No categories assigned

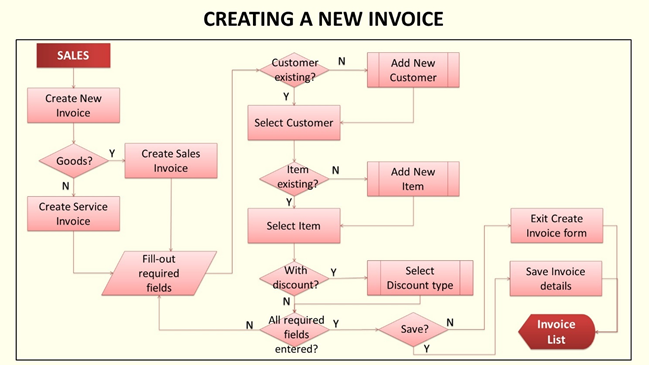

Creating a New Invoice

-

- Last edited 5 years ago by John Ruel Montesino

-

To create a new Invoice:

- On the menu bar, click on “Sales”. The Invoice list will be displayed.

- Click “Create New Invoice” button, then select “Sales Invoice” for goods invoicing. Select “Service Invoice” for service invoicing.

- Invoice form will be displayed. Fill it out:

- Invoice No. – system auto-generated

- Customer – list of customers will be displayed for selection. You can add new customer by clicking “Add new Customer” link from the Customer dropdown list.

- DR NO. – for entry of delivery receipt number (if any)

- PO NO. – for entry of purchase order number (if any)

- Date – for Sales Invoice transaction date selection (displays current date by default)

- Due Date – for Sales Invoice payment due date selection (displays date based on customer’s payment terms)

- Notes – for entry of remarks / notes for the Sales Invoice

- Item – list of items will be displayed for selection. You can add new item by clicking “Add new Item” link from the Item dropdown list.

- Description – for entry of selected item’s description (displays selected item’s description by default)

- Quantity – for entry of selected item’s quantity for invoicing (displays “1.00” by default)

- Price – for entry of item’s selling price per quantity (displays selling price from the Master Pricelist or Customer’s Pricelist by default (if any))

- Tax – for sales tax type selection (displays item’s Revenue Tax Type from Maintenance: Items by default)

- Amount – system calculated (Amount = Quantity x Price - tax amount)

- Add a New Line – link for adding new item for invoicing

- VATable Sales – total amount; system display based from selected Tax

- VAT-Exempt Sales – total amount; system display based from selected Tax

- VAT-Zero Rated Sales – total amount; system display based from selected Tax

- Total Sales – sum of items’ amounts

- Discount – click green button to select discount type (displays “0.00” by default)

- None

- PWD Discount – enter PWD’s Name, Address, ID No., ID Type

- Senior Citizen Discount – enter Senior Citizen’s Name, Address, ID No., ID Type

- Trade Discount – enter trade discount rate

- Add 12% VAT – displays system calculated sum of sales tax amount (if any)

- Total Amount Due – system calculated (Total Amount Due = Total Sales – Discount + tax amount)

- After filling-out the form, select saving option to finalize Sales Invoice creation. Otherwise, click “Exit”, to discard entries and exit the form.

- Save – click to save entries and exit back to Invoice list.

- Save & New – click to save entries and open a new cleared Invoice form.

- Save & Preview – click to save entries and view the created Invoice details.