You are viewing an old version of this page. Return to the latest version.

Difference between revisions of "Pro BIR Form 0605"

(Tag: Visual edit) |

(Tag: Visual edit) |

||

| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | {{DISPLAYTITLE:BIR Form 0605}} | + | {{DISPLAYTITLE:BIR Form 0605}}<div style="text-align: center;">[[Pro BIR Form 0605|BIR Form 0605]] | [[Pro Bank|Bank]] | [[Pro Chart of Account|Chart of Account]] | [[Pro Tax|Tax]] | [[Pro BIR Form 0605 Job Aids|BIR Form 0605 Job Aids]]</div> |

| − | |||

==BIR Form 0605== | ==BIR Form 0605== | ||

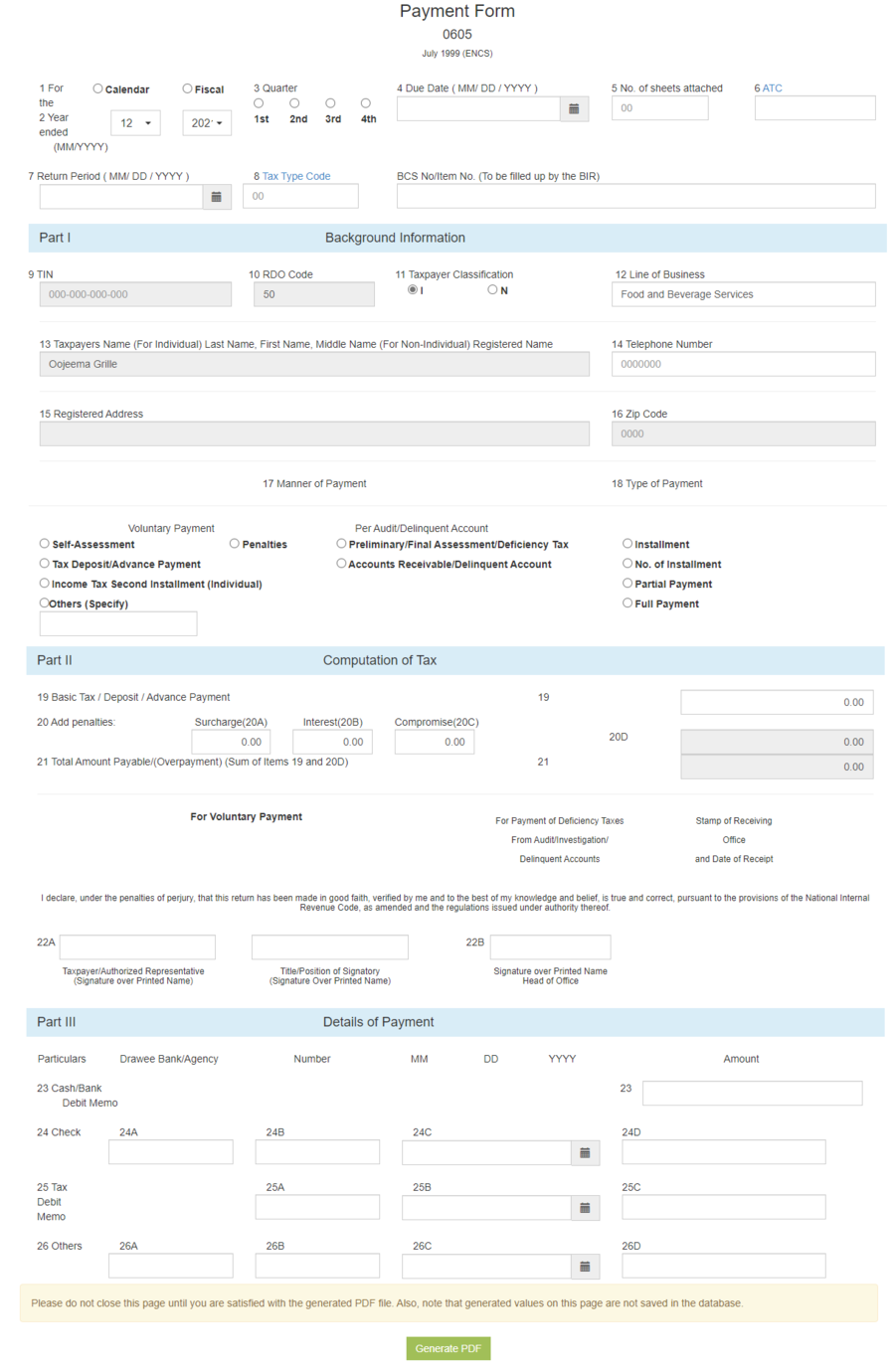

'''BIR Form 0605''' is use to pay taxes and fees which do not require the use of a tax return such as second installment payment for income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits, installment payments, etc. | '''BIR Form 0605''' is use to pay taxes and fees which do not require the use of a tax return such as second installment payment for income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits, installment payments, etc. | ||

[[File:Pro BIR Form 0605.png|center|thumb|1380x1380px|BIR Form 0605]]<br /> | [[File:Pro BIR Form 0605.png|center|thumb|1380x1380px|BIR Form 0605]]<br /> | ||

{| class="wikitable" | {| class="wikitable" | ||

| − | |+BIR Form 0605 Terms | + | |+BIR Form 0605 Terms |

! style="width:30%;" |Field | ! style="width:30%;" |Field | ||

!Description | !Description | ||

| Line 12: | Line 11: | ||

|Refers to the type of Calendar Year of the Business. | |Refers to the type of Calendar Year of the Business. | ||

| − | * Calendar Year - follows the traditional start of the year (January) | + | *Calendar Year - follows the traditional start of the year (January) |

| − | * Fiscal Year - The starting month of the year will be depending on the Company | + | *Fiscal Year - The starting month of the year will be depending on the Company |

|- | |- | ||

| style="width:30%;" |2. Year End | | style="width:30%;" |2. Year End | ||

| Line 21: | Line 20: | ||

|<span style="color: rgb(34, 34, 34)">Refers to the which quarter of the year.</span> | |<span style="color: rgb(34, 34, 34)">Refers to the which quarter of the year.</span> | ||

| − | * For Calendar Year | + | *For Calendar Year |

| − | ** First Quarter - January to March | + | **First Quarter - January to March |

| − | ** Second Quarter - April to June | + | **Second Quarter - April to June |

| − | ** Third Quarter - July to September | + | **Third Quarter - July to September |

| − | ** Fourth Quarter - October to December | + | **Fourth Quarter - October to December |

| − | * For Fiscal Year | + | *For Fiscal Year |

| − | ** Every three months starting from the Fiscal Year. | + | **Every three months starting from the Fiscal Year. |

|- | |- | ||

| style="width:30%;" |4. Due Date | | style="width:30%;" |4. Due Date | ||

|<span style="color: rgb(34, 34, 34)">Due date of the form when it should be submitted.</span> | |<span style="color: rgb(34, 34, 34)">Due date of the form when it should be submitted.</span> | ||

| − | * It is always marked on the 10th Day of the following month | + | *It is always marked on the 10th Day of the following month |

|- | |- | ||

| style="width:30%;" |5. Number of Sheets | | style="width:30%;" |5. Number of Sheets | ||

| Line 38: | Line 37: | ||

Number of Attached Sheets declared when submitting the BIR Form 2550M | Number of Attached Sheets declared when submitting the BIR Form 2550M | ||

| − | * Number of sheets is needed when filing E-BIR and EFPS | + | *Number of sheets is needed when filing E-BIR and EFPS |

|- | |- | ||

| style="width:30%;" |6. ATC | | style="width:30%;" |6. ATC | ||

| Line 50: | Line 49: | ||

|- | |- | ||

| style="width:30%;" |9. TIN | | style="width:30%;" |9. TIN | ||

| − | | <span style="color: rgb(34, 34, 34)">Tax Identification Number of the Company/Branch</span> | + | |<span style="color: rgb(34, 34, 34)">Tax Identification Number of the Company/Branch</span> |

|- style="height:45px;" | |- style="height:45px;" | ||

| style="width:30%;" |10. RDO Code | | style="width:30%;" |10. RDO Code | ||

| Line 58: | Line 57: | ||

|Taxpayer Classification of an Individual/Business | |Taxpayer Classification of an Individual/Business | ||

| − | * Individual | + | *Individual |

| − | * Non-Individual | + | *Non-Individual |

|- | |- | ||

| style="width:30%;" |12. Line of Business | | style="width:30%;" |12. Line of Business | ||

| Line 74: | Line 73: | ||

|- | |- | ||

| style="width:30%;" |16. Zip Code | | style="width:30%;" |16. Zip Code | ||

| − | | <span style="color: rgb(34, 34, 34)">Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer</span> | + | |<span style="color: rgb(34, 34, 34)">Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer</span> |

|- | |- | ||

| style="width:30%;" |17. Manner of Payment | | style="width:30%;" |17. Manner of Payment | ||

|Refers how the payment will be paid if it is Voluntary or per Audit/Delinquent Account | |Refers how the payment will be paid if it is Voluntary or per Audit/Delinquent Account | ||

| − | * Voluntary | + | *Voluntary |

| − | ** Self Assessment | + | **Self Assessment |

| − | ** Tax Deposit/Advance Payment | + | **Tax Deposit/Advance Payment |

| − | ** Income Tax Second Installment | + | **Income Tax Second Installment |

| − | ** Others | + | **Others |

| − | * Per Audit/Delinquent Account | + | *Per Audit/Delinquent Account |

| − | ** Preliminary/Final Assessment/Deficiency Tax | + | **Preliminary/Final Assessment/Deficiency Tax |

| − | ** Accounts Receivable/Delinquent Account | + | **Accounts Receivable/Delinquent Account |

|- | |- | ||

| style="width:30%;" |18. Type of Payment | | style="width:30%;" |18. Type of Payment | ||

|Nature of Payment | |Nature of Payment | ||

| − | * Installment | + | *Installment |

| − | * No. of Installment | + | *No. of Installment |

| − | * Partial Payment | + | *Partial Payment |

| − | * Full Payment | + | *Full Payment |

|- | |- | ||

| style="width:30%;" |19. Basic Tax/ Deposit / Advance Payment | | style="width:30%;" |19. Basic Tax/ Deposit / Advance Payment | ||

| Line 102: | Line 101: | ||

|<span style="color: rgb(34, 34, 34)">Penalties to be applied if any</span> | |<span style="color: rgb(34, 34, 34)">Penalties to be applied if any</span> | ||

| − | * '''Surcharge''' | + | *'''Surcharge''' |

| − | * '''Interest''' | + | *'''Interest''' |

| − | * '''Compromise''' | + | *'''Compromise''' |

| − | * '''Total Penalties''' | + | *'''Total Penalties''' |

|- | |- | ||

| style="width:30%;" |21. Total Amount Payable/Over Payment | | style="width:30%;" |21. Total Amount Payable/Over Payment | ||

| Line 113: | Line 112: | ||

|Details of Tax Payer/ Authorized Representative | |Details of Tax Payer/ Authorized Representative | ||

| − | * Tax Payer/ Authorized Representative Name | + | *Tax Payer/ Authorized Representative Name |

| − | * Title/Position of Signatory | + | *Title/Position of Signatory |

| − | * Signature over Printed Name | + | *Signature over Printed Name |

|- | |- | ||

| style="width:30%;" |23. Cash / Bank Debit Memo | | style="width:30%;" |23. Cash / Bank Debit Memo | ||

| Line 128: | Line 127: | ||

| style="width:30%;" |26. Others | | style="width:30%;" |26. Others | ||

|Any details to be Applied | |Any details to be Applied | ||

| + | |}Notes: | ||

| + | |||

| + | *For further instructions on how to file BIR Form 0605, the user may visit the BIR Form 0605 Job Aids which can be found [[Pro BIR Form 0605 Job Aids|here]] | ||

| + | |||

| + | {| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | ||

| + | |+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Reports''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Tax Report | ||

| + | | style="" |[[Pro Sales Journal|Sales Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Journal|Purchase Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Receipt Journal|Receipt Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Discount Senior and PWD|Discount Senior and PWD]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Disbursement Journal|Disbursement Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0605|BIR Form 0605]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0619E|BIR Form 0619E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2550M|BIR Form 2550M]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2550Q|BIR Form 2550Q]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2551M|BIR Form 2551M]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2551Q|BIR Form 2551Q]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601E|BIR Form 1601E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601EQ|BIR Form 1601EQ]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1604E|BIR Form 1604E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Sales Relief|Sales Relief]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Relief|Purchase Relief]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Reports Job Aid Aids''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Tax Report | ||

| + | | style="" |[[Pro Sales Journal Job Aids|Sales Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Journal Job Aids|Purchase Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Receipt Journal Job Aids|Receipt Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Discount Senior and PWD Job Aids|Discount Senior and PWD Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Disbursement Journal Job Aids|Disbursement Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0605 Job Aids|BIR Form 0605 Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0619E Job Aids|BIR Form 0619E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601E Job Aids|BIR Form 1601E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601EQ Job Aids|BIR Form 1601EQ Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1604E Job Aids|BIR Form 1604E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Sales Relief Job Aids|Sales Relief Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Relief Job Aids|Purchase Relief Job Aids]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Modules''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Sales | ||

| + | | style="" |[[Pro Sales|Sales]]<nowiki> | </nowiki>[[Pro Sales and Service Invoice|Sales and Service Invoice]]<nowiki> | </nowiki>[[Pro Receive Payments|Receive Payments]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Maintenance | ||

| + | | style="" |[[Pro Bank|Bank]]<nowiki> | </nowiki>[[Pro Chart of Account|Chart of Account]]<nowiki> | </nowiki>[[Pro Tax|Tax]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Job Aid Modules''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Sales Aids | ||

| + | | style="" |[[Oojeema Pro Sales Job Aids|Sales Job Aids]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Maintenance Aids | ||

| + | | style="" |[[Pro Bank|Bank]]<nowiki> | </nowiki>[[Oojeema Pro Chart of Accounts Job Aids|Chart of Accounts Job Aids]]<nowiki> | </nowiki>[[Oojeema Pro Tax Job Aids|Tax Job Aids]] | ||

|} | |} | ||

Latest revision as of 12:07, 1 September 2021

BIR Form 0605

BIR Form 0605 is use to pay taxes and fees which do not require the use of a tax return such as second installment payment for income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits, installment payments, etc.

| Field | Description |

|---|---|

| 1. Calendar | Refers to the type of Calendar Year of the Business.

|

| 2. Year End | The last month of the Calendar Year of the Business |

| 3. Quarter | Refers to the which quarter of the year.

|

| 4. Due Date | Due date of the form when it should be submitted.

|

| 5. Number of Sheets | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2550M

|

| 6. ATC | Alphanumeric Tax Code of the form to be submitted |

| 7. Return Period | The return period of the Tax Return |

| 8. Tax Type Code | Categorizes and controls the function of a tax detail transaction. |

| 9. TIN | Tax Identification Number of the Company/Branch |

| 10. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 11. Tax Payer Classification | Taxpayer Classification of an Individual/Business

|

| 12. Line of Business | Company's Nature of Business |

| 13. Tax Payer's Name | Registered Name for Non-Individual(Company) and Whole name for Individual |

| 14. Telephone Number | Contact Number of the Tax Payer |

| 15. Registered Address | The registered Address of the Tax Payer. |

| 16. Zip Code | Zip Code of the Tax Payer. This is depending on the registered address of the Tax Payer |

| 17. Manner of Payment | Refers how the payment will be paid if it is Voluntary or per Audit/Delinquent Account

|

| 18. Type of Payment | Nature of Payment

|

| 19. Basic Tax/ Deposit / Advance Payment | The amount to be Paid based from the manner and type of payment |

| 20. Penalties | Penalties to be applied if any

|

| 21. Total Amount Payable/Over Payment | Total Amount to be Paid base from the amount of Basic Tax/Deposit/Advance Payment(19) and Penalties(20) |

| 22. Tax payer/ Authorized Representative | Details of Tax Payer/ Authorized Representative

|

| 23. Cash / Bank Debit Memo | Amount to be paid using Cash or Debit Bank Memo |

| 24. Check | Amount to be paid using Check which includes the Bank Source, Check Number and Date Issued |

| 25. Tax Debit Memo | Amount details to be paid using Tax Debit Memo |

| 26. Others | Any details to be Applied |

Notes:

- For further instructions on how to file BIR Form 0605, the user may visit the BIR Form 0605 Job Aids which can be found here

| Reports | |

|---|---|

| Tax Report | Sales Journal | Purchase Journal | Receipt Journal | Discount Senior and PWD | Disbursement Journal | BIR Form 0605 | BIR Form 0619E | BIR Form 2550M | BIR Form 2550Q | BIR Form 2551M | BIR Form 2551Q | BIR Form 1601E | BIR Form 1601EQ | BIR Form 1604E | Sales Relief | Purchase Relief |

| Reports Job Aid Aids | |

| Tax Report | Sales Journal Job Aids | Purchase Journal Job Aids | Receipt Journal Job Aids | Discount Senior and PWD Job Aids | Disbursement Journal Job Aids | BIR Form 0605 Job Aids | BIR Form 0619E Job Aids | BIR Form 1601E Job Aids | BIR Form 1601EQ Job Aids | BIR Form 1604E Job Aids | Sales Relief Job Aids | Purchase Relief Job Aids |

| Modules | |

| Sales | Sales | Sales and Service Invoice | Receive Payments |

| Maintenance | Bank | Chart of Account | Tax |

| Job Aid Modules | |

| Sales Aids | Sales Job Aids |

| Maintenance Aids | Bank | Chart of Accounts Job Aids | Tax Job Aids |