You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "Pro BIR Form 2551M"

(Created page with "== BIR Form 2551M == <span style="color: rgb(32, 33, 36)">BIR Form 2551M is used as a standard monthly tax return. Based on this declaration, the monthly amount of the tax is...") (Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 1: | Line 1: | ||

| − | == BIR Form 2551M == | + | {{DISPLAYTITLE:BIR Form 2551M}} |

| + | <div style="text-align: center;">[[Pro BIR Form 2551M]] | [[Pro Bank|Bank]] | [[Pro Chart of Account|Chart of Account]] | [[Pro Tax|Tax]] | [[Pro BIR Form 2551M Job Aids|BIR Form 2551M Job Aids]]</div><br /> | ||

| + | ==BIR Form 2551M== | ||

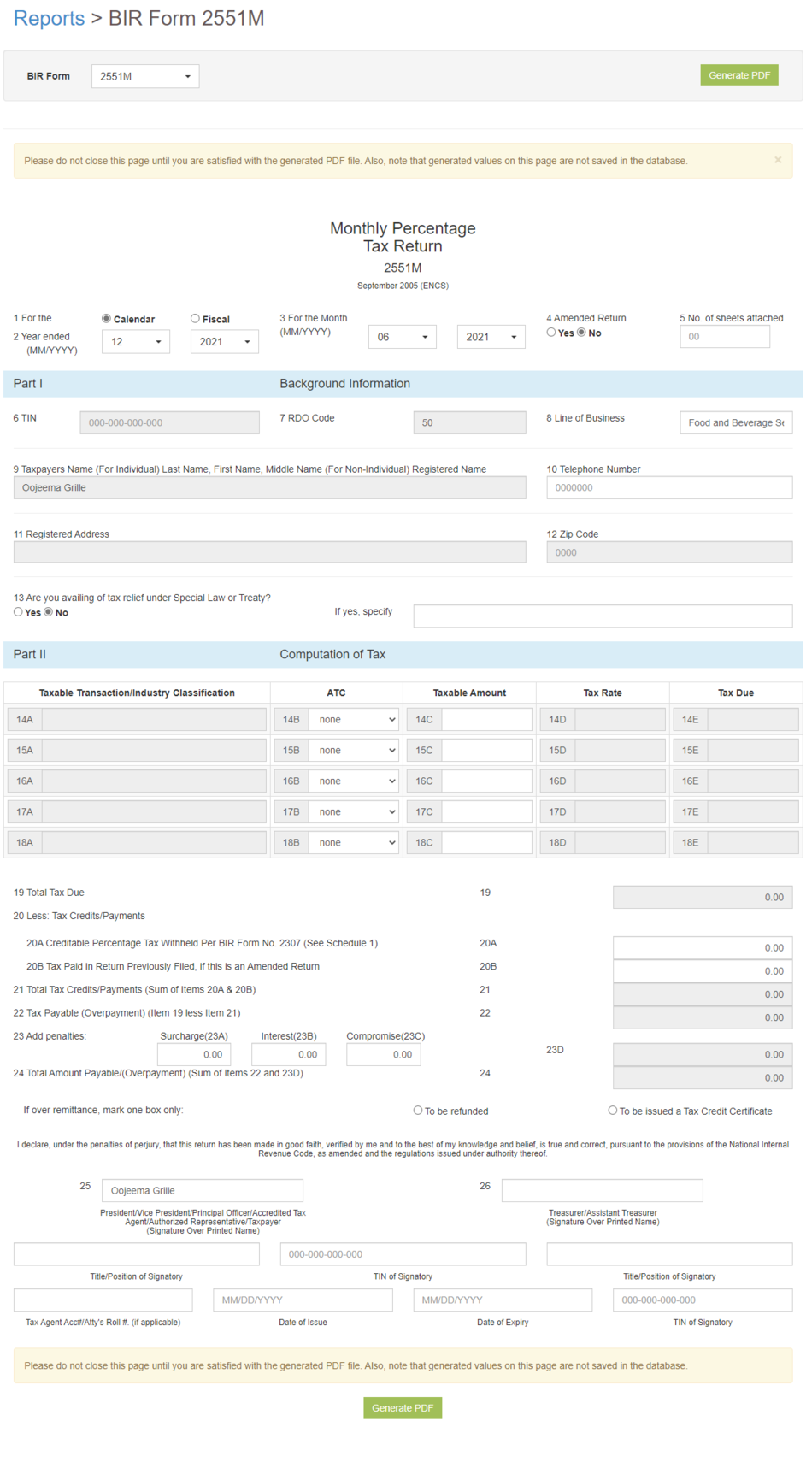

<span style="color: rgb(32, 33, 36)">BIR Form 2551M is used as a standard monthly tax return. Based on this declaration, the monthly amount of the tax is to be paid.</span> | <span style="color: rgb(32, 33, 36)">BIR Form 2551M is used as a standard monthly tax return. Based on this declaration, the monthly amount of the tax is to be paid.</span> | ||

[[File:Pro BIR Form 2551M.png|center|thumb|1710x1710px|BIR Form 2551M]] | [[File:Pro BIR Form 2551M.png|center|thumb|1710x1710px|BIR Form 2551M]] | ||

| Line 16: | Line 18: | ||

| style="" |<span style="color: rgb(34, 34, 34)">Refers to the which quarter of the year.</span> | | style="" |<span style="color: rgb(34, 34, 34)">Refers to the which quarter of the year.</span> | ||

| − | * For Calendar Year | + | *For Calendar Year |

| − | ** First Quarter - January to March | + | **First Quarter - January to March |

| − | ** Second Quarter - April to June | + | **Second Quarter - April to June |

| − | ** Third Quarter - July to September | + | **Third Quarter - July to September |

| − | ** Fourth Quarter - October to December | + | **Fourth Quarter - October to December |

| − | * For Fiscal Year | + | *For Fiscal Year |

| − | ** Every three months starting from the Fiscal Year. | + | **Every three months starting from the Fiscal Year. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |4. '''Amended Return''' | | style="" |4. '''Amended Return''' | ||

| Line 51: | Line 53: | ||

| style="" |The registered Address of the Tax Payer. | | style="" |The registered Address of the Tax Payer. | ||

| − | * '''9A ZIP Code''' - Zone Improvement Plan Code of the registered Address of the Tax Payer. | + | *'''9A ZIP Code''' - Zone Improvement Plan Code of the registered Address of the Tax Payer. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |12. <span>'''ZIP Code'''</span> | | style="" |12. <span>'''ZIP Code'''</span> | ||

| Line 65: | Line 67: | ||

|Components(14B - 14E) | |Components(14B - 14E) | ||

| − | * <span style="color: rgb(51, 51, 51)">ATC</span> | + | *<span style="color: rgb(51, 51, 51)">ATC</span> |

| − | * <span style="color: rgb(51, 51, 51)">Taxable Amount</span> | + | *<span style="color: rgb(51, 51, 51)">Taxable Amount</span> |

| − | * <span style="color: rgb(51, 51, 51)">Tax Rate</span> | + | *<span style="color: rgb(51, 51, 51)">Tax Rate</span> |

| − | * <span style="color: rgb(51, 51, 51)">Tax Due</span> | + | *<span style="color: rgb(51, 51, 51)">Tax Due</span> |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |19. '''Total Tax Due''' | | style="" |19. '''Total Tax Due''' | ||

| Line 76: | Line 78: | ||

|20A and 20B | |20A and 20B | ||

| − | * '''Creditable Percentage Tax Withheld Per BIR FORM No. 2307 -''' This certificate exhibits the income that is subjugated to Expanded Withholding Tax (EWT) that is paid by a withholding agent. | + | *'''Creditable Percentage Tax Withheld Per BIR FORM No. 2307 -''' This certificate exhibits the income that is subjugated to Expanded Withholding Tax (EWT) that is paid by a withholding agent. |

| − | * '''Tax Paid in Return Previously Filed, if this is an Amended Return -''' This certificate exhibits the income that is subjugated to Expanded Withholding Tax (EWT) that is paid by a withholding agent. <br /> | + | *'''Tax Paid in Return Previously Filed, if this is an Amended Return -''' This certificate exhibits the income that is subjugated to Expanded Withholding Tax (EWT) that is paid by a withholding agent. <br /> |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |21. <span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">'''Total Tax Credits/Payments'''</span> | | style="" |21. <span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">'''Total Tax Credits/Payments'''</span> | ||

| Line 90: | Line 92: | ||

| style="" |List of Penalties: | | style="" |List of Penalties: | ||

| − | * '''Surcharge(23A)''' | + | *'''Surcharge(23A)''' |

| − | * '''Interest(23B)''' | + | *'''Interest(23B)''' |

| − | * '''Compromise(23C)''' | + | *'''Compromise(23C)''' |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |23. '''Total Penalties (Sum of Items 20 to 22)''' | | style="" |23. '''Total Penalties (Sum of Items 20 to 22)''' | ||

| Line 100: | Line 102: | ||

| style="" |Total Amount Payable based from Tax Payable and Total Penalties. | | style="" |Total Amount Payable based from Tax Payable and Total Penalties. | ||

| − | * If Overpayment | + | *If Overpayment |

| − | ** To be refunded | + | **To be refunded |

| − | ** To be issued a Tax Certificate | + | **To be issued a Tax Certificate |

|- | |- | ||

|25. '''President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name)''' | |25. '''President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name)''' | ||

|<span style="color: rgb(34, 34, 34)">President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details</span> | |<span style="color: rgb(34, 34, 34)">President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details</span> | ||

| − | * '''Title/Position of Signatory''' | + | *'''Title/Position of Signatory''' |

| − | * '''Tin of Signatory''' | + | *'''Tin of Signatory''' |

| − | * '''Tax Agent Acc# / Atty's Roll #. (if applicable)''' | + | *'''Tax Agent Acc# / Atty's Roll #. (if applicable)''' |

| − | * '''Date of Issue''' | + | *'''Date of Issue''' |

| − | * '''Date of Expiry''' | + | *'''Date of Expiry''' |

|- | |- | ||

|26. '''Treasurer/Assistant Treasurer''' <span style="color: rgb(34, 34, 34)">(Signature Over Printed Name)</span> | |26. '''Treasurer/Assistant Treasurer''' <span style="color: rgb(34, 34, 34)">(Signature Over Printed Name)</span> | ||

|<span style="color: rgb(34, 34, 34)">Treasurer/Assistant Treasurer details</span> | |<span style="color: rgb(34, 34, 34)">Treasurer/Assistant Treasurer details</span> | ||

| − | * '''Treasurer/Assistant Treasurer''' | + | *'''Treasurer/Assistant Treasurer''' |

| − | * '''Title/Position of Signatory''' | + | *'''Title/Position of Signatory''' |

| − | * '''TIN of Signatory''' | + | *'''TIN of Signatory''' |

| + | |}Notes: | ||

| + | |||

| + | * For detailed instructions on how to Generate BIR Form 2551M, the user may visit the BIR Form 2551M Job Aids which can be found [[Pro BIR Form 2551M Job Aids|here]] | ||

| + | |||

| + | {| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | ||

| + | |+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Reports''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Tax Report | ||

| + | | style="" |[[Pro Sales Journal|Sales Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Journal|Purchase Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Receipt Journal|Receipt Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Discount Senior and PWD|Discount Senior and PWD]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Disbursement Journal|Disbursement Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0605|BIR Form 0605]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0619E|BIR Form 0619E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2550M|BIR Form 2550M]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2550Q|BIR Form 2550Q]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2551M|BIR Form 2551M]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2551Q|BIR Form 2551Q]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601E|BIR Form 1601E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601EQ|BIR Form 1601EQ]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1604E|BIR Form 1604E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Sales Relief|Sales Relief]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Relief|Purchase Relief]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Reports Job Aid Aids''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Tax Report | ||

| + | | style="" |[[Pro Sales Journal Job Aids|Sales Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Journal Job Aids|Purchase Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Receipt Journal Job Aids|Receipt Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Discount Senior and PWD Job Aids|Discount Senior and PWD Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Disbursement Journal Job Aids|Disbursement Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0605 Job Aids|BIR Form 0605 Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0619E Job Aids|BIR Form 0619E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601E Job Aids|BIR Form 1601E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601EQ Job Aids|BIR Form 1601EQ Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1604E Job Aids|BIR Form 1604E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Sales Relief Job Aids|Sales Relief Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Relief Job Aids|Purchase Relief Job Aids]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Modules''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Maintenance | ||

| + | | style="" |[[Pro Bank|Bank]]<nowiki> | </nowiki>[[Pro Chart of Account|Chart of Account]]<nowiki> | </nowiki>[[Pro Tax|Tax]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Job Aid Modules''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Maintenance Aids | ||

| + | | style="" |[[Oojeema Pro Chart of Accounts Job Aids|Chart of Accounts Job Aids]]<nowiki> | </nowiki>[[Oojeema Pro Tax Job Aids|Tax Job Aids]] | ||

|} | |} | ||

Revision as of 11:27, 31 August 2021

BIR Form 2551M

BIR Form 2551M is used as a standard monthly tax return. Based on this declaration, the monthly amount of the tax is to be paid.

| Fields | Description |

|---|---|

| 1. Month Year | Month and year when the BIR Form 2551Q was issued. |

| 2. Year Ended | Refers to the last day of the Year. |

| 3. Quarter | Refers to the which quarter of the year.

|

| 4. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 5. No. of Sheets Attached | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2551Q |

| Part I - Background Information | |

| 6. TIN | Tax Identification Number of an Individual or Business |

| 7. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 8. Line of Business | Company's Nature of Business |

| 9. Tax Payer's Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 10. Telephone Number | Contact Number of the Tax Payer(Individual/Business). |

| 11. Registered Address | The registered Address of the Tax Payer.

|

| 12. ZIP Code | Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer |

| 13. Tax Relief | (Optional)

Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty |

| Part II - Computation of Tax | |

| 14 - 18. Taxable Transaction/Industry Classification | Components(14B - 14E)

|

| 19. Total Tax Due | The total Tax due based from the breakdown of Schedule 1 Computation of Tax Sheet. |

| 20. Less Tax/Credits | 20A and 20B

|

| 21. Total Tax Credits/Payments

(Sum of Items 20A & 20B) |

Total Tax Credits/Payments to be deducted to Total Tax Due |

| 22. Tax Payable (Overpayment)

(Item 19 less Item 21) |

Total Tax Payable based from the Total Tax Due less the total credits/payments. |

| 23. Penalties | List of Penalties:

|

| 23. Total Penalties (Sum of Items 20 to 22) | Total Penalties applied if any. |

| 24. Total Amount Payable(Overpayment(Sum of Items 22 and 23D) | Total Amount Payable based from Tax Payable and Total Penalties.

|

| 25. President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name) | President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details

|

| 26. Treasurer/Assistant Treasurer (Signature Over Printed Name) | Treasurer/Assistant Treasurer details

|

Notes:

- For detailed instructions on how to Generate BIR Form 2551M, the user may visit the BIR Form 2551M Job Aids which can be found here

| Reports | |

|---|---|

| Tax Report | Sales Journal | Purchase Journal | Receipt Journal | Discount Senior and PWD | Disbursement Journal | BIR Form 0605 | BIR Form 0619E | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551M | BIR Form 2551Q | BIR Form 1601E | BIR Form 1601EQ | BIR Form 1604E | Sales Relief | Purchase Relief |

| Reports Job Aid Aids | |

| Tax Report | Sales Journal Job Aids | Purchase Journal Job Aids | Receipt Journal Job Aids | Discount Senior and PWD Job Aids | Disbursement Journal Job Aids | BIR Form 0605 Job Aids | BIR Form 0619E Job Aids | BIR Form 1601E Job Aids | BIR Form 1601EQ Job Aids | BIR Form 1604E Job Aids | Sales Relief Job Aids | Purchase Relief Job Aids |

| Modules | |

| Maintenance | Bank | Chart of Account | Tax |

| Job Aid Modules | |

| Maintenance Aids | Chart of Accounts Job Aids | Tax Job Aids |