Difference between revisions of "Pro BIR Form 1604E"

(Created page with "{{DISPLAYTITLE:BIR Form 1604E}} == BIR Form 1604E == '''BIR 1604E''' is annual tax return that summarizes the BIR Form 1601E – Monthly Remittance Return of Creditable Incom...") (Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 1: | Line 1: | ||

| − | {{DISPLAYTITLE:BIR Form 1604E}} | + | {{DISPLAYTITLE:BIR Form 1604E}}<div style="text-align: center;">[[Pro BIR Form 1604E|BIR Form 1604E]] | [[Pro Bank|Bank]] | [[Pro Chart of Account|Chart of Account]] | [[Pro Tax|Tax]] | [[Pro BIR Form 1604E Job Aids|BIR Form 1604E Job Aids]]</div><br /> |

| − | + | ==BIR Form 1604E== | |

| − | == BIR Form 1604E == | ||

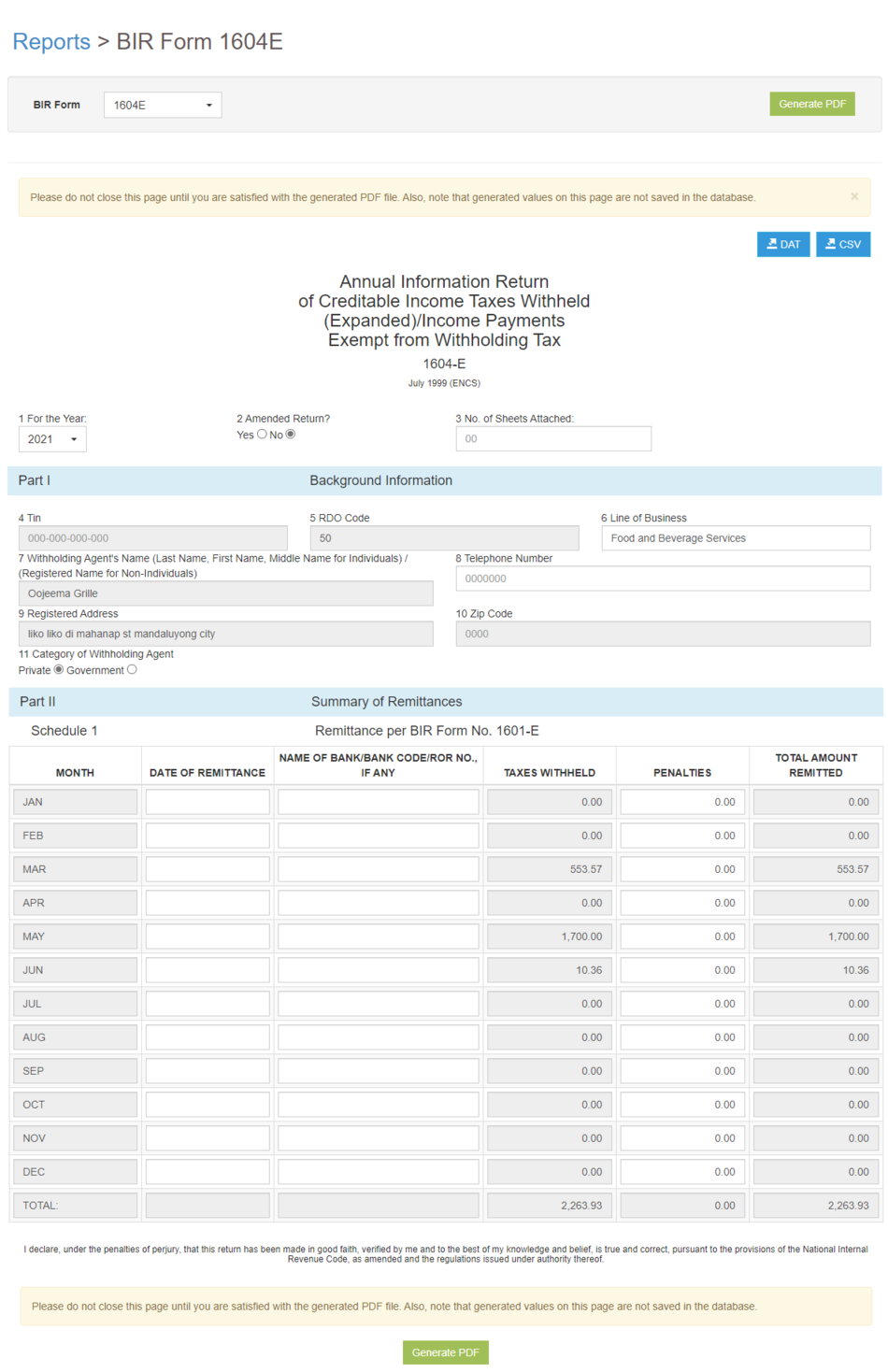

'''BIR 1604E''' is annual tax return that summarizes the BIR Form 1601E – Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) paid/filed by the taxpayer within the taxable year (January to December). | '''BIR 1604E''' is annual tax return that summarizes the BIR Form 1601E – Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) paid/filed by the taxpayer within the taxable year (January to December). | ||

<br /> | <br /> | ||

| Line 41: | Line 40: | ||

| style="" |<span style="color: rgb(34, 34, 34)">The registered Address of the Tax Payer</span> | | style="" |<span style="color: rgb(34, 34, 34)">The registered Address of the Tax Payer</span> | ||

| − | * Indicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905 | + | *Indicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905 |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="width:156px;" |10. '''ZIP Code''' | | style="width:156px;" |10. '''ZIP Code''' | ||

| Line 55: | Line 54: | ||

| style="" |List of Months in the form | | style="" |List of Months in the form | ||

| − | * This is based from the months submitted on BIR Form 0619-E | + | *This is based from the months submitted on BIR Form 0619-E |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="width:156px;" |'''Date of Remittance''' | | style="width:156px;" |'''Date of Remittance''' | ||

| style="" |Date of Remittance declared on each month. | | style="" |Date of Remittance declared on each month. | ||

| − | * By default it is always set on the 10th day of the following month | + | *By default it is always set on the 10th day of the following month |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="width:156px;" |'''Name of Bank/Bank Code/ ROR No''' | | style="width:156px;" |'''Name of Bank/Bank Code/ ROR No''' | ||

| Line 66: | Line 65: | ||

Bank - the bank where the payment was made. | Bank - the bank where the payment was made. | ||

| − | * If no payment occurred, Not Applicable will be applied. | + | *If no payment occurred, Not Applicable will be applied. |

ROR(Revenue Official Receipts) - put the Reference Number of Filing or Payment. If no reference number | ROR(Revenue Official Receipts) - put the Reference Number of Filing or Payment. If no reference number | ||

| − | * If no reference number available, Not Applicable will be applied. | + | *If no reference number available, Not Applicable will be applied. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="width:156px;" |'''Taxes Withheld''' | | style="width:156px;" |'''Taxes Withheld''' | ||

| Line 78: | Line 77: | ||

| style="" |Total penalties implied based from | | style="" |Total penalties implied based from | ||

| − | * '''Surcharges''' | + | *'''Surcharges''' |

| − | * '''Interest''' | + | *'''Interest''' |

| − | * '''Compromise''' | + | *'''Compromise''' |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |'''Total Amount Remitted''' | | style="" |'''Total Amount Remitted''' | ||

| style="" |Total Amount Remitted based from Taxes withheld and Penalties applied. | | style="" |Total Amount Remitted based from Taxes withheld and Penalties applied. | ||

| + | |} | ||

| + | {| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | ||

| + | |+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Reports''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Tax Report | ||

| + | | style="" |[[Pro Sales Journal|Sales Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Journal|Purchase Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Receipt Journal|Receipt Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Discount Senior and PWD|Discount Senior and PWD]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Disbursement Journal|Disbursement Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0605|BIR Form 0605]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0619E|BIR Form 0619E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2550M|BIR Form 2550M]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2550Q|BIR Form 2550Q]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2551M|BIR Form 2551M]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2551Q|BIR Form 2551Q]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601E|BIR Form 1601E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601EQ|BIR Form 1601EQ]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1604E|BIR Form 1604E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Sales Relief|Sales Relief]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Relief|Purchase Relief]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Reports Job Aid Aids''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Tax Report | ||

| + | | style="" |[[Pro Sales Journal Job Aids|Sales Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Journal Job Aids|Purchase Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Receipt Journal Job Aids|Receipt Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Discount Senior and PWD Job Aids|Discount Senior and PWD Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Disbursement Journal Job Aids|Disbursement Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0605 Job Aids|BIR Form 0605 Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0619E Job Aids|BIR Form 0619E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601E Job Aids|BIR Form 1601E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[BIR Form 1601E-Q Aids|BIR Form 1601EQ Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1604E Job Aids|BIR Form 1604E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Sales Relief Job Aids|Sales Relief Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Relief Job Aids|Purchase Relief Job Aids]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Modules''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Maintenance | ||

| + | | style="" |[[Pro Bank|Bank]]<nowiki> | </nowiki>[[Pro Chart of Account|Chart of Account]]<nowiki> | </nowiki>[[Pro Tax|Tax]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Job Aid Modules''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Maintenance Aids | ||

| + | | style="" |[[Pro Bank|Bank]]<nowiki> | </nowiki>[[Oojeema Pro Chart of Accounts Job Aids|Chart of Accounts Job Aids]]<nowiki> | </nowiki>[[Oojeema Pro Tax Job Aids|Tax Job Aids]] | ||

|} | |} | ||

Latest revision as of 13:15, 1 September 2021

BIR Form 1604E

BIR 1604E is annual tax return that summarizes the BIR Form 1601E – Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) paid/filed by the taxpayer within the taxable year (January to December).

| Field | Description |

|---|---|

| 1. Year | The current year when the BIR Form 1604E was issued. |

| 2. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 3. No. of Sheets | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 1604E |

| Part I - Background Information | |

| 4. TIN | Tax Identification Number of an Individual or Business |

| 5. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 6. Line of Business/Occupation | Nature of Business of the Company or the Occupation of an Individual |

| 7. Withholding Agent’s Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 8. Telephone No. | Contact Number of the Tax Payer(Individual/Business). |

| 9.Registered Address | The registered Address of the Tax Payer

|

| 10. ZIP Code | Contact Number of the Tax Payer(Individual/Business). |

| 11. Category of Withholding Agent | Private - if the type of business is a Private Company

Government - if the Agent is working on any Government Sector. |

| Part II - Summary of Remittances | |

| Month | List of Months in the form

|

| Date of Remittance | Date of Remittance declared on each month.

|

| Name of Bank/Bank Code/ ROR No | (Optional)

Bank - the bank where the payment was made.

ROR(Revenue Official Receipts) - put the Reference Number of Filing or Payment. If no reference number

|

| Taxes Withheld | The amount of withholding tax paid for the applicable return |

| Penalties | Total penalties implied based from

|

| Total Amount Remitted | Total Amount Remitted based from Taxes withheld and Penalties applied. |

| Reports | |

|---|---|

| Tax Report | Sales Journal | Purchase Journal | Receipt Journal | Discount Senior and PWD | Disbursement Journal | BIR Form 0605 | BIR Form 0619E | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551M | BIR Form 2551Q | BIR Form 1601E | BIR Form 1601EQ | BIR Form 1604E | Sales Relief | Purchase Relief |

| Reports Job Aid Aids | |

| Tax Report | Sales Journal Job Aids | Purchase Journal Job Aids | Receipt Journal Job Aids | Discount Senior and PWD Job Aids | Disbursement Journal Job Aids | BIR Form 0605 Job Aids | BIR Form 0619E Job Aids | BIR Form 1601E Job Aids | BIR Form 1601EQ Job Aids | BIR Form 1604E Job Aids | Sales Relief Job Aids | Purchase Relief Job Aids |

| Modules | |

| Maintenance | Bank | Chart of Account | Tax |

| Job Aid Modules | |

| Maintenance Aids | Bank | Chart of Accounts Job Aids | Tax Job Aids |