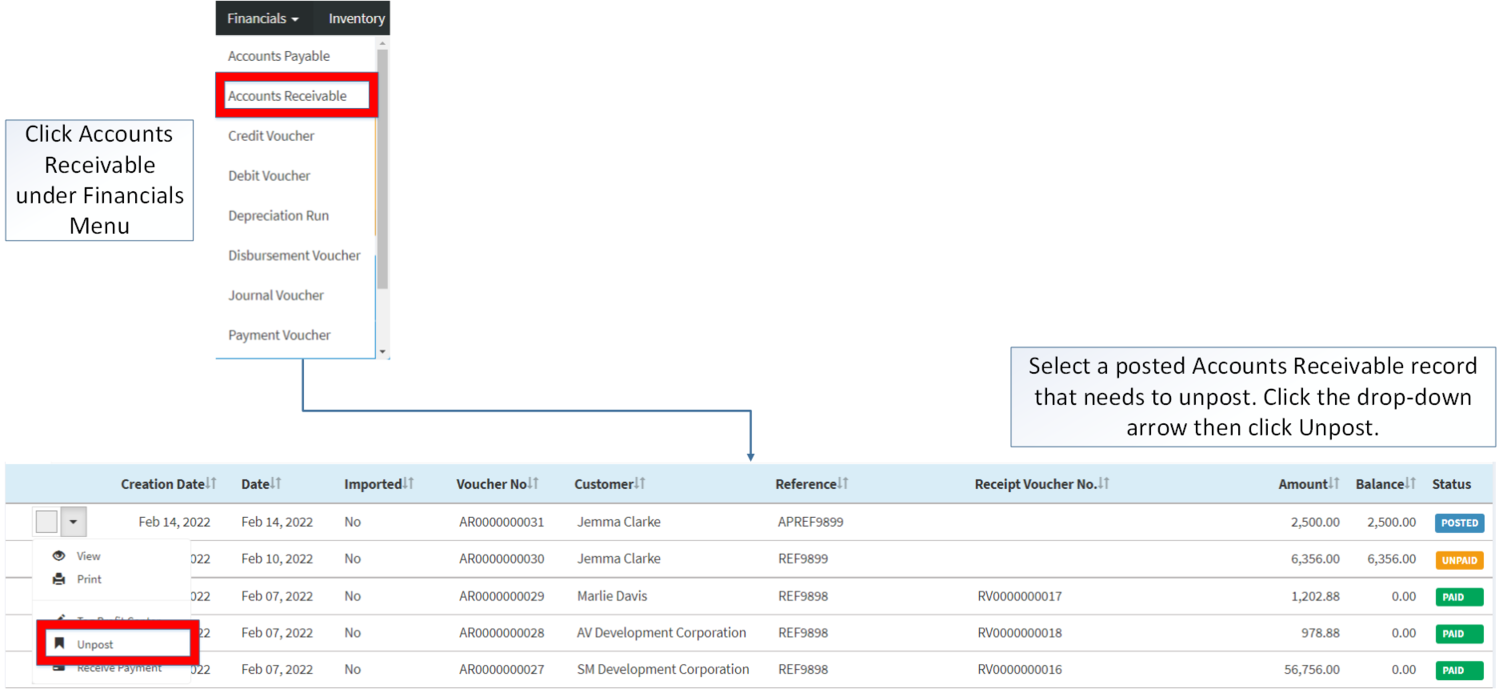

Unposting Accounts Receivable

- Click Financials then click Accounts Receivable

- Select a Posted Accounts Receivable that needs to post its details. Click the drop-down arrow then click Unpost

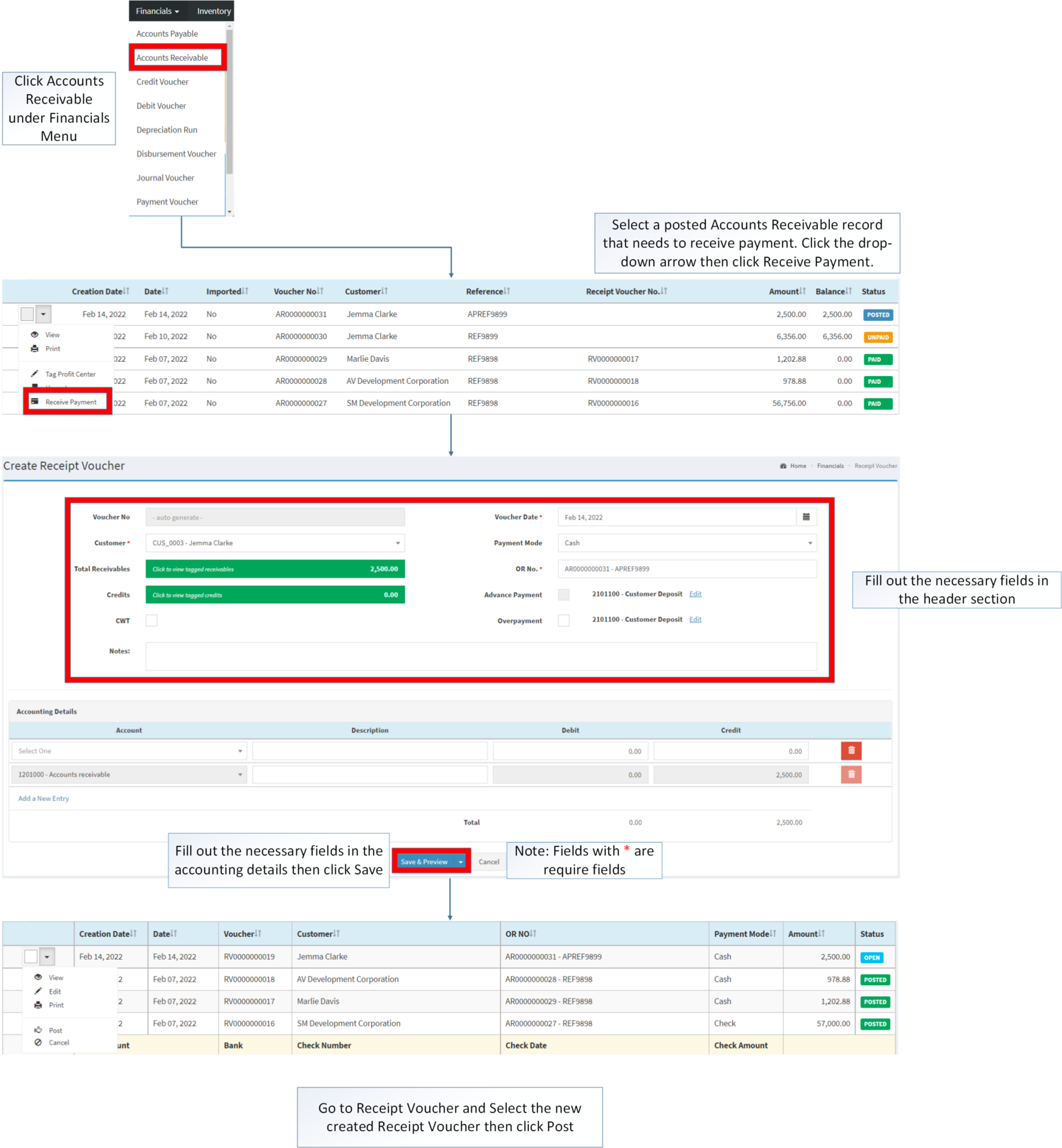

Receiving Payment in Accounts Receivable

- Click Financials then click Accounts Receivable

- Select the Accounts Receivable that needs to received its payment, Click the drop-down arrow then click Receive Payment

- Under Create Receipt Voucher screen, fill up the Header details and its accounting details then click Save

- Under Receipt Voucher, select the receipt voucher, click the drop-down arrow then click Post.

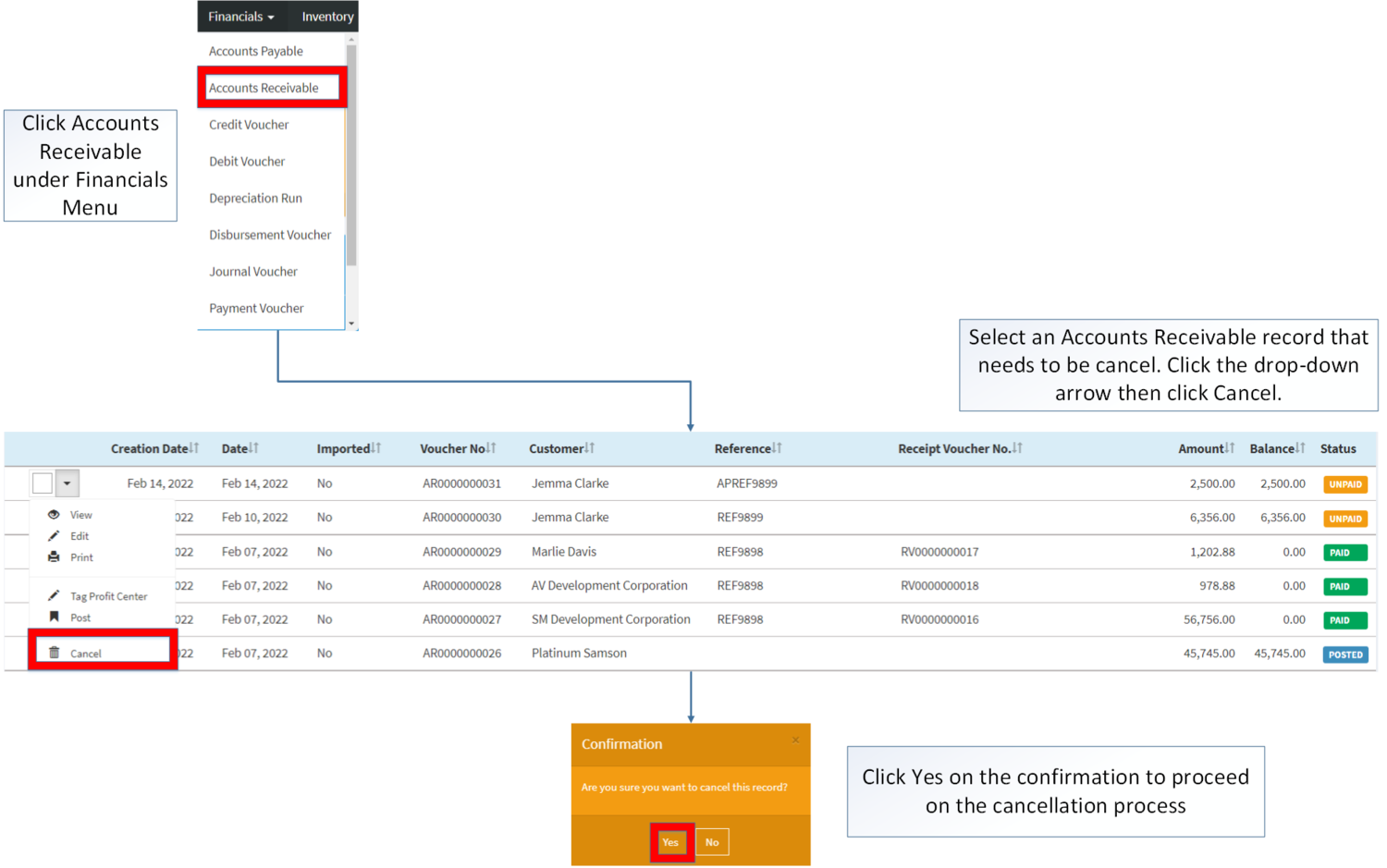

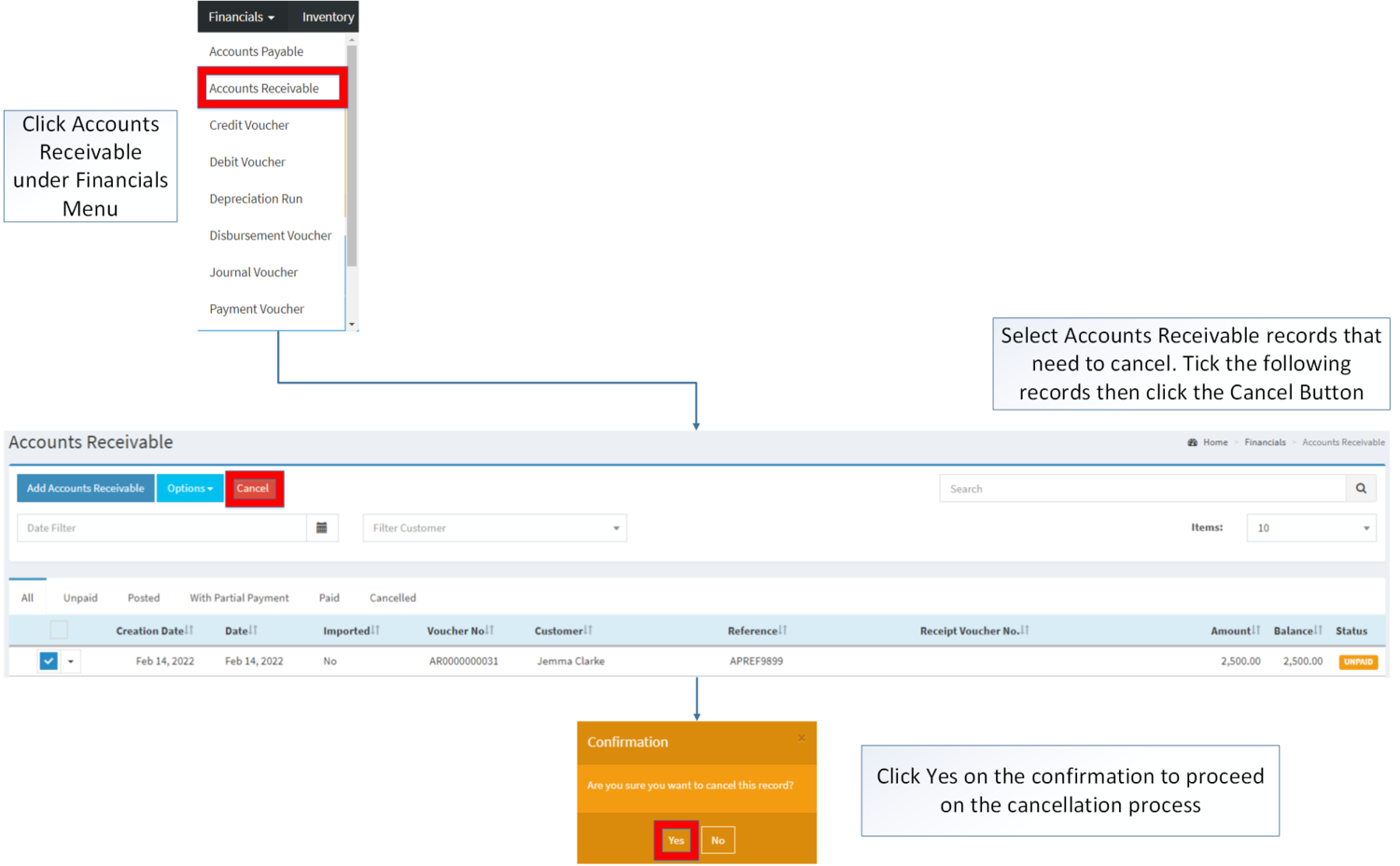

Cancelling Accounts Receivable Record

Import Purchase Order can be canceled in two ways:

- Using drop-down arrow of a record can be used in single record cancellation

- Using Cancel Button for cancelling multiple records

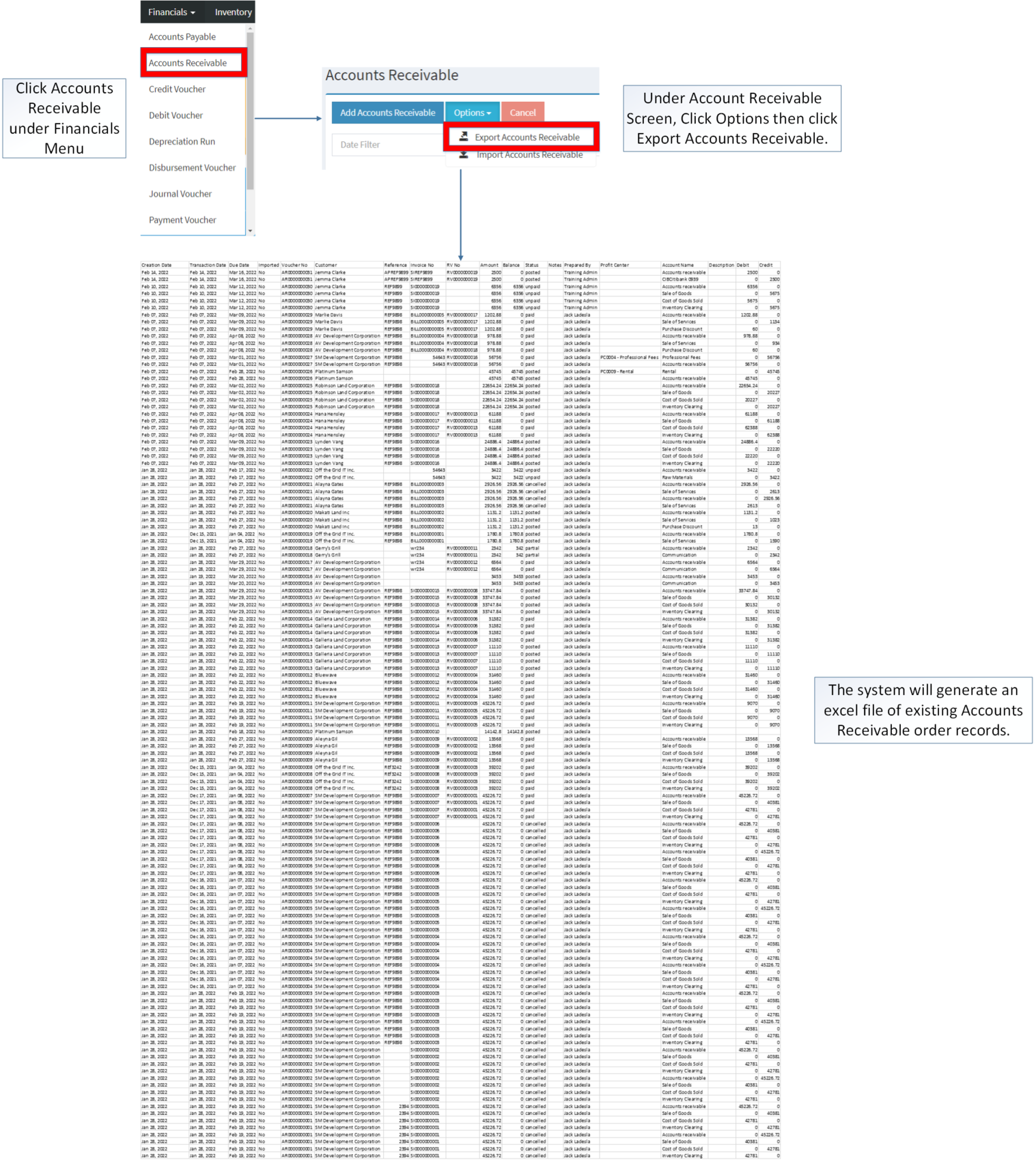

Importing and Exporting Accounts Receivable

- Under Accounts Receivable Screen, Click Options

- Under Options, the user may Export or Import Accounts Receivable

- When Exporting the records, the user may also use the filter options such as Date Filter, Search Bar and Customer filter for precise searching and exporting of records.

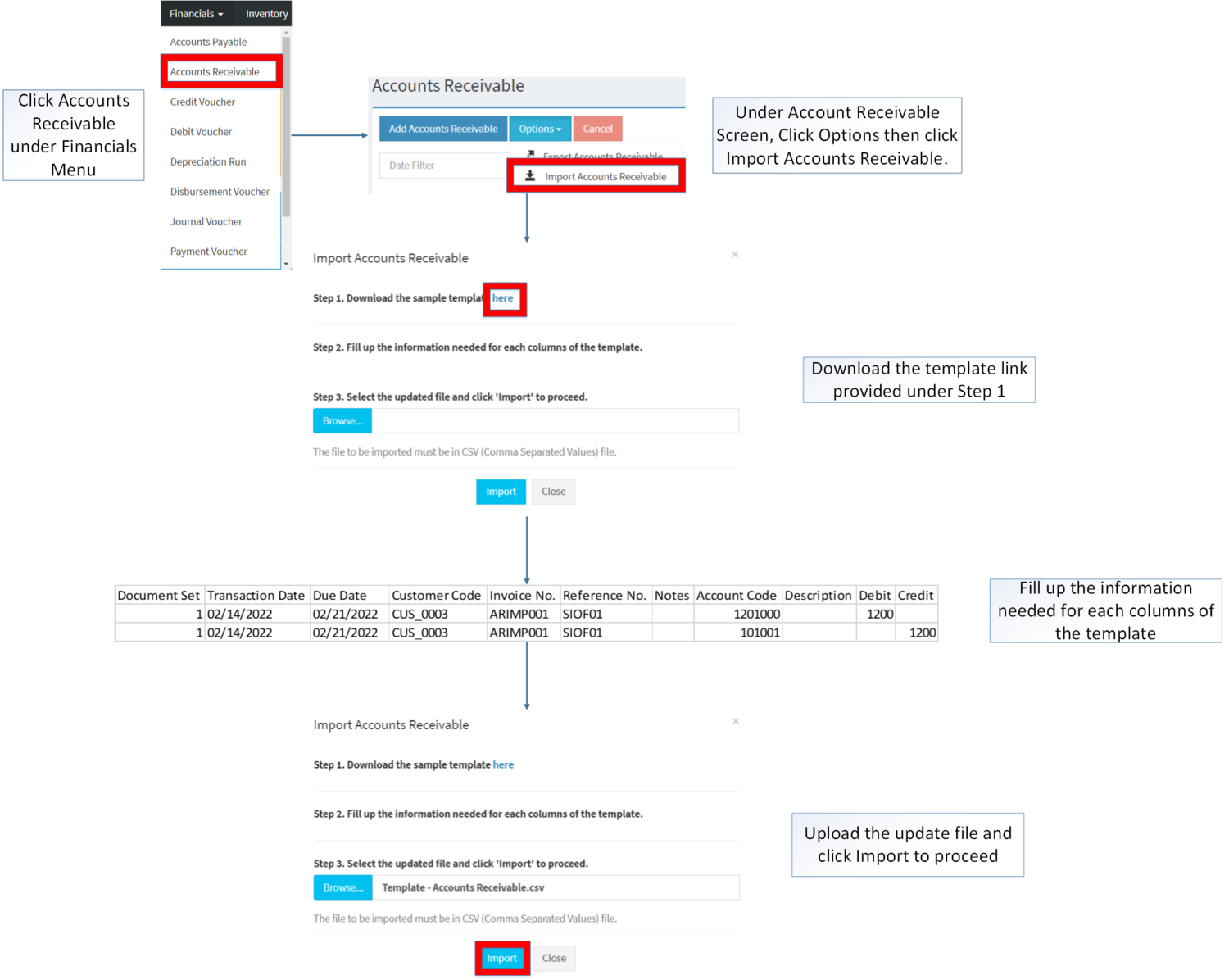

- For batch creation, under Accounts Receivable menu, click options then choose Import Accounts Receivable button

- Download the Template provided in the Step 1

- Fill up the information needed for each column of the template

- Upload the updated template then click Import to Proceed

| Field | Description of Data Output | Allowed Inputs | Input Restrictions | Required (Y/N) |

|---|---|---|---|---|

| 1. Document Set | Manual entry of Document Set of Accounts Receivable (e.g., 1, 2, 3, A, B, C) | *Alphanumeric

*Underscore (_) |

*Other special characters not mentioned | Y |

| 2. Transaction Date | Manual entry of Transaction Date of Accounts Receivable | *Numeric

*Dash (-), Backslash (/) |

*Other special characters not mentioned | Y |

| 3. Due Date | Manual entry of Due Date of Accounts Receivable – must be based on Customer’s payment terms | *Numeric

*Dash (-), Backslash (/) |

*Other special characters not mentioned | Y |

| 4. Customer Code | Manual entry of Customer code – must be based from Customer Data maintenance | *Numeric

* Customer Code based from Customer maintenance |

*Any input not mentioned in the required inputs | Y |

| 5. Invoice No. | Manual entry of Accounts Receivable Invoice No. | *Alphanumeric

*Underscore (_), Dash (-) |

*Other special characters not mentioned | N |

| 6. Reference No. | Manual entry of Accounts Receivable Reference No. | *Alphanumeric

*Underscore (_), Dash (-) |

*Other special characters not mentioned | N |

| 7. Notes | Manual entry of Accounts Receivable Notes | *Alphanumeric

*Underscore (_), Dash (-) |

*Other special characters not mentioned | N |

| 8. Account Code | Manual entry of Account Code – must be based from Chart of Accounts maintenance | *Numeric

*Account Code based from Chart of Accounts maintenance |

*Any input not mentioned in the required inputs | Y |

| 9. Description | Manual entry of Account Description | *Alphanumeric

*Special Characters |

*None | N |

| 10. Debit | Manual entry of Debit amount | *Numeric | *Any input excepts numbers | Y |

| 11. Credit | Manual entry of Credit amount | *Numeric | *Any input excepts numbers | Y |

Accounts Receivable Record Option

| Status | View | Edit | Post | Receive Payment | Cancel |

|---|---|---|---|---|---|

| UNPAID | ☑ | ☑ | ☑ | ☑ | ☑ |

| POSTED | ☑ | ☑ | |||

| WITH PARTIAL PAYMENT | ☑ | ☑ | |||

| PAID | ☑ | ||||

| CANCELLED | ☑ |

Notes:

- The user can only Receive Payment the Accounts Receivable if the Receivable transaction has tag reference on it.

- Posted Receivable can also received payments but cannot be edited.

| Modules | |

|---|---|

| Financials | Financials | Accounts Receivable | Receipt Voucher |

| Sales | Delivery Receipt | Sales Invoice |

| Maintenance | Customer | Proforma | Chart of Account | Tax |