Difference between revisions of "Pro BIR Form 2550Q"

(Tag: Visual edit) |

(Tag: Visual edit) |

||

| Line 1: | Line 1: | ||

| − | {{DISPLAYTITLE:BIR Form 2550Q}}<div style="text-align: center;">[[Pro BIR Form | + | {{DISPLAYTITLE:BIR Form 2550Q}}<div style="text-align: center;">[[Pro BIR Form 2550Q|BIR Form 2550Q]] | [[Pro Sales|Sales]] | [[Pro Purchase|Purchase]] | [[Pro Bank|Bank]] | [[Pro Chart of Account|Chart of Account]] | [[Pro Tax|Tax]] | [[Pro BIR Form 2550Q Job Aids|BIR Form 2550Q Job Aids]]</div> |

==<span class="mw-headline" id="BIR_Form_2550Q" style="box-sizing: inherit;">BIR Form 2550Q</span>== | ==<span class="mw-headline" id="BIR_Form_2550Q" style="box-sizing: inherit;">BIR Form 2550Q</span>== | ||

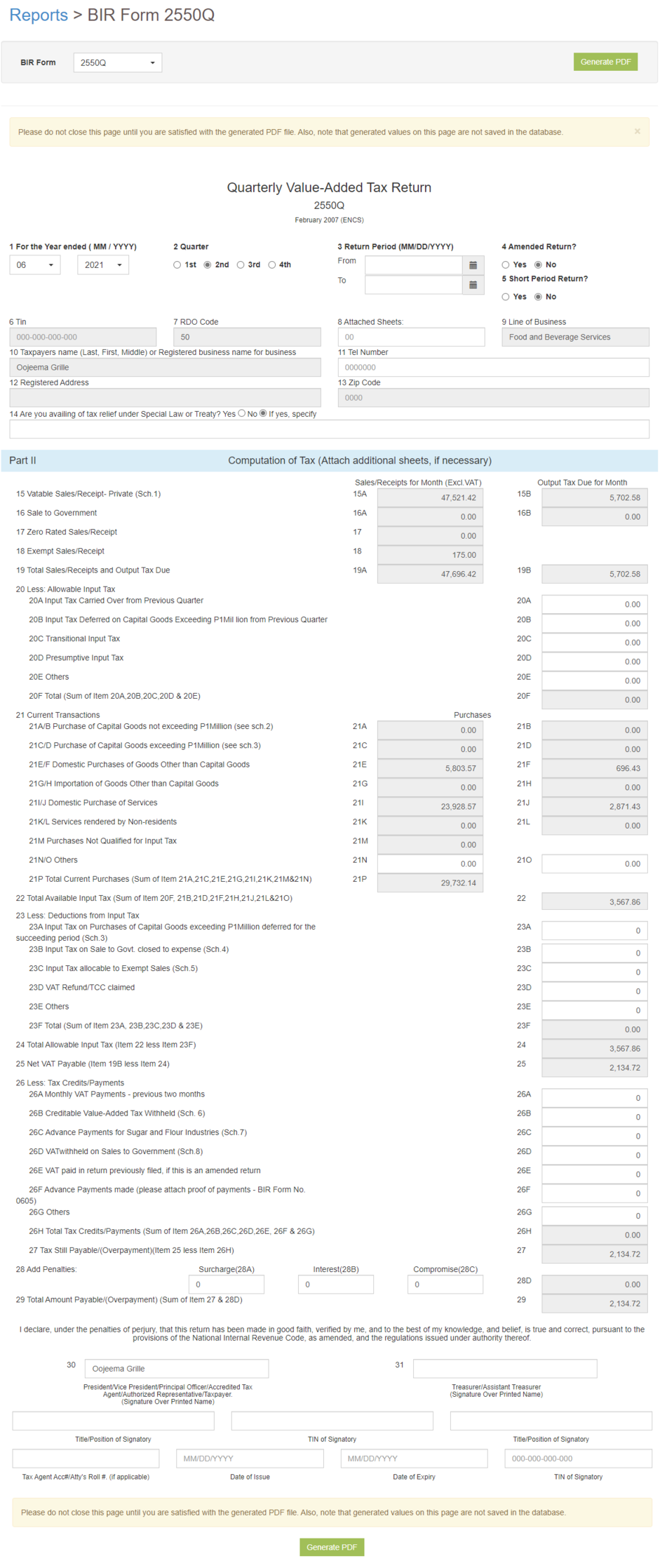

'''BIR Form 2550Q''' refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a quarterly basis(Every 3 months). | '''BIR Form 2550Q''' refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a quarterly basis(Every 3 months). | ||

Latest revision as of 12:52, 31 August 2021

BIR Form 2550Q

BIR Form 2550Q refers to the Monthly Value-Added Tax Declaration of the Company. It is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines in a quarterly basis(Every 3 months).

| Fields | Description |

|---|---|

| 1. Month Year | Month and year when the BIR Form 2550Q was issued. |

| 2. Quarter | Refers to the which quarter of the year.

|

| 3. Return Period | The month range of the specific quarter. |

| 4. Amended Return | Amended Return is filed to make corrections, additions or omissions to returns already declared, provided they have not yet been issued letters of authority from the BIR. |

| 5. Short Period | A return for a short period, that is, for a taxable year consisting of a period of less than 12 months. This can be due to company being dissolved. |

| Part I - Background Information | |

| 6. TIN | Tax Identification Number of an Individual or Business |

| 7. RDO Code | Regional District Office Code is a three-digit numeric or alphanumeric code assigned to each RDO in the country. The BIR uses these codes for tracking the amount of tax collection within a particular region, as well as recording and processing tax returns, tax payments, and withholding taxes. |

| 8. No. of Sheets Attached | (Optional)

Number of Attached Sheets declared when submitting the BIR Form 2550Q |

| 9. Line of Business | Nature of Business of the Company |

| 10. Tax Payer's Name | Registered Name for Non-Individual(Company) or Whole Name for Individual. |

| 11. Telephone Number | Contact Number of the Tax Payer |

| 12. Registered Address | The registered Address of the Tax Payer. |

| 13. ZIP Code | Zone Improvement Plan Code of the registered Address of the Tax Payer. |

| 14. Tax Relief | (Optional)

Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses. This can be under: Special Law or International Tax Treaty. |

| Part II - Computation of Tax | |

| 15. Vatable Sales/Receipt-Private | Sales that the business will have to charge VAT on if it is registered for VAT. |

| 16. Sale to Government | VAT transactions applied to the Government |

| 17. Zero Rated Sales/Receipts | Sales that does not impose any VAT |

| 18. Exempt Sales/Receipts | Sales that does not impose any VAT |

| 19. Total Sales/Receipts and Output Tax Due | Total Value of Tax Types Mentioned from Vatable Sales up to Exempt Sales. |

| 20. Less: Allowable Input Tax |

|

| 21. Current Transactions |

|

| 22. Total Available Input Tax (Sum of Item 20F, 21B, 21D, 21F, 21H, 21J, 21L,&21O) | Overall Total of Available Input Tax declared. |

| 23. Less: Deductions from Input Tax |

|

| 24. Total Allowable Input Tax (Item 22 less Item 23F) | Remaining Available Input Tax based from the Total Input Tax Less the deductions Declared from input tax. |

| 25. Net VAT Payable (Item 19B less Item 24) | Net Amount of Value Added Tax Payable based from Total Sales/Receipts and Output Tax Due less the Total Allowable Input Tax. |

| 26. Less: Tax Credits/Payments |

|

| 27. Tax Still Payable/(Overpayment)(Item 25 less Item 26H) | Remaining Tax Payable base from Net VAT Payable less the Total Tax Credits/Payments. |

| 28. Penalties | Penalties to be applied if any

|

| 29. Total Amount Payable/(Overpayment) (Sum of Item 27 & 28D) | Remaining Tax Payable base from Net VAT Payable less the Tax Credits Applied. |

| 30. President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer | President/Vice President/Principal Officer/Accredited Tax Agent/Authorized Representative/Taxpayer Details

|

| 31. Treasurer/Assistant Treasurer (Signature Over Printed Name) | Treasurer/Assistant Treasurer Details

|

Notes:

- Grey fields are auto-generated and will automatically adjust based on the input of the user.

- For further instructions on how to Generate BIR Form 2550Q, the user may visit BIR Form 2550Q Job Aids which can be found here