Difference between revisions of "Creating a New Expense"

(Created page with "center|thumb|648x648px <span style="font-size:12.0pt;line-height:115%">To create a new Expense:</span> # <span styl...") (Tag: Visual edit) |

(No difference)

|

Latest revision as of 15:38, 10 December 2020

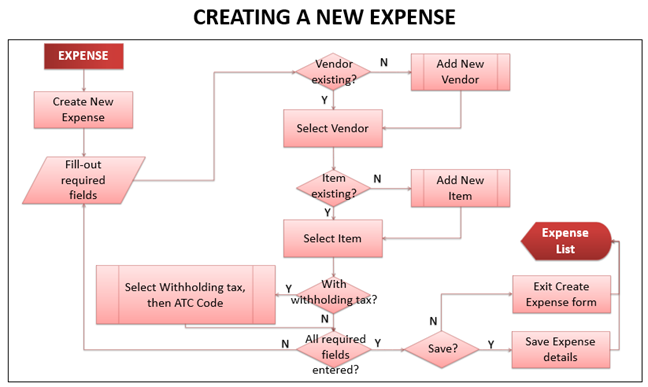

To create a new Expense:

- On the menu bar, click on “Expense”. The Expense list will be displayed.

- Click “Create New Expense” button.

- Expense form will be displayed. Fill it out:

- Expense No. – system auto-generated

- Vendor – list of vendors will be displayed for selection. You can add new vendor by clicking “Add new Vendor” link from the Vendor dropdown list.

- Date – for Expense transaction date selection (displays current date by default)

- Document Number – for entry of reference document number (if any)

- Notes – for entry of remarks / notes for the Expense

- Expense Account – list of expense account will be displayed for selection.

- Description – for entry of selected Expense’s description

- Credit Account – list of credit account will be displayed for selection (displays “Accounts Payable – Non-Trade by default)

- Price – for entry of item’s purchase price per quantity (displays gross purchase price from the Maintenance: Items by default (if any))

- Tax – for expense tax type selection (displays “none” by default)

- Amount – system calculated (Amount = Price - tax amount)

- Add a New Line – link for adding new item for expense

- Subtotal – sum of expense’ amounts

- Total Purchases Tax – displays system calculated sum of purchase tax amount (if any)

- Withholding Tax – for withholding tax (ATC Code) selection (displays “none” by default)

- None

- WTAX (1%) – pop-up selection of applicable ATC Code

- WTAX (2%) – pop-up selection of applicable ATC Code

- WTAX (5%) – pop-up selection of applicable ATC Code

- WTAX (10%) – pop-up selection of applicable ATC Code

- WTAX (15%) – pop-up selection of applicable ATC Code

- Total – system calculated (Total = Subtotal + Total Purchases Tax – Withholding Tax amount)

- After filling-out the form, select saving option to finalize Expense Voucher creation. Otherwise, click “Exit”, to discard entries and exit the form.

- Save – click to save entries and exit back to Expense list.

- Save & New – click to save entries and open a new cleared Expense form.

- Save & Preview – click to save entries and view the created Expense Voucher details.