Difference between revisions of "Pro BIR Form 2551M"

(Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 10: | Line 10: | ||

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |1. '''Month Year''' | | style="" |1. '''Month Year''' | ||

| − | | style="" |Month and year when the BIR Form | + | | style="" |Month and year when the BIR Form 2551M was issued. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |2. '''Year Ended''' | | style="" |2. '''Year Ended''' | ||

| Line 31: | Line 31: | ||

| style="" |5. '''No. of Sheets Attached''' | | style="" |5. '''No. of Sheets Attached''' | ||

| style="" |(Optional) | | style="" |(Optional) | ||

| − | Number of Attached Sheets declared when submitting the BIR Form | + | Number of Attached Sheets declared when submitting the BIR Form 2551M |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| colspan="2" style="vertical-align:middle;text-align:center;" |'''Part I - Background Information''' | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Part I - Background Information''' | ||

Latest revision as of 11:31, 31 August 2021

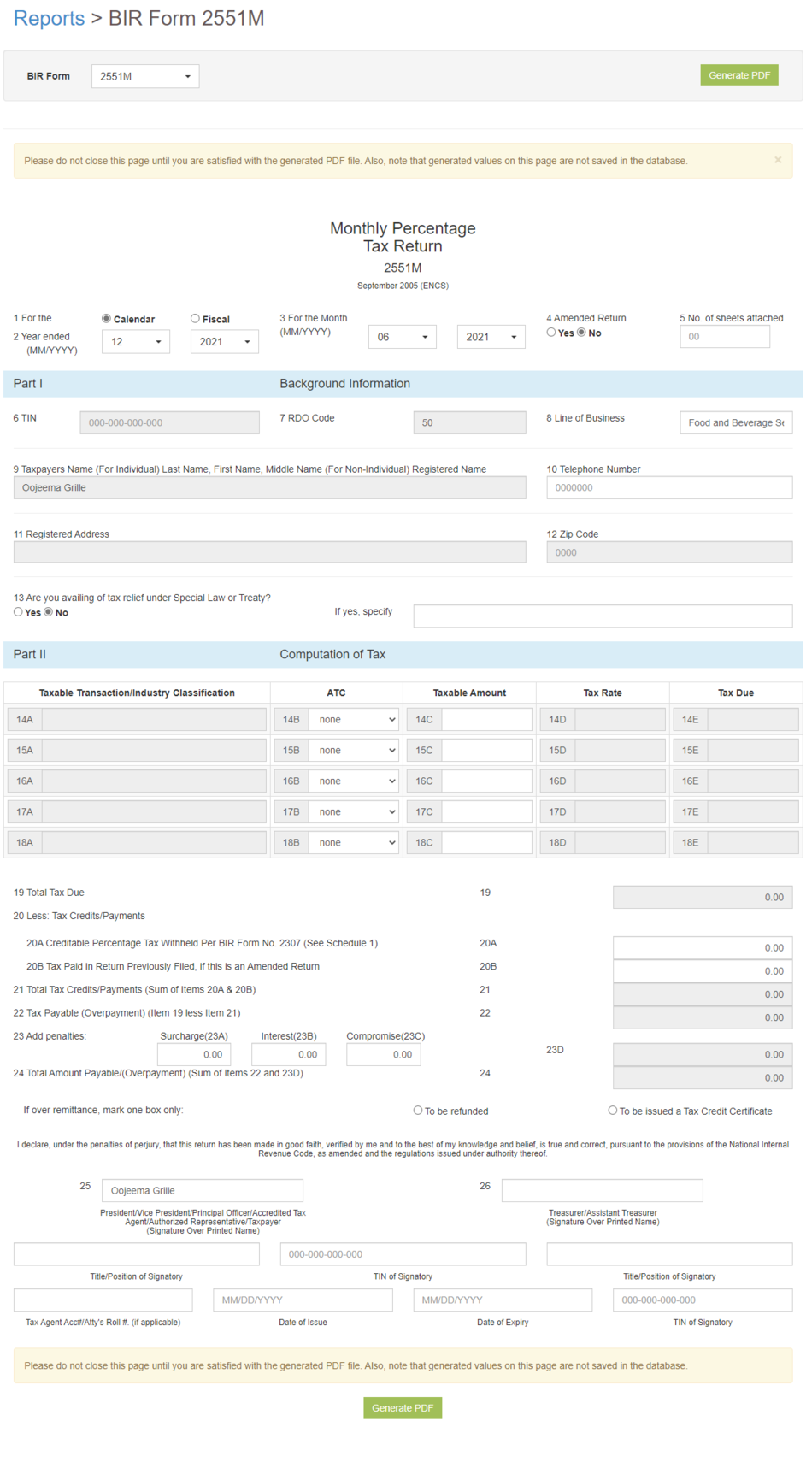

BIR Form 2551M

BIR Form 2551M is used as a standard monthly tax return. Based on this declaration, the monthly amount of the tax is to be paid.

| Fields | Description |

|---|---|

| 1. Month Year | Month and year when the BIR Form 2551M was issued. |

| 2. Year Ended | Refers to the last day of the Year. |

| 3. Quarter | Refers to the which quarter of the year.

|

| 4. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 5. No. of Sheets Attached | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2551M |

| Part I - Background Information | |

| 6. TIN | Tax Identification Number of an Individual or Business |

| 7. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 8. Line of Business | Company's Nature of Business |

| 9. Tax Payer's Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 10. Telephone Number | Contact Number of the Tax Payer(Individual/Business). |

| 11. Registered Address | The registered Address of the Tax Payer.

|

| 12. ZIP Code | Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer |

| 13. Tax Relief | (Optional)

Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty |

| Part II - Computation of Tax | |

| 14 - 18. Taxable Transaction/Industry Classification | Components(14B - 14E)

|

| 19. Total Tax Due | The total Tax due based from the breakdown of Schedule 1 Computation of Tax Sheet. |

| 20. Less Tax/Credits | 20A and 20B

|

| 21. Total Tax Credits/Payments

(Sum of Items 20A & 20B) |

Total Tax Credits/Payments to be deducted to Total Tax Due |

| 22. Tax Payable (Overpayment)

(Item 19 less Item 21) |

Total Tax Payable based from the Total Tax Due less the total credits/payments. |

| 23. Penalties | List of Penalties:

|

| 23. Total Penalties (Sum of Items 20 to 22) | Total Penalties applied if any. |

| 24. Total Amount Payable(Overpayment(Sum of Items 22 and 23D) | Total Amount Payable based from Tax Payable and Total Penalties.

|

| 25. President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name) | President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details

|

| 26. Treasurer/Assistant Treasurer (Signature Over Printed Name) | Treasurer/Assistant Treasurer details

|

Notes:

- For detailed instructions on how to Generate BIR Form 2551M, the user may visit the BIR Form 2551M Job Aids which can be found here

| Reports | |

|---|---|

| Tax Report | Sales Journal | Purchase Journal | Receipt Journal | Discount Senior and PWD | Disbursement Journal | BIR Form 0605 | BIR Form 0619E | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551M | BIR Form 2551Q | BIR Form 1601E | BIR Form 1601EQ | BIR Form 1604E | Sales Relief | Purchase Relief |

| Reports Job Aid Aids | |

| Tax Report | Sales Journal Job Aids | Purchase Journal Job Aids | Receipt Journal Job Aids | Discount Senior and PWD Job Aids | Disbursement Journal Job Aids | BIR Form 0605 Job Aids | BIR Form 0619E Job Aids | BIR Form 1601E Job Aids | BIR Form 1601EQ Job Aids | BIR Form 1604E Job Aids | Sales Relief Job Aids | Purchase Relief Job Aids |

| Modules | |

| Maintenance | Bank | Chart of Account | Tax |

| Job Aid Modules | |

| Maintenance Aids | Chart of Accounts Job Aids | Tax Job Aids |