You are viewing an old version of this page. Return to the latest version.

Version of 13:15, 15 June 2021 by Gelo

Difference between revisions of "Pro BIR Form 2551Q"

(Created page with "== BIR FORM 2551Q == '''BIR Form 2551Q''' <span style="color: rgb(51, 51, 51)">refers to the Quarterly Percentage Tax Return. These taxes imposed on individuals or businesses...") (Tag: Visual edit) |

(Tag: Visual edit) |

||

| (2 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | == BIR | + | {{DISPLAYTITLE:BIR Form 2551Q}}<div style="text-align: center;">[[Pro BIR Form 2551Q|BIR Form 2551Q]] | [[Pro Sales|Sales]] | [[Pro Purchase|Purchase]] | [[Pro Bank|Bank]] | [[Pro Chart of Account|Chart of Account]] | [[Pro Tax|Tax]] | [[Pro BIR Form 2551Q Job Aids|BIR Form 2551Q Job Aids]]</div><br /> |

| + | ==BIR Form 2551Q== | ||

'''BIR Form 2551Q''' <span style="color: rgb(51, 51, 51)">refers to the Quarterly Percentage Tax Return. These taxes imposed on individuals or businesses who sell goods or services which are exempted from VAT.</span> | '''BIR Form 2551Q''' <span style="color: rgb(51, 51, 51)">refers to the Quarterly Percentage Tax Return. These taxes imposed on individuals or businesses who sell goods or services which are exempted from VAT.</span> | ||

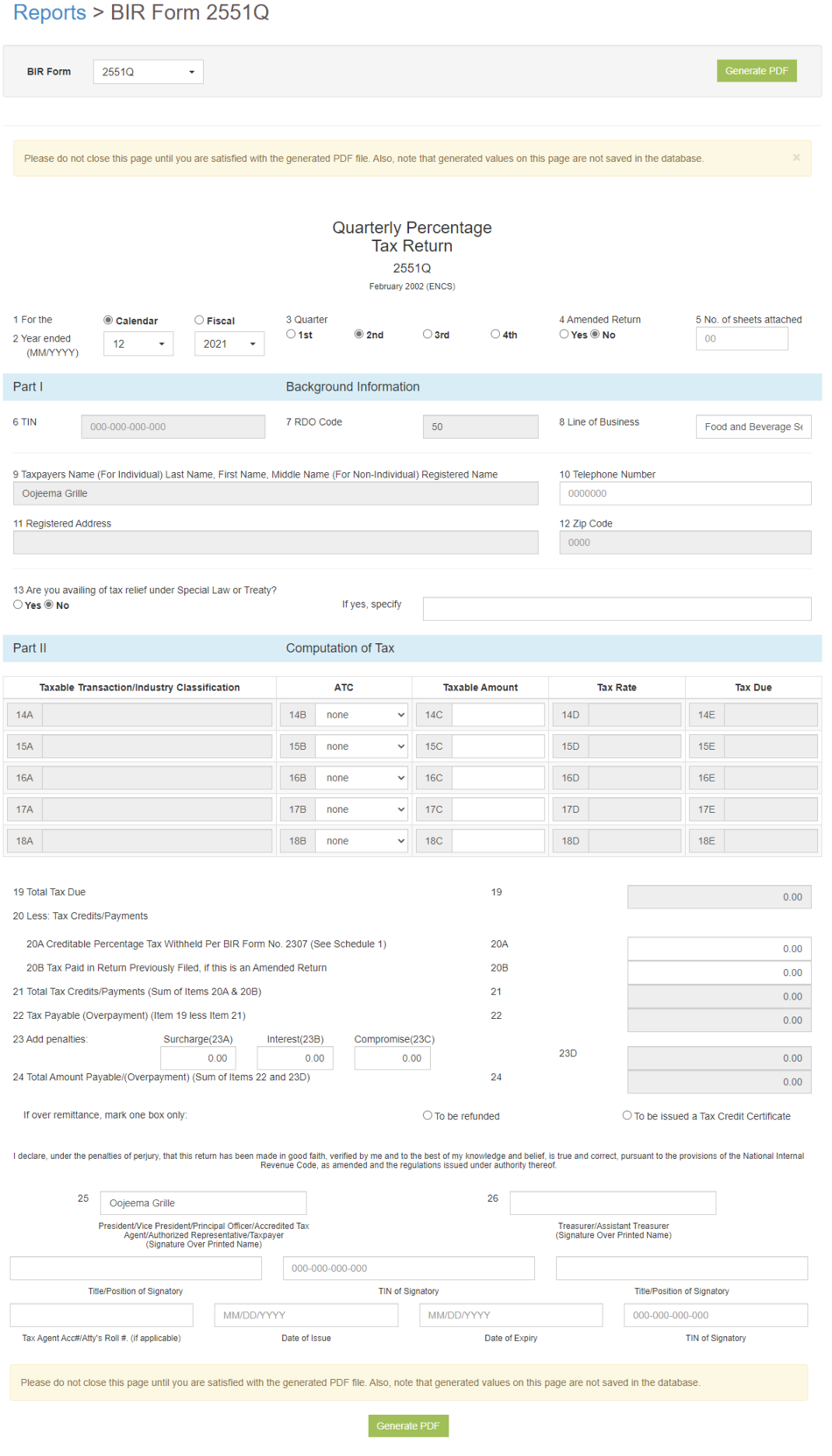

[[File:Pro BIR Form 2551Q.png|center|thumb|1662x1662px|BIR Form 2551Q]] | [[File:Pro BIR Form 2551Q.png|center|thumb|1662x1662px|BIR Form 2551Q]] | ||

| Line 16: | Line 17: | ||

| style="" |<span style="color: rgb(34, 34, 34)">Refers to the which quarter of the year.</span> | | style="" |<span style="color: rgb(34, 34, 34)">Refers to the which quarter of the year.</span> | ||

| − | * For Calendar Year | + | *For Calendar Year |

| − | ** First Quarter - January to March | + | **First Quarter - January to March |

| − | ** Second Quarter - April to June | + | **Second Quarter - April to June |

| − | ** Third Quarter - July to September | + | **Third Quarter - July to September |

| − | ** Fourth Quarter - October to December | + | **Fourth Quarter - October to December |

| − | * For Fiscal Year | + | *For Fiscal Year |

| − | ** Every three months starting from the Fiscal Year. | + | **Every three months starting from the Fiscal Year. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |4. '''Amended Return''' | | style="" |4. '''Amended Return''' | ||

| Line 45: | Line 46: | ||

| style="" |The registered Address of the Tax Payer. | | style="" |The registered Address of the Tax Payer. | ||

| − | * '''9A ZIP Code''' - Zone Improvement Plan Code of the registered Address of the Tax Payer. | + | *'''9A ZIP Code''' - Zone Improvement Plan Code of the registered Address of the Tax Payer. |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |10. '''Contact Number''' | | style="" |10. '''Contact Number''' | ||

| Line 61: | Line 62: | ||

<span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">Only for individual taxpayers whose sales/receipts are subject to Percentage Tax under Section 116 of the Tax Code</span> | <span class="ve-pasteProtect" style="color: rgb(51, 51, 51)" data-ve-attributes="{"style":"color: rgb(51, 51, 51)"}">Only for individual taxpayers whose sales/receipts are subject to Percentage Tax under Section 116 of the Tax Code</span> | ||

| − | * Graduated income tax rate on net taxable income | + | *Graduated income tax rate on net taxable income |

| − | * 8% income tax rate on gross sales/receipts/others | + | *8% income tax rate on gross sales/receipts/others |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| colspan="2" style="vertical-align:middle;text-align:center;" |'''Part II - Computation of Tax''' | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Part II - Computation of Tax''' | ||

| Line 87: | Line 88: | ||

| style="" |List of Penalties: | | style="" |List of Penalties: | ||

| − | * '''Surcharge(20)''' | + | *'''Surcharge(20)''' |

| − | * '''Interest(21)''' | + | *'''Interest(21)''' |

| − | * '''Compromise(22)''' | + | *'''Compromise(22)''' |

|- style="box-sizing: inherit;" | |- style="box-sizing: inherit;" | ||

| style="" |23. '''Total Penalties (Sum of Items 20 to 22)''' | | style="" |23. '''Total Penalties (Sum of Items 20 to 22)''' | ||

| Line 97: | Line 98: | ||

| style="" |Total Amount Payable based from Tax Payable and Total Penalties. | | style="" |Total Amount Payable based from Tax Payable and Total Penalties. | ||

| − | * If Overpayment | + | *If Overpayment |

| − | ** To be refunded | + | **To be refunded |

| − | ** To be issued a Tax Certificate | + | **To be issued a Tax Certificate |

|- | |- | ||

|<span style="color: rgb(34, 34, 34)">25.</span> '''President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name)'''<br /> | |<span style="color: rgb(34, 34, 34)">25.</span> '''President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name)'''<br /> | ||

|<span style="color: rgb(34, 34, 34)">President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details</span> | |<span style="color: rgb(34, 34, 34)">President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details</span> | ||

| − | + | *'''Title/Position of Signatory''' | |

| − | * '''Title/Position of Signatory''' | + | *'''Tin of Signatory''' |

| − | * '''Tin of Signatory''' | + | *'''Tax Agent Acc# / Atty's Roll #. (if applicable)''' |

| − | * '''Tax Agent Acc# / Atty's Roll #. (if applicable)''' | + | *'''Date of Issue''' |

| − | * '''Date of Issue''' | + | *'''Date of Expiry''' |

| − | * '''Date of Expiry''' | ||

|- | |- | ||

|<span style="color: rgb(34, 34, 34)">26.</span> '''Treasurer/Assistant Treasurer''' <span style="color: rgb(34, 34, 34)">(Signature Over Printed Name)</span> | |<span style="color: rgb(34, 34, 34)">26.</span> '''Treasurer/Assistant Treasurer''' <span style="color: rgb(34, 34, 34)">(Signature Over Printed Name)</span> | ||

|<span style="color: rgb(34, 34, 34)">Treasurer/Assistant Treasurer details</span> | |<span style="color: rgb(34, 34, 34)">Treasurer/Assistant Treasurer details</span> | ||

| − | + | *'''Treasurer/Assistant Treasurer''' | |

| − | + | *'''Title/Position of Signatory''' | |

| − | + | *'''TIN of Signatory''' | |

| − | + | |} | |

| + | {| class="wikitable" style="box-sizing: inherit; border-collapse: collapse; border-spacing: 0px; background-color: rgb(248, 249, 250); font-size: 14px; color: rgb(34, 34, 34); margin: 1em 0px; border: 1px solid rgb(162, 169, 177); font-family: "Open Sans", Roboto, arial, sans-serif; font-style: normal; font-variant-ligatures: normal; font-variant-caps: normal; font-weight: 400; letter-spacing: normal; orphans: 2; text-align: start; text-transform: none; white-space: normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; text-decoration-thickness: initial; text-decoration-style: initial; text-decoration-color: initial;" | ||

| + | |+ style="box-sizing: inherit; padding-top: 8px; padding-bottom: 8px; color: rgb(119, 119, 119); text-align: left; font-weight: bold;" |Categories: | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Reports''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Tax Report | ||

| + | | style="" |[[Pro Sales Journal|Sales Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Journal|Purchase Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Receipt Journal|Receipt Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Discount Senior and PWD|Discount Senior and PWD]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Disbursement Journal|Disbursement Journal]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0605|BIR Form 0605]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0619E|BIR Form 0619E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2550M|BIR Form 2550M]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2550Q|BIR Form 2550Q]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2551M|BIR Form 2551M]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 2551Q|BIR Form 2551Q]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601E|BIR Form 1601E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601EQ|BIR Form 1601EQ]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1604E|BIR Form 1604E]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Sales Relief|Sales Relief]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Relief|Purchase Relief]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Reports Job Aid Aids''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Tax Report | ||

| + | | style="" |[[Pro Sales Journal Job Aids|Sales Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Journal Job Aids|Purchase Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Receipt Journal Job Aids|Receipt Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Discount Senior and PWD Job Aids|Discount Senior and PWD Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Disbursement Journal Job Aids|Disbursement Journal Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0605 Job Aids|BIR Form 0605 Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 0619E Job Aids|BIR Form 0619E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601E Job Aids|BIR Form 1601E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1601EQ Job Aids|BIR Form 1601EQ Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro BIR Form 1604E Job Aids|BIR Form 1604E Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Sales Relief Job Aids|Sales Relief Job Aids]] <span style="color: rgb(34, 34, 34)"><nowiki>|</nowiki></span> [[Pro Purchase Relief Job Aids|Purchase Relief Job Aids]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | ! colspan="2" style="background-color:rgb(234, 236, 240);text-align:center;" |'''Modules''' | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Sales | ||

| + | | style="" |[[Pro Sales|Sales]]<nowiki> | </nowiki>[[Pro Sales and Service Invoice|Sales and Service Invoice]]<nowiki> | </nowiki>[[Pro Receive Payments|Receive Payments]] | ||

| + | |- | ||

| + | |Purchase | ||

| + | |[[Pro Purchase|Purchase]]<nowiki> | </nowiki>[[Pro Purchase Order|Purchase Order]]<nowiki> | </nowiki>[[Pro Issue Payment]] | ||

| + | |- | ||

| + | |Journal | ||

| + | |[[Pro Journal|Journal]]<nowiki> | </nowiki>[[Pro Journal Voucher|Journal Voucher]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Maintenance | ||

| + | | style="" |[[Pro Bank|Bank]]<nowiki> | </nowiki>[[Pro Chart of Account|Chart of Account]]<nowiki> | </nowiki>[[Pro Tax|Tax]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | colspan="2" style="vertical-align:middle;text-align:center;" |'''Job Aid Modules''' | ||

| + | |- | ||

| + | |Sales | ||

| + | |[[Oojeema Pro Sales Job Aids|Sales Job Aids]] | ||

| + | |- | ||

| + | |Purchase | ||

| + | |[[Oojeema Pro Purchase Job Aids|Purchase Job Aids]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Journal | ||

| + | | style="" |[[Oojeema Pro Journal Job Aids|Journal Job Aids]] | ||

| + | |- style="box-sizing: inherit;" | ||

| + | | style="" |Maintenance Aids | ||

| + | | style="" |[[Pro Bank|Bank]]<nowiki> | </nowiki>[[Oojeema Pro Chart of Accounts Job Aids|Chart of Accounts Job Aids]]<nowiki> | </nowiki>[[Oojeema Pro Tax Job Aids|Tax Job Aids]] | ||

|} | |} | ||

Latest revision as of 12:59, 31 August 2021

BIR Form 2551Q

BIR Form 2551Q refers to the Quarterly Percentage Tax Return. These taxes imposed on individuals or businesses who sell goods or services which are exempted from VAT.

| Fields | Description |

|---|---|

| 1. Month Year | Month and year when the BIR Form 2551Q was issued. |

| 2. Year Ended | Refers to the last day of the Year. |

| 3. Quarter | Refers to the which quarter of the year.

|

| 4. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 5. No. of Sheets Attached | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2551Q |

| Part I - Background Information | |

| 6. TIN | Tax Identification Number of an Individual or Business |

| 7. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 8. Tax Payer's Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 9. Registered Address | The registered Address of the Tax Payer.

|

| 10. Contact Number | Contact Number of the Tax Payer(Individual/Business). |

| 11. Email Address | Email Address of the Tax Payer |

| 12. Tax Relief | (Optional)

Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty |

| 13. Income Tax Rate | (Optional)

Only for individual taxpayers whose sales/receipts are subject to Percentage Tax under Section 116 of the Tax Code

|

| Part II - Computation of Tax | |

| 14. Total Tax Due | The total Tax due based from the breakdown of Schedule 1 Computation of Tax Sheet. |

| 15. Creditable Percentage Tax Withheld Per BIR FORM No. 2307 | This certificate exhibits the income that is subjugated to Expanded Withholding Tax (EWT) that is paid by a withholding agent. |

| 16. Tax Paid in Return Previously Filed, if this is an Amended Return | Tax Paid Return based from the Amended Return of the previous Form. |

| 17. Other Tax Credit/Payment | Any Tax Credit or Payment to be deducted. |

| 18. Total Tax Credits/Payments (Sum of Items 15 & 17) | Total Tax Credits/Payments to be deducted to Total Tax Due |

| 19. Tax Payable (Overpayment) (Item 14 less Item 18) | Total Tax Payable based from the Total Tax Due less the total credits/payments. |

| 20 - 22. Penalties | List of Penalties:

|

| 23. Total Penalties (Sum of Items 20 to 22) | Total Penalties applied if any. |

| 24. Total Amount Payable(Overpayment)(Sum of Items 19 and 23) | Total Amount Payable based from Tax Payable and Total Penalties.

|

| 25. President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer. (Signature Over Printed Name) |

President /Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/ Tax Payer Details

|

| 26. Treasurer/Assistant Treasurer (Signature Over Printed Name) | Treasurer/Assistant Treasurer details

|